Employee Benefits Report: Payroll

From behind-the-scenes support to the forefront of strategic HR innovation, payroll systems are evolving into indispensable tools for transforming the employee experience and driving organizational success.

Everyone enjoys getting paid, but the timing of those paychecks matters more than most realize for both businesses and employees.

With nearly half of Americans living paycheck to paycheck, payroll frequency is more than just an administrative detail – it can directly impact financial well-being and job satisfaction.

In this article, we address the question of what is bi-weekly payroll, what are its benefits and drawbacks, and why many businesses adopt it.

To begin with, what is bi-weekly payroll?

In a bi-weekly payroll system, employees receive a paycheck every two weeks.

Unlike semi-monthly payroll (which occurs twice per month on specific dates), bi-weekly pay happens every 14 days regardless of the calendar month.

Therefore, employees receive 26 paychecks per year with this schedule, compared to 24 with semi-monthly or 52 with weekly payroll.

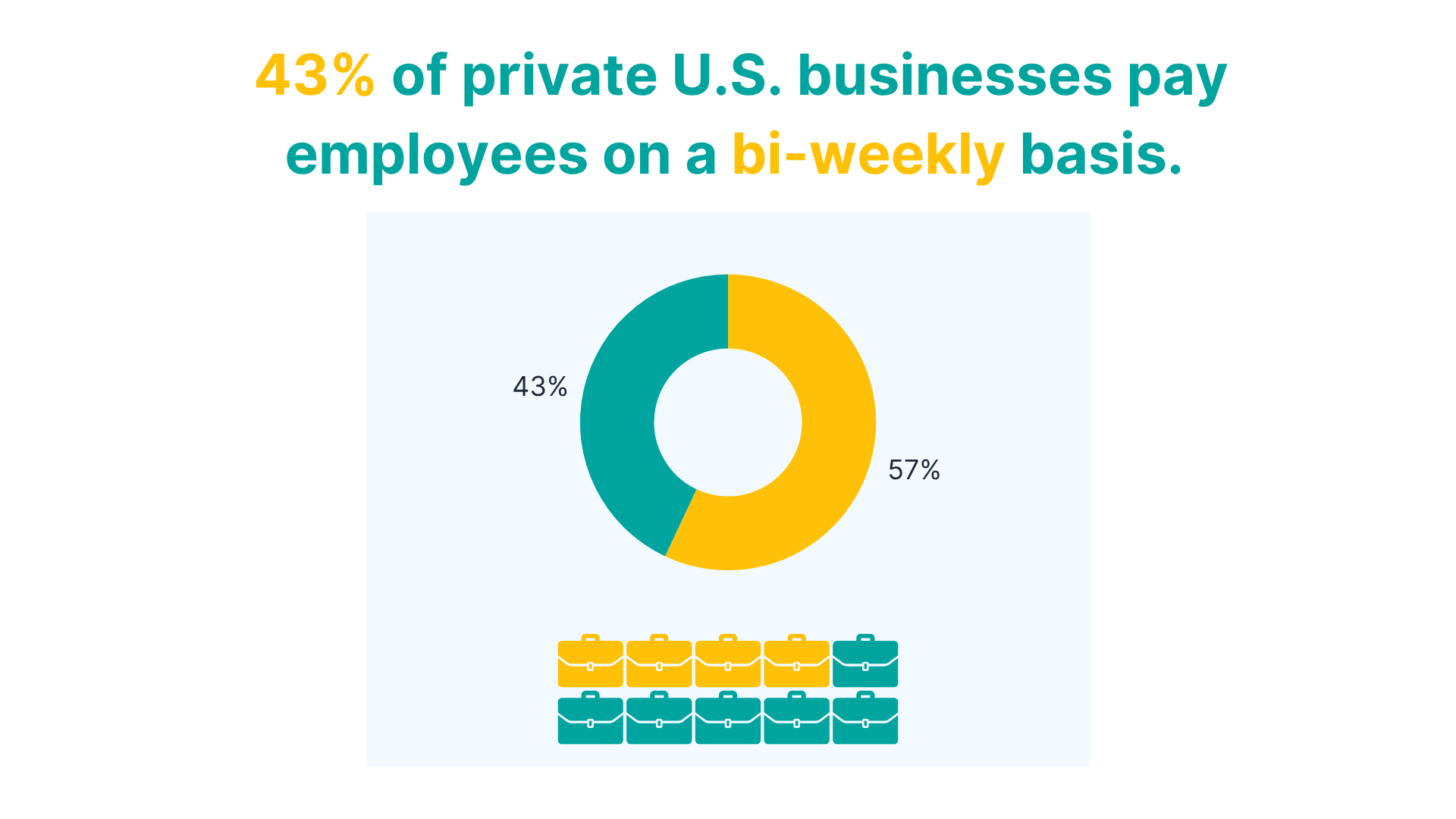

According to government data, bi-weekly payroll is the most popular pay frequency among U.S. employers. In fact, 43% of private U.S. businesses pay employees on a bi-weekly basis.

