In This Post:

Presenters:

Toni Baltimore

HCM Partnership Manager

Kyle McClure

Partner Marketing Manager

For many Americans, financial stress doesn’t just affect life at home, but it shows up at work. From covering rent and childcare to navigating unexpected expenses, the delay between earning and getting paid creates more than inconvenience. It contributes to anxiety, burnout, and disengagement on the job.

In today’s economy, where 65% of workers live paycheck to paycheck and nearly 60% can’t afford a $1,000 emergency, the connection between financial wellness and workplace performance is undeniable. When employees are under financial pressure, their focus, productivity, and morale suffer, ultimately affecting business outcomes.

That’s why financial wellness can no longer be seen as an optional benefit. It’s a business imperative.

This was the driving theme of the “Meet a Vendor” Webinar hosted by Shortlister on July 9, 2025, where Kyle McClure, Partner Marketing Manager, and Toni Baltimore, HCM Partnership Manager at DailyPay explored how employers can better support their teams with flexible pay access and tools that grow with employees as their financial needs evolve.

What was made clear in the presentation is that financial challenges don’t look the same for everyone, and they change as people advance in their careers. Some need immediate access to cover daily essentials, while others seek to manage debt, build credit, or save for the future. The solution presented is built to adapt, meeting employees where they are and helping them progress toward long-term financial stability.

This personalized approach doesn’t just reduce financial stress, but it also strengthens engagement, trust, and retention, giving employers a sustainable way to support their workforce at every level.

About DailyPay

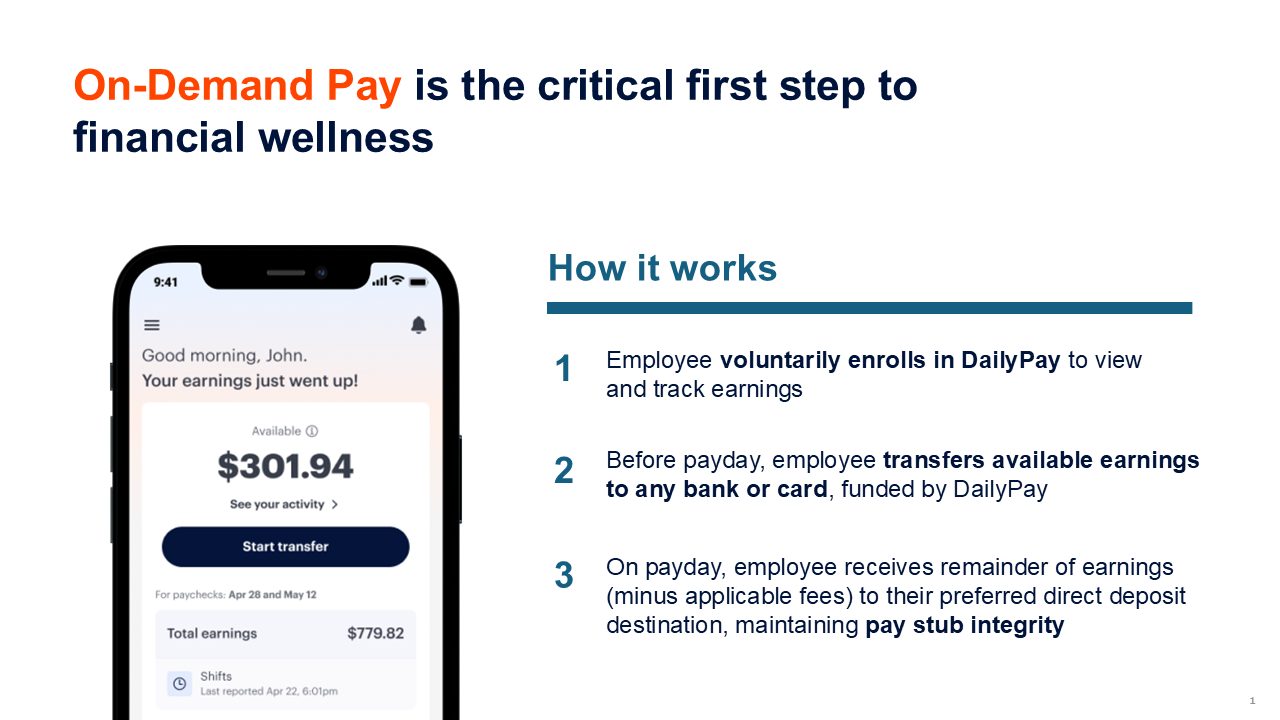

DailyPay enables companies to offer employees access to their earned pay before the scheduled payday – without requiring changes to payroll systems, timing, or tax processes. This flexibility not only provides financial relief but supports a core aspect of well-being: financial wellness. When employees can cover expenses in real time, financial stress decreases, mental health improves, and overall satisfaction at work rises—benefiting both employee and employer through stronger retention and productivity.

