50+ Infertility Statistics

Discover 50+ essential infertility statistics and get valuable insights into this prevalent issue.

Disclaimer: The views and opinions expressed in this guest post are solely those of the author and do not necessarily reflect the official policy, position, or opinions of Shortlsiter, its owners, editors, or staff members.

Employers have long viewed rising medical and pharmacy costs as unavoidable.

Still, in today’s healthcare environment, these steeply increasing costs are prompting a rethinking of the approach to employee benefits and talent management.

Finance and HR leaders are sifting through medical, absence, and leave claims and employee performance and engagement dashboards to separate programs that deliver real value from those that drain budgets.

Yet one of the expensive forces shaping those numbers rarely stands out in traditional data: inadequately supported employee caregivers.

Across the US, healthcare and social-care systems are pushing more care into the home.

This responsibility lands squarely on the shoulders of your workforce. On any given day, many employees may coordinate moms’ physical therapy sessions from three states away, arrange childcare, or manage a spouse’s chemotherapy aftercare.

Caregiving costs companies about $3.1 million per 1,000 employees per year in a combination of higher medical claims, absence and leave, productivity loss, and turnover. These costs are driven by caregiver burnout, and seventy percent of caregiver employees report delaying or neglecting their care, with 42% reporting having a chronic condition themselves. 65% report financial stress, and more than half experience strained relationships. Two-thirds missed workdays, on average, 7 days per year.

Caregivers often have exceptional time management, empathy, and problem-solving skills, making them highly effective and resilient employees. Their ability to juggle complex responsibilities translates into powerful performance, adaptability, and commitment in the workplace. However, employers need to understand the challenges caregivers face and provide support to ensure they can maintain high performance and avoid the excessive cost of burnout.

Unsupported caregivers themselves have a higher prevalence and severity of:

