In This Post:

Presenters:

Jake Aldrich

Sales Director at SAVVI Financial

Ben Yomtoob

Strategic Advisor, AI & HR Tech at BuckleyRoberts

Sims Tillirson

Founder & Principal at Tillirson Consulting Group

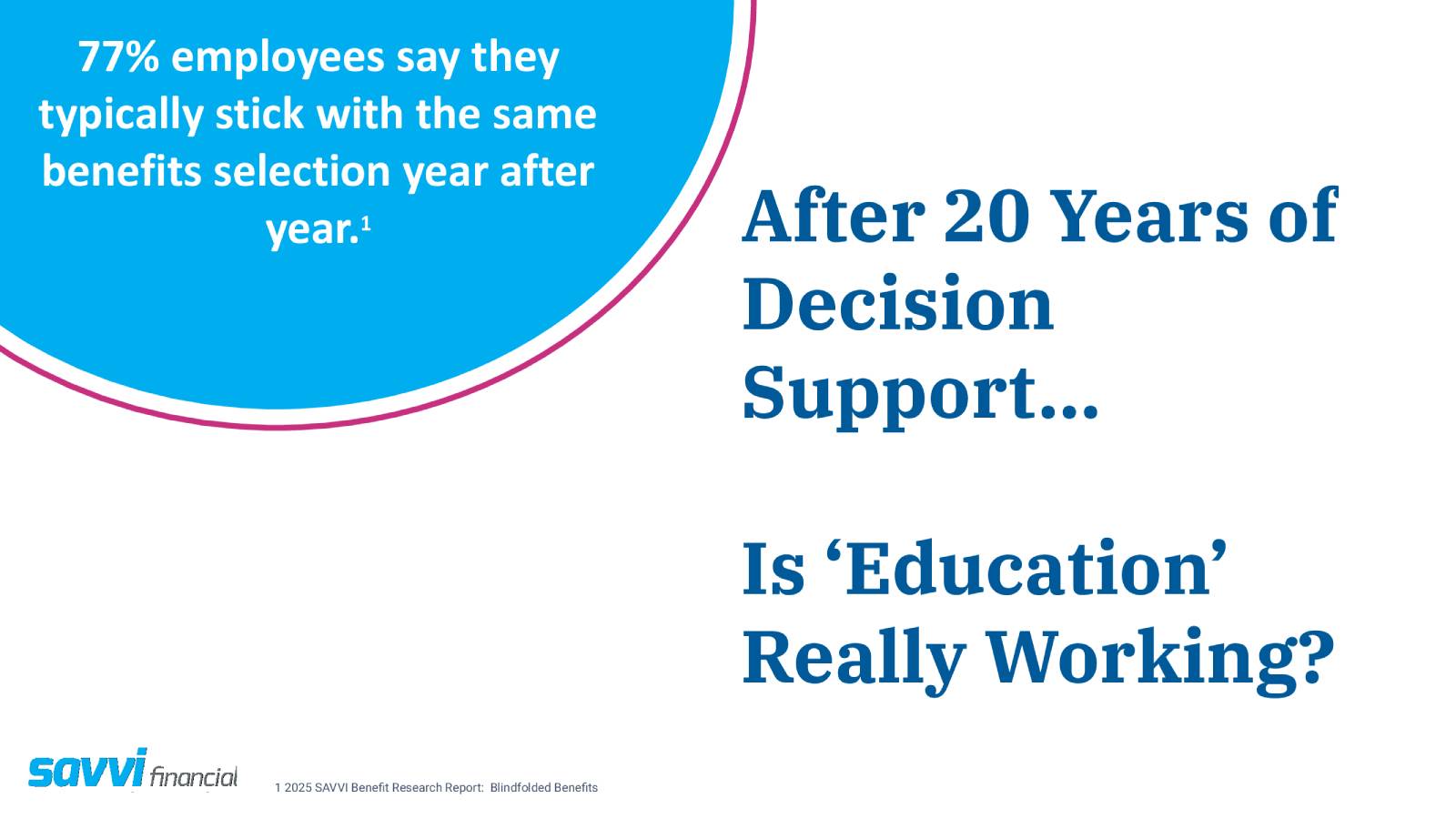

Each year, employees are faced with the task of selecting their workplace benefits, healthcare plans, financial coverage, retirement options, and more. And yet, despite the time and effort HR teams dedicate to education and communication, the overwhelming majority of employees default to the same choices they made the year before. According to SAVVI Financial’s recent Blindfolded Benefits report, 77% of employees repeat their previous selections, often without taking the time to review their current needs or explore better-suited options.

This is not a reflection of apathy, but rather of the complexity and confusion that often surrounds benefits enrollment. Faced with a flood of information, tight deadlines, and a lack of personalized guidance, many employees turn to friends or coworkers for advice, or simply stick with what’s familiar. This behavior signals a deeper issue: the traditional model of benefits education, long considered the gold standard, may no longer be sufficient.

To address this challenge, Shortlister partnered with SAVVI Financial for a webinar titled “Effortless Enrollment: The Future of Data-Driven Health & Financial Guidance.” The session explored how employers can reimagine the enrollment experience using personalized, data-driven tools that make choosing the right benefits simpler, faster, and more meaningful.

About SAVVI Financial

At the center of the conversation was SAVVI Financial, a company leading the shift toward smarter, data-driven benefits decision-making. One of their key innovations is SelectSmart, a solution designed to simplify enrollment by offering personalized, curated benefit recommendations based on employee needs. Designed to replace guesswork with guidance, SelectSmart brings clarity to an often opaque and stressful process.

What sets SelectSmart apart is its ability to personalize the entire enrollment journey. The tool begins by collecting relevant data from employees. This includes financial goals, healthcare priorities, family structure, and budget constraints. Rather than overwhelming individuals with every possible option, the system analyzes this information and presents curated benefit bundles tailored to their unique needs.

