BNPL & Financial Literacy: What is Buy Now, Pay Later?

Is it a reinvention of the installment plan, a new form of consumer credit, a revival of layaway programs, or an e-commerce marketing tool?

As inflation and rising costs continue to put pressure on long-term financial security, planning for retirement has become more necessary than ever.

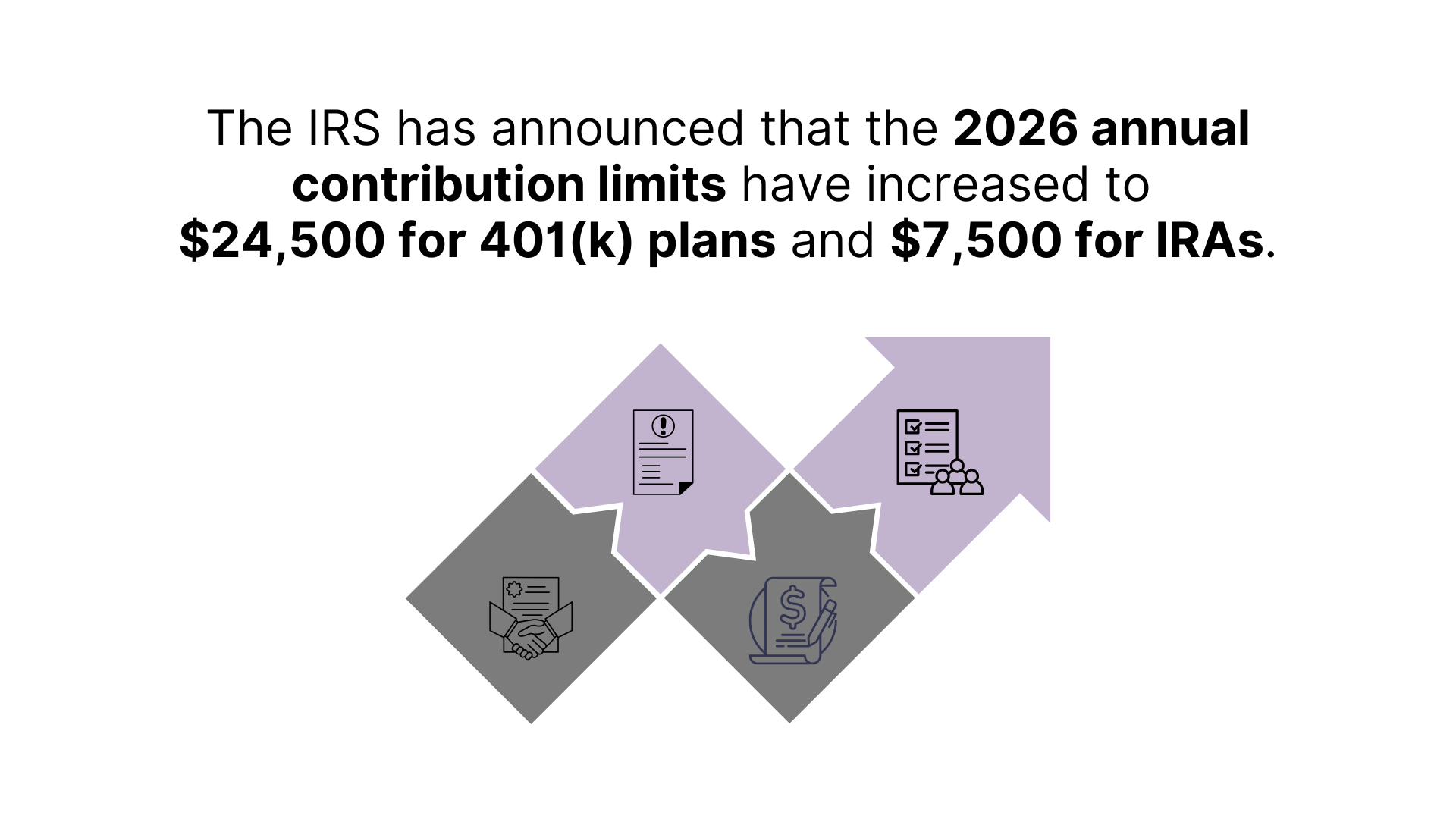

In response, the IRS has introduced new cost-of-living-adjusted contribution limits for 2026, providing employees with a significant opportunity to grow their savings.

However, while this increase is a positive development, it represents only one aspect of a much larger strategy to maximize pension-related deductions. Understanding the full scope of available opportunities is crucial for securing a comfortable future for millions of Americans.

Before discussing strategy, it’s necessary to have a clear understanding of what a pension-related deduction is.