This system works through a secure, proprietary network, connecting to over 6,000 banking endpoints and powered by a unique vendor-funded model that ensures money moves reliably and instantly. Employees can track earnings as they work, plan for expenses, and even receive automatic balance alerts, making it easier to decide whether to pick up extra shifts or stay on budget.

Beyond access, the platform supports long-term financial health. Users have access to tools for savings, credit monitoring, and free one-on-one financial counseling, covering topics like budgeting, debt management, credit scores, and more. Educational resources, such as newsletters and in-app tips, help employees build healthy money habits and improve financial decision-making over time.

The Disconnect Between What Employees Need and What Employers Think They're Offering

A striking insight shared during the webinar revealed just how wide the gap is between employee needs and employer priorities: only 24% of employees feel their employer genuinely cares about their well-being, and on the flip side, only 22% of employers consider financial benefits a top priority. This disconnect leaves a significant gap between what employees are asking for and what most wellness programs currently deliver.

While many companies focus on long-term perks, like retirement plans or fitness stipends, employees are often struggling with immediate, day-to-day financial stress. With 78% of Americans facing at least one bill increase in 2024, that gap only grows wider, leaving traditional programs unable to keep pace with employees’ real-life needs.

The conversation in the webinar made it clear: closing that gap requires more than adding another benefit. It requires rethinking how employees access, understand, and engage with their pay. Financial literacy and wellness aren’t learned overnight. They take time, tools, and consistent support. That’s where flexible pay access and real-time financial insights come in.

The impact is immediate. According to survey data shared during the webinar, 32% of employees rank on-demand pay as the most adopted benefit right after healthcare, even above retirement or flexible scheduling. Giving employees more control over their earnings doesn’t just provide relief, but it builds financial confidence and trust in their employer.

Source: DailyPay

Meeting Every Employee Where They Are

One of the most valuable insights from the webinar was the importance of flexibility and adaptability in meeting employees’ evolving needs. The solution discussed wasn’t built around a one-size-fits-all model, but it was designed to adjust based on each individual’s financial situation, stage of life, and goals. That adaptability is a major reason why employees respond so positively to it.

Whether someone is just starting their career, managing a household on a tight budget, or working toward long-term savings goals, the platform offers the tools they need, when they need them. Employees can enroll quickly, track their earnings in real time, and access helpful features like automatic savings, credit monitoring, or financial counseling as their needs change.

Real-time earnings visibility gives employees the information they need to budget smarter, avoid overdraft fees, and reduce reliance on high-interest loans. Over time, this shift from reactive to proactive money management helps workers gain control, reduce stress, and make more confident financial decisions.

And the impact extends well beyond individual users. According to data shared in the session, employers who offer this benefit see measurable improvements across key workforce metrics:

- Lower turnover, thanks to reduced financial stress — which means lower employee replacement costs for employers

- Improved morale, as workers feel more secure and supported — leading to reduced absenteeism

- Increased engagement, with employees feeling more connected and in control — resulting in better timeclock compliance

What About Employers? Is It Hard to Implement?

That’s the beauty of it—it’s not. The ease of adoption is built into the model.

Employers often assume that adding a financial wellness platform requires overhauling payroll systems or increasing administrative workload, but that’s not the case.

The entire process is automated and designed to work with existing payroll infrastructure, meaning no changes to funding schedules, tax withholding, or compliance. Most importantly, there’s no added burden on payroll teams. Employees enroll independently, start tracking their earnings, and access available pay when needed, even on weekends or holidays.

