How Brand Protection Can Safeguard Your Business Reputation

In a world where deepfakes and counterfeit schemes are on the rise, is your business prepared to defend its brand from digital deception?

Nowadays, many workers are faced with the harsh reality of financial instability and uncertainty. The cost of living has surged, wages haven’t kept pace, and mortgage rates are climbing, presenting employees with unprecedented financial challenges.

In short, today’s stress-filled economic climate makes the idea of financial security feel more like a far-off fantasy than something within reach.

Considering these challenges, companies are emphasizing financial wellness as a crucial part of their support for employees.

In this report, we examine the growing importance of financial wellness programs within the workplace, backed by industry trends and Shortlister data, highlighting the impact these initiatives have on both employers and employees.

According to Shortlister’s 2021 Workplace Wellness Trends report, the pandemic era created an unparalleled focus on financial wellness.

During this time, employers significantly ramped up their commitment to financial wellness programs, resulting in a sharp increase in adoption rates by 2021.

In fact, Shortlister saw interest and demand for these benefits among employers jump from 36% in 2020 to 55% in 2021.

However, there has been a decline from these high levels after reaching this peak. The subsequent years, 2022 and 2023, while still reflecting an overall positive stance towards financial wellness programs, have seen a slight retreat from the peak interest levels.

This trend suggests a move towards a more stabilized interest in financial wellness initiatives as the initial pandemic-driven urgency wanes.

Transitioning from Shortlister’s findings, we explore broader industry data to understand how these trends reflect and intersect with broader economic dynamics.

While employers have long included financial wellness as a crucial part of their overall well-being programs, it’s clear that the current economic climate has reemphasized the importance of offering benefits that address employees’ financial concerns.

Financial concerns have become a significant source of worry for many employees.

The struggles to manage student loans and unexpected bills, save for a home, support a family, or plan for retirement are not new.

Yet, these challenges have deepened, especially in the aftermath of the pandemic. With inflation, increasing mortgage rates, and dwindling savings, employees feel financially strained more than ever.

In 2023, a looming recession and economic uncertainty drove financial wellness among employees to 42%, the lowest since Bank of America (BoA) started its research in 2010.

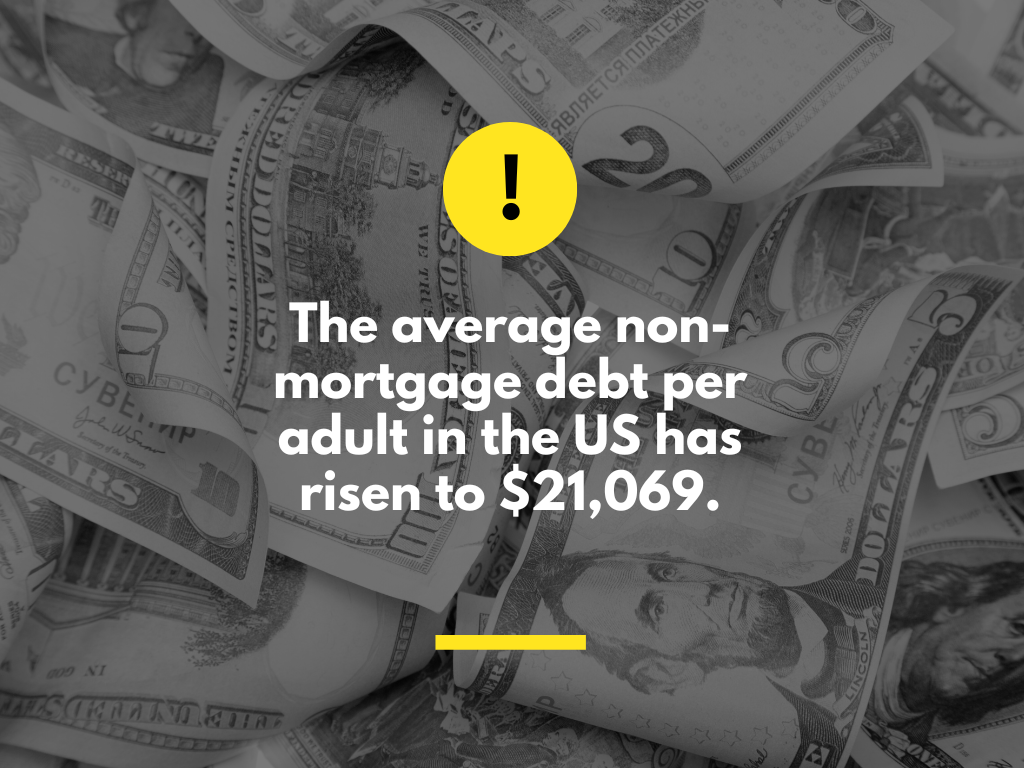

Here are some key statistics that illustrate the current financial landscape for US employees:

Unsurprisingly, by September 2023, a LendingClub report showed that 60% of Americans lived paycheck to paycheck. Even more worrisome is that this financial crisis isn’t limited to lower income brackets; over half of those earning more than $100,000 annually are also caught in this cycle.

