Diabetes and Health Equity in the Workplace

Workplace equity is more than a buzzword—it’s a lifeline in the fight against diabetes and the health gaps shaped by where we live, work, and grow.

The drug-fueled weight-loss revolution sweeping across America is challenging our understanding and definition of obesity. A new generation of anti-obesity drugs like Ozempic, Wegovy, and Mounjaro can potentially improve the health and lives of millions of Americans. But what’s the hidden cost?

While these innovative treatments could tackle one of the most pressing health crises in the US, one challenge for the nation’s healthcare system lies in finding a viable way to cover their costs.

Considering the price tag associated with these medications is thousands of dollars, many employees wonder if Ozempic is covered by insurance, making it a pressing problem for employer-sponsored health plans.

This article explores the implications of viral medications and different strategies employers might adopt to tackle the accompanying expenses.

Out of the 37.3 million Americans living with some form of diabetes, the majority of them (90-95%) have type 2 diabetes. Ozempic, Wegovy, and Mounjaro are three prescription medications used to treat type 2 diabetes.

They all contain the same active ingredient, semaglutide, which is a GLP-1 receptor agonist. GLP-1 receptors are found in the gut and pancreas and regulate appetite and blood sugar levels.

|

Drug |

Overview |

Mechanism of action |

Instructions |

Targeted health conditions |

Approximate weight loss |

|

Ozempic |

A once-weekly injectable medication |

Works by mimicking the natural hormone GLP-1, which helps to control blood sugar levels and reduce appetite |

Starting dose is 0.25 mg once weekly, increased to 0.5 mg after 4 weeks, and then to 1 mg after 4 more weeks. The maximum dose is 2 mg once weekly. |

Type 2 diabetes |

5%-7% |

|

Wegovy |

A once-weekly injectable medication |

Works by mimicking the natural hormone GLP-1, which helps to control blood sugar levels and reduce appetite. It also has a longer half-life than Ozempic, which means that it stays in the body longer and can produce more weight loss. |

Starting dose is 0.25 mg once weekly, increased to 0.5 mg after 4 weeks, and then to 1 mg after 4 more weeks. The maximum dose is 2.4 mg once weekly. |

Obesity or overweight with at least one weight-related health condition |

12%-15% |

|

Mounjaro |

A once-weekly injectable medication |

Works by mimicking the natural hormones GLP-1 and GIP, which help to control blood sugar levels, reduce appetite, and increase feelings of fullness. It also has a longer half-life than Ozempic and Wegovy, which means that it stays in the body longer and can produce more weight loss. |

Starting dose is 2.5 mg once weekly, increased to 5 mg after 4 weeks, and then to 10 mg after 4 more weeks. The maximum dose is 15 mg once weekly. |

Type 2 diabetes;

Awaiting approval for: Obesity or overweight with at least one weight-related health condition |

15%-20% |

Ozempic was the first of these drugs approved by the FDA in 2017, originally to be used for the treatment of adults with type 2 diabetes. However, it was soon discovered that Ozempic also caused significant weight loss in many patients.

Unsurprisingly, this sky-rocketed its popularity and ignited a widespread cultural buzz.

The hashtag Ozempic has over 1.4 billion views on TikTok, and even celebrities like Tesla CEO Elon Musk have openly credited their weight loss to these drugs. From news headlines to TV advertisements and mentions at events like the Oscars, it’s clear that GLP-1s are everywhere.

However, as the demand for these weight loss drugs is soaring, it’s also causing shortages and off-label use.

Prescriptions for GLP-1 drugs for people without diabetes increased by nearly 100% in the first five months of 2023 compared to all of 2022. This is because many insurers do not cover weight loss medications, so doctors have been prescribing GLP-1 drugs, such as Ozempic, off-label for obesity treatment.

The increased demand for GLP-1 drugs is also putting a strain on supply.

In some cases, diabetes patients have been unable to fill their prescriptions, and some pharmacies have even imposed limits on how many doses of GLP-1 drugs they can dispense.

In fact, the demand among Americans is so high that Canada introduced new regulations to stop sales of Ozempic to people who do not live in Canada.

Novo Nordisk, the maker of Ozempic and Wegovy, recently announced that it would temporarily stop advertising Wegovy. The company cited high demand for the drug as the reason for the decision, which is expected to prevent a shortage.

As a result, the market for weight loss drugs is expected to grow from $2.5 billion in 2022 to $44 billion by 2030, clearly indicating that the world of anti-obesity medicines is changing rapidly.

In recent months, there have been several studies presented at the American Diabetes Association meeting in San Diego that suggest the age of Ozempic is over.

Newer drugs that work by the exact mechanism as Ozempic are showing even more promise for weight loss.

For example, a new oral form of semaglutide works just as well as Ozempic or Wegovy, while another pill containing a drug called orforglipron also shows promise. Moreover, pharmaceutical company Eli Lilly has asked the FDA to approve another diabetes drug, Mounjaro, for weight loss.

The future of weight loss drugs is very bright.

With so many new and effective options on the horizon, should companies reconsider their employer-sponsored medication coverage?

The high demand for weight loss drugs is a sign of the growing problem of obesity in the United States and the rising cost of obesity-related healthcare. As weight loss statistics show, one in three US adults, almost 42% of the population, are considered obese, and another one in three is considered overweight.

Obesity is also a risk factor for various health conditions – like heart disease, cancer, diabetes, stroke, and so on – that are among the most common causes of death in the United States. In fact, obesity has been identified as the third biggest contributor to premature and preventable deaths in the country.

It’s also important to note that treating these chronic conditions is costly, with the estimated annual medical cost of obesity at a staggering $260 billion in the US alone. Adults with obesity had medical costs that were $1,861 higher than medical costs for people with a healthy weight.

However, a highly anticipated study with 17.600 adults that took place over five years shows that Wegovy reduces the risk of a heart attack and a stroke by 20%. This study is the first to demonstrate that weight-loss drugs can also have major health benefits, even for people without diabetes.

Interestingly, there are growing reports that GLP-1s may have a number of other potential benefits, including suppressing “food noise”, which are excessive and obsessive thoughts of food and other addictive behaviors. While there is still more research to be done, the potential benefits of GLP-1s for addictive behaviors such as smoking and alcohol use are significant.

So, if there’s clear proof that Wegovy reduces heart attacks and strokes, would that make it easier for people to convince insurance companies to cover the cost of the medication?

The mounting evidence that anti-obesity drugs are effective means that insurers can no longer ignore them.

While their effectiveness is evident, anti-obesity drugs have an unwelcome trade-off: painful and sometimes dangerous side effects.

As with all medication, weight loss drugs have a long list of side effects, the most common ones being nausea, stomach pain, vomiting, constipation, and diarrhea.

Yet, recent news headliners are flooded with seemingly terrifying reports of stomach paralysis, heart palpitations, and the infamous “Ozempic face.”

However, with the media’s tendency to sensationalize stories, it’s hard to gauge if taking Ozempic has any real dangers.

For example, the widely reported Ozempic face, a gaunt or hollow look, is simply a side effect of weight loss or fat loss in the face. Similarly, reports of hair thinning can also be attributed as a side effect of weight reduction.

Ozempic and similar medications come with a black box warning for medullary thyroid cancer. However, this risk has only been detected in some animals, and no human trials have shown an increase in the risk of cancer.

On the other hand, patents must consider some claims of more serious negative effects.

For example, the makers of Ozempic and Mounjaro are currently sued over ‘stomach paralysis’ claims, also known as severe gastroparesis, a condition in which the stomach does not empty properly.

Furthermore, with a well-researched gut-brain connection, there are reports that these medications can cause depression, anxiety, and mood changes.

Ultimately, these medications can be effective for weight loss but are not without risks. The reality is that most people who take the drug never experience severe side effects, and even minor ones, such as nausea, can be controlled with a balanced diet and medical supervision.

Nevertheless, patients must consult with a trusted health professional and share their full medical history to weigh in on the pros and cons of anti-obesity drugs.

Undoubtedly, the new generation of anti-obesity drugs presents an opportunity to improve the health and well-being of millions of employees. The question of whether Ozempic is covered by insurance and will insurance cover Ozempic for prediabetes or other weight loss drugs is a pressing one.

Typically, insurance providers will cover Ozempic as long as it is prescribed for type 2 diabetes or prediabetes. However, getting coverage without a diabetes diagnosis is more complicated and may require prior authorization.

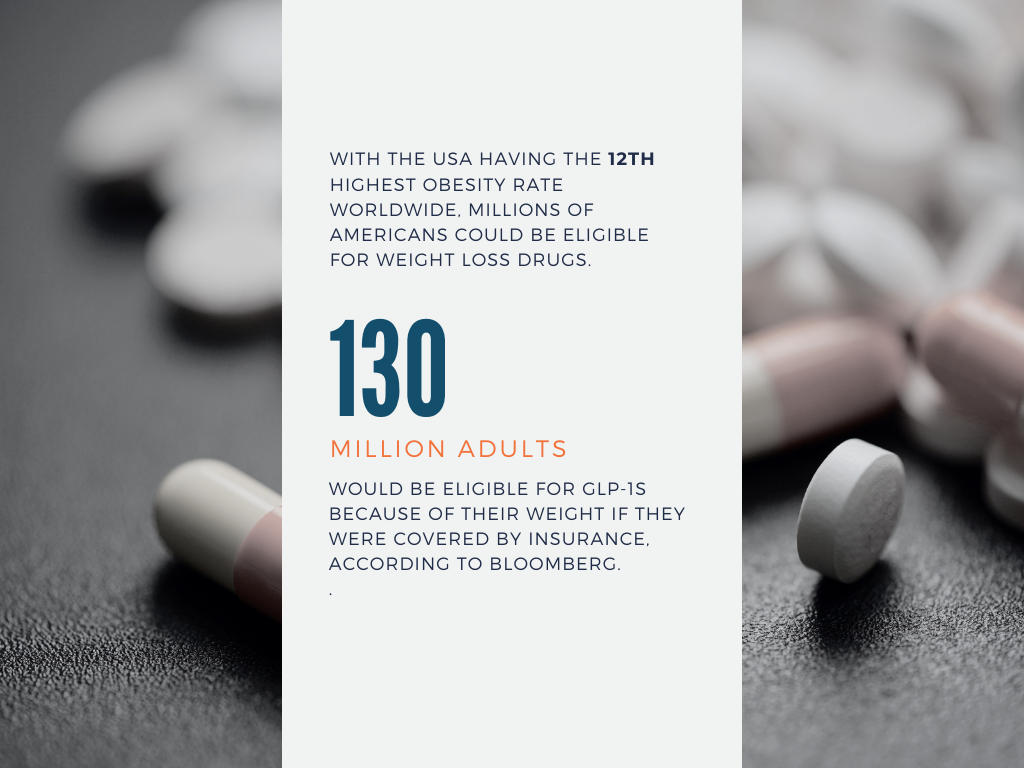

With the USA having the 12th highest obesity rate worldwide, millions of Americans could be eligible for weight loss drugs. According to Bloomberg, nearly 130 million adults would be eligible for GLP-1s because of their weight if they were covered by insurance.

So, does insurance cover Ozempic for weight loss? The simple answer is no – for now.

Many insurance companies do not cover weight-loss drugs, even if they are FDA-approved and have been shown to be effective. They argue that obesity is not a disease but a behavioral problem, so they should not be required to cover weight-loss drugs.

Currently, only 11 state Medicaid programs and a handful of private insurers cover GLP-1s for weight loss.

Medicare, however, does not cover weight loss drugs at all.

|

States with Broad Medicaid Coverage for Obesity Drugs |

States with Limited Medicaid Coverage for Obesity Drugs |

|

California |

New Mexico |

|

Connecticut |

Louisiana |

|

Kansas |

Tennessee |

|

Minnesota |

Georgia |

|

Wisconsin |

South Carolina |

|

Michigan |

New Jersey |

|

Pennsylvania |

|

|

Virginia |

|

|

Delaware |

|

|

Rhode Island |

|

|

New Hampshire |

|

|

|

|

The cost of weight-loss drugs is a significant barrier to access for many Americans.

A recent survey found that 70% of Americans reported they could not afford to take Ozempic, putting companies, insurers, and the government under increasing pressure to cover new weight-loss drugs.

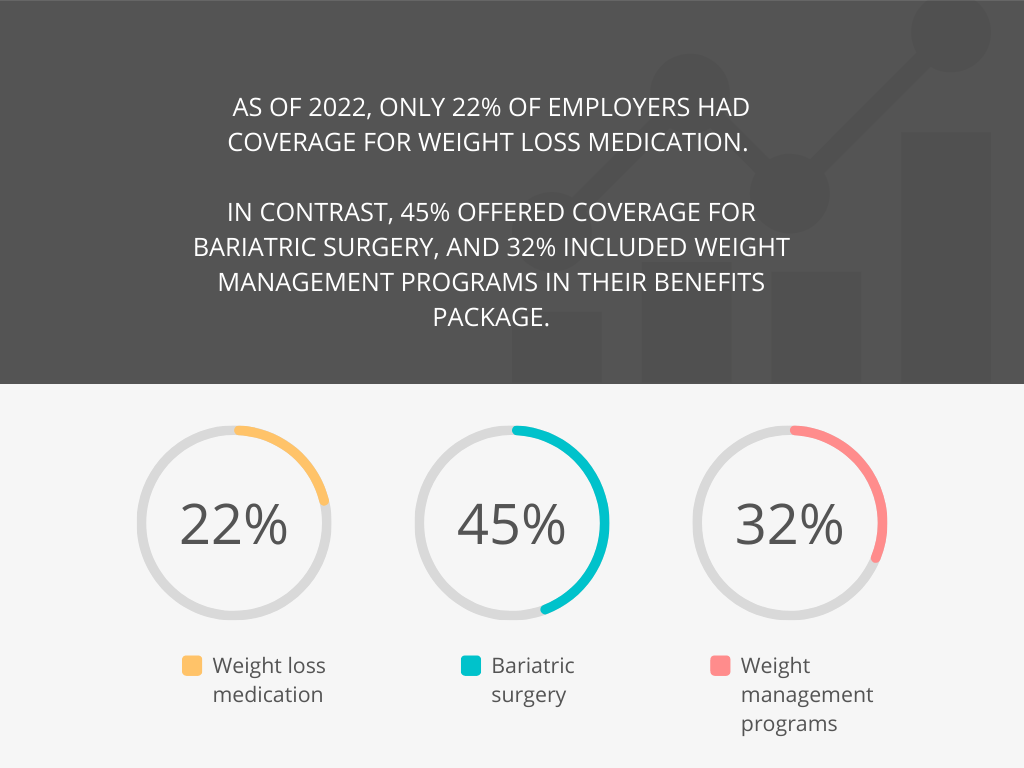

While the majority of employers provide various wellness programs, along with diabetes programs, as of 2022, only 22% of employers had coverage for weight loss medication. In contrast, 45% offered coverage for bariatric surgery, and 32% included weight management programs in their benefits package.

However, employers’ concerns over the costs of anti-obesity drugs are valid.

The cost of Ozempic without insurance ranges from $730 to $1,400, and it must be taken continuously to keep the pounds off.

The net cost of Wegovy for each person is around $9,000 per year after estimated rebates and discounts. If half of the eligible individuals opt for GLP-1 prescriptions, it could lead to an upsurge of more than $70 per member per month in pharmacy costs for the entire population.

The situation is particularly worrying for employers already facing the highest premium increases over a decade in 2023. In fact, the cost of anti-obesity medication in employer-sponsored health insurance increased at an unprecedented rate in the first two months of 2023, rising 3.5 times faster than in all of 2022.

Employers are also concerned that they won’t see the long-term savings of weight loss if employees move on to other jobs after taking the drugs. However, for companies experiencing employee turnover, including GLP-1 medications in coverage could prove more cost-effective than covering bariatric surgery, given that the average expense for this surgical procedure is around $30,000.

As established previously, obesity poses a major public health challenge, and the correlated expenses present a problem for companies and the US economy at large.

A study found that the annual cost related to obesity among full-time employees amounts to $73.1 billion. In other words, people whose body mass index (BMI) is 35 or above make up 37% of the obese population, yet they contribute to 61% of the excess costs.

Employers are also feeling the financial impact of obesity.

A study found that 25% of employers say obesity has the greatest impact on overall healthcare costs.

Widespread use of effective anti-obesity drugs could have a lot of immediate and long-term potential benefits for employers, including:

Employers who want to stay ahead of the curve should focus on weight loss drugs as a potentially cost-effective solution for the coming years.

For many employees struggling to lose weight, prescription weight loss medication can be a helpful tool. However, consulting with a healthcare provider before embarking on this journey is essential.

Each person’s health profile is unique, and each medication has unique characteristics that cater to specific needs. In addition, understanding the potential side effects of these medications is vital. Only a doctor can determine which medication is suitable.

Distinguishing between the options, such as Wegovy vs. Ozempic, and even considering Mounjaro vs. Wegovy, can significantly impact an employee’s weight-loss journey.

Understanding that weight loss medications are not a “quick fix” solution is also important. They work best when combined with lifestyle changes, including a balanced diet and regular exercise.

Employers can play a role in helping employees lose weight and improve their health. Here are some strategies that employers can implement:

By taking these steps, employers can ensure that new medications are used safely and cost-effectively.

As highlighted by this article, many obstacles exist when integrating new medications into employee health insurance plans.

The US healthcare system is set up in a way that allows drug companies to set high prices for their products. Insurers can negotiate some of these prices down, but they are also incentivized to restrict coverage to keep costs low.

Insurance companies’ coverage decisions are worsening existing health disparities by making it more difficult for people from low-income communities and racial and ethnic minority groups to access weight loss medications.

Since the American workforce is more mobile, with an average tenure of only four years, employer plans typically only cover a patient for a few years, so they are focused on short-term savings rather than long-term benefits.

This situation is unique to the US.

Other developed countries with high obesity rates also face the challenge of paying for weight-loss treatments, but they don’t have the same cost pressures as the US.

For example, in the UK, one month’s supply of Wegovy costs about $88, or if it becomes available on the NHS, it would be either free or cost the standard prescription fee of about $10 per order.

In comparison, the same medicine has a list price of $1,349 in the US.

Employers, insurers, and healthcare providers need to collaborate to overcome these barriers.

Employers have three options when it comes to covering anti-obesity drugs:

1. Excluding coverage is the most straightforward option.

It will save employers money on drug costs, but it may also lead to some employees seeking off-label prescriptions for the versions of these medications approved for diabetes treatment. This could widen health inequalities, as higher-wage and more highly educated employees are more likely to be able to afford off-label prescriptions.

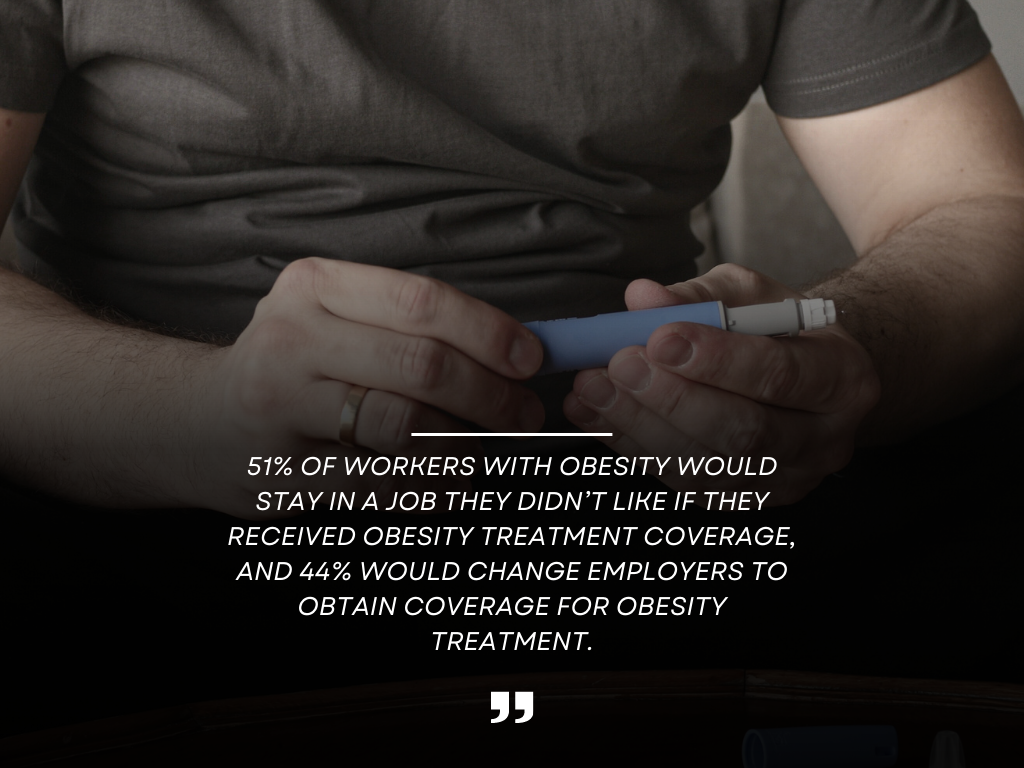

Employers might also face a disadvantage in attracting and retaining employees if rival companies provide benefits that include coverage for anti-obesity medications.

2. Covering with restrictions can be more cost-effective than excluding coverage, while ensuring that employees who are most likely to benefit from anti-obesity drugs have access to them.

One way to do this is to set a higher BMI threshold for eligibility for coverage. This would mean that only employees with the most severe obesity would be eligible for coverage, lowering the overall medication cost.

However, some employees with BMIs below the threshold may seek off-label prescriptions for the versions of these medications approved for diabetes treatment.

3. Providing permissive coverage is the most expensive option but also the most satisfactory for employees. This implies that employers would provide coverage for anti-obesity medications whenever a physician states it is a medical necessity with minimal review.

This would ensure that all employees who could benefit from anti-obesity drugs have access, but it would also come at a higher cost. Employers may also gain a competitive advantage in hiring if they offer permissive coverage for anti-obesity drugs.

The landscape of employee health insurance is experiencing a great shift, and Ozempic, Wegovy, and Mounjaro represent a significant step toward addressing obesity-related challenges.

The growing demand for Wegovy and Ozempic to be covered by insurance indicates the urgent need to combat the obesity crisis and its associated health risk factors.

However, their high costs present a hurdle, warranting proactive discussions between employers, HR professionals, and benefits managers.

Employers stand at a crossroads, facing the need to balance the financial implications of having weight loss drugs covered by insurance against the potential benefits for their workforce.

In pursuing a healthier workforce, companies must carefully examine the pros and cons of weight loss medications as a potential solution.

Disclosure: The information provided in this post is for general informational purposes only and should not be considered as legal or medical advice. For advice on specific issues, please consult with a qualified professional.

Senior Content Writer at Shortlister

Browse our curated list of vendors to find the best solution for your needs.

Subscribe to our newsletter for the latest trends, expert tips, and workplace insights!

Workplace equity is more than a buzzword—it’s a lifeline in the fight against diabetes and the health gaps shaped by where we live, work, and grow.

Substance use disorders impact 9% of the adult population. To address this challenge, GoMo Health has launched the “Recovery Pathways: Workplace” program, becoming one of the first to be nationally certified as a recovery-friendly workplace.

As we explore the value of regular health screenings, cost-effectiveness emerges as a major benefit for individuals, companies, and society.

What does Doctor on Demand cost people with and without insurance coverage, and is it better than in-person appointments?

Used by most of the top employee benefits consultants in the US, Shortlister is where you can find, research and select HR and benefits vendors for your clients.

Shortlister helps you reach your ideal prospects. Claim your free account to control your message and receive employer, consultant and health plan leads.