In This Post:

Presenters:

Max Miller

Business Development Director

Joe Amato

Denior Account Manager, Business Development professional

From healthcare savings to leave management, new trends are redefining what employees value and employers must remain proactive in managing both traditional and emerging employee benefits. Understanding what’s next is key to how employers will deliver real value for clients and employees alike as we approach 2026. It’s the only way to strike a balance between compliance, cost control, and employee satisfaction. From health savings accounts (HSAs) to family and medical leave (FMLA) administration, employers face mounting pressure to stay informed, compliant, and competitive. BBP Admin has been at the forefront of these changes, offering reliable administration and compliance services for brokers and employers nationwide.

In this webinar, we welcomed Max Miller, Business Development Director, and Joe Amato, Senior Account Manager and Business Development professional, to share and explore together the latest trends in employee benefits, IRS updates for 2026, and how organizations can leverage innovative solutions like HSAs and streamlined FMLA administration.

About BBP Admin

BBP Admin creates benefit programs that strike the perfect balance between technology and the human touch. The primary focus is building teams of experts to better serve their customers in a variety of important ways. With a reputation for exceptional customer service and transparent pricing, BBP Admin integrates seamlessly with HR and payroll systems, helping businesses of all sizes streamline their benefits processes.

BBP Admin has become a leading nationwide benefit administrator, providing innovative employee benefits solutions for COBRA, FMLA, FSA, HRA, HSA, Payroll, and Transit Plans. They are committed to making it easier for owners to run their business, understanding that technology alone is not the answer. Building teams of experts to better serve their customers in various important ways is BBP Admin’s primary focus.

