In This Post:

Presenters:

David Kinsey

Vice President of Partnerships and Sales

Healthcare in the United States is as much a financial challenge as it is a medical one. We need to focus on promoting getting care at the right time, at the right place of service. Rising deductibles, growing out-of-pocket costs, and shifting employer strategies are placing more pressure on employees to make difficult decisions about their health. According to recent studies, 59% of Americans would need to finance a medical bill over $1,000, and the average annual out-of-pocket cost for an individual has reached $1,100. For many, these costs determine not just when they seek care, but if they seek it at all.

This reality creates a troubling cycle. When employees delay treatment due to cost concerns, it often leads to worsening conditions. That leads to even higher overall medical expenses. At the same time, financial stress impacts workplace performance, increasing absenteeism and reducing productivity. Employers find themselves bearing the cost in two ways. One is through rising insurance premiums and the other is through lost employee effectiveness.

TempoPay was created to break this cycle. At our latest webinar David Kinsey, Vice President of Partnerships and Sales at TempoPay, showed us how TempoPay empowers employees to access the care they need, when they need it, while giving employers a simple, low-risk way to strengthen their benefits offering. And that’s by offering a capped, interest-free healthcare financing solution.

About TempoPay

As a part of HPS/PayMedix, TempoPay’s mission is to help people access healthcare when they need it, without concerns about affordability. HPS/PayMedix has been simplifying the medical payments process for over 15 years and can work with employers to provide a stronger financial safety net for employees while lowering overall medical trends.