However, the weight of this financial stress extends far beyond bank balances and budget sheets and directly impacts employees’ personal and professional lives.

The American Psychological Association (APA) consistently points out money as a major stressor in their Stress in America surveys.

In 2023, for those ages 35–44, money worries were on top of the list, affecting 77%, with concerns about the economy not far behind at 74%.

Financial stress can profoundly impact employees, leading to greater health risks, worsened mental health, and reduced focus at work.

In fact, research links financial worries with a spike in anxiety and depression rates. According to the National Institute of Mental Health, individuals experiencing financial stress are more than twice as likely to develop depression compared to those who are not.

Additionally, financial stress increases the risk of cardiovascular disease by 40% and weakens the immune system by approximately 20%.

However, financial stress is not just negatively impacting employees but is also costing employers.

A survey by PwC found that nearly half of the workforce (48%) struggles to stay focused due to money worries. The APA also links financial strain to a rise in absenteeism and presenteeism and a dip in overall productivity.

Simply put, financial wellness programs are at the core of a company’s overall strategy because whether employees feel financially secure greatly affects their health, happiness, work performance, and productivity.

For these reasons, the current statistics indicate that financial wellness has never been a greater priority for employers. The good news is that the benefits industry has never been better equipped to help.

In light of the current state of financial wellness, employees are increasingly turning to their employers for guidance and assistance.

Research by BoA reveals that an overwhelming majority of employees (76%) and an even higher percentage of employers (96%) agree that it falls upon employers to ensure the financial well-being of their staff.

However, despite this acknowledgment, the implementation of financial wellness programs remains relatively low, with just two in five employers offering such support, as indicated by the report.

Similarly, Shortlister’s findings mirror those of the Principal Financial Group’s 2023 Global Financial Inclusion Index, which points to a slight decline in employer support for employee financial concerns on an annual basis.

While there has been an expansion in benefits aimed at boosting the overall value of compensation — through increased paid time off, sick leave, family leave, and supplemental health benefits — research shows that the emphasis on financial wellness benefits specifically has not been as strong, with only 33% of employers focusing on these benefits.

Several factors may contribute to this trend. Employers may be grappling with their own economic uncertainties, with concerns about a recession and a calculated approach towards additional investments in benefits programs and salary increases.

Alternatively, employers may not believe that employees are interested in these programs.

However, the same survey found that companies offering financial wellness benefits saw a great utilization of these services by their employees. Instead, this shows that employees may simply not be aware of the financial wellness options available to them, rather than being disinterested.

Despite these challenges, the importance of employers addressing financial wellness remains clear.

Investing in financial education for employees not only empowers them but also addresses the indirect costs associated with financial illiteracy in the workplace.

The Society for Human Resource Management highlights the value of these programs, noting that 82% of businesses saw an increase in employee satisfaction, while 80% witnessed improvements in their financial behaviors post-implementation.

Further supporting this is research from ERBI, which shows that most companies observed positive impacts on their employees’ mental, emotional, and social well-being as a result of their financial wellness initiatives.

For these reasons, financial well-being is quickly climbing corporate agendas, as shown in a 2023 Chartered Institute of Personnel and Development (CIPD) report.

Historically, financial wellness programs were often exclusive, catering primarily to high-net-worth employees or those at the top of the corporate ladder.

However, there’s been a significant shift in this approach.

Progressive companies now recognize the diversity in their workforce and the varied financial needs that come with it. This recognition has led to a more inclusive and multifaceted approach to financial wellness, going beyond the traditional one-size-fits-all strategy.

With a diverse workforce that has a wide range of demographics, lifestyles, and career paths, companies are now adopting a mix of benefits, initiatives, and policies.

With frameworks that combine technology, innovative products, and in-depth education, organizations can help employees navigate the cost-of-living challenges, make informed financial choices, and build financial stability.

The goal is to provide immediate relief for financial concerns while also establishing a foundation for long-term stability.

Looking ahead, the outlook for financial well-being benefits is very promising. According to the Transamerica Prescience report, by 2026, expansions in financial well-being benefits, including support for mortgage or rent payments and credit improvement initiatives, will be introduced.

Furthermore, over 50% of employers are projected to implement student loan repayment programs, emphasizing a significant commitment to employee financial health.

Ultimately, by offering these programs, companies not only enhance employee satisfaction and behavior but also contribute to a more resilient and informed workforce.

