In This Post:

Presenters:

Mike Quigg

Benefits Solutions Consultant

Measuring benefits and comparing performance to identify areas for improvement and drive better performance continues to play a crucial role in shaping total rewards strategies. Employees’ expectations are rising, and companies are looking to improve to remain competitive in talent retention, want to take care of their people because they understand that people are the most valuable asset. Benepass redefines how organizations support their teams with flexible, user-friendly solutions, helping them rethink how they design, fund, and deliver benefits.

Megan Burns, Benefits Solutions Consultant at Benepass helps innovative companies learn about different types of spending accounts, and she consults on program design, cost projections, compliance engagement strategies, and more. During last week’s webinar, Megan presented The 2025 Benepass Benchmarking Report, providing timely insights into how leading employers evolve their benefit programs, especially around lifestyle and pre-tax spending accounts.

About Benepass

Benepass is a modern spending accounts platform focused on helping companies deliver more personalized, flexible benefits. It is a global company that supports employers in more than 112 countries today and over 400k eligible employees.

At its core, Benepass’ innovative solution simplifies and enhances the benefits experience with a highly configurable benefits card that integrates pre-tax accounts, employer-sponsored programs, and compliance tools. Employees can manage their benefits seamlessly through a sleek, user-friendly web and mobile app, enhancing their experience. Some of the most popular accounts include lifestyle, wellness, fitness, caregiving, work from home, and expensing to some of the pre-tax accounts like FSA, HAS, commuter, specialty HRA such as fertility, mental health, medical travel to COBRA & Complience which is a partnership with Peak One and help to manage and take over the administration of all these products for you.

The 2025 Benepass Benchmarking Report

Benepass has positioned itself as a premier platform for customizable spending accounts, and this benchmarking report reflects the depth of its data. It was designed as a resource that would explain account benchmarks and stories about Benepass’ customers, best practices, and new ideas that can help streamline how your clients administer their benefits today. Ultimately, its whole idea was to provide a comprehensive resource that will help design and launch programs that are incredibly valued by employees, making recommendations with programs and plan choices, especially on pretax accounts, that will help streamline administration.

