In This Post:

Presenters:

Bryan Preston

Chief Commercial Officer at

Firefly Health

Patti Wahl

Senior Vice President, Health Transformation at Aon

Rising costs, inconsistent care quality, and increasingly complex employee needs have pushed employers to rethink traditional health insurance models. High-deductible health plans have been in place for approximately 20 years as a strategy to help consumers be more knowledgeable of their healthcare. Most organizations remained loyal to legacy carriers simply because switching felt too overwhelming or too risky. However, today, employers seek sustainable cost control, enhanced member experience, and measurable clinical outcomes, and are increasingly moving toward alternative health plans (AHPs).

We had an insightful session with a unique approach, featuring Bryan Preston, Chief Commercial Officer at Firefly Health, and Patti Wahl, Senior Vice President of Health Transformation at Aon, discussing how healthcare arrived at this point and what we can do about it. Patti’s experience on the hospital side for 11 years in a regional business coalition, and a wide purview working with a lot of different customers across the country, supported every detail shared in this session.

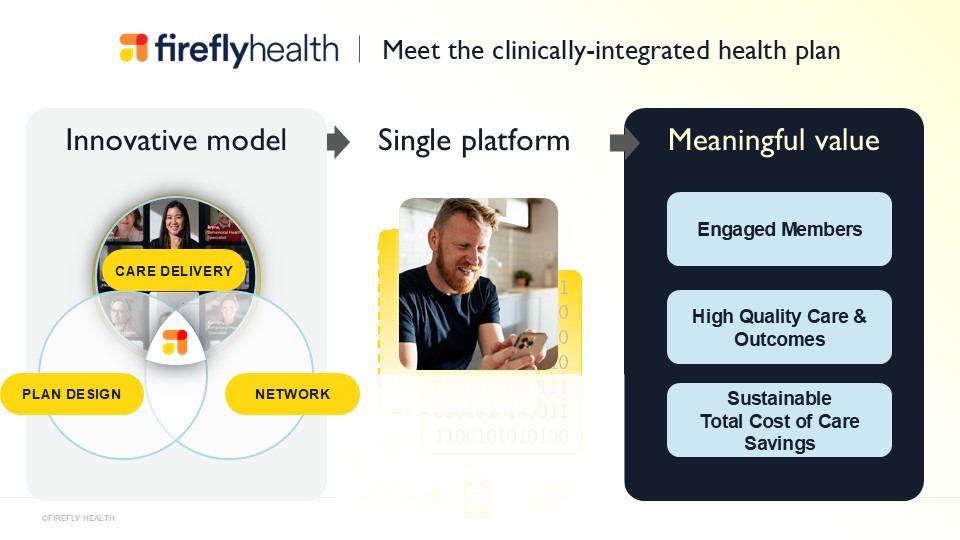

About Firefly Health

Firefly Health is a clinically integrated alternative health plan that combines modern care delivery models, clinically-integrated networks, and innovative plan designs to create healthcare ecosystems that work better for both organizations and employees.

AHPs represent a structural shift toward a more connected, technology-driven, outcomes-based approach to healthcare. Using a team approach, Firefly offers an affordable and differentiated health benefit that combines hybrid advanced primary care, a nationwide provider network, and a full suite of TPA services with innovative plan designs.

Traditional Plans Are No Longer Enough

In the late 1990s, the HMOs and capitation gained popularity, but have lacked in effectiveness. Then, high-deductible health plans came into place as a strategy to help consumers be more knowledgeable of their healthcare.

And looking 25 years later, it proved that’s not working either. From the employee’s perspective, they can no longer afford the high deductibles. Therefore, they’re avoiding necessary care, which is causing the rise in high-cost claimants and other types of challenges.

Aon predicts a 9.5% trend, which is particularly notable at this unprecedented time, as many self-insured employers, clients of brokers and consultants, are identifying healthcare costs as one of the top two drivers of their budgets. The C-suite is getting more involved than ever before. Aon’s seeing a shift where clients close open enrollment and immediately want to start strategy discussions for 2027, much earlier this year than expected.

For decades, employers relied on the big, familiar names in health insurance. But the status quo has become expensive and unsustainable:

- Premiums continue to rise year over year.

- High-deductible plans push costs onto employees.

- Care remains fragmented and reactive.

- Member dissatisfaction is increasing.

This combination has created a breaking point. Employers need solutions that do more than simply negotiate rates or adjust deductibles. They need models that fundamentally redesign how healthcare is delivered and paid for.