Under a bi-weekly pay schedule, paydays occur on a fixed day once every two weeks. If you choose Fridays as your payday, employees receive paychecks every other Friday throughout the year.

However, because bi-weekly periods don’t align perfectly with calendar months, employees may receive three paychecks in a single month twice a year.

So, how does bi-weekly payroll work?

Each pay cycle, the HR team or payroll software calculates earnings and deductions for 14 consecutive days.

For salaried employees, their gross pay is usually calculated as their annual salary divided by 26. For example, a $50,000 yearly salary becomes about $1,923 per paycheck.

Hourly workers are simply paid their hourly rate times hours worked in the two weeks.

For example, if an hourly employee works 75 hours over two weeks at $20/hour, their gross pay would be 75 x $20 = $1,500.

Choosing any pay schedule involves trade-offs. Here’s how a bi-weekly frequency compares against other standard options:

Popularity: As mentioned, bi-weekly is the most common frequency and familiar to employees

Employees appreciate the predictability and frequency of bi-weekly payroll.

A 2024 study found that nearly half (49%) of American workers regularly run short of money before payday. Therefore, having more frequent pay periods can alleviate some financial stress by shortening the gap between paychecks.

Twice a year, when a month includes three pay periods, employees enjoy what often feels like an “extra” paycheck.

Then, there’s also the predictability of setting it on a fixed day of the week. Many employees find it easier to budget when they know exactly which Friday will yield their next paycheck.

On the other hand, employers benefit from streamlined payroll processing compared to weekly systems. Bi-weekly schedules lower administrative costs and, at the same time, keep employees happy.

Calculating overtime is also more straightforward since bi-weekly schedules align perfectly with the standard 40-hour workweek.

For many organizations, bi-weekly payroll offers a good balance between operational efficiency and employee satisfaction.

Bi-weekly pay has a few downsides to keep in mind.

The biggest challenge involves those two “extra” pay periods each year.

For two months each year, payroll administrators must process three pay periods instead of two, which might complicate bookkeeping and require finance teams to plan ahead to cover the extra payroll.

Plus, if your payroll service is charged per run, more paydays could mean higher processing fees.

For these reasons, leadership teams should weigh these factors with finance and payroll providers before deciding.

Before adopting a bi-weekly payroll schedule, assess whether your business can maintain consistent cash flow to support more frequent payments.

Moving from monthly to bi-weekly increases the number of payroll runs, which can put additional pressure on cash reserves. Confirm that your financial operations can cover these obligations without disrupting other business expenses.

Before changing pay frequency, confirm that bi-weekly pay is compliant for all categories of your employees. Most states allow bi-weekly work for all employees, but a few have exceptions.

For example, certain manual laborers in New York must be paid weekly by law.

Once the decision is made, give employees at least 90 days’ notice to prepare for the change. Schedule mandatory training sessions for managers since they are the main point of contact for employee questions and concerns.

As part of the transition, review and adjust all payroll deductions and benefit contributions. Employees contributing flat dollar amounts to 401(k) plans, HSA deductions, or other programs may need to modify their elections to reflect the higher number of pay periods.

Finally, develop a detailed payroll policy and calendar outlining pay dates, processing cutoffs, and accrual schedules for PTO, garnishments, and child support payments.

