Nationwide Completes $1.2B Acquisition, Gallagher and Marsh McLennan Expand Regionally & More Industry News

July brought a quieter pace across many industries, but what it lacked in volume, it made up for in consolidation and strategic growth

The One Big Beautiful Bill Act, which was signed into law on July 4, 2025, brings several changes to employee benefit programs. Many of these updates will affect employer-sponsored benefit plans starting in 2026, with a few applied retroactively to 2025.

High-deductible health plans (HDHPs) can now cover telehealth and other remote care before the deductible is met without losing their HSA-eligible status.

Under the new law, what began as a temporary pandemic relief is now permanent, effective for plan years beginning after December 31, 2024.

In practice, this means employees with HDHP/HSA plans can continue enjoying low- or no-cost telehealth visits without jeopardizing their ability to contribute to a Health Savings Account.

In short, this change gives employers more flexibility to support telemedicine as part of their health plans.

The annual limit for employer-sponsored Dependent Care Flexible Spending Accounts (FSAs) is rising for the first time in decades.

Starting in 2026, the maximum pre-tax contribution to a dependent care FSA will increase from $5,000 to $7,500 or $2,500 to $3,750 for married employees filing separately.

Unlike health FSAs, the new Dependent Care FSA limit is not indexed for inflation and will remain flat unless changed by future legislation.

In practice, these changes mean that employees can set aside more tax-free money to cover childcare and dependent care expenses, such as daycare, preschool, or elder care.

For employers that offer dependent care FSAs, this means that they will need to update plan documents and communicate this higher limit to employees during open enrollment for 2026 and beyond.

Employer student loan repayment programs are now a permanent, tax-free benefit. Under COVID-era relief, employers were temporarily allowed to pay up to $5,250 per year toward an employee’s student loans on a tax-free basis.

The provision, originally set to expire at the end of 2025, is now a permanent option under Section 127 of the tax code.

Employers can continue to offer tax-free student loan repayment contributions (up to the annual limit, shared with tuition assistance) as an employee benefit indefinitely.

Companies that have or plan to implement student loan assistance programs can now do so with more certainty that the tax advantages will remain in place.

The Act boosts traditional employer education assistance benefits as well.

The $5,250 annual limit for tax-free educational assistance, which covers tuition, courses, and related expenses under Section 127, will now be indexed for inflation starting in 2026.

In practical terms, this means the annual limit, which has been unchanged for many years, will gradually increase to keep pace with rising education costs.

Employers offering tuition reimbursement or similar programs may allow higher amounts over time without tax implications for the employee. These changes help keep education benefits a meaningful incentive as education expenses continue to rise.