When an employee receives their salary, the amount they take home is usually less than their gross pay. A portion of earnings is automatically subtracted from their paycheck for payroll deductions, typically including taxes, Social Security, Medicare, and, in many cases, contributions to retirement savings plans.

In this context, a pension-related deduction is a tax benefit that reduces an employee’s taxable income for contributions made to a qualifying pension plan. It also refers to the amount of money taken from an employee’s salary or wages to fund their retirement savings and build long-term financial security.

Salary deferrals, including pension-related ones, fall into two main categories: mandatory and voluntary.

Mandatory contributions are required by the employer, typically through a defined benefit plan, which is considered a traditional pension plan. The employer is primarily responsible for funding the plan, but in some cases, the employee contributes a fixed (mandatory) percentage of their earnings, typically on a pre-tax basis.

Voluntary contributions to retirement plans are much more common because they are optional and decided by the employee. Therefore, they can choose the amount they want to contribute, up to the annual IRS limits.

Usually, they are pre- or post-tax:

There’s another essential category to consider when planning for retirement, specifically catch-up contributions. These allow employees ages 50 or older to make additional payments to their voluntary retirement accounts beyond the standard limits. They apply to 401(k)s, 403(b) plans, and IRA plans, allowing older workers to accelerate their retirement savings as they approach retirement age.

As the IRS adjusts retirement plan contribution limits for 2026, employees have a unique opportunity to maximize their pension-related deduction.

Announced in Notice 2025-67, these changes, based on cost-of-living increases, directly impact the amount individuals can contribute to tax-advantaged retirement accounts.

The following is a breakdown of the most important updates effective January 1, 2026:

| Retirement Account Type | 2025 Limit | 2026 Limit | Increase |

|---|---|---|---|

| 401(k)/403(b) Contribution | $23,500 | $24,500 | +$1,000 |

| Catch-up (age 50+) | $7,500 | $8,000 | +$500 |

| Catch-up (age 60-63) | $11,250 | $11,250 | No change |

| IRA Contribution | $7,000 | $7,500 | +$500 |

| IRA Catch-up (age 50+) | $1,000 | $1,100 | +$100 |

| SIMPLE Retirement Plans | $16,500 | $17,000 | +$500 |

| Annual Compensation Limit | $350,000 | $360,000 | +$10,000 |

| Defined Benefit Plan Max | $280,000 | $290,000 | +$10,000 |

In 2026, the income phase-out ranges for IRA and Roth IRA contributions will also significantly increase, allowing more high earners to qualify for deductions.

Traditional IRA phase-out range:

Roth IRA phase-out range:

For those seeking to maximize their pension-related deduction, these updates present valuable opportunities to increase tax-advantaged retirement contributions.

Whether pension contributions are tax-deductible depends on the type of retirement plan and the specific tax rules governing it.

Most employer-sponsored plans provide some benefit, but they do so through different mechanisms that all reduce taxable income in some form.

For example, employer plans, such as 401(k), 403(b), and 457(b), as well as most defined benefit pension plans, are funded with pre-tax contributions. These deposits are made before taxes are applied to wages, so the advantage happens automatically through payroll rather than through a deduction claimed at filing.

For self-employed individuals, contributions to SEP IRA plans and SIMPLE IRAs are considered tax-deductible business expenses, and the deduction is taken on the tax return.

Traditional IRAs, however, work differently.

Their contributions may be tax-deductible, but only if the income falls within specific IRS limits and depending on whether the individual (or their spouse) has coverage through a workplace plan. When allowed, this deduction directly reduces adjusted gross income on the tax return, offering more flexibility to manage taxes at year-end.

Tax relief on pension contributions is a key benefit and an incentive for employees to participate in pension and retirement plans. It works by reducing the employee’s overall tax burden, either immediately or over the long term.

Pre-tax contributions to employer plans automatically lower taxable income, while deductible contributions to IRAs or self-employed plans reduce it at the time of filing. Other forms of relief, such as the Saver’s Credit, directly offset taxes owed, while Roth accounts provide tax-free growth for the future.

Taken together, these mechanics demonstrate that tax relief is not a single, uniform benefit, but rather a combination of immediate and long-term advantages.

Therefore, understanding how they interact with income and tax rules allows employees to plan strategically and optimize their pension-related deductions in the upcoming year.

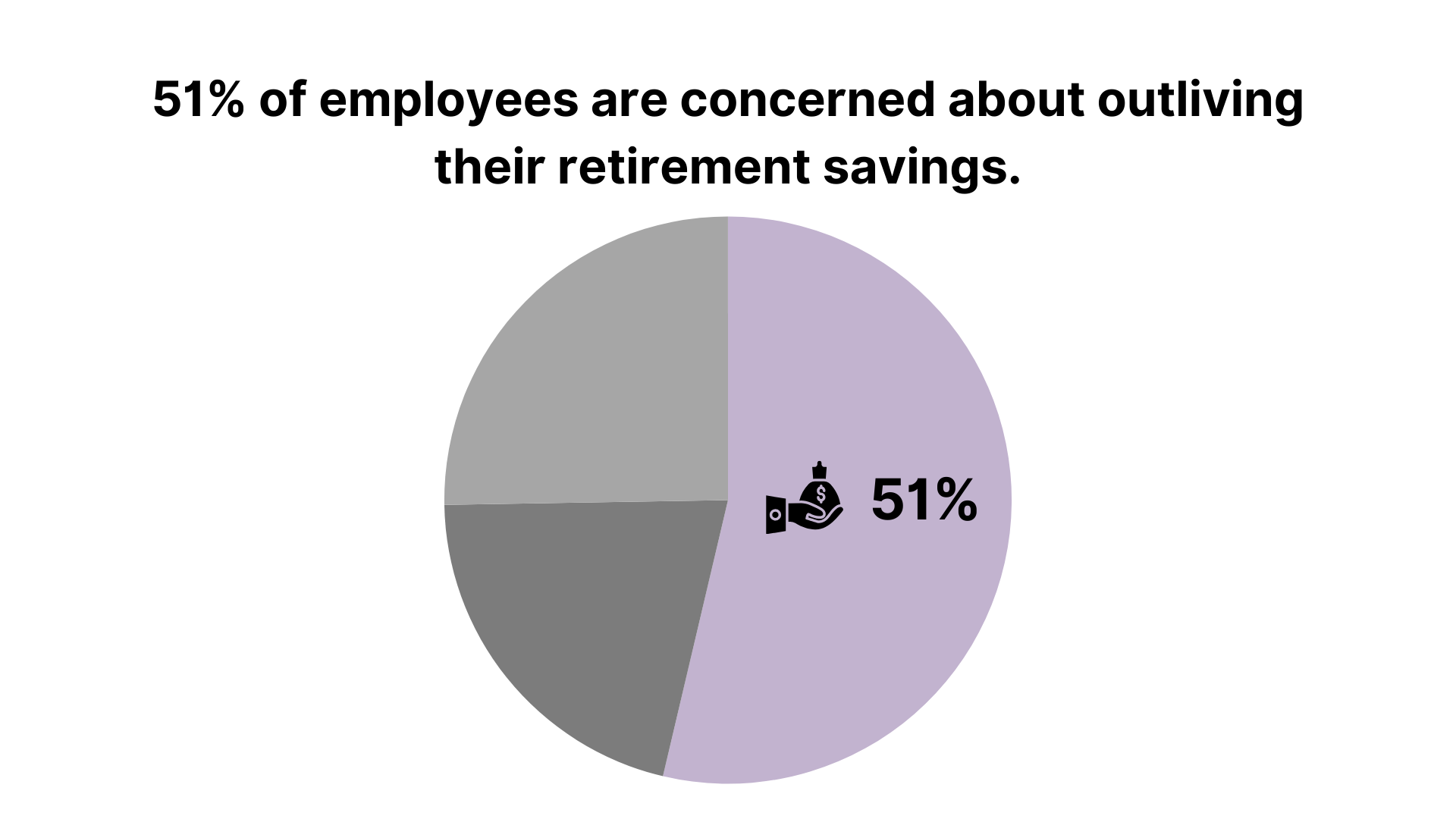

Recent SHRM data shows a concerning reality for many workers’ retirement preparedness.

Among those with retirement savings, only a quarter report having set aside just one year or less of their current annual income for post-work years.

Additionally, 51% are worried about outliving their savings, while 35% have yet to take action on this issue.

Despite these concerns, with the IRS raising contribution limits for 2026, new opportunities arise to maximize pension-related deductions. The following strategies address the gaps in preparedness and strengthen retirement security.

One of the most effective strategies is to contribute the maximum allowed amount to employer-sponsored retirement plans, such as a 401(k) or 403(b).

For 2026, the elective deferral limit is $24,500, up from $23,500 in 2025. It’s the largest single deduction opportunity.

Contributions to this plan are made on a pre-tax basis, which reduces taxable income for the year. For employees, this means they pay less in taxes now while deferring tax payments until retirement.

Many employers offer matching contributions to their employees’ retirement accounts. It’s a benefit where the company matches a portion of the employee’s contribution to the retirement plan, typically up to a set percentage of their salary.