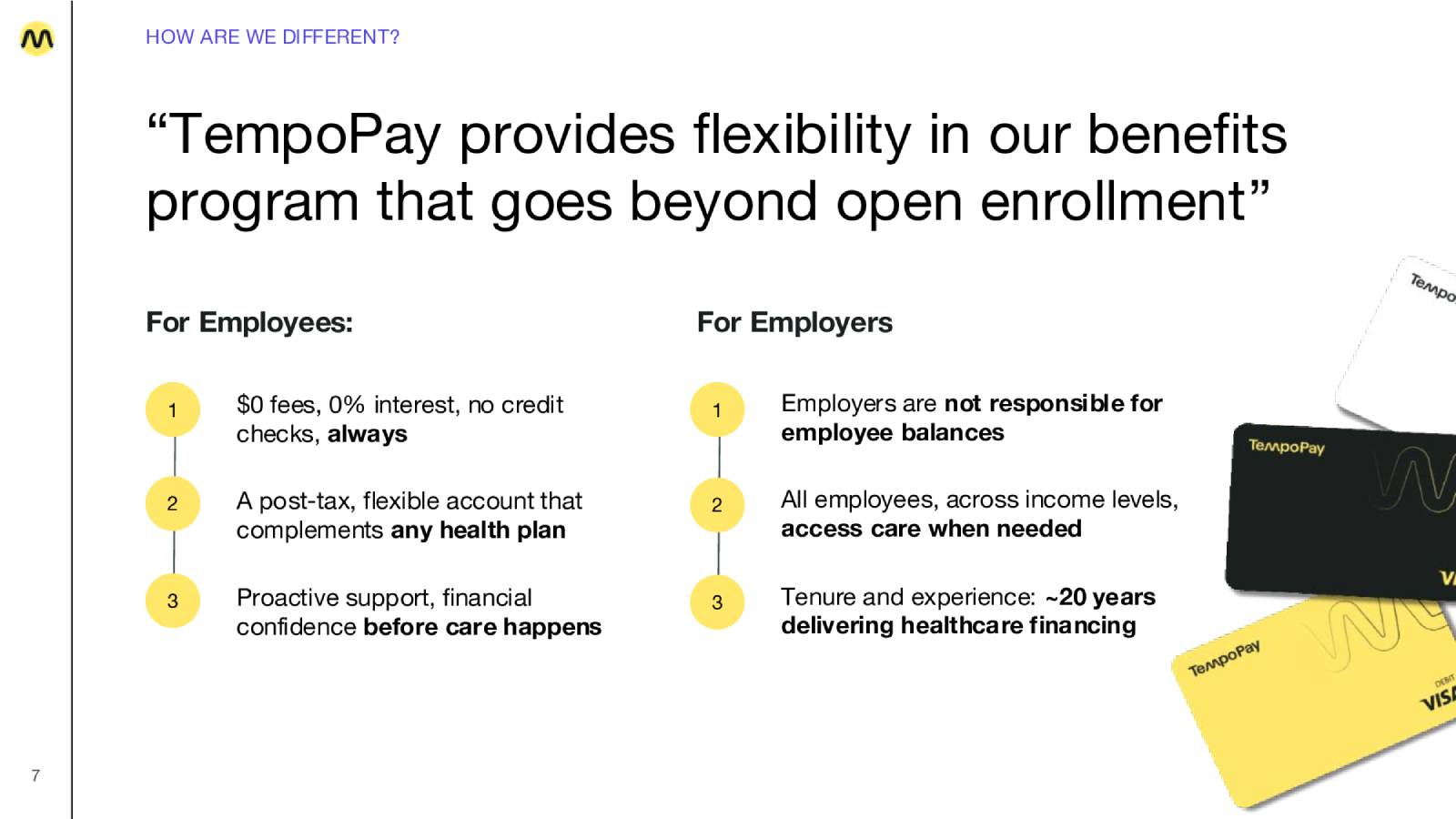

It’s a benefit employees need now. By offering interest-free healthcare financing as a benefit, employers can provide employees with peace of mind to manage out-of-pocket healthcare costs. TempoPay is simple to implement, available outside of open enrollment, and requires minimal tech lift.

The Connection Between Financial Stress and Health

The connection between financial stability and health outcomes is clear. Employers are already feeling the financial squeeze. In 2023 and 2024, businesses experienced the steepest cost increases in a decade, and projections suggest that by 2026, healthcare costs will be 62% higher than they were in 2017. Simply put: the current model is unsustainable.

TempoPay offers a sustainable path forward by addressing the root issue, financial barriers to care.

How TempoPay Works

TempoPay is designed to be simple, flexible, and inclusive. Here’s how it operates:

- Employee Enrollment – Workers can sign up at any time and receive access to a predetermined limit of funds, set by their employer.

- Care Payment – Employees use their TempoPay Visa® card to pay for healthcare expenses upfront or as billed by providers.

- Repayment – Employees choose a repayment schedule, with options to pay via post-tax payroll deductions, personal bank accounts, or pre-tax account reimbursements.

Employers determine the maximum balance and eligible spending categories, while TempoPay handles the financing. Crucially, employers are not responsible for employee balances, eliminating financial risk on their end.

Benefits and Real-Time Reporting

For employees, TempoPay provides peace of mind and immediate access to healthcare without the burden of interest or fees. The fees are $0, and the interest is 0%, which means employees never pay extra for accessing care. There are no credit checks. Everyone, regardless of credit score, has equal access to financing. Payment is flexible, which means payment schedules are tailored to employees’ payroll or financial circumstances. Мost importantly, TempoPay has a wide coverage. From doctor visits and prescriptions to dental care, vision, physical therapy, wellness services, and even veterinary care, TempoPay covers the needs of the whole family.

This flexibility makes healthcare more predictable and less intimidating for employees, reducing financial stress and encouraging proactive care decisions.

Employers, meanwhile, gain a powerful tool to build financial resilience and health equity across their workforce. Inclusivity across income levels, meaning all employees receive the same capped access, ensuring fairness in benefits. There is no employer liability, and employers are not on the hook for unpaid balances. By removing cost barriers, employees are less likely to delay care, leading to better health outcomes and fewer disruptions at work, thus improving productivity. Мost importantly, TempoPay has a simple implementation. It integrates seamlessly with existing payroll systems and benefits programs.

TempoPay also provides real-time reporting, enabling HR teams and advisors to track participation, spending categories, and repayment activity at both the employee and group levels.

One of the most powerful aspects of TempoPay is its ability to complement existing benefits, ideal for companies with deductible plans, HSA-eligible plans, or considering cost-shifting strategies. For some, TempoPay acts as a daily spending account, and for others, it serves as an entry-level financial tool, fostering responsible healthcare spending habits and opening the door to broader financial literacy.

With average transaction sizes of $131 and 35 – 40% employee registration within six months of launch, TempoPay’s utilization mirrors real consumer demand for flexible, interest-free healthcare financing.