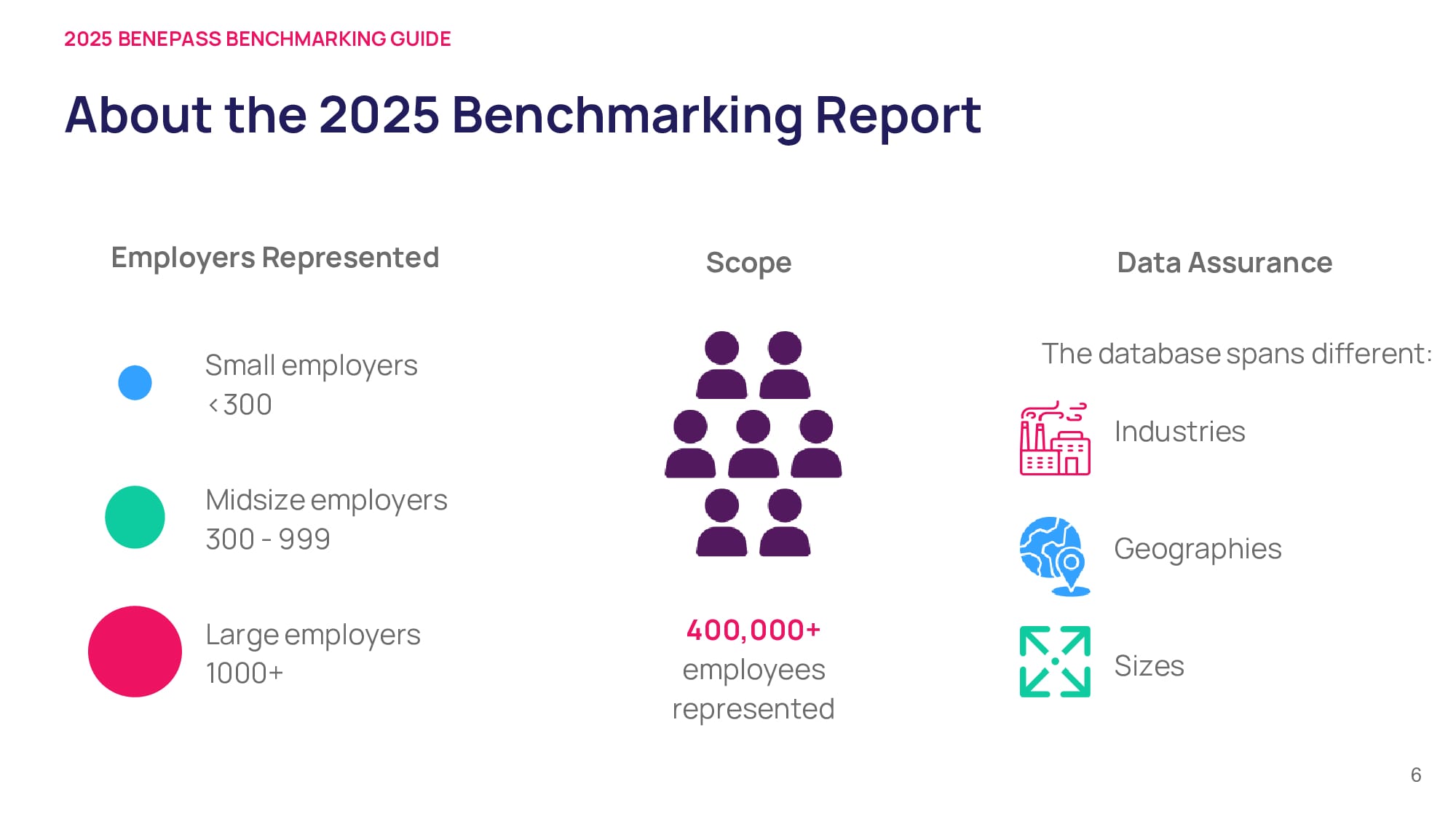

The report includes a representative group of оver 400,000 employees from companies of all sizes, small (under 300 employees), midsize, and large, from various industries, including tech, healthcare, finance, professional services, retail, manufacturing, and non-profits. The result is a comprehensive look into the evolving landscape of employee benefits.

Read more: 2025 Benepass Benchmarking Report

Flexibility Is the Future

LSAs have gained rapid popularity for their ability to support a wide array of employee needs, well beyond traditional health coverage. The report identifies 16 types of customizable LSAs, many of which are taxable but highly valued by employees for their practical and personal relevance.

To match employee lifestyles, companies experiment with diverse funding modules and expiration policies, thus pursuing new design and funding trends. Monthly funding is particularly popular for LSAs tied to fitness, food, caregiving, commuting, and remote work support. On the other hand, professional development, medical travel, and family planning benefits are typically funded annually.

The funding amounts also show encouraging trends. The report notes a year-over-year increase in median employer contributions, reflecting a greater investment in employee well-being. To ensure comparability, all contributions were annualized in the report.

Expiration modules vary widely. Monthly and quarterly are standard for commuter, food, phone, and entertainment benefits, where regular use is expected. Meanwhile, LSAs linked to wellness, caregiving, and professional enrichment tend to expire annually or not at all, offering more flexibility and reducing the risk of unused benefits.

What is striking is the way employees access their LSA funds. About 90% of companies offer both card and claims-based options. Interestingly, certain categories such as professional enrichment or family planning rely more on claims, while others like food and post-tax commuter benefits lean heavily on prepaid card usage.

Sharing benchmarks across 80 different countries, LSA goes beyond U.S. borders, presenting usage data from countries like Bosnia, Oman, and South Africa, where card-based transactions account for 100% of LSA use. The trend holds strong across regions like Latin America, Central Europe, and the Middle East, where card usage exceeds 90% in most cases.

In North America and parts of Western Europe, the card remains the dominant method for accessing benefits, with 80–90% of transactions processed this way. This signals a broader trend toward digital, flexible, and user-friendly benefit administration.

Still Relevant and Evolving

While LSAs are gaining momentum, pre-tax accounts remain a staple in employee benefits, especially when it comes to healthcare, dependent care, commuting, and long-term savings.

Despite their longstanding presence, FSAs continue to evolve. Key findings include:

- Median annual employee contributions for Healthcare FSAs sit at $1,400, with employers contributing around $500.

- About 41% of employees max out their Dependent Care FSA.

- Rollovers are favored over grace periods for Healthcare FSAs, especially when paired with HSAs.

- Median rollover amounts remain below IRS maximums, highlighting room for education and strategic planning.

One area of concern is forfeitures. In 2022, 52% of FSA users left money unspent, with an average of $441 lost per person. However, Benepass users show significantly lower forfeiture rates, especially when FSAs are paired with LSAs. The result is higher employee engagement and smarter benefit utilization.