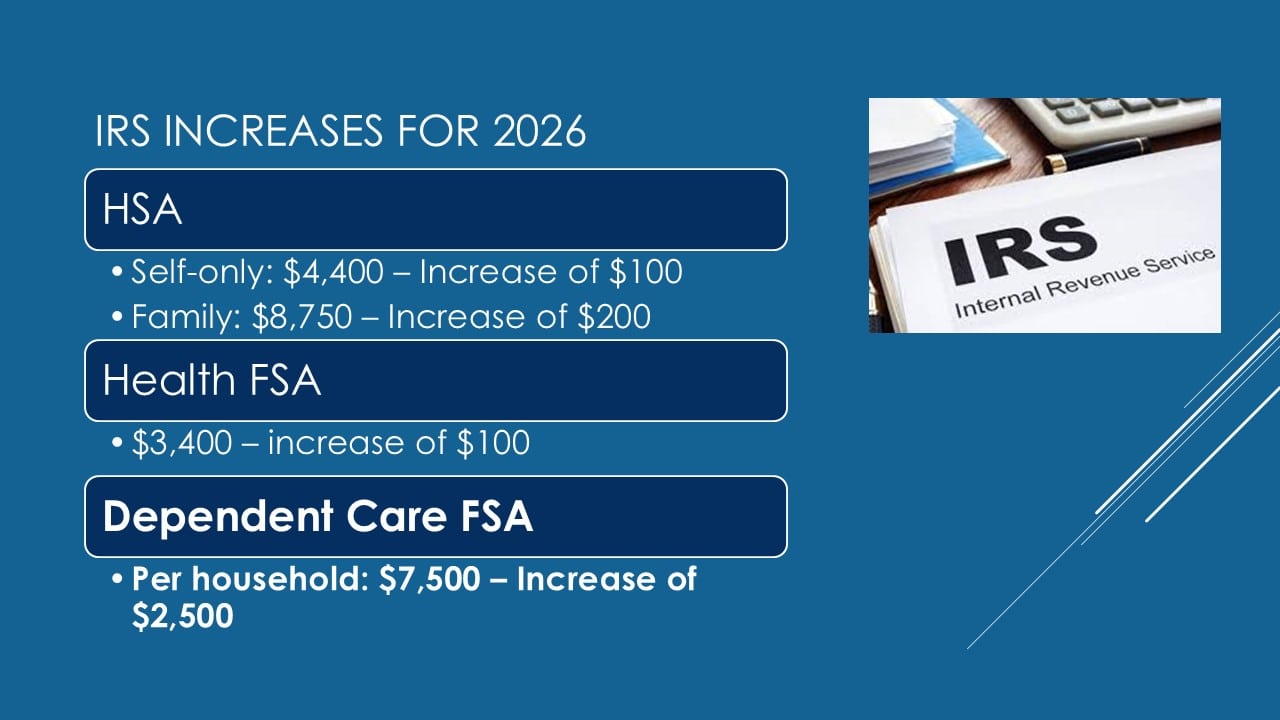

IRS Updates for 2026: What’s Changing

The IRS has announced several important updates for 2026 that will affect both employers and employees. One of the most notable changes is the increase in contribution limits for Health Savings Accounts (HSAs) and High-Deductible Health Plans (HDHPs).

HDHPs continue to grow in popularity due to their flexibility and cost-effectiveness. Paired with HSAs, they allow employees to save pre-tax dollars for medical expenses—whether planned or unexpected. Contributions can come from both employers (ER) and employees (EE), and the funds roll over year after year.

Perhaps the most appealing aspect of an HSA is its triple tax advantage:

- Contributions are made pre-tax.

- Growth through interest or investment is tax-free.

- Withdrawals for qualified medical expenses are also tax-free.

As healthcare costs continue to rise, this combination of flexibility, tax savings, and long-term value makes HSAs one of the most powerful tools in employee benefits today.

HSA Investments: Empowering Employees to Build for the Future

BBP Admin emphasizes the growing opportunity for employees to invest their HSA funds to build long-term savings. Employees now have three main options for managing their HSA money:

- FDIC-Insured Bank Account:

The safest option for risk-averse individuals, though the growth potential is limited. - High-Yield Savings Accounts:

Still conservative, but with greater returns than standard bank accounts, ideal for employees seeking a balance between safety and growth. - Stock Market Investments:

Employees can invest in partial or full shares of stocks, giving them the potential to grow their HSA balances exponentially over time.

This flexibility enables employees to tailor their financial strategy to their comfort level and long-term healthcare planning needs. As more employees recognize HSAs as an investment vehicle, rather than just a savings account, employers who offer them gain a significant advantage in attracting and retaining top talent.