From there, employees are walked through a streamlined review process, where the selected bundles are clearly explained, and trade-offs are easy to understand. Finally, the enrollment process is completed with integrated tools that allow for one-click submission, making the entire process not only intuitive but nearly effortless.

This guided experience is transformative. When employees feel confident in their choices and see how their selections align with both their personal needs and financial goals, satisfaction naturally increases. And when more informed choices are made, employers benefit from better engagement, optimized plan utilization, and a more financially secure workforce.

Reframing the Problem: Why Education Alone Isn’t Enough

The webinar panel, featuring Jake Aldrich from SAVVI Financial, Ben Yomtoob of BuckleyRoberts, and Sims Tillirson of Tillirson Consulting Group, opened with a candid look at how benefits education has traditionally been delivered. Despite decades of investment in educational materials, live sessions, and enrollment campaigns, most employees still lack the clarity and confidence needed to make empowered choices during benefits season.

According to recent findings from SAVVI Financial, there remains a significant disconnect between what employers are offering and what employees actually need. This communication gap is widening, particularly as the benefits landscape becomes more complex and crowded. Employees are often overwhelmed by the number of options, unclear on the value of certain plans, and unsure how their choices impact their long-term financial well-being.

Rather than proactively engaging with resources, many employees wait until the last minute to select their benefits, often defaulting to last year’s choices or making decisions based on convenience, peer advice, or urgency. This reactive behavior results in poor plan fit, underutilization of key offerings, and, in some cases, unnecessary financial stress.

The panelists also acknowledged a deeper structural issue within the industry: the language and strategy around decision support hasn’t evolved meaningfully. Many of the tools intended to assist employees are still rooted in aggressive sales behaviors or outdated models of education. As a result, employees are not receiving the kind of support they truly need, support that guides rather than sells.

