50+ Adoption Statistics

Gain insight into the current state of adoptions in the United States with 50+ crucial statistics and trends, providing valuable information on the evolving adoption landscape.

CEO, Preppy

CEO, FATJOE

Founder of The Stock Dork

Mid-market companies are an economic powerhouse in the United States.

Typically defined as businesses with 100 to 999 employees or annual revenues between $10 million and $1 billion, these companies account for roughly one-third of U.S. private-sector jobs and about 40% of national GDP.

Given their tremendous impact, it’s no surprise that how mid-market employers manage employee benefits can influence broader economic and workforce trends.

So, what benefits strategies are mid-sized employers adopting, and why does it matter?

Mid-market organizations occupy a unique space: they are “too big to be small and too small to be big.”

Unlike larger corporations, which layers of bureaucracy tend to slow down, mid-market organizations have the advantage of speed and adaptability. Their size allows them to experiment with creative benefit solutions while still offering more than the limited resources of small businesses.

That flexibility is especially valuable in today’s unpredictable environment, where issues like supply chain disruptions or a bad job market call for fast, strategic decisions.

Because of this unique position, trends emerging in the mid-market often serve as early signals of where workplace strategy and employee benefits are headed at a broader scale.

The pandemic redrew the lines around work and wellbeing, and benefits strategies are still catching up.

Employees now expect more than basic coverage. They expect support that reflects the realities of modern life, from mental health to financial resilience.

For mid-market employers, this post-pandemic era has triggered a reevaluation of what benefits really matter, how they’re delivered, and whether they align with a changing workforce.

Flexibility, personalization, and affordability are now put at the center of the benefits conversation.

But, at the same time, rising costs and leaner budgets are pushing HR leaders to make every dollar count.

What’s happening in the economy and the world around us greatly influences how mid-market companies shape their benefits strategies. And as the economy shifts, so does the pressure on mid-market employers.

Rising healthcare expenses, salary costs, global trade policies, and changing regulations are weighing heavily and influencing the benefits decisions companies make.

Undoubtedly, benefits planning has never been more complex.

Rather than choosing between cost or care, many mid-sized companies are pursuing creative solutions. They are reallocating resources toward the benefits employees value most and cutting back on underutilized perks.

Some are renegotiating vendor contracts to get more value for their spend.

Others are leveraging data to identify cost drivers (for example, specialty drug spending or emergency room overuse) and implementing targeted interventions.

In short, the current economic context is forcing mid-market firms to become more strategic: doing more with each benefit dollar while still meeting employees’ needs.