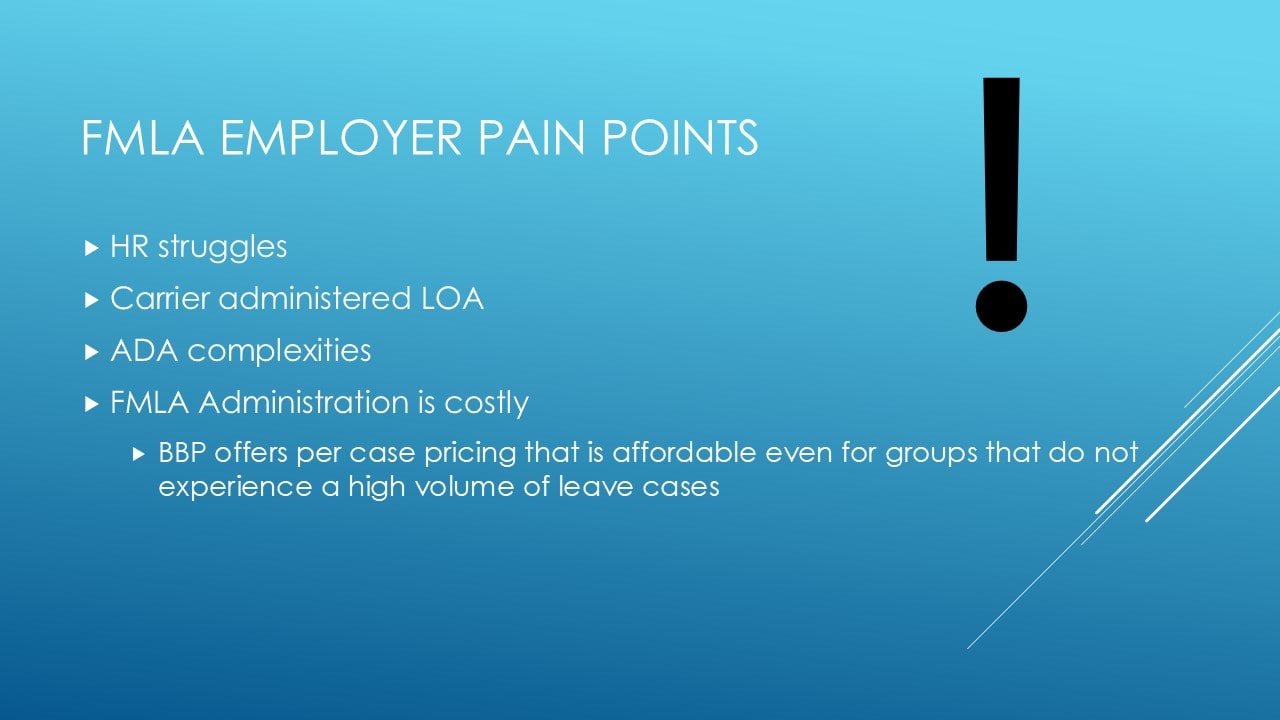

FMLA Administration: Turning Pain Points into Opportunities

While HSAs offer opportunities for financial growth, FMLA (Family and Medical Leave Act) administration remains a challenge for many HR teams. Between complex federal and state regulations, ADA (Americans with Disabilities Act) considerations, and varying leave policies, managing employee absences can quickly become overwhelming.

HR departments often face pain points such as:

- Confusing carrier-administered leave processes

- High administrative costs

- Difficulty managing intermittent leave

- Poor communication and tracking systems

BBP Admin addresses these issues through a per-case pricing model, offering affordable solutions even for smaller employers or those with minimal leave cases. This ensures that organizations pay only for what they need without sacrificing quality or compliance.

A Better Way to Manage Leave

BBP Admin’s FMLA Service is built on a customer-first approach that combines technology, transparency, and expert support. Their unique POD system connects clients directly with dedicated customer service and case managers available by direct dial, email, or even mobile.

Behind the scenes, a robust support system ensures no request goes unanswered. From online ticketing and mobile chat to auto-attendant and tiered phone support, BBP Admin’s infrastructure is designed to deliver fast, consistent, and personal service.

The software includes built-in metrics to monitor performance, identify issues, and resolve them proactively before they impact clients. Whether it’s ensuring compliance with evolving state laws, managing intermittent leave, or integrating with COBRA and workers’ compensation coordination, BBP Admin’s team helps employers stay organized, compliant, and confident.

FMLA, State, and ADA Coordination

Beyond federal FMLA compliance, employers must also manage state-specific leave laws and ADA accommodations. BBP Admin assists HR teams in maintaining accurate records, tracking laws across jurisdictions, and ensuring consistent communication with employees and managers.

The online portal simplifies this process by providing real-time access for HR, managers, and employees. From payment collection to data feed notifications, BBP Admin’s comprehensive platform keeps everyone aligned. This approach helps organizations not only meet their legal obligations but also improve employee experience during what can often be a stressful time.

Comprehensive Benefits Administration

In addition to HSA and FMLA administration, BBP Admin provides a full suite of services that support every stage of the employee benefits lifecycle. Their offerings include:

- FSA, HRA, and LSA administration

- Commuter benefits

- COBRA administration

- 5500 filings and Wrap/POP documents

- Compliance notices and ACA support

Each service is designed to integrate seamlessly with existing HR systems, providing a unified and efficient approach to benefits management.

Get in touch with the BBP Admin today!

Companies need to gain insights that drive smarter benefits decisions. From the growing appeal of HSA investments to the complexities of FMLA compliance, success depends on choosing a partner that combines experience, innovation, and personal service.

BBP Admin has built its legacy on these principles, helping brokers and employers navigate the evolving benefits landscape with confidence. With nearly five decades of expertise, integrated technology, and a hands-on support team, BBP Admin continues to set the standard for benefits administration nationwide.

In case you missed it: Log in to access the full Meet A Vendor Presentation!

Not a subscriber? Request access.

Did you find this article interesting?

Don’t keep this knowledge to yourself – share it on your social media channels and spark engaging conversations!