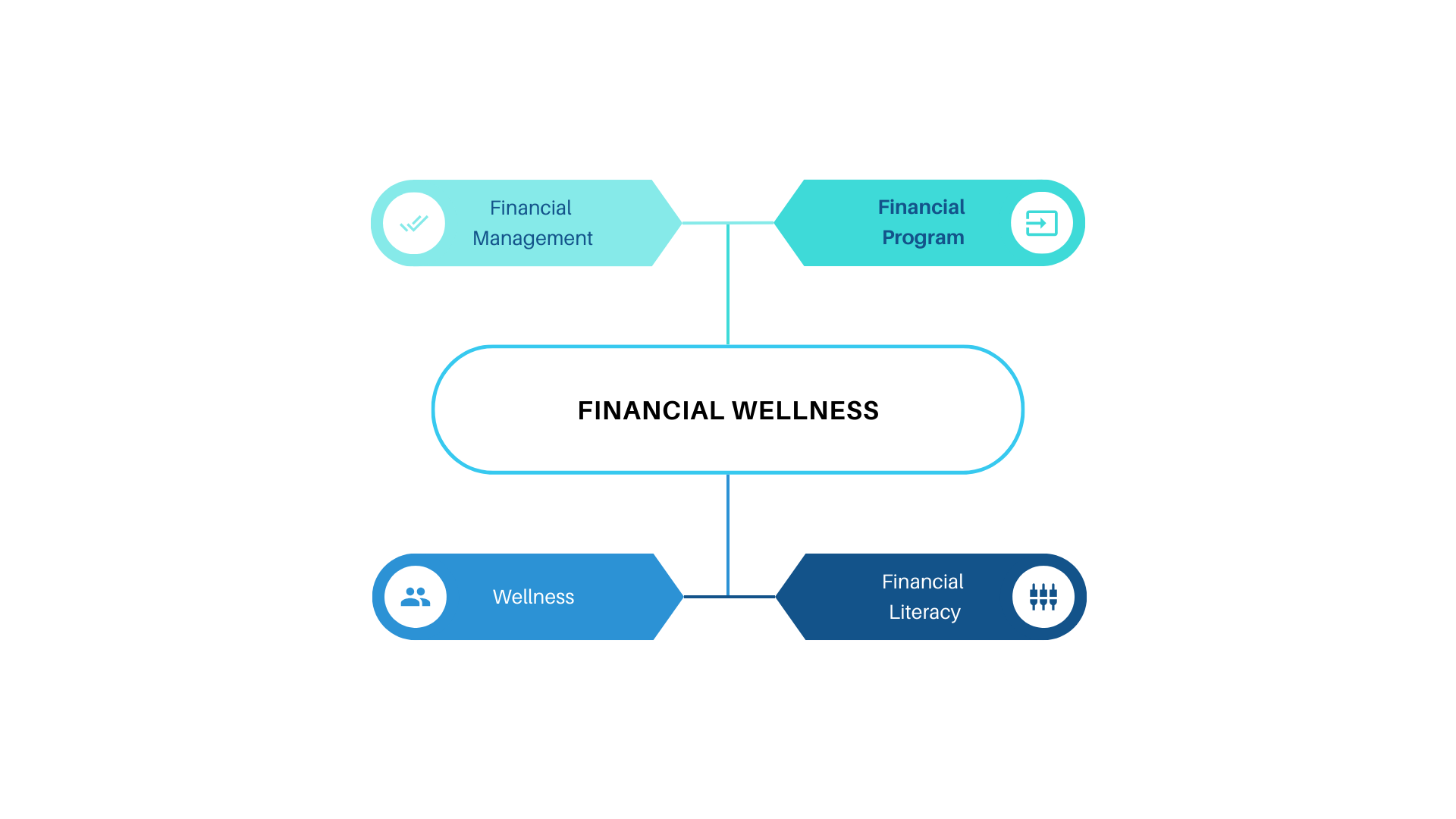

According to internal Shortlister data, our users tend to search for financial wellness benefits using the following keyword map:

Senior Content Writer at Shortlister

Browse our curated list of vendors to find the best solution for your needs.

Subscribe to our newsletter for the latest trends, expert tips, and workplace insights!

In a world where deepfakes and counterfeit schemes are on the rise, is your business prepared to defend its brand from digital deception?

Gain knowledge of state disability insurance tax. Discover the different rates and types of SDI tax plans and how they can impact you.

Just switched jobs? What you do with your 401(k) next could either save or drain thousands from your retirement.

Offering a 401(k) sends a clear message to your workers that you care – and are willing to invest in – their future. Explore our 401(k) Providers Buyers Guide to equip your organization with the knowledge for a successful selection and implementation process.

Used by most of the top employee benefits consultants in the US, Shortlister is where you can find, research and select HR and benefits vendors for your clients.

Shortlister helps you reach your ideal prospects. Claim your free account to control your message and receive employer, consultant and health plan leads.