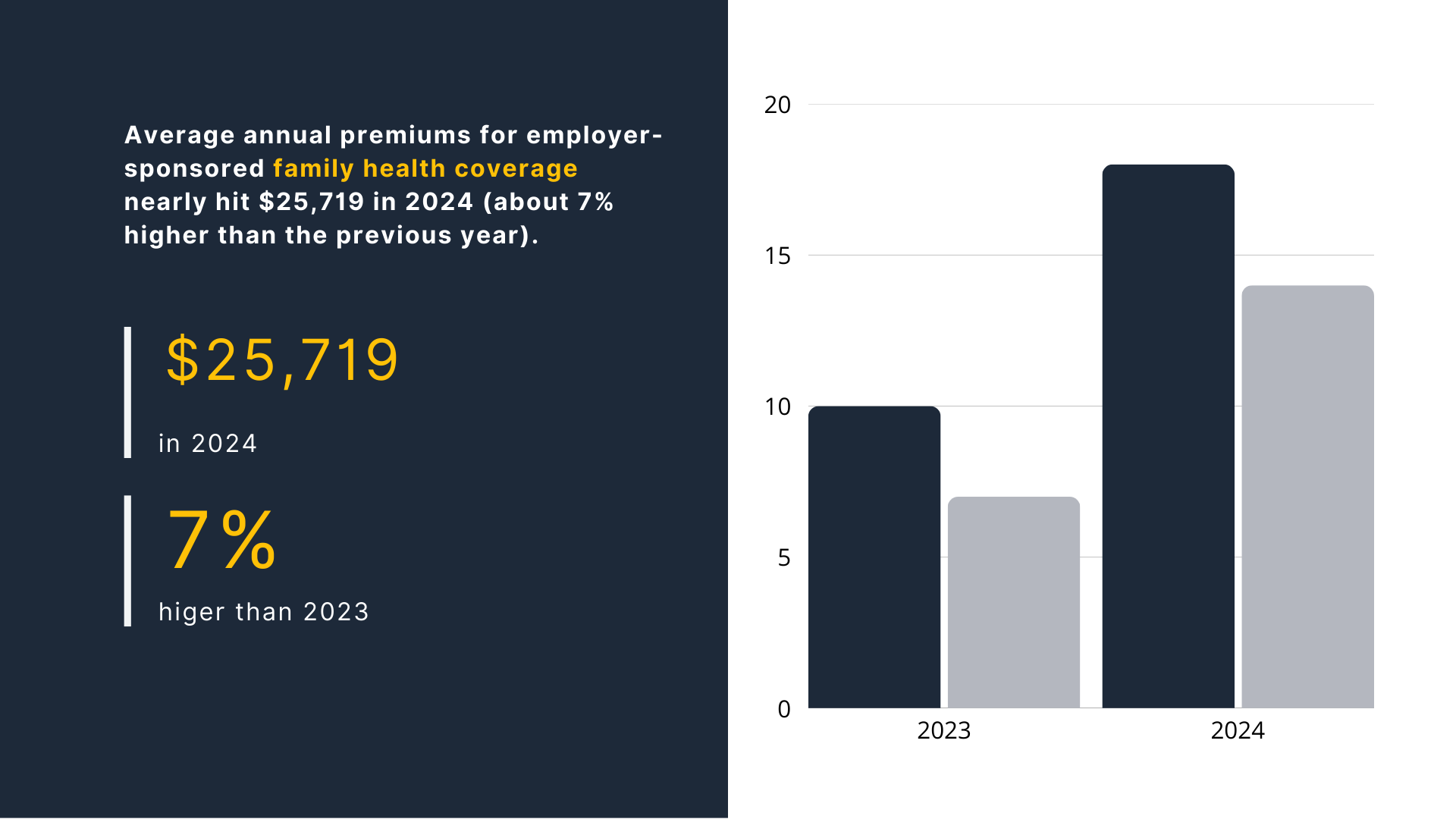

Healthcare coverage will likely always be part of employers’ core offerings. According to SHRM research, nearly all organizations (97%) offer their employees some type of health insurance.

However, with medical costs climbing each year, mid-sized employers are rethinking how they design and deliver health plans.

Average annual premiums for employer-sponsored family health coverage nearly hit $25,719 in 2024 (about 7% higher than the previous year).

Facing these unsustainably high costs, mid-market companies are adopting strategies that might have been available only to the largest corporations a few years ago.

There are a few notable trends that stand out:

Joe Davies, CEO of FATJOE, shares his experience, “I’ve found that combining high-deductible health plans with robust HSA employer contributions has helped my clients manage inflation without burdening employees. One manufacturer I work with increased their HSA match from $500 to $1,500 while raising deductibles, which actually saved them money while giving employees more control.”

The common theme is that mid-market employers are exploring alternative delivery models, smarter plan design, and preventative care to protect both their people and their bottom line.

