In This Post:

Presenters:

Tanner Seidler

Director of Consultant Relations

Health Savings Accounts (HSAs) were designed to empower employees: tax-advantaged, flexible accounts that help people pay for healthcare today while saving for tomorrow. On paper, they’re one of the most valuable benefits available. In practice, however, many employees aren’t getting the value they expect, and employers aren’t seeing the full return they could be realizing either.

Despite years of education and increasing adoption of high-deductible health plans (HDHPs), HSAs remain widely misunderstood, underutilized, and frustrating to use. The issue isn’t a lack of interest. It’s the experience.

We welcomed Tanner Seidler, Director of Consultant Relations at InComm Benefits to share some of the latest findings from InComm’s employee research report from the past year. InComm analyzed HSA users, habits, some of the challenges they’re faced with, and what they’re looking for as it relates to these programs. Recent insights reveal a clear message: employees want to use their HSAs, primarily as a spending tool, but the current system makes it harder than it needs to be. And that gap presents a real opportunity for employers willing to rethink what a “modern HSA” should look like.

About InComm Benefits

InComm’s HSA solution is designed to be intuitive and low-maintenance, offering automated tools to identify eligible expenses and reduce confusion. Since transaction records are saved automatically, there’s no need to scan receipts. For those who want to invest, funds can be set to invest each month automatically.