The Value of Personalized Guidance

In today’s environment, education alone is no longer sufficient. What’s needed is real guidance, especially in areas like healthcare, where financial implications are substantial. The distinction is crucial: effective healthcare guidance must be understood as financial guidance. And that requires more than just HR handbooks or plan comparisons. It calls for tools and strategies that meet employees at their point of decision with timely, personalized, and unbiased insights.

There’s a clear need for benefits teams to be equipped with not only better tools, but also deeper expertise. HR and benefits departments are being called to operate more like strategic advisors than simply administrators. While many organizations are making progress, the panel agreed: most are not yet where they need to be. However, a shift is underway toward smarter, data-backed solutions that elevate benefits decision-making through clarity, context, and personalization.

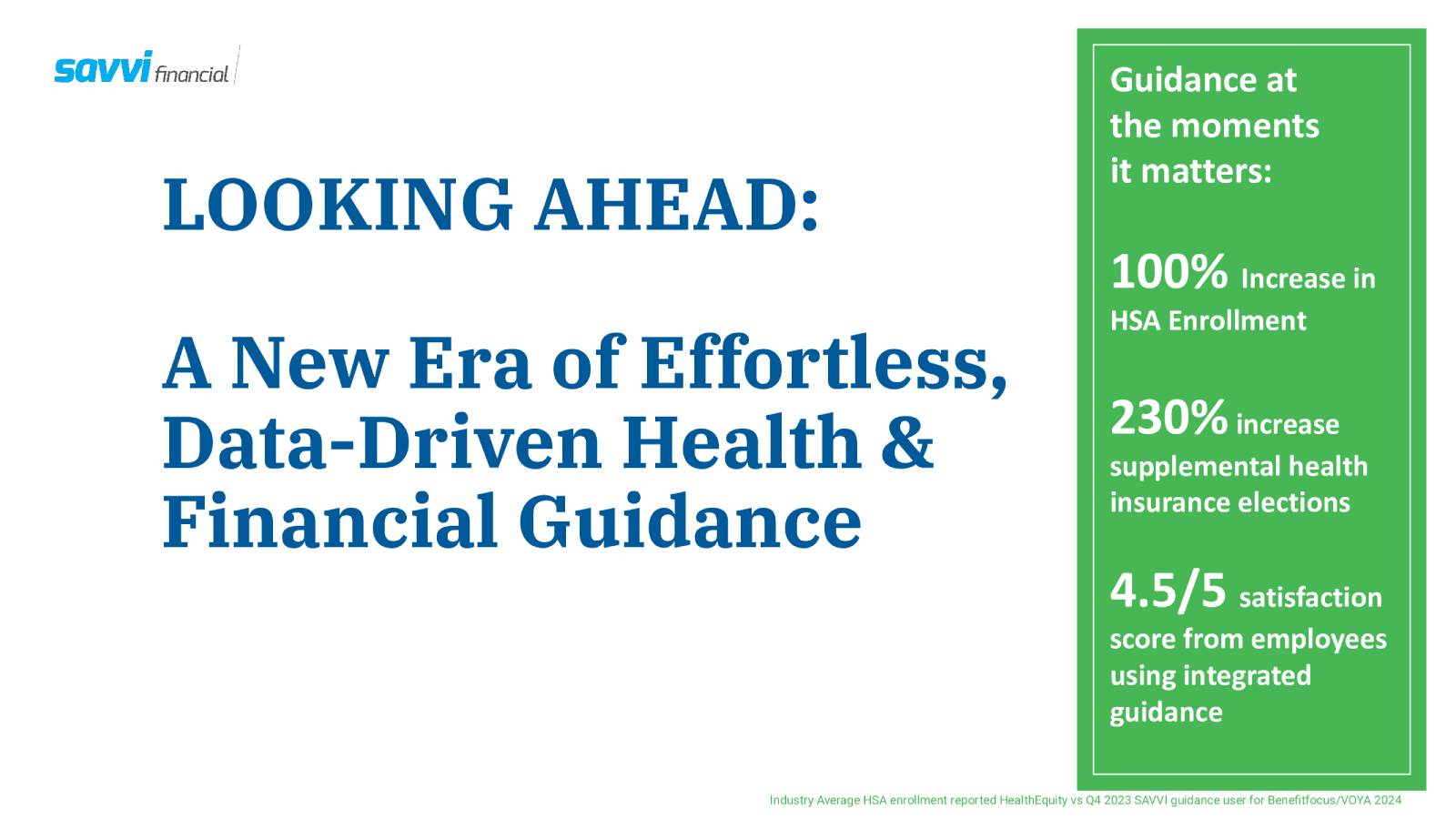

Looking Ahead: A Smarter Standard for Employee Benefits

The message of the SAVVI Financial webinar was clear and urgent: it’s time to evolve our approach to benefits enrollment. In a world where employees are constantly overwhelmed with information, and decision fatigue is part of daily life, relying on education alone is no longer enough. Open enrollment has become more than just a transactional process. It’s now an opportunity to support employee well-being, engagement, and long-term retention.

Progressive organizations are beginning to recognize this shift. Rather than overwhelming employees with an abundance of choices and documents, they are turning to data-driven solutions, like those offered by SAVVI Financial, that streamline the decision-making process through personalization, relevance, and simplicity. These platforms go beyond presenting options. They provide curated, actionable guidance based on real employee data and financial goals.

And while making benefits decisions may feel like an individual task, the reality is that these choices often affect an employee’s broader circle, especially their family. This highlights the importance of tools that help employees assess not just their healthcare preferences, but their overall financial wellness. With the right insight, employees can choose plans that support their family’s needs today and build financial security for the future.

When this kind of support is available, employee satisfaction rises, because the process begins to feel less like decoding a technical manual and more like having a thoughtful, empowering conversation. SAVVI’s approach ensures that every benefits moment is an opportunity for employees to gain clarity and confidence, not confusion and stress.