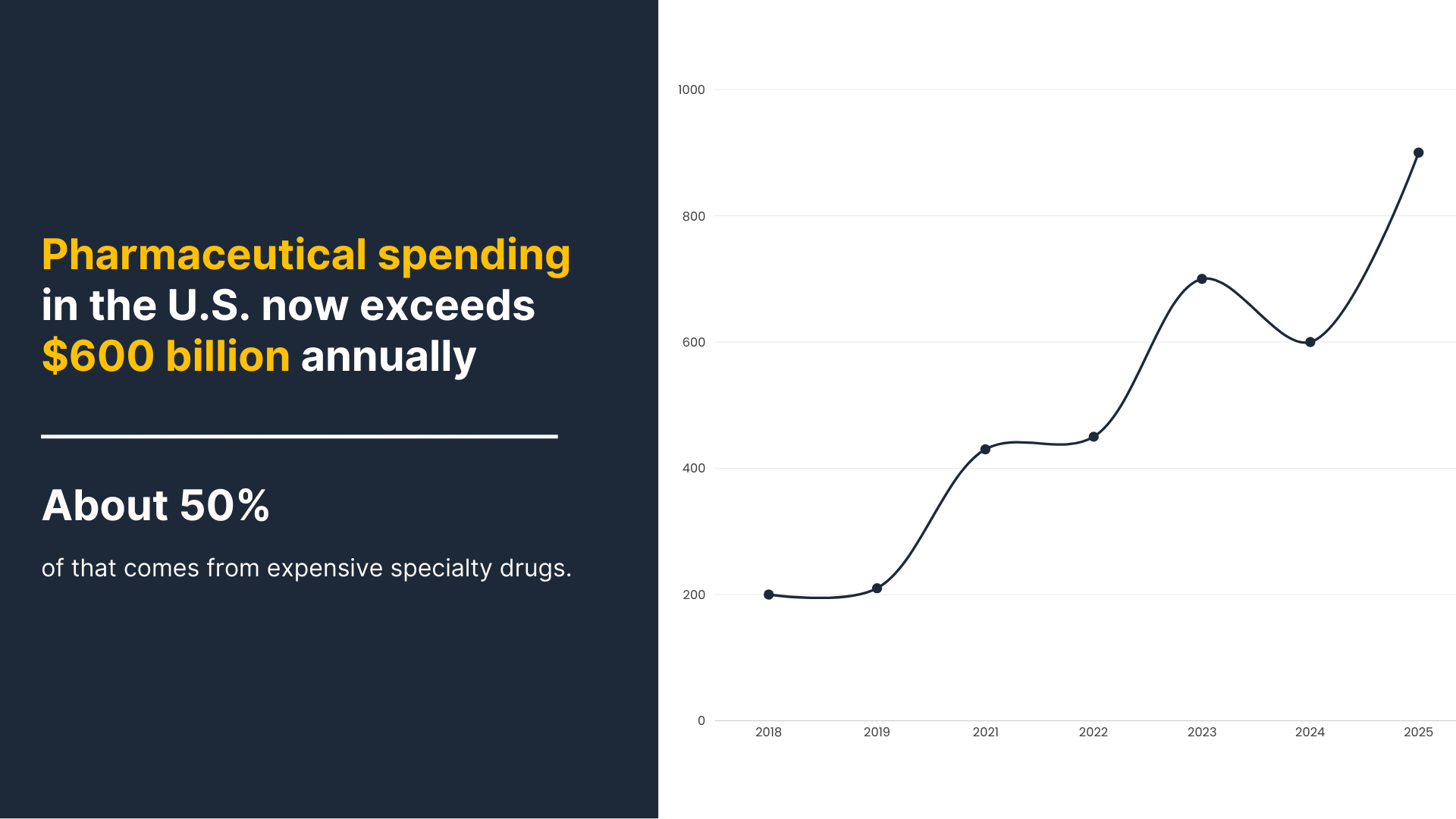

Pharmacy benefits are one area that is ripe for innovation, as prescription drug costs have been rising even faster than the general cost of living.

In fact, pharmaceutical spending in the U.S. now exceeds $600 billion annually, and about 50% of that comes from expensive specialty drugs.

Typically, these include transformative drugs, gene therapies, biosimilars, and specialty medications that can significantly help patients but have exorbitant price tags.

However, probably the most recent example is the interest in GLP-1 medications – drugs like Ozempic, Wegovy & Mounjaro – for weight loss and diabetes management.

While these medications hold a lot of promise, the downside is that they cost roughly $10,000 per patient annually. And unlike most specialty drugs, they can be prescribed to a much broader population, potentially leading to a massive spike in employer-sponsored health plan costs.

Understandably, many employers have been cautious.

A recent KFF survey found that despite high employee demand, only 18% of mid-market companies (with at least 200-1000 employees) cover GLP-1 weight-loss drugs.

As mentioned in Shortlister’s article on rolling out GLP-1 coverage, employers are balancing costs through utilization management, step therapy, narrowing provider networks, cost-sharing, and lifetime caps.

Aside from weight-loss medications, mid-market employers are also rethinking their pharmacy strategies in several innovative ways:

For companies asking: how can we provide the medications our employees need, but in a sustainable way?

The answers lie in creative, data-driven pharmacy benefit innovations.

The past few years have seen an alarming rise in mental health challenges among employees, from anxiety and depression to burnout and substance use issues.

