What is Personal Insurance?

Understanding the benefits of personal insurance is a good step in the right direction when protecting people and their families from losses they couldn’t afford to cover on their own.

Managing Director at KIS Finance

HR Consultant, KIS Finance

CEO & Founder of Fig Loans

AI Expert & Founder, Clepher

Chief Finance Officer, Culture.org

Founder, Deep AI

Head of Marketing, Ninja Patches

The chance of a global recession climbed to 40% last month, according to J.P. Morgan Research.

Across the U.S., anxiety is rising about the economy as inflation threatens to climb again, the job market shows signs of cooling, and trade tensions escalate.

Yet, aside from these external pressures, America is facing another challenge, one that is tied to everyday decisions.

Low financial literacy is a crisis unfolding quietly, far less visible than inflation or unemployment, but one that is equally as dangerous.

When it comes to managing money, borrowing, saving, and planning, too many Americans are left without the tools or confidence.

In this article, we explore the benefits of financial literacy during downturns and how it builds resilience, stabilizes households, and supports recovery when the economy sinks.

April is Financial Literacy Month in the U.S., a time to reflect on how far we’ve come in promoting financial education, and how far we still have to go.

Despite growing awareness and national initiatives, the gap remains wide.

According to the Financial Industry Regulatory Authority (FINRA), about two-thirds of Americans (66%) are financially illiterate.

And the real-world impact of that gap is hard to ignore.

A 2022 FINRA survey found that people with low financial literacy were more likely to overspend, lack emergency savings, and have no retirement plan. They also faced more fees, relied on cash advances, maxed out credit cards, and turned to high-cost lenders like payday loans.

So, what is financial literacy? And why is financial literacy important?

In simple terms, financial literacy means understanding financial concepts and, even more importantly, being able to apply that knowledge to your decisions.

The core principles include:

Together, these elements create a guide for smart financial decision-making, which becomes crucial during economic uncertainty when margins for error shrink.

While financial knowledge can’t predict or prevent a recession, the benefits of financial literacy are most clearly seen in how employees weather economic hardship.

One of the first lessons in financial literacy is to save for a rainy day and become financially resilient.

Financial resilience is the ability to adapt and stay financially stable during major life disruptions like job loss or economic downturns.

Nearly 90% of Americans felt increased financial stress during the early 2020 COVID-19 crisis.

As Holly Andrews, Managing Director of KIS Finance, puts it, “During tough times, the difference between panic and planning can determine whether someone stays afloat or spirals financially.”

While being able to remain unaffected during these economic storms is typically linked to high income and wealth, it also largely depends on how money is managed.

Even families with modest earnings can build resilience if their expenses are low, while high-income households may struggle if they spend above their means.

Since World War II, the U.S. has experienced 12 recessions, roughly one every six and a half years.

Economic downturns are unusual times that create unique financial challenges.

During these periods, interest rates fluctuate, lending standards tighten, and employment security weakens.

Research shows that these unexpected events also disrupt household finances in many ways. Families fall behind on debt, struggle to cover monthly expenses and prioritize immediate needs over long-term goals like retirement savings.

Susan Andrews, HR Consultant at KIS Finance, has observed this firsthand, saying, “Without solid financial knowledge, people react impulsively – maxing out credit cards or emptying savings accounts with no plan.”

In the past year alone, more than a third of American adults (37%) had to dip into their emergency savings.

The problem is that when employees experience economic instability and do not have proper financial education, they tend to:

To understand the advantages of financial literacy, we must consider the consequences when they are missing.

The ripple effects of financial illiteracy show up fast in the workplace – in burnout, stress, and mass resignations.

Employees lose over seven hours a week on average to money-related worries, costing U.S. businesses an estimated $183 billion each year, according to BrightPlan. For Gen Z, the losses are even higher, with more than eight hours a week wasted.

Nearly four out of five company leaders said this stress increased turnover in the past year as workers chased bigger paychecks or stronger financial support.

The personal impact is just as profound, as less than half of workers say they feel financially healthy, while 60% report feeling anxious or say their wages can’t keep up with inflation.

With lasting effects on productivity, engagement, and retention, employee financial stress in the workplace has clearly become an increasingly urgent concern for employers.

The good news is that financial wellness programs provide practical tools to address most money-related problems, such as emergency fund strategies, debt repayment plans, and clarity on credit scores.

Susan Andrews shares, “These programs teach practical skills like budgeting, handling debt, and building savings that prevent employees from making panicked financial moves when markets drop.”

Financial literacy sets the groundwork for stability – and when employees thrive financially, so do the companies they work for.

Financial literacy is a life skill that everyone could benefit from learning.

When people grasp core financial concepts, they’re better equipped to make intentional decisions that build security, create opportunity, and stay grounded through economic ups and downs.

Employees with strong financial knowledge are more likely to contribute to retirement plans like 401(k)s and IRAs, understand compound interest, and make wise investment choices early.

As Kevin Baragona, Founder of Deep AI, points out, “Beliefs such as ‘I don’t need to save for retirement because Social Security will cover it,’ or ‘I can always rely on my company’s pension plan,’ can be detrimental to an employee’s long-term financial well-being—especially during a downturn, with the decrease in employer-provided pensions and uncertainty around the future of Social Security.”

Studies show that greater financial literacy directly correlates with higher retirement savings and better planning behavior.

In contrast, those without this foundation often delay saving or miss out on employer benefits. Tools like multiple employer plans and workplace education can help close these gaps.

Financial literacy is what turns passive savers into confident investors.

When employees understand core principles, like market trends, diversification, and the trade-off between risk and reward, they begin to build lasting wealth rather than just accumulate cash.

Brooke Webber, Head of Marketing at Ninja Patches, offers a unique perspective, stating, “Reframing emergency savings as a ‘tool for work freedom’ instead of delayed gratification can greatly impact younger employees, particularly Gen Z.”

She adds, “Presenting savings as a way to gain control over their careers–like saying no to toxic clients or negotiating better roles–helps employees see its true value. This shift makes savings feel less like a sacrifice and more like a means of empowerment. “

Viewed through this lens, financial knowledge doesn’t just secure the future, but it creates options in the present.

Those who understand how interest works, how credit scores are calculated, and how to prioritize repayments are better positioned to avoid life-long debt traps.

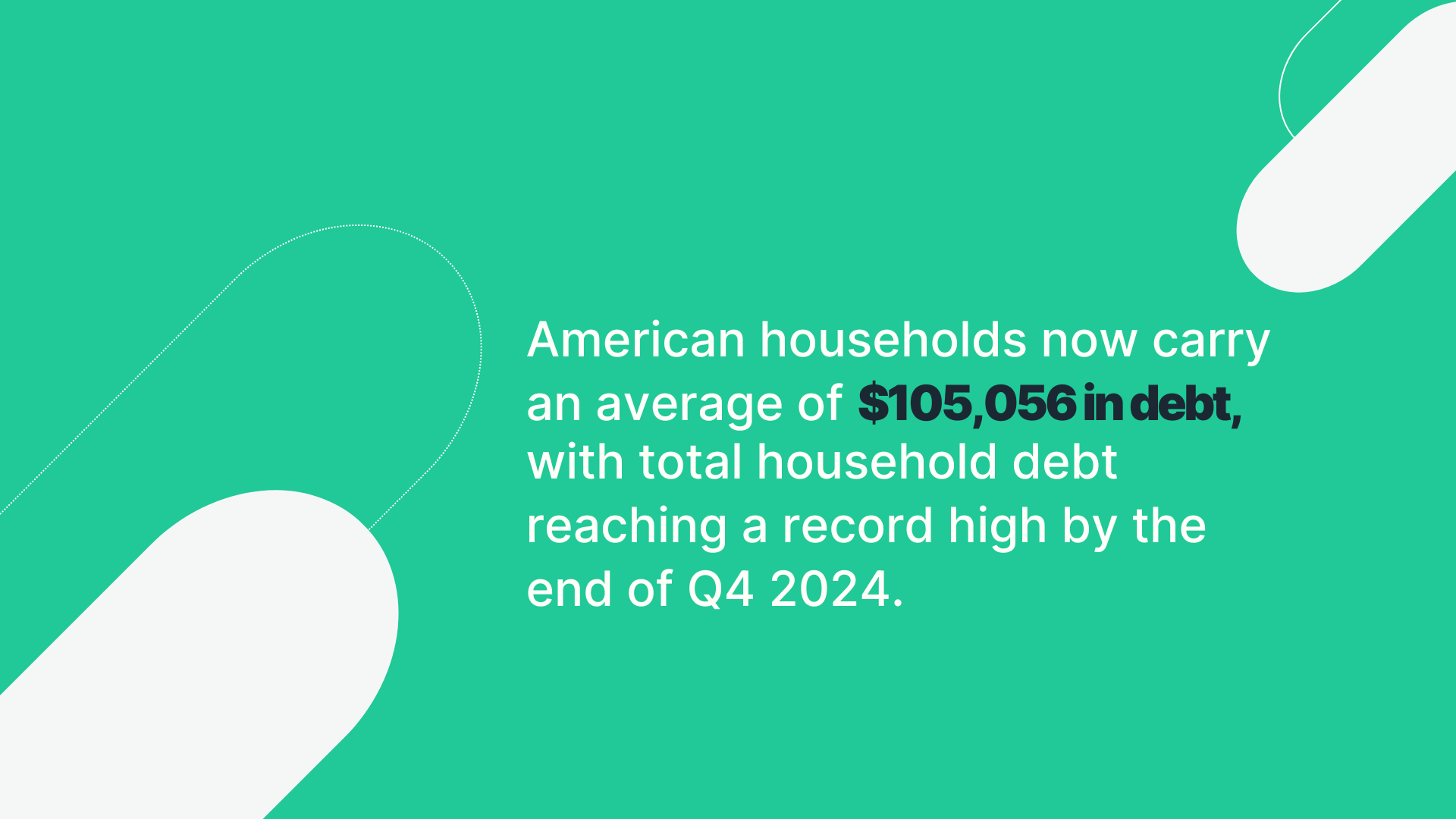

American households now carry an average of $105,056 in debt, with total household debt reaching a record high by the end of Q4 2024.

As Bankrate’s report shows, in 2025, over 30% of Americans reported having more credit card debt than emergency savings. Without the knowledge to navigate repayment strategies or avoid predatory lending, many fall into cycles of high-interest debt that can last for years.

“Many Gen X and Millennial employees carry shame around personal debt, which leads to silence and isolation just when they need the most support. When financial education includes real conversations about debt as a common life reality–not a personal flaw–it helps break down stigma,” shares Jeffrey Zhou, CEO & Founder of Fig Loans.

He adds, “This transparency reduces financial stress and helps people get ahead of problems before they spiral during a downturn.”

Financial education clarifies concepts like debt snowball vs. avalanche methods, responsible credit use, and refinancing options.

The benefits of financial literacy don’t stop at the personal level.

As more families and communities become financially educated, we see broader effects: higher rates of home ownership (because people improved their credit and saved for down payments), more local investment, and less dependence on high-cost debt.

For example, a parent who understands the importance of college savings might set up a 529 college fund for their child, opening doors for the next generation.

In many ways, this kind of widespread financial education can break cycles of poverty and help reduce racial, gender, and income-based knowledge gaps.

Globally, 35% of men are financially literate vs only 30% of women, and in the U.S., White and Asian adults score higher on financial knowledge than Black and Hispanic adults.

For these reasons, over 90% of U.S. states have integrated some form of personal finance education into their school systems, whether through elective classes, curriculum standards, or graduation requirements.

Beyond school-based education, there’s also a growing need for continued financial education into adulthood.

As new financial tools and products emerge, such as buy now, pay later services, adults need ongoing access to education to stay informed.

Employers can support this lifelong learning by offering programs and financial coaching that equip employees with practical skills and resources to manage their money confidently.

Improving financial literacy and helping employees feel financially secure is a strategic investment that pays off, especially during economic challenges.

Key strategies include:

As Rose Jimenez, Chief Finance Officer at Culture.org, shares, “One effective strategy is offering on-demand, interactive financial education combined with access to 1:1 coaching… [which] can lead to measurable outcomes, such as fewer 401(k) loans, higher emergency savings participation, and reduced financial stress—all of which benefit workplace productivity and retention.”

Financial decisions start early, often before people are fully prepared to make them.

For young adults (18–34), financial literacy is the foundation for healthy money habits before major life milestones.

Stefan Van der Vlag, AI Expert and Founder of Clepher, observes: “Younger generations may face challenges with managing debt and establishing a strong financial foundation during a downturn if they are not financially literate.”

Indeed, according to research from Bank of America, younger generations are mostly burdened by student debt. In fact, 24% of Gen Z and 27% of millennials had student loans in 2021.

On the other hand, middle-aged adults (35–54) are in their prime earning years and can gain a lot from financial literacy, especially when it comes to managing debt and planning for retirement.

Many in this age group also explore movements like FIRE (Financial Independence, Retire Early), using innovative investing strategies to grow their projected 401(k) value and reach financial freedom ahead of traditional retirement timelines.

Unfortunately, adults over 55 have lower rates of financial knowledge of newer financial products and are prime targets for fraud.

Increasing their understanding of finances can help protect their accumulated assets during market volatility and prepare for retirement income, healthcare costs, and legacy planning.

“A lack of financial literacy in older generations often results in difficulties managing their retirement savings and investments,” Van der Vlag adds.

“Many retirees may have relied on their company pension plans or government benefits for income during retirement, but with economic downturns affecting these sources, they may be left struggling to cover their expenses.”

That’s why financial education can’t follow a one-size-fits-all model. Instead, it must be tailored to each stage of life, income level, and financial reality to make an impact.

When the economy is sluggish, several factors lead to more fraud: higher financial stress provides motivation for some to commit fraud, and widespread uncertainty makes it easier for scammers to trick others.

Historical data backs this up.

During the 2009 recession, over half of fraud experts observed an increase in fraudulent activity. More than 49% of respondents attributed the rise in fraud to growing financial strain on people.

More recently, during the pandemic downturn in the first four months of 2021, fraud attempts jumped 149%, according to a TransUnion report. From phishing emails and fake investment opportunities to identity theft and Ponzi schemes, there’s no shortage of threats.

However, a financially literate person is far less likely to fall victim to these.

When it comes to money, the old adage still rings true: “Knowledge is wealth.”

While some financial choices are tied to certain stages of life, such as buying a home or retiring, many others are constant and cumulative. The ability to navigate these decisions successfully, year after year, depends heavily on one’s financial literacy.

Ultimately, the benefits of financial literacy go far beyond surviving economic downturns. They show up in everyday decisions, long-term goals, and generational outcomes.

In a world of changing financial tools and rising uncertainty, financial literacy isn’t just a skill – it’s a lifelong advantage.

Senior Content Writer at Shortlister

Browse our curated list of vendors to find the best solution for your needs.

Subscribe to our newsletter for the latest trends, expert tips, and workplace insights!

Understanding the benefits of personal insurance is a good step in the right direction when protecting people and their families from losses they couldn’t afford to cover on their own.

Update your succession planning strategy with expert tips and unlock the potential for a seamless leadership transition, fostering a culture of long-term organizational success.

Beyond bad credit scores, identity theft’s financial and emotional damages spill into the workplace. Looking for solutions, employers turn to insurance policies. But is identity theft insurance worth it?

It’s almost impossible to predict when a stock market crash will happen and how long it will last. Thus, how can you find peace of mind long before and after your retirement?

Used by most of the top employee benefits consultants in the US, Shortlister is where you can find, research and select HR and benefits vendors for your clients.

Shortlister helps you reach your ideal prospects. Claim your free account to control your message and receive employer, consultant and health plan leads.