Shortlister hosted Jason Herman, Head of Partnerships, and Troy Savigny, Partnerships Manager at SecureSave, to discuss how SecureSave helps people save for emergencies and ensures they are prepared for life’s unexpected events with their emergency savings solution.

ESAS: A BENEFIT EMPLOYEES WANT

Employer-sponsored emergency savings accounts (ESAs) have become the trending new benefit. America’s lack of savings and new legislation included in SECURE 2.0 has brought this topic to the forefront of the benefits community.

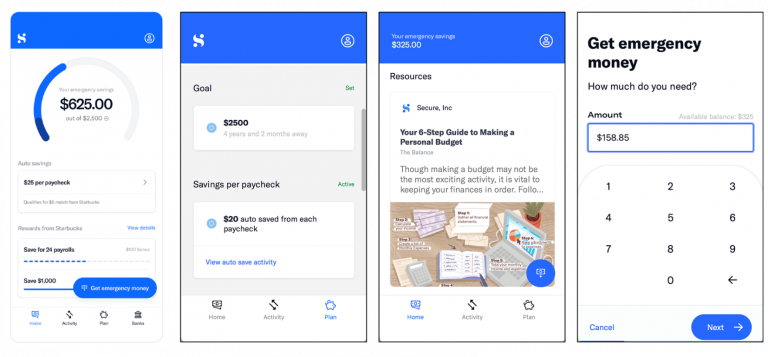

SecureSave provides an ESA solution purpose-built to drive positive savings habits – leading to an average adoption rate of 60%. Emergency savings is all SecureSave does, which means they are 100% focused on creating an easy-to-use savings program that ensures employees are prepared for unexpected expenses.

Why do employers like it?

An easy, low-cost benefit supporting all income levels.

- It can be implemented at any time during the year.

- No training, enrollment process, or paperwork is involved.

- Uses after-tax dollars with no ERISA requirements.

Improves employee satisfaction and well-being.

- Prevents employees from accessing 401k funds (or payday loans or credit cards) for emergencies.

- Gives lower income and ‘early in career’ employees a way to develop healthy saving habits.

- It can be used as an attraction and retention tool in a tight labor market.

Why do employees like it?

Employees get a free FDIC-insured emergency savings account that provides a fast and simple way to access emergency funds without withdrawal fees or penalties.

- Eliminate the “Path to Poverty” due to payday loans, credit card debt, second jobs, and 401K loans.

- No minimum balances, paperwork, or approvals.

- Money is not at risk in the market.

- Employer match results in a 10-20% ‘return’ on an employee’s savings.

HOW IS SECURESAVE DIFFERENT?

Purpose-built for emergency savings

- SecureSave’s solution is based on industry leading research and behavioral science

- The application is easy to use and supports employees in setting and achieving their goals

- Employees have quick access and full control over their funds

Innovative invitation-based program

- SecureSave manages the rollout process

- Users simply activate their accounts with 3 clicks in less than 2 minutes

- Autosave directly from the paycheck

- Ability to offer to a subset of employees

Incentives

- Employer match, sign-up bonus, and/or milestone awards

- A little match goes a long way: we recommend $25 to $250 per year per employee

- The current average employer match per year per employee is $125

SecureSave leads with the guiding tagline: Emergency savings is the foundation for financial wellness. For the vast majority of people, the goal of money is to make them feel safe and secure. This is the core of SecureSave as a benefit and financial solution they wish they had throughout their careers – and one they are excited to offer as leaders.

In case you missed it: Log in to access the full Meet A Vendor Presentation!

Not a subscriber? Request access.