This has led to the emergence of AHPs, which are a loosely defined group of plans offering alternatives to status quo employer plans like standard PPOs, HMOs, or HDHPs. These innovative health plans look to maximize member engagement, price transparency, and cost efficiency.

Aon found that 9% of their clients are moving forward with these so-called alternative health plans, which is what Firefly is offering. And then 21% are considering it for the future. So, they predict that when the next round of their survey results come in, the statistics will be even higher.

Firefly Takes a Clinically-Integrated Approach

Firefly Health’s approach to an alternative plan serves member and employer goals by orienting toward the utilization of high-value care. The entire model is designed to encourage care that delivers stellar health outcomes, cost-efficient–advanced primary care, high-quality specialists, and lower-cost sites of care. Instead of members bouncing between disconnected providers, Firefly unify care delivery through a single platform that has:

- One connected care team, comprising primary care, behavioral health, and specialty navigation, is seamlessly aligned.

- Personalized guidance where members get help choosing providers, scheduling appointments, and understanding their benefits.

- Tech-driven touchpoints with virtual-first care, mobile tools, and proactive outreach improve engagement and outcomes.

The results speak for themselves. In many implementations, many members actively use their centralized care platform, showing rare levels of engagement in a system where members typically feel lost or unsupported.

Improved Outcomes are the Core Value

Unlike traditional plans that measure success through claims processing, Firefly Health’s clinically-integrated health plan is built to deliver measurable clinical outcomes, especially for high-risk populations. For example, in one client population, Firefly saw with among members continuing coverage year to year, 97% of high-risk members were identified and connected to care. These members received targeted interventions, helping prevent costly complications down the line.

For the same client, the median out-of-pocket spend for members dropped from $163 in 2023 to just $75 in 2024.

When employers see clinical improvements paired with cost reductions, the value becomes impossible to ignore.

Cost control remains one of the biggest drivers behind the shift to AHPs. For Firefly, what makes these savings sustainable are three major factors:

- Eliminating unnecessary care. Through strong navigation support and evidence-based guidelines, Firefly significantly reduces low-value care, unnecessary ER visits, and avoidable specialist referrals.

- Prioritizing preventive and longitudinal care. Members build long-term relationships with clinicians, leading to earlier detection, better chronic condition management, and reduced high-cost escalations.

- Integrating technology and data science. Continuous data monitoring identifies risk faster and targets interventions more precisely than traditional plans.

This is a cost transformation where employers are paying less and are getting more value from every healthcare dollar.

Member Experience Finally Takes the Front Seat

Employees today expect more from their health benefits. They want simplicity, personalization, and care that fits into their daily lives, not a maze of deductibles, networks, and vague billing. Firefly believes employer-sponsored coverage can do better—by design. That means moving away from blunt cost-sharing tools and toward smarter incentives, clearer costs, and built-in care delivery and navigation that actually helps people make better decisions for their health and their wallets.

When 97% of Firefly Health plan members report satisfaction with their care experience, employers take notice, especially in a benefits environment where differentiation matters for recruitment and retention.

Your RFP Process Has To Evolve For AHP Models

As AHPs enter the mainstream, the traditional RFP process no longer fits. Employers and consultants now need new frameworks that evaluate:

- Care quality and clinical integration

- Member experience strategies

- Virtual and hybrid care capabilities

- Risk stratification and data analytics

- Total cost of care impact

- Technology platform functionality

- Partner transparency and long-term innovation

Forward-thinking employers are using new RFP templates tailored specifically for evaluating alternative health plans, ensuring they get the right partner, not just a carrier with the lowest bid.

Get in touch with Firefly Health today!

Employers today are facing unprecedented pressure, from rising healthcare costs to competitive talent markets to the evolving needs of a diverse workforce. Alternative health plans offer a viable, proven, and forward-thinking solution.

By integrating care delivery, modernizing navigation, leveraging technology, and focusing on outcomes, they create a healthcare ecosystem that benefits employers, supports employees, and drives long-term sustainability.

Employers that move now will be able to control costs more effectively and redefine what it means to offer industry-leading benefits.

For more information, contact:

Patti Wahl – patti.wahl@aon.com

Bryan Preston – bryan.preston@firefly.health

In case you missed it: Log in to access the full Meet A Vendor Presentation!

Not a subscriber? Request access.

Did you find this article interesting?

Don’t keep this knowledge to yourself – share it on your social media channels and spark engaging conversations!