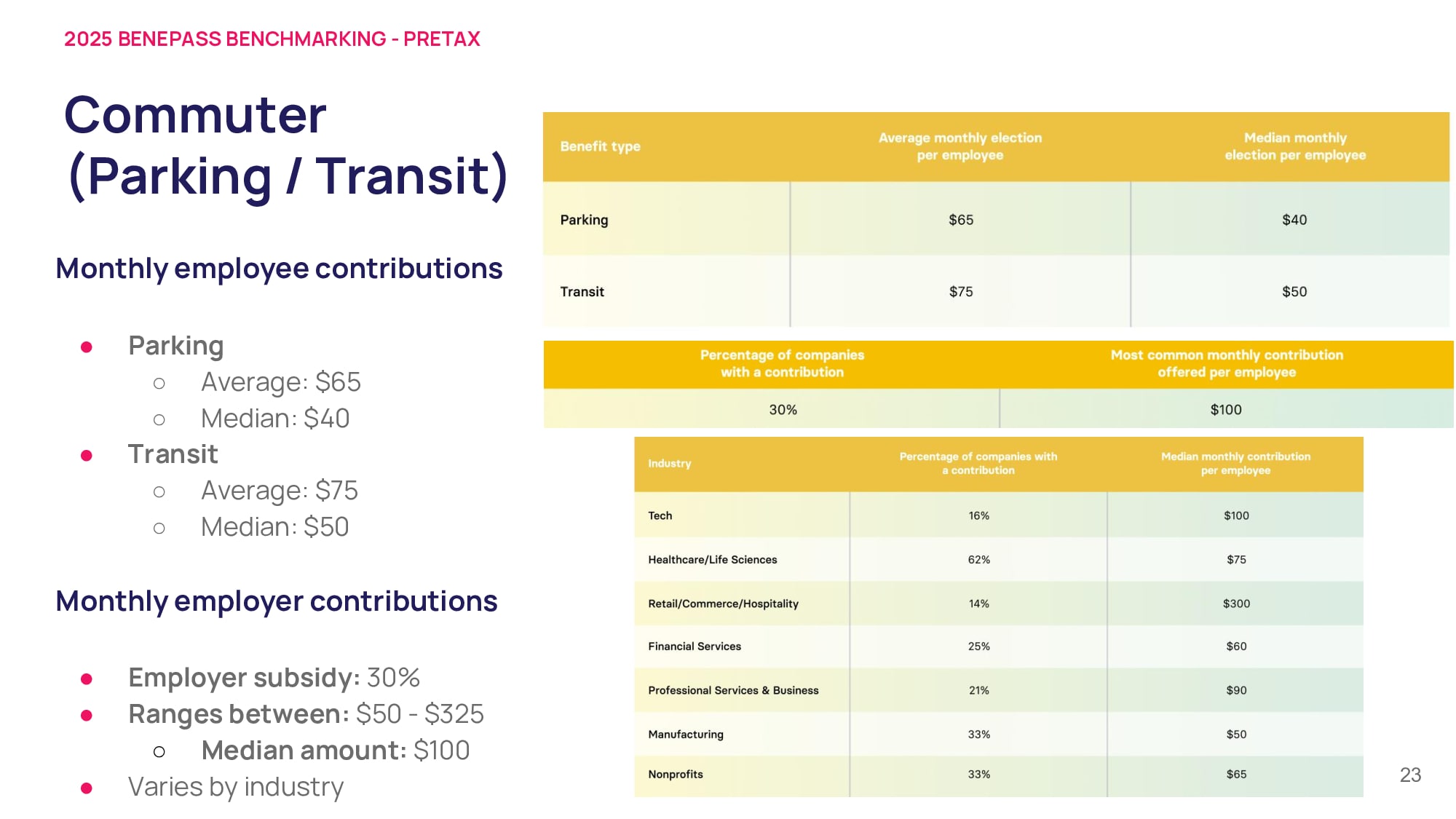

Commuter benefits remain popular. Key benchmark for parking and transit benefits, especially in urban centers include:

- Median monthly parking contribution: $40

- Median monthly transit contribution: $50

- Employer subsidies range from $50 to $325, with a median of $100

Cities like New York, San Francisco, and Chicago lead in commuter spending, with an increasing number of employees using contactless or mobile wallet payments.

The report reveals significant employer investment in HSAs:

- Individual contribution: median of $900

- Family contribution: median of $1,800

- 75% of employers fund HSAs per pay period; 25% opt for front-loaded contributions

Most strikingly, 26% of HSA users on Benepass choose to invest their funds, more than triple the industry average of 8%. This indicates a growing awareness of HSAs as a long-term financial asset rather than just a spending tool.

Get in touch with Benepass today!

The 2025 Benepass Benchmarking Report highlights a clear shift in how companies think about benefits. Flexibility, personalization, and global applicability are must-haves for forward-thinking organizations.

Employers looking to remain competitive should consider:

- Expanding and customizing LSAs based on employee needs

- Offering varied funding and expiration cadences

- Promoting tax-advantaged accounts with education around usage

- Encouraging long-term health savings through HSA investment support

Ultimately, smarter benefits lead to more engaged employees, better retention, and a stronger employer brand. Make your benefits program stand out and learn how tools like Benepass can help you raise the bar.

For more information, contact:

Megan Burns – mburns@getbenepass.com

In case you missed it: Log in to access the full Meet A Vendor Presentation!

Not a subscriber? Request access.

Did you find this article interesting?

Don’t keep this knowledge to yourself – share it on your social media channels and spark engaging conversations!