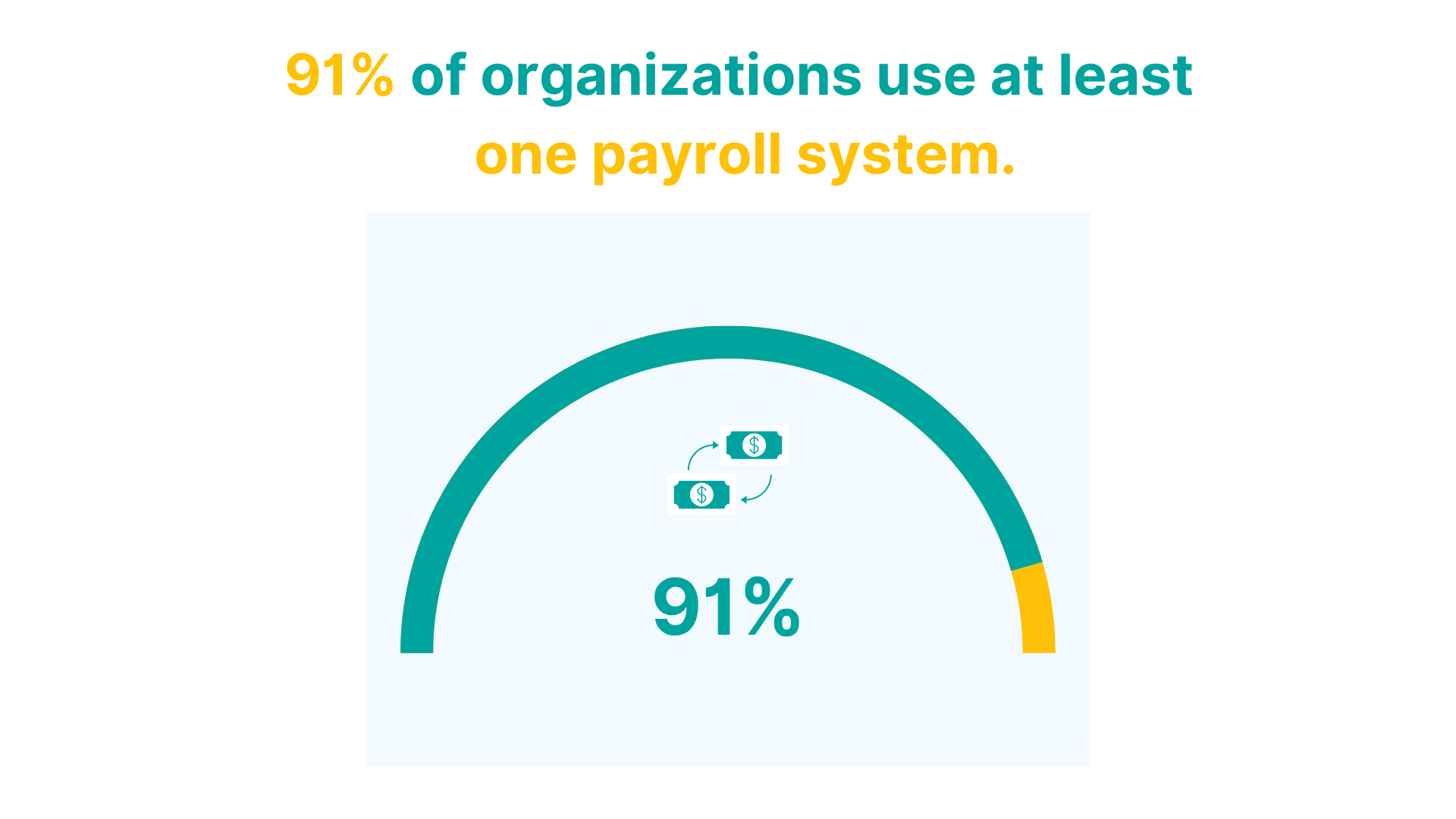

In today’s market, most companies rely on specialized payroll software or services to manage bi-weekly pay. As mentioned in our recent payroll industry report, 91% of organizations use at least one payroll system.

That’s simply because modern technology makes running bi-weekly payroll much easier.

Key tools and solutions include:

Outsourcing Payroll Services – You can hire a payroll service or PEO to run payroll for you. Outsourcing providers have systems that easily accommodate any pay frequency.

Understanding what bi-weekly payroll is the key here: it doesn’t change an employee’s or employer’s total tax liability; it only affects how taxes are withheld throughout the year.

Taxes and withholdings are calculated based on each paycheck, but the total annual amount remains the same.

Whether employees are paid weekly, bi-weekly, or semi-monthly, they end up paying the same total income and payroll taxes over the year.

The same principle applies to employer payroll taxes (Social Security, Medicare): the sum due over the year is fixed by law, and bi-weekly withholding just splits that sum into 26 parts instead of 24 or 52.

However, businesses should be aware of special rules or exceptions.

In the past, there have been temporary measures like payroll tax deferrals, sometimes called “payroll tax holidays.” For example, during the COVID-19 relief plan of 2020, a deferral allowed employers to withhold 0% of the employee’s Social Security tax from September to December 2020.

It should also be noted that bi-weekly schedules must still comply with the Fair Labor Standards Act (FLSA). Overtime is calculated on a weekly basis regardless of the pay frequency.

In practice, this means tracking hours each week and paying overtime accordingly, even though the check covers two weeks.

Processing payroll – especially when it’s done frequently, like bi-weekly – can be time-consuming and complex. It’s no wonder that payroll is the most frequently outsourced HR function.

Consider payroll outsourcing when:

Another popular option is partial outsourcing or taking a hybrid approach.

For example, using in-house software for the bulk of payroll but outsourcing certain tasks like year-end tax filing or multi-state tax calculations.

Ultimately, in deciding whether to outsource, evaluate factors like your budget, internal expertise, and the reliability of available providers.

Changing to a bi-weekly payroll requires more planning than just changing pay dates.

Here are some best practices to make your transition run smoothly:

5. Conduct regular audits

Schedule routine audits to check payroll accuracy, confirm deductions, and ensure ongoing compliance with payroll regulations.

A business’s decision to adopt a bi-weekly payroll schedule requires more than simply understanding what bi-weekly payroll is. The following are some common FAQs and scenarios that typically arise when implementing bi-weekly pay.

Employees receive 26 paychecks per year with a bi-weekly payroll frequency. Most months contain two paychecks, but two months annually will have three pay periods due to the 14-day cycle.

Divide the annual salary by 26 pay periods. For example, a $65,000 salary equals $2,500 per bi-weekly paycheck before taxes and deductions.

Bi-weekly payroll strikes a good balance for small businesