Financial Wellness: Buyer’s Guide

How can employers create and implement a successful financial wellness program? And what does success mean?

Director of PR at Financial Literacy Foundation

While the work world and the ways we conduct business have evolved dramatically in the last few decades, payment methods for employees have stayed the same.

However, as many employees face persistent economic uncertainties, expectations for real-time payments are fueling a change to the traditional payment system.

Many companies are introducing earned wage access tools—also known as on-demand pay—that allow employees to claim their income before payday as a potential route to supporting employees’ financial well-being.

In this article, we explore the concept of earned wage access, its impact on employee financial well-being, and its growing significance in modern employee benefits packages.

Earned Wage Access (EWA) terminology can be confusing due to its various names, such as instant pay, daily pay, wage advance, accrued wage access, and on-demand pay.

So, what is earned wage access?

Instead of waiting for a scheduled payday, earned wage access allows employees to access a portion of their wages as they earn them.

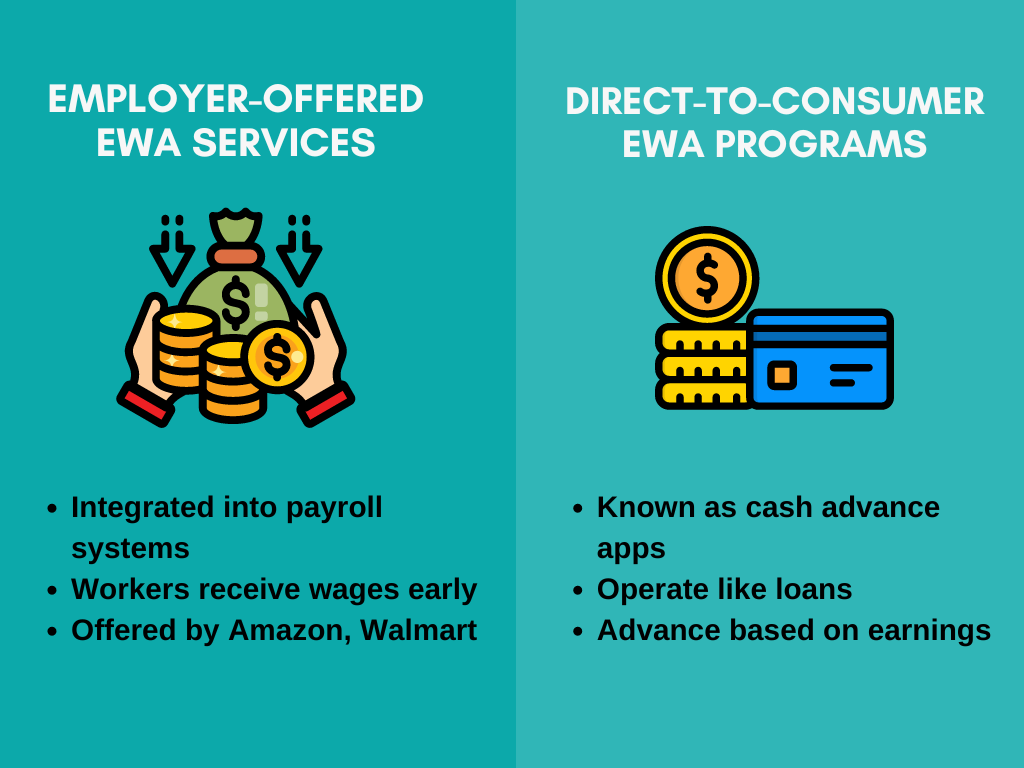

While earned wage access has become an umbrella term, there are differences between these programs.

Typically, employer-offered EWA services are integrated directly into employers’ payroll systems so workers can receive a portion of their wages ahead of schedule. These programs are offered by major companies in the country, like Amazon and Walmart.

On the other hand, direct-to-consumer early wage access programs, often referred to as cash advance apps, operate similarly to loans. They advance workers’ wages based on anticipated earnings.

Both service types are experiencing substantial market growth. More payroll companies, such as ADP with Wisely and Ceridian with Dayforce Wallet, are offering tailored solutions to meet the unique needs of employers.

Most people prefer not to wait for payday to access their earnings.

Whether it’s covering bills, managing childcare expenses, or handling emergency expenses – having flexible access to funds is important.

Is offering this financial flexibility difficult? And how does earned wage access work?

In essence, employers partner with an EWA provider that syncs with their payroll system. Through the provider’s app, employees can access their accounts and withdraw a portion of their earned wages before payday.

It’s important to note that earned wage access apps do not conduct hard or soft credit checks. Instead, they determine how much employees can withdraw early based on their payroll data and the limits set by their employer.

Over the past decade, a wave of innovative fintech solutions have reshaped how consumers spend and manage their money.

From BNPL (Buy Now, Pay Later) schemes to mobile wallets like Apple Pay and Google Wallet, peer-to-peer payment platforms like Venmo and Cash App, to EWA apps —these tools have altered financial interactions.

Unsurprisingly, these trends also influence employee expectations around pay, presenting challenges and opportunities for employers as they adapt to these evolving preferences.

How would a sudden $400 expense impact your workers?

Shortlister’s financial wellness report mentions that nearly 40% of American workers would be unable to cover that kind of expense without turning to payday loans or racking up credit card debt.

It’s a troubling statistic, especially given that financial wellness among Americans today is at its lowest point in decades.

Despite a recovering economy, many employees struggle financially – a reality employers cannot afford to overlook.

Aaliyah Kissick, Director of PR at the Financial Literacy Foundation, emphasizes the transformative potential of financial wellness benefits like on-demand pay. “The long-term economic effects of adopting EWA could affect employees greatly,” Kissick explains.

“The ability to access earned wages instantly can lead to reduced financial stress, potentially leading to higher productivity and job satisfaction.”

Kissick’s perspective is supported by robust data: a recent survey by ZayZoon, shows that an impressive 89% of employees using EWA experience a significant reduction in financial stress.

As with any novelty service, introducing on-demand pay comes with its own set of challenges.

On-demand pay, or EWA, often involves a transaction fee—a few dollars per use, which might vary depending on the withdrawal amount.

When we compare this against cash advance apps, which can charge anywhere from under a dollar to over $20, EWA often emerges as the more economical choice.

Yet, these fees can quickly add up over time, and frequent use can translate to an annual interest rate of more than 330%, according to a recent report from California’s Department of Financial Protection and Innovation.

So, while EWA can be a lifesaver in emergencies, consumer advocates caution against making early withdrawals a regular practice, as it could lead to unsustainable financial habits.

In addition, early withdrawals mean less money later, which could pose a problem for autopay bills and lead to missed payments.

Despite these challenges, EWA apps have gained traction across various sectors and remain particularly popular within industries that tend to pay lower wages, such as food service, retail, and gig work.

However, since these workers often face greater financial risks, employers must ensure their teams’ financial literacy to prevent potential misuse of EWA services.

Traditionally, on-demand pay has been a perk reserved for gig workers and contractors who invoice and receive immediate compensation.

Now, EWA solutions are quickly expanding into industries with high turnover rates where employees often live paycheck to paycheck and need more regular access to their funds.

On-demand pay solutions directly address one of the primary sources of financial stress: the mismatch between the timing of income and expenses.

Without it, employee financial stress can spill into the workplace, where it manifests as absenteeism, reduced performance, and an overall distraction, eventually culminating in employee turnover.

Indeed, it’s estimated that financial stress accounts for 20% of turnover, costing employers in the US and the UK approximately $300 billion each year.

Therefore, by providing employees with more frequent access to their earned wages, employers tackle a significant root cause of job dissatisfaction.

As Aaliyah Kissick insightfully notes, “Employees may be less likely to leave their jobs if they are not stressed. Longer tenures in positions may lead to increased productivity amongst companies that adopt EWA.”

Data backs this up, as employers who offer on-demand access to earned wages see up to a 29% reduction in turnover.

Financial anxiety is a significant stressor for American workers, with nearly 50% reporting financial stress, according to ADP.

For employers, that is an important figure, considering there’s a proven link between financial stress and drops in workplace productivity.

Workers overwhelmed by financial concerns often struggle to focus on the immediate tasks essential for their job performance.

In fact, employees stressed about finances are nearly five times more likely to be distracted at work, according to PwC’s 2023 Employee Financial Wellness Survey.

On top of that, employees spend approximately 9.2 hours each week handling personal financial issues during work hours—tasks like managing credit card debt, budgeting, and covering basic living expenses.

However, PwC’s survey also revealed that businesses that support their employees in managing financial stress are likely to see a boost in productivity.

For these reasons, EWA solutions have emerged as a true “win-win” for both employees and employers.

Today, as many as 65% of workers consider EWA to be an important benefit.

In fact, employees say it’s nearly as important to them as retirement, 401(k), and life insurance benefits.

However, integrating EWA into workplace benefits does more than meet employee needs—it also influences various HR functions.

Implementing EWA can significantly reduce the administrative burden of managing advance pay requests or emergency loans.

Furthermore, given the strong interest, EWA can improve the attractiveness of a company’s benefits package and make it easier for HR to recruit top talent in competitive markets.