This “free money” can boost savings at no additional cost to the individual, but they must contribute enough to receive the full employer match.

It’s also important to know that while contribution limits have gone up, employer matching deposits don’t count toward this limit. Instead, total contributions (including employee and employer) can be up to $72,000, an increase from $69,000 in 2025.

This means that beyond the regular deposits and the employer match, there’s room for additional after-tax contributions if the plan allows it.

If you’ve maxed out tax-advantaged accounts, after-tax savings can help build additional retirement resources with fewer restrictions. These contributions don’t reduce taxable income for the current year, but they allow employees to save more than the limits on traditional retirement plans.

After-tax savings can take several forms, including after-tax 401(k) contributions, which may be eligible for conversion to Roth accounts, or a strategy often referred to as the “mega backdoor Roth.”

Traditional retirement accounts may offer tax-deferred growth, but Roth 401(k)s and Roth IRAs present the advantage of tax-free withdrawals in retirement.

This approach can be a strategic way to diversify savings, and it’s particularly beneficial for those who anticipate being in a higher tax bracket during retirement.

There’s also significant movement in the 2026 phase-out income range for Roth IRA accounts.

Specifically, the range for married couples filing jointly is now $242,000 – $252,000. For singles and heads of households, the range has increased to $153,000 and $168,000, up from $150,000 and $165,000 in 2025.

The increase in these limits expands eligibility, meaning more employees can contribute, either fully or partially, and take advantage of the greater flexibility it provides in long-term retirement planning.

Workers who are 50 or older have the opportunity to contribute extra amounts to their retirement accounts through catch-up contributions.

Following the recent limit expansion in 2026, individuals nearing retirement age will be able to contribute an additional $8,000 to their 401(k)s, bringing their total annual deposit limit to $32,500.

These pension-related deductions are also tax-deferred, meaning they lower taxable income for the current year while increasing retirement savings for a better financial cushion.

A defined benefit plan can be an effective strategy for high-income earners seeking to maximize pension-related tax deductions.

Unlike defined contribution plans such as the 401(k), these offer a fixed, guaranteed income in retirement, based on a formula that often considers salary and years of service.

If you’re eligible for this plan, ensure you’re fully enrolled and understand the formula for your retirement benefit.

Also, stay aware of annual adjustments. For 2026, the limit under a defined benefit plan increased from $280,000 to $290,000, allowing for a larger retirement payout if the plan is designed to take advantage of these limits.

In addition to traditional retirement accounts, consider contributing to Health Savings Accounts (HSAs), which offer significant tax advantages. Although primarily designed for healthcare expenses, they can also serve as a powerful retirement planning tool.

HSAs are unique because they offer a triple tax advantage, or tax deductions on deposits, tax-free growth, and tax-free spending for qualified expenses.

Additionally, after the age of 65, HSA funds can be used for non-medical expenses without incurring 20% penalties (only income tax), making them a valuable asset for supplementing retirement savings.

Ultimately, any effective strategy relies on how well you plan it.

A simple way to maximize pension-related deductions is to track contributions throughout the year, rather than waiting until tax season.

Employees should also revisit and adjust their deposits whenever their income changes, especially after a raise or bonus, as even small increases can significantly expand their savings.

Financial wellness programs can support this by offering clear tools and guidance for navigating deduction limits. Many also provide personalized advice on pension planning, helping employees improve their contribution strategy to minimize taxes and maximize savings.

Retirement may seem like an abstract goal for many employees, but the reality is that current decisions have a profound impact on their future.

A strategic approach to pension-related deduction allows individuals to reduce their tax burdens while building a stronger retirement nest egg.

With contribution limits increasing in 2026, there’s a unique opportunity to maximize savings. Employees who take advantage of these changes are positioned to create a more stable future for themselves, transforming retirement goals into achievable milestones.

Content Writer at Shortlister

Browse our curated list of vendors to find the best solution for your needs.

Subscribe to our newsletter for the latest trends, expert tips, and workplace insights!

Is it a reinvention of the installment plan, a new form of consumer credit, a revival of layaway programs, or an e-commerce marketing tool?

What does the latest labor narrative mean for HR teams and employers?

Explore the reasons behind the labor shortage in the US and the strategies to overcome this global problem. Gain insightful advice on how leading experts attract high-quality talent in a tight labor market.

In 2025, employee detachment is quietly draining workplace energy. Explore how leaders can step in to re-engage their teams, reignite motivation, and rebuild a sense of purpose.

Used by most of the top employee benefits consultants in the US, Shortlister is where you can find, research and select HR and benefits vendors for your clients.

Shortlister helps you reach your ideal prospects. Claim your free account to control your message and receive employer, consultant and health plan leads.