But the impact doesn’t stop there. Employers benefit as well. When employees are equipped with the right guidance and understand the true value of their benefits, they become more engaged in their roles. They are more likely to stay, grow, and thrive within the organization. Benefits, then, are no longer just a checkbox. They become a cornerstone of retention, loyalty, and well-being.

Still, one critical question remains: What is the employer’s role in engaging employees in benefits?

The answer begins with listening. HR teams and managers must create space, through 1:1 meetings, surveys, or team conversations, to understand what their people need and how those needs are evolving. Corporate communication channels can also be used more strategically, not just to inform but to invite dialogue and feedback.

Employers must also invest in their own education. Understanding the tools available, the challenges employees face, and the opportunities that smarter decision support can unlock is essential for building a truly employee-centric benefits strategy.

And for those early in their careers, there’s a responsibility too. Now is the time to build financial literacy and to understand how your benefits fit into your bigger life plan. Whether it’s saving for future healthcare costs, starting a family, or planning for long-term financial goals, tools can help demystify the process and guide you toward smart, informed choices.

Ultimately, what emerged from the SAVVI Financial webinar was not just a call for better technology, but for better alignment between employers and employees. Benefits aren’t just about coverage. They’re about confidence, well-being, and the feeling that you, and your family, are supported every step of the way.

Get in touch with SAVVI Financial today!

As the benefits landscape continues to evolve, it’s clear that data-driven guidance is already here. With tools from SAVVI Financial, employers have the opportunity to turn open enrollment from a burden into a moment of empowerment.

If you’re a benefits leader, HR professional, or manager looking to deliver smarter, simpler, and more impactful benefit experiences, now is the time to take action.

Learn more at: www.savvifi.com

For more information, contact:

Jake Aldrich – jaldrich@savvifi.com

In case you missed it: Log in to access the full Meet A Vendor Presentation!

Not a subscriber? Request access.

Did you find this article interesting?

Don’t keep this knowledge to yourself – share it on your social media channels and spark engaging conversations!