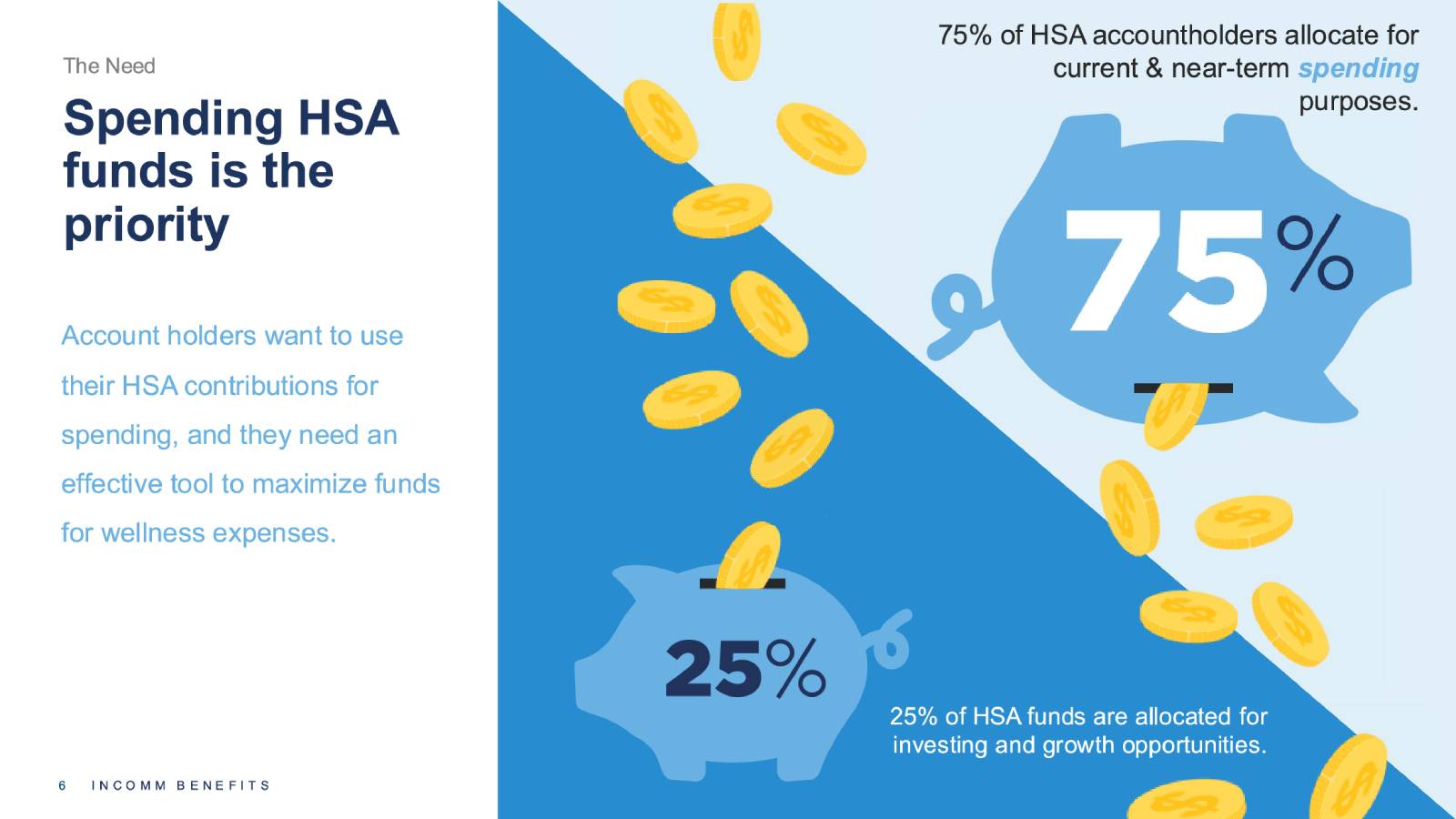

Employees Want to Spend Their HSA Funds

Most employees believe that HSAs are mainly long-term investments, saving for retirement healthcare costs.

The majority of HSA users prioritize current and near-term healthcare spending. They want to use their funds for prescriptions, co-pays, dental and vision care, and everyday wellness expenses. These are real, recurring costs that impact household budgets right now.

Many respondents have had HSAs for years, not first-time accountholders. This means that long-term HSA users are familiar with how accounts work and still choose to spend rather than save. That tells us something critical: the desire to spend is intentional, not due to a lack of education.

Yet even with that intention, employees often don’t feel confident using their HSA when it matters most.

Confusion at Checkout Is the Breaking Point

Surveyed 1,227 HSA users, InComm Benefits found something that should be emphasized. That is, 40% of the respondents have delayed healthcare treatment because they couldn’t afford it. It’s the moment of purchase where eligible and non-eligible items are often mixed. Other than that, employees frequently find themselves asking about their eligibility, whether their HSA card will be declined, or if they need to file for reimbursement later. That uncertainty leads to hesitation. Over time, these small friction points add up and many employees avoid using their HSA entirely.

And while HSAs can’t fix the seemingly endless increase in healthcare costs year over year, a well-structured HSA can make a difference and enable employees to cover their expenses without having to delay care.