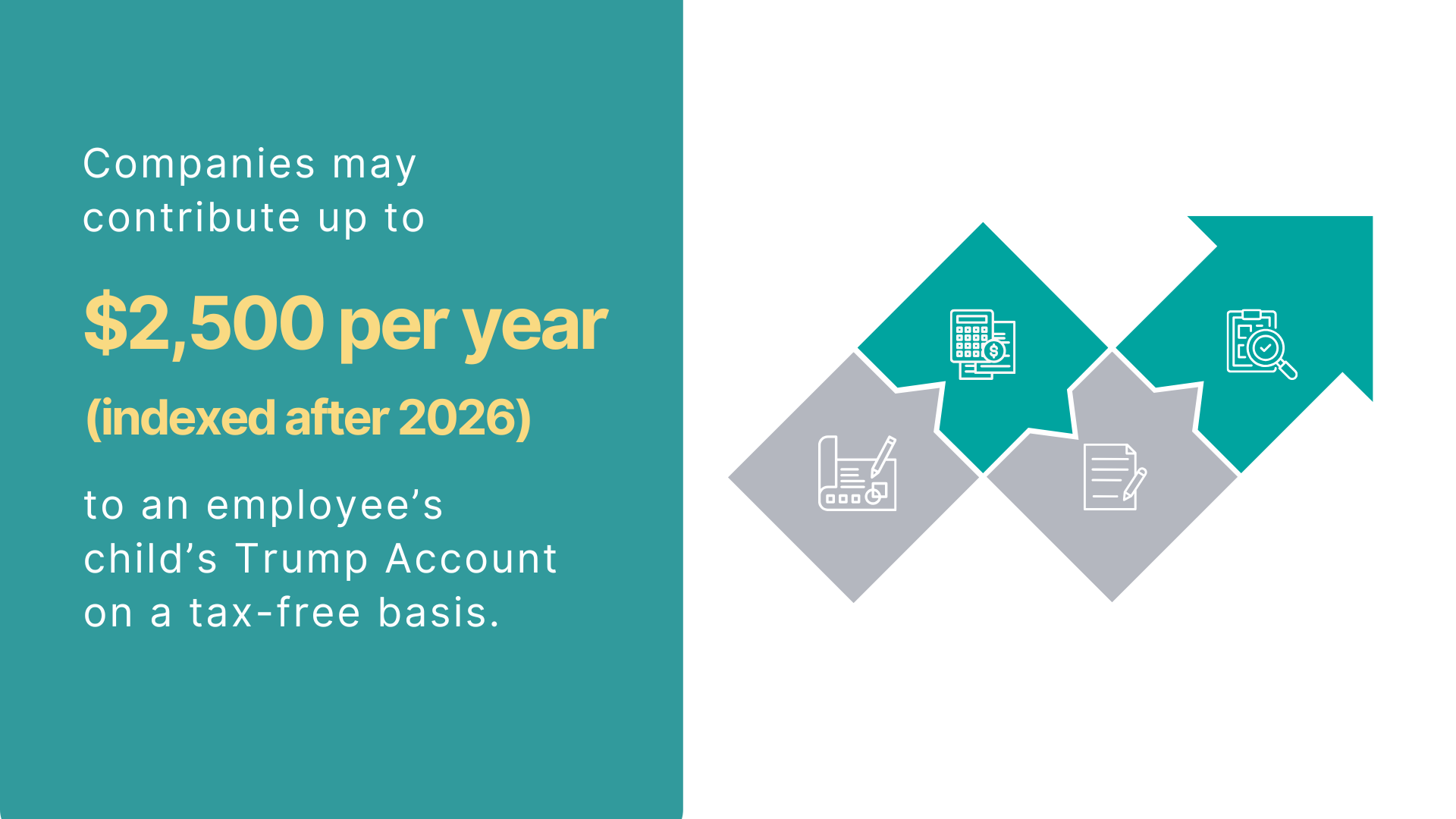

OBBBA also establishes new tax-advantaged savings accounts for minors, nicknamed “Trump Accounts,” beginning in 2026. These accounts function similarly to IRAs for kids under age 18, and investments grow tax-free.

Key features include:

The new program will require additional IRS guidance, but it opens the door for a unique employer-sponsored benefit for employees with young children.

The Act makes a few changes to tax-free commuter benefits provided by employers.

One change is the permanent elimination of the bicycle commuting reimbursement.

Employers used to be able to offer a tax-free $20 monthly reimbursement for bicycle commuting, but that benefit was suspended through 2025. The OBBBA now officially permanently eliminates the bike commuting tax break, stopping it from returning in 2026.

Other transportation fringe benefits, such as transit passes and parking, remain in place with their monthly pre-tax limits, and those limits will continue to be adjusted annually for inflation under a revised calculation formula.

In short, train, bus, and parking benefits are unaffected, aside from normal inflation increases, but the separate bike commuter benefit is no longer tax-free going forward.

The law also permanently extended the federal tax credit for employers who provide paid family and medical leave to workers. Previously, the credit was scheduled to expire in 2025.

Starting in 2026, employers can now continue to claim a tax credit for offering paid family and medical leave. They can choose to base the credit on either:

In addition, employers can now treat employees as “qualified” after just 6 months of service, down from the previous 12-month requirement, when calculating eligibility for the credit.

The ongoing availability of this credit may encourage more employers to introduce or grow their paid leave offerings.

To incentivize employer-supported childcare, the Act expanded the business tax credit for employer-provided childcare facilities and services.

Beginning in 2026, employers can receive a credit for 40–50% of qualified childcare expenditures, up to a maximum of $500,000 in expenses, or $600,000 for small businesses.

The previous cap was just $150,000, making this a substantial increase that could motivate more companies to invest in on-site childcare or subsidize employees’ costs.

Each of these changes in the One Big Beautiful Bill Act has implications for employer benefit offerings. Employers should review their benefit plans and policies in light of the new law and plan for 2026.

In short, many of these updates may require changes to plan documents, HR systems, and employee communications to remain compliant and maximize available tax benefits.

Senior Content Writer at Shortlister

Browse our curated list of vendors to find the best solution for your needs.

Subscribe to our newsletter for the latest trends, expert tips, and workplace insights!

July brought a quieter pace across many industries, but what it lacked in volume, it made up for in consolidation and strategic growth

Their recognition of Shortlister emphasizes the platform’s dedication to providing an efficient, data-driven approach to selecting HR and benefits vendors.

December’s HR tech, wellness, and benefits activity sits at the intersection of reflection and forecast, pointing to how the trends that defined 2025 are set to carry forward in 2026.

Employee monitoring is everywhere, from email logs to biometrics. However, leaders must carefully decide what is necessary for safety and productivity and what constitutes a privacy violation.

Used by most of the top employee benefits consultants in the US, Shortlister is where you can find, research and select HR and benefits vendors for your clients.

Shortlister helps you reach your ideal prospects. Claim your free account to control your message and receive employer, consultant and health plan leads.