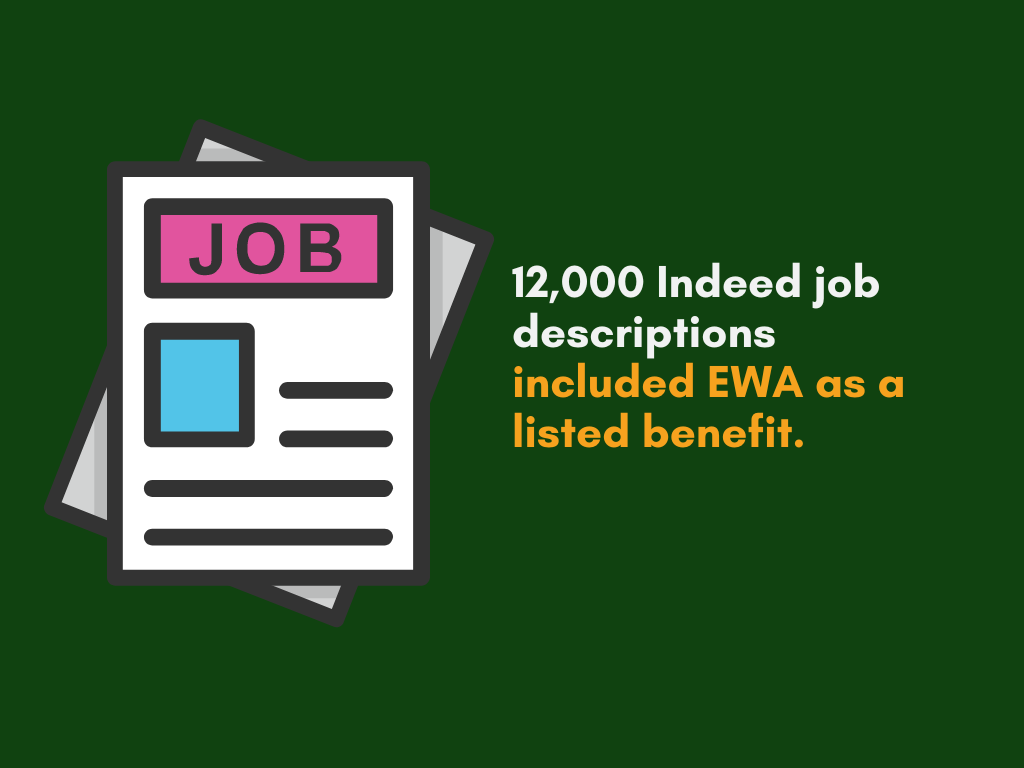

For instance, in 2022, as many as 12,000 Indeed job descriptions included EWA as a listed benefit.

The impact is clear — businesses implementing EWA receive twice as many job applicants and see a 5% reduction in hiring costs.

However, implementing earned wage access does require careful consideration by HR teams and leaders.

Integrating EWA requires careful coordination with existing employer systems to ensure accuracy and effectiveness.

With only 11% of companies still relying on spreadsheets for their payroll needs, the majority now have the technical capability to incorporate earned wage access.

As HR and payroll systems continue to digitalize, it becomes increasingly cost-effective for employers to adopt these solutions, even on a smaller scale.

The biggest concern for many employers is managing various wage deductions, but the good news is that this responsibility doesn’t fall on them.

Instead, EWA providers pay the wages upfront, and employers reimburse them during the regular payroll cycle.

As a result, the company’s cash flow and working capital remain stable and unchanged.

However, employers looking to implement EWA services must set clear eligibility criteria based on factors such as tenure and employment status. In addition, they need to comply with local and industry-specific regulations to prevent misuse.

Most on-demand pay technologies also allow employers to limit how often and how much employees can withdraw, with data from ADP showing that withdrawals typically range from 25% to 75% of available wages.

Finally, employers must communicate clearly about the timing of these transfers and any associated fees to maintain transparency and trust.

The importance of timely and flexible wage access cannot be overstated during the current economic environment for improving workers’ financial well-being.

With 62% of Americans navigating a paycheck-to-paycheck lifestyle, earned wage access has quickly evolved from a novel benefit to an essential feature of employee benefits packages.

For these reasons, EWA is increasingly integrated into comprehensive financial wellness programs.

Projections show that within the next two to three years, nearly a third of businesses (31%) intend to introduce new employee payment options—a significant rise from just 20% in 2022.

Ultimately, all these indicators point to the fact that earned wage access is not just a trend; it’s a transformative tool reshaping the landscape of modern employee benefits.

Disclosure: The information provided in this post is for general informational purposes only and should not be considered as legal, tax, accounting, or investment advice. For advice on specific issues, please consult with a qualified professional.

Senior Content Writer at Shortlister

Browse our curated list of vendors to find the best solution for your needs.

Subscribe to our newsletter for the latest trends, expert tips, and workplace insights!

How can employers create and implement a successful financial wellness program? And what does success mean?

From uncovering new qualified leads and creating meaningful relationships with prospects to driving more sales, learn how intent data is a cutting-edge tool for an effective sales strategy.

You can cash out 401(k) early while still working. But how will it affect tax retributions and your overall pension fund?

Your SaaS company doesn’t need a physical office abroad to trigger a multimillion-dollar tax bill. With authorities expanding the definition of permanent establishment, unprepared employers often realize the risk too late.

Used by most of the top employee benefits consultants in the US, Shortlister is where you can find, research and select HR and benefits vendors for your clients.

Shortlister helps you reach your ideal prospects. Claim your free account to control your message and receive employer, consultant and health plan leads.