Reimbursement: Technically Possible, Practically Avoided

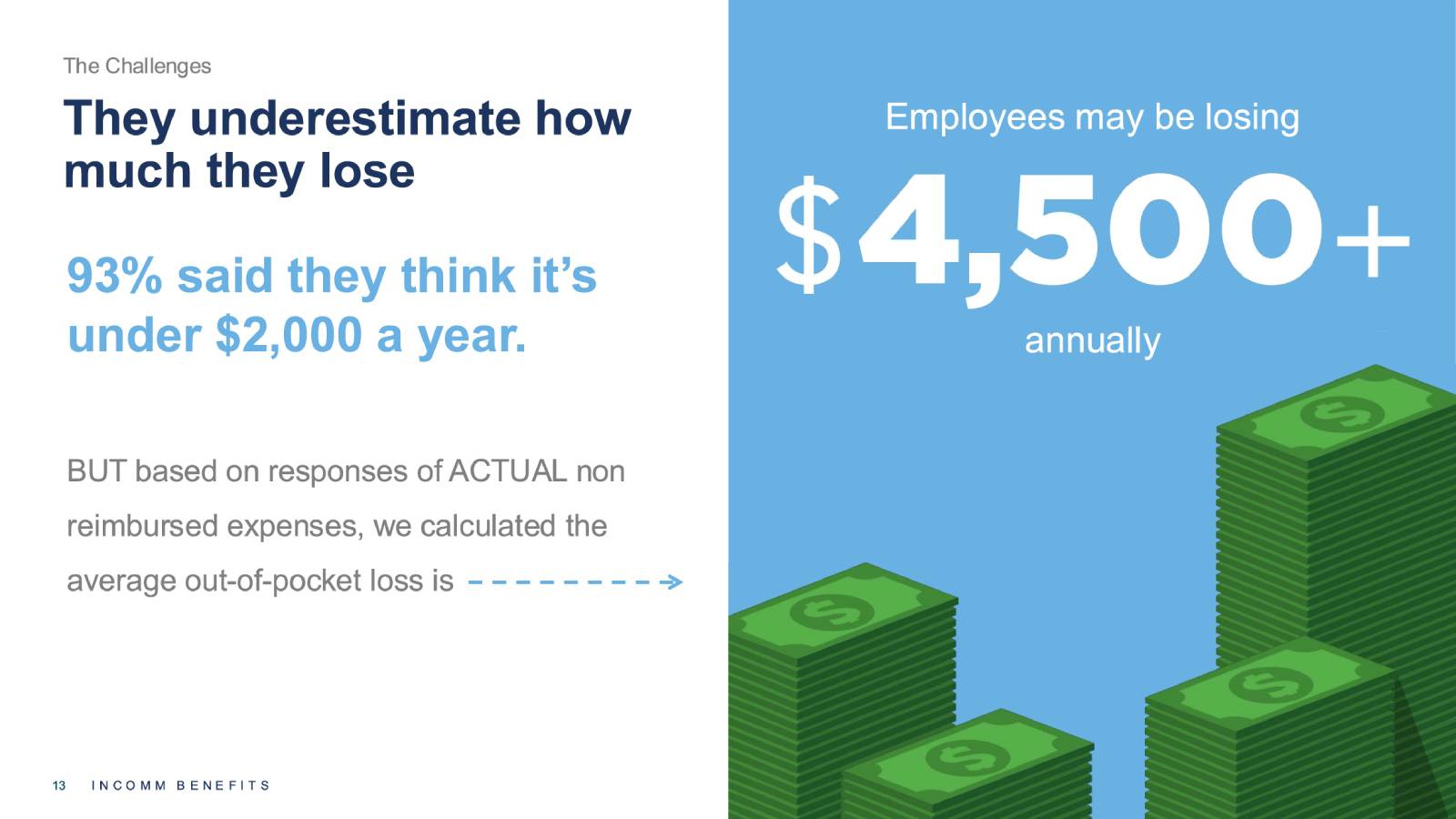

In theory, reimbursement solves everything. In reality, it’s one of the most common reasons employees leave money on the table, because it is usually time-consuming, confusing, or not worth the effort for smaller purchases.

As a result, many employees only seek reimbursement for “big ticket” items like prescriptions or co-pays, and what’s more concerning is that employees significantly underestimate how much money they lose each year by not reimbursing themselves.

This is more of a system design problem than a behaviour problem.