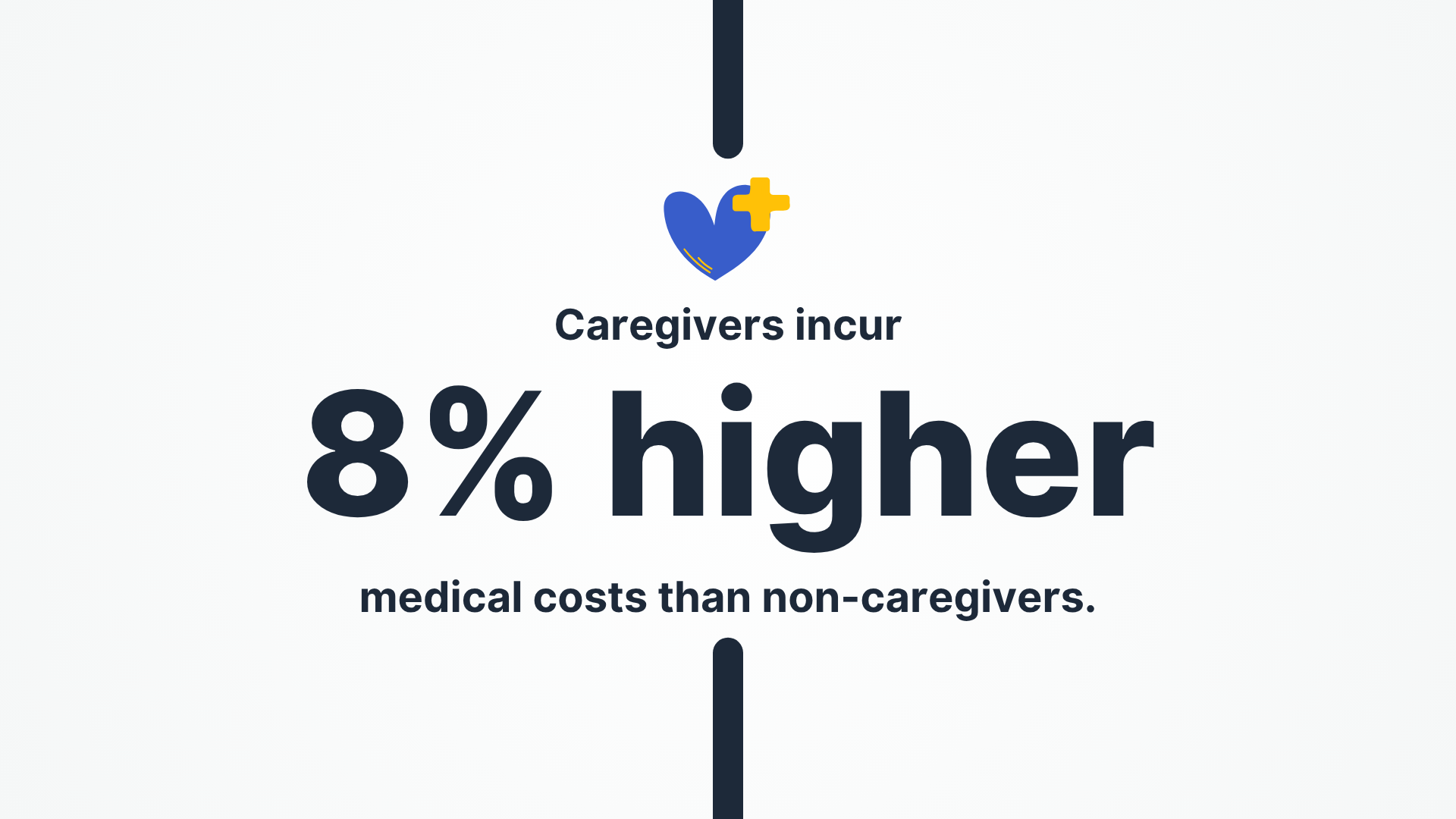

On average, caregivers incur 8% higher medical costs than non-caregivers. Caregivers are also key decision makers and home care providers to your sickest and highest cost members – those with serious illnesses and complex treatments such as cancer, mental health disorders, autoimmune disease, and orthopedic surgery – making caregivers critical to the best health outcomes for these members.

When caregivers are well equipped to manage the care of a loved one, adherence improves, complications decline, and avoidable admissions drop.

Many employers already offer flexible schedules, PTO, or back-up childcare. These benefits matter, but they rarely address the root causes of caregiver challenges and burnout:

A true solution must go deeper than time-off policies or emergency care.

Forward-thinking organizations are reframing benefit strategy through a lens for the vital role that caregivers play in better health outcomes and as a key influencer in employee experience and performance.

Below is a roadmap to minimize the financial impact of caregiving on your organization:

Conduct a care-needs assessment. Start with data: an employee pulse survey or Employee Resource Group (ERG) feedback, review Family Medical Leave or disability-leave incidence with demographic variables, and review EAP utilization and need types.

Look for patterns in claims like frequent unplanned absences or recurring codes for depression or hypertension among mid-career employees, for example, which point to caregiver stress and burnout.

This baseline will inform both the scope of caregiver challenges and potential segments that require tailored resources.

Review the current benefit strategy from the caregiver’s perspective. Map each benefit against the pain points uncovered. Does your leave policy accommodate intermittent absences for the care of self or a loved one for treatment, therapy, or counseling meetings?

Solicit open-ended feedback. Employees will tell you that downloading five separate apps – one for mental health, one for childcare, one for a chronic condition, etc. – is confusing and overwhelming.

Invest in a personalized, comprehensive, one-stop platform that gets at the root cause of caregiver challenges and burnout.

The most effective solutions wrap clinical guidance, emotional coaching, advocacy, and logistical assistance into a single experience that follows employees through every life stage.

Look for:

Because these platforms capture real-time caregiving data, they can also fill the visibility gap to employee day-to-day challenges that plague traditional claims analytics, informing future program design and spending.

Imagine a 5,000-employee organization. If caregiving costs an average of $3.1 million per 1,000 employees, the annual cost is roughly $15.5 million, a figure that dwarfs many wellness budgets.

Even modest gains matter: a 15% reduction in caregiver-related absence, paired with a 5% drop in medical costs for both caregivers and their loved ones, can generate millions in savings and a compelling ROI story for finance.

Finally, integrating caregiver-centric or family-supportive benefits is not just a cost-containment tactic. It signals empathy, drives engagement scores, and differentiates your talent brand, particularly among Millennials and Gen Xers who are sandwiched between child and elder-care duties.

Employees who feel seen and supported are less likely to take a new job, more willing to recommend the company to peers, and are more productive day-to-day.

High medical and pharmacy trends may have nudged employers towards assessing the value and impact of their benefit programs, but they also offer an opportunity to rethink benefits holistically.

By recognizing caregivers as pivotal influencers of health outcomes and employee experience and by equipping them with comprehensive, outcomes-driven support, you protect your people and manage costs.

Caregiving is no longer a personal issue that stops at the office door; it is a strategic lever for business performance.

Alaina Melena is the Chief Strategy Officer at Family First and is a seasoned health and benefits strategist with over 20 years of experience advising mid-sized to multinational companies. A former consultant at Mercer and WTW, she has led transformative initiatives in health strategy, DEI, cost management, and workforce wellbeing. Alaina is known for developing data-driven, employee-centered solutions that align business and talent goals, with deep expertise across the healthcare and benefits continuum.

Browse our curated list of vendors to find the best solution for your needs.

Subscribe to our newsletter for the latest trends, expert tips, and workplace insights!

Discover 50+ essential infertility statistics and get valuable insights into this prevalent issue.

In times of high economic uncertainty and an increasing cost of living, employers should ensure the well-being of their workers without hurting the business’s prosperity. The question is – how can they do this?

Despite the progress, women have unique health needs beyond reproductive and maternal care, and not all of them are met.

Gain insight into the current state of adoptions in the United States with 50+ crucial statistics and trends, providing valuable information on the evolving adoption landscape.

Used by most of the top employee benefits consultants in the US, Shortlister is where you can find, research and select HR and benefits vendors for your clients.

Shortlister helps you reach your ideal prospects. Claim your free account to control your message and receive employer, consultant and health plan leads.