Employers have taken notice. In a recent extensive employer survey, 77% of companies reported an increase in mental health concerns among their workforce in the past year.

Yet, a substantial gap exists between what employees need and what’s actually available. While nine in ten workers say mental health benefits matter to them, only 35% have access to meaningful support.

With 53% of psychologists no longer taking new patients, many employees face long wait times and limited access to mental health support.

In response, mid-market companies have been increasing their support. Many have expanded their Employee Assistance Programs (EAPs) or introduced alternative offerings like teletherapy, mindfulness apps, and virtual counseling services.

Shortlister’s “Workplace Wellness Trends 2025” also shows that companies are investing more heavily in specialized providers to address unique needs. Our data also reveals a growing trend of bundling EAPs with broader mental health solutions to offer more accessible, affordable care.

Adam Garcia, Founder of The Stock Dork, shared a similar experience: “I learned the hard way that mental health benefits are severely underestimated – our finance company saw a 30% drop in turnover after adding virtual therapy and wellness apps to our benefits package.”

As demand grows for accessible and affordable mental health support, many mid-sized employers are turning to integrated wellness programs that blend mental, physical, and emotional care into a single platform.

As inflation, debt, and economic uncertainty persist through mid-2025, employers are paying closer attention to financial wellness.

Consider the following statistics:

For mid-sized employers that can’t always outbid larger firms on salary, offering financial wellness support is an effective strategy to improve retention, productivity, and morale.

What do these financial wellbeing benefits look like in practice?

A growing number of mid-market companies are introducing programs like student loan repayment assistance, budgeting tools built into payroll software, or refinancing tools to help employees pay off debt.

On-demand pay or earned wage access is also becoming more common as it allows struggling employees to access earned pay ahead of payday.

Financial literacy is expanding, too, and goes beyond basic “how-to” budgeting tips. Workshops and tools are made specifically for various life stages, from mortgage counseling to retirement planning.

Overall, new compensation and benefits strategies will focus on building financial stability, resiliency, and long-term confidence.

While many call 2025 the year of the RTO (return to the office), employees aren’t ready to give up the flexibility they’ve grown used to.

Pew Research reports that 46% of remote workers would consider quitting if forced back on-site full-time.

In fact, companies that take a strict stance on RTO policies risk losing their top talent. Studies of major firms like Apple and Microsoft, as well as broader S&P 500 companies, have found that such policies often lead to the departure of senior and highly skilled employees.

Even among those who stay, research shows that job satisfaction tends to decline, often followed by a drop in productivity.

Mid-market employers seem to recognize the value of workplace flexibility as part of the benefits package. As much as 69% of mid-sized companies have adopted a hybrid work model, more than large (60%) or small (62%) organizations.

To stay competitive, many mid-market companies are expanding new workplace strategies: offering flexible start and end times, extending leave policies, and even exploring four-day work weeks.

A recent Bank of America survey found that 64% of employees and 42% of employers are in favor of a shorter workweek, which could lead to potential future adoption of this model.

Operating in a four-generation workplace means employers must take a more personalized, data-driven approach to benefits.

To be successful with this approach, listening is central.

Using tools like pulse surveys, focus groups, and AI-driven analysis of responses and exit interviews, companies are gaining insights into what employees value and, even more importantly, where they’re willing to make trade-offs.

But it’s not just about formal surveys. Informal conversations and on-the-ground feedback can provide more context than numbers can. Together, these insights help employers identify where to invest, adjust programs in real-time, and align benefits with workforce priorities.

Instead of relying on many-point solutions, employers are adopting more integrated offerings that reflect their employee population, considering factors like age, gender, life stage, and other key demographics.

Grant Aldrich, CEO of Preppy, explains another approach, “One of the smartest moves I’m seeing in mid-market benefits planning is the use of retention risk scores combined with benefits usage data. It’s not just about offering more perks—it’s about aligning the right perks with the right people. “

As AI continues to evolve rapidly, many companies are investing heavily in new technologies to stay ahead.

But in the rush to modernize, there’s a risk of overlooking the most valuable asset of all: people. In order for organizations to make real progress, they shouldn’t choose between tech or talent, they must advance both.

Nearly 90% of HR leaders expect that as much as half of their workforce will require reskilling within the next five years.

The current pace of development requires that employers move beyond basic training and toward more intentional human capital strategies that support long-term skill development and career growth.