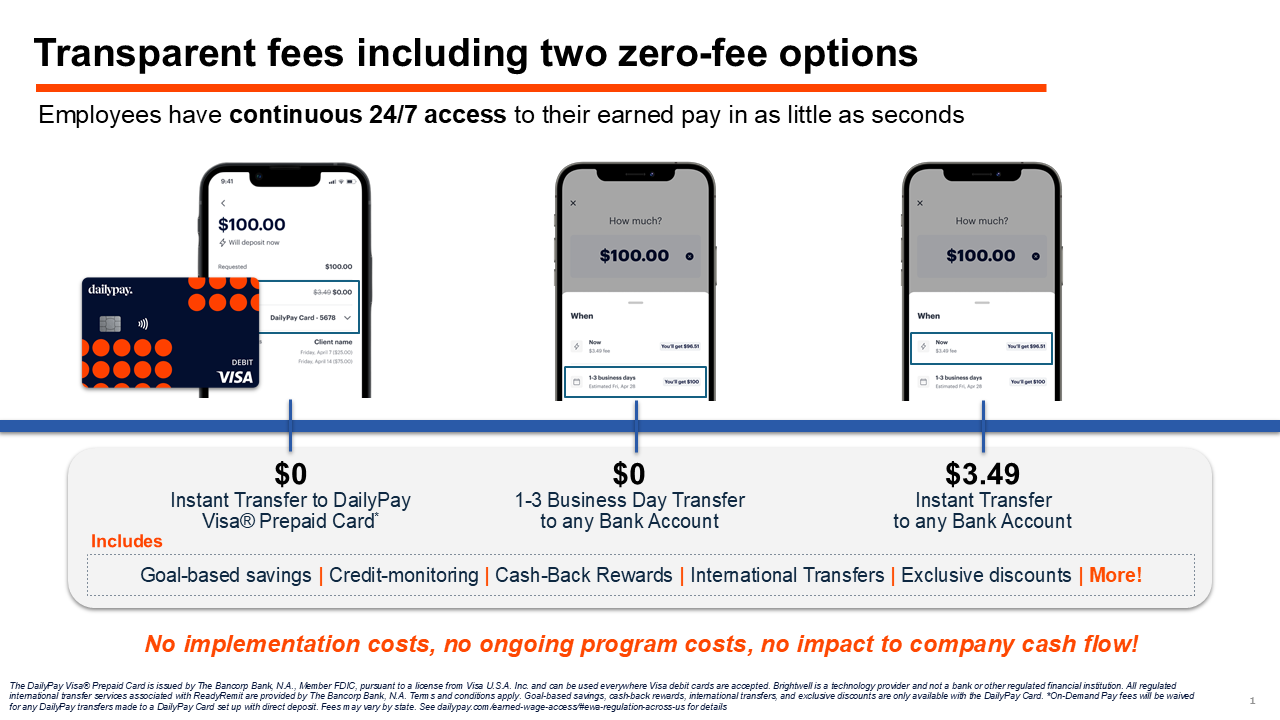

The presenters also emphasized the value of 24/7 access and transparent pricing. Employees always know their options, including zero-fee transfer methods, and can choose what works best for their needs. Meanwhile, employers benefit from a plug-and-play model that includes built-in marketing and communication tools to help drive awareness and adoption, without extra effort from internal teams.

And the results? They speak for themselves. Over 60% of users report reduced financial stress, and many said they felt more empowered to take on additional shifts because they knew they’d have access to earnings right away.

Source: DailyPay

More Than a Product - A Proven Partner

The presentation closed with a look at the broader impact of this work in metrics, but in people’s lives, too.

The platform’s high user satisfaction is reflected in its 430,000+ five-star reviews and industry recognition, including awards from TIME Magazine, Built In, Workday, and CB Insights. But even more compelling are the voices of the employees who rely on it:

“Very grateful for being able to take care of my family and have that little piece of mind this [moneyʼs] here just in case.”

— Nicole S., Retail Employee

“A true game changer. This app is 100 times better than the other “pay advanceˮ apps.”

— Tia E., Retail Employee

“It’s hard to stretch two weeks between paydays. Now I can pay myself once a week, and more if needed.”

— Laura M., Customer Service Agent

The takeaway from the session was clear: when companies invest in real-time pay flexibility and financial tools, they’re not just improving processes, they’re changing lives.

Build a Better Future for Your Workforce

Whether you’re an HR leader, benefits manager, or business owner, now is the time to rethink how your organization supports employee well-being, especially when it comes to financial stability.

From small teams with under 100 employees to large enterprises with thousands, and across industries like healthcare, manufacturing, hospitality, and more, the needs may vary, but the solution adjusts. The flexibility and scalability of the platform make it a fit for companies of all shapes and sizes, helping them drive retention, improve morale, and offer real-time support when it matters most.

Ready to see how it could work for your team?

Contact the team to learn more or request a personalized demo:

Toni Baltimore – tonesha.baltimore@dailypay.com

Kyle McClure – kyle.mcclure@dailypay.com

In case you missed it: Log in to access the full Meet A Vendor Presentation!

Not a subscriber? Request access.

Did you find this article interesting?

Don’t keep this knowledge to yourself – share it on your social media channels and spark engaging conversations!