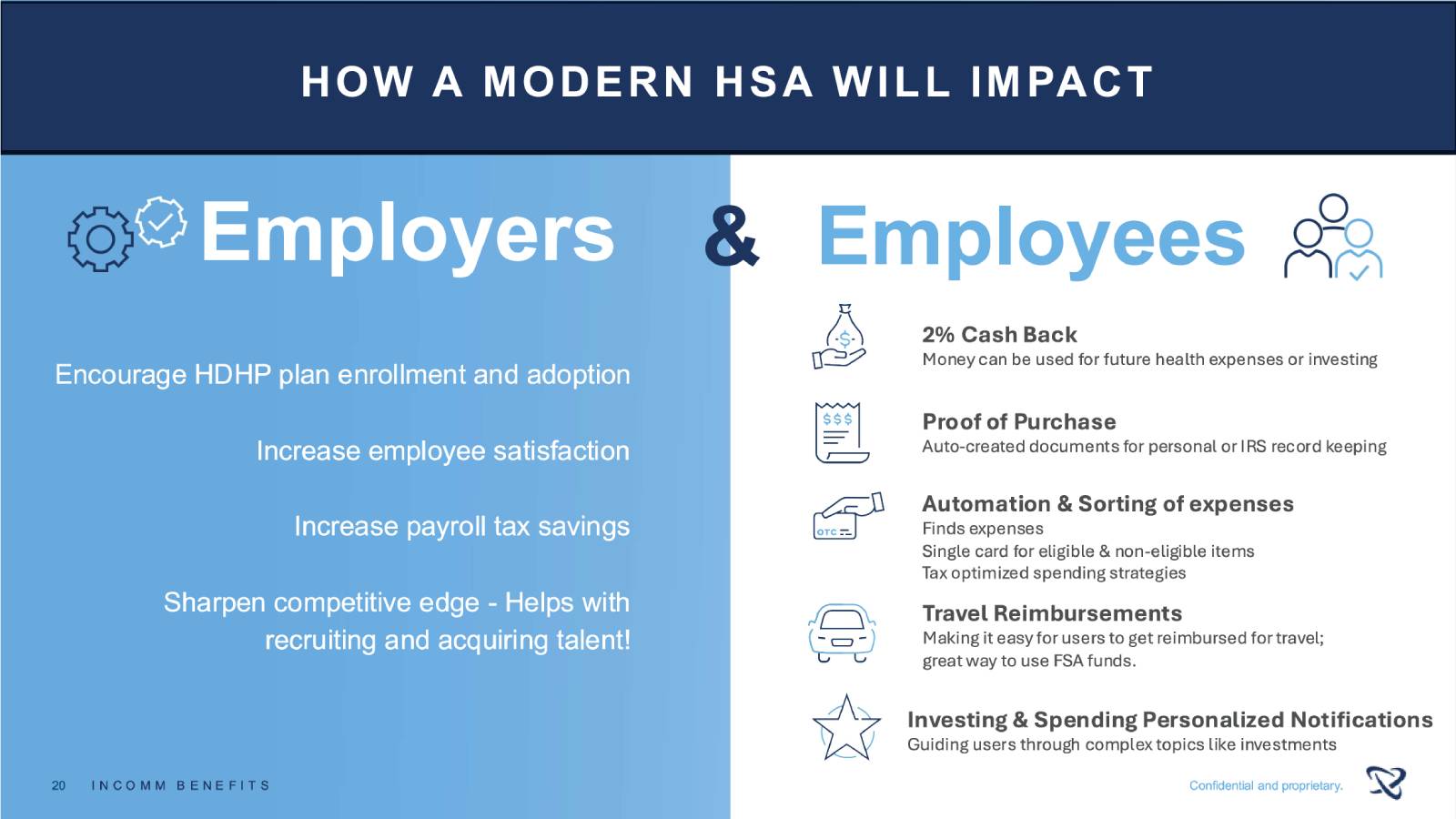

Why a Better HSA Experience Benefits Employers Too

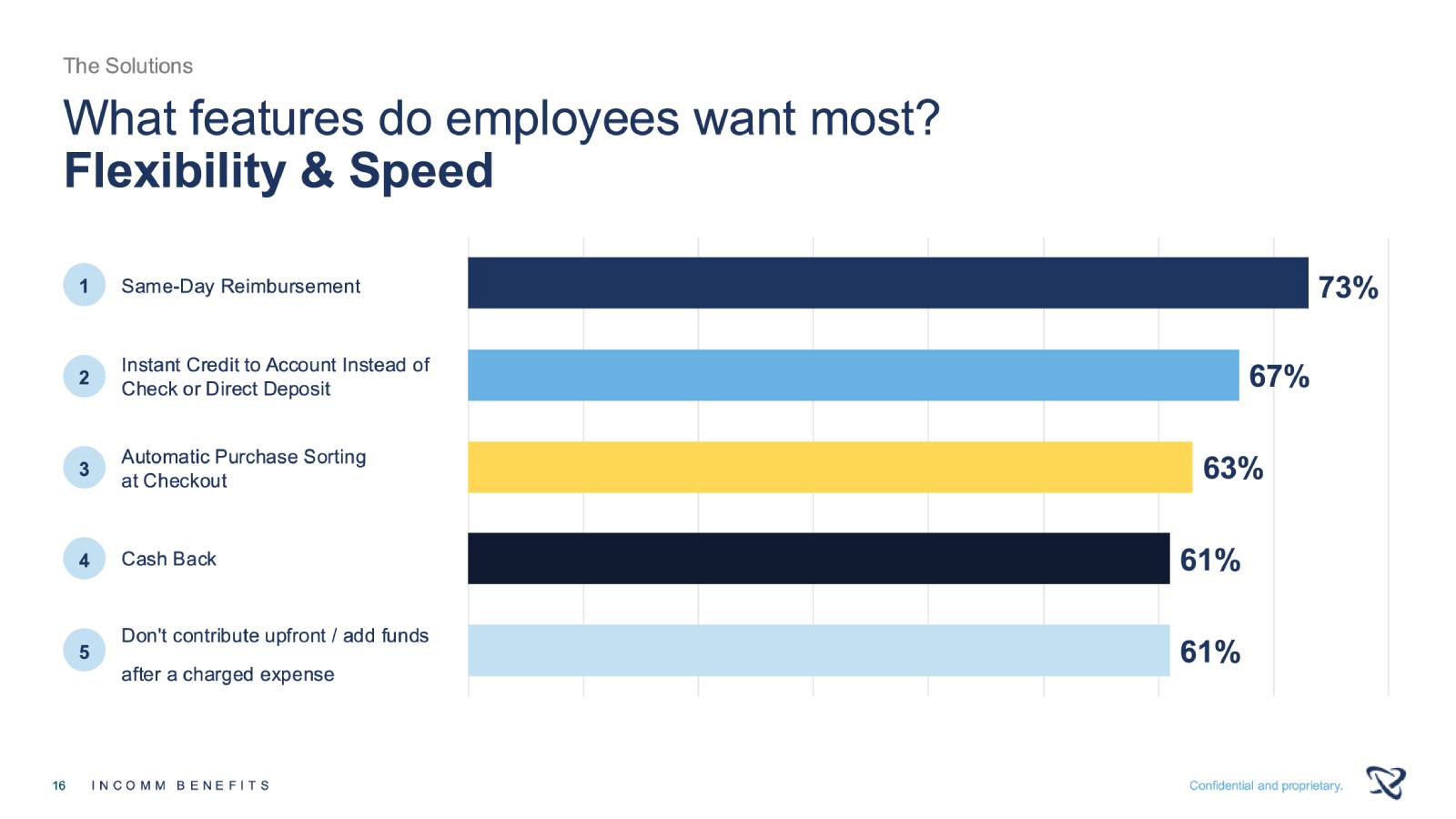

When asked to imagine a better HSA experience, employees are remarkably consistent in what they ask for. The top requests center around automation, speed, and flexibility, and that will fundamentally change how employees engage with their accounts. When spending feels simple and predictable, confidence increases. And when confidence increases, usage follows.

This is an employee satisfaction issue and a strategic employer opportunity.

When employees use their HSAs more frequently and effectively:

- They’re more likely to contribute consistently

- Employers benefit from increased payroll tax savings

- HDHP adoption becomes easier to support

- Overall satisfaction with the benefits package improves

A modern HSA can also be a powerful differentiator in a competitive talent market. Employees are paying closer attention to benefits that actually help them manage expenses. Offering HSA with automation, transparency, and smart incentives shows employees that their time, money, and experience matter.

Get in touch with InComm Benefits today!

The future of HSAs is about enabling spending and saving through better design.

A truly modern HSA:

- Meets employees where they are

- Removes friction from everyday healthcare spending

- Encourages smarter financial behavior without added complexity

- Aligns employee needs with employer financial goals

HSAs were never meant to be confusing. With the right tools in place, they can finally deliver on their original promise: making healthcare spending simpler, smarter, and more rewarding for everyone involved.

For more information, contact:

Tanner Seidler – tseidler@incomm.com

Stay Connected: www.InComm.com/Benefits

In case you missed it: Log in to access the full Meet A Vendor Presentation!

Not a subscriber? Request access.

Did you find this article interesting?

Don’t keep this knowledge to yourself – share it on your social media channels and spark engaging conversations!