For many employees, the chance to learn new skills and grow professionally can be as important as traditional benefits.

In fact, 94% of employees say they would stay at a company longer if it invested in their career development.

In summary, professional development and learning benefits are moving from a niche offering to a mainstream necessity.

What’s the value of great benefits if employees don’t know how to use them?

As benefits become more personalized and complex, employers are investing in smarter benefits administration systems.

With so many standalone solutions in today’s benefits portfolio, employees need consistent support throughout the year, not just during open enrollment.

In fact, 68% of Gen Z workers want benefits communication to continue after enrollment, according to MetLife.

To meet rising expectations, employers are turning to technology that personalizes the experience, maintains year-round communication, and makes benefits easier to understand and use.

Tools like open enrollment software, mobile self-service portals, and AI-powered chatbots have raised the standard.

Technology also addresses another central pain point: fragmentation. Disconnected benefit and care experiences lead to confusion and frustration.

An integrated approach, backed by the right tools, creates smoother, more connected experiences across the employee wellbeing journey.

As mid-market employers modernize their benefits strategies, they must also be mindful of how they handle sensitive personal health information (PHI) and personal identifiable information (PII).

Laws like HIPAA and emerging state privacy laws require employers and their vendors to protect this information.

On top of that, they must also navigate a changing regulatory landscape. Yet for companies without large legal teams, keeping up can be a challenge.

Several law changes that directly affect compliance obligations are:

In response, mid-market employers are working closely with benefits consultants, legal counsel, and technology providers to stay ahead of these changes.

Regular compliance audits and training have become a regular part of HR management.

The good news is that as challenging as compliance can be, many of the regulations ultimately aim to create fairer, more effective benefits for employees and workplaces.

Today’s HR teams increasingly use real-time analytics to track benefit usage, spot trends, and guide where to invest. Whether it’s evaluating telehealth adoption or analyzing mental health claims, these insights help direct resources toward what employees truly value.

As much as 67% of employers have a data strategy in place, and 93% consider data integral to their healthcare strategy.

Given this, the criteria for choosing benefits software have changed.

Integration with existing HR systems, strong cybersecurity measures, and AI-driven insights are now just as important as the user experience itself.

In addition, data is also key to evaluating the impact of benefits on business outcomes. Companies are measuring how programs influence turnover, absenteeism, and employee engagement.

Driven by these data insights, 2025 is the year that companies are holding vendors to higher standards. Employers want clear visibility into vendor performance, cost-effectiveness, and whether the outcomes justify the investment.

In a competitive labor market with little margin for error, mid-sized companies are using data not just to react but to plan with precision.

The mid-market has always been about being dynamic and adaptable, and their approach to employee benefits is proving to be no exception. Looking ahead, we can expect an even greater integration of technology and personalization in benefits.

Over the past year, 99% of mid-sized business owners have adopted digital strategies to optimize operations.

Now, 89% of mid-market employers are planning to incorporate AI tools to further their goals, including strengthening their competitive position.

Mid-market employers will continue to find clever ways to offer “large company” perks by using vendors and platforms. They’ll lean into platforms that make benefits more accessible, data more actionable, and decisions more agile.

The next era of mid-market benefits won’t be about scale. It’ll be about strategy.

Disclosure: Some of the products featured in this blog post may come from our partners who compensate us. This might influence the selection of products we feature and their placement and presentation on the page. However, it does not impact our evaluations; our opinions are our own. The information provided in this post is for general informational purposes only.

Senior Content Writer at Shortlister

Browse our curated list of vendors to find the best solution for your needs.

Subscribe to our newsletter for the latest trends, expert tips, and workplace insights!

Gain insight into the current state of adoptions in the United States with 50+ crucial statistics and trends, providing valuable information on the evolving adoption landscape.

Explore alternatives to Humana’s EAP and work-life services, providing consumers with a list of the top vendors offering EAP and work-life benefits.

How does interior office design impact employee productivity, from desk layout to lighting choices?

Can employers afford to cover GLP-1 medications without letting costs spiral out of control?

Used by most of the top employee benefits consultants in the US, Shortlister is where you can find, research and select HR and benefits vendors for your clients.

Shortlister helps you reach your ideal prospects. Claim your free account to control your message and receive employer, consultant and health plan leads.