Building Health Equity and Lowering Costs

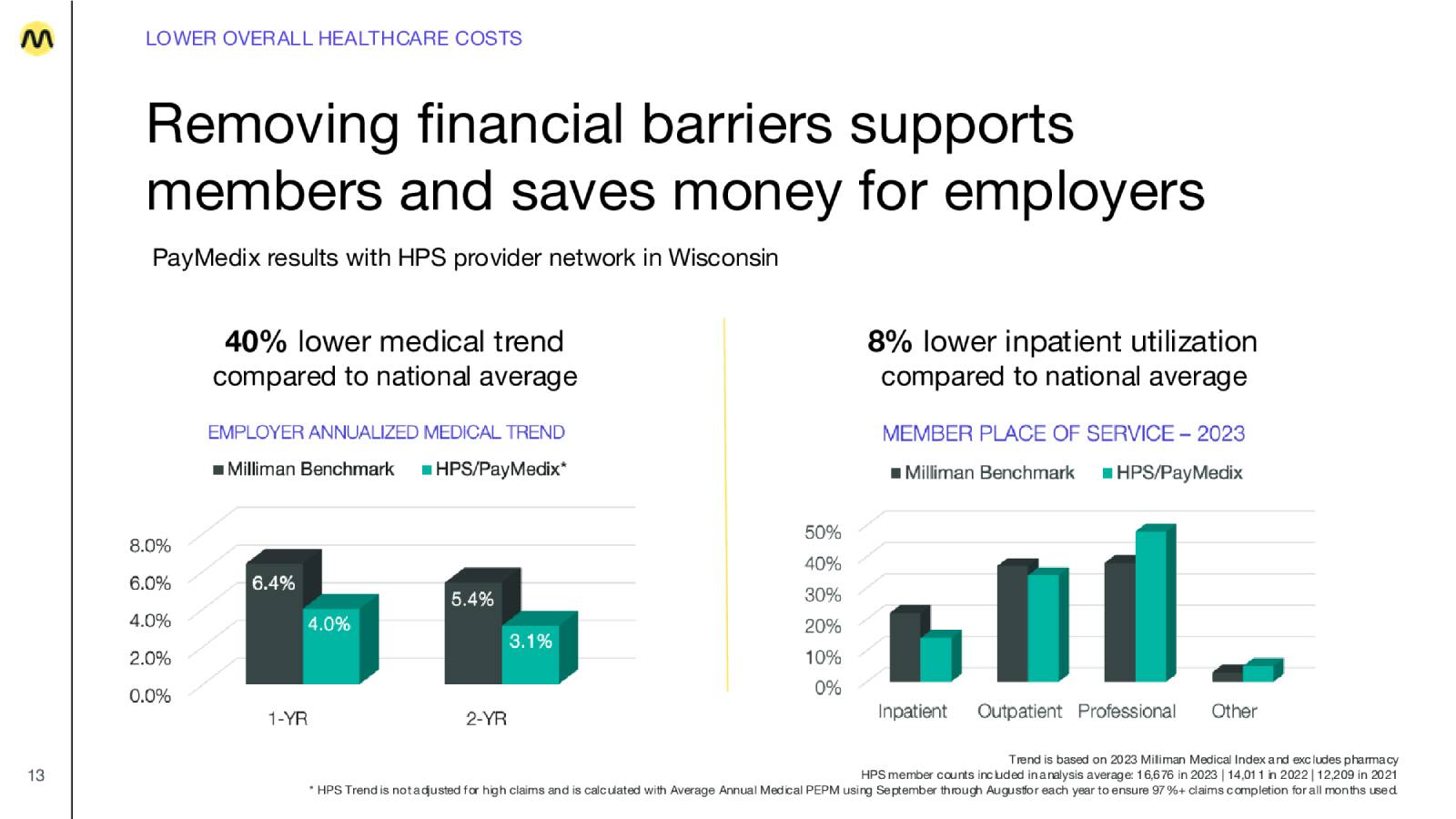

Health equity is a growing priority for employers, and TempoPay directly addresses it by ensuring that employees across all income levels can access care at similar rates. By eliminating financial barriers, TempoPay promotes fairness in benefits while also delivering measurable cost savings.

For example, data from PayMedix, a related solution within the same network, showed a 40% lower medical trend compared to the national average and 8% lower inpatient utilization. These results underscore the potential for TempoPay to reduce overall healthcare costs while improving employee well-being.

A Holistic Solution for a Broken System

The healthcare financing system in the U.S. is often fragmented, with patients caught between providers, insurers, and employers. TempoPay takes a holistic approach by combining proven payment networks, interest-free financing, and seamless employer integration. With nearly 20 years of experience in healthcare financing, the company has built a model that prioritizes sustainability, accessibility, and fairness.

The mission is simple yet powerful: remove financial barriers, build health equity, and ensure every employee can access care at the right time.

Get in touch with TempoPay today!

Employers are rethinking their benefits strategies to support both organizational sustainability and employee well-being. TempoPay offers a unique solution that expands the financial safety net for employees while reducing costs and improving outcomes for employers.

By giving employees healthcare at their rhythm and payment at their pace, TempoPay is financing medical expenses and reshaping how employers and employees approach health benefits.

In a world where care decisions are financial decisions, TempoPay ensures that finances no longer stand in the way of better health.

For more information, contact:

David Kinsey – dkinsey@hps.md

In case you missed it: Log in to access the full Meet A Vendor Presentation!

Not a subscriber? Request access.

Did you find this article interesting?

Don’t keep this knowledge to yourself – share it on your social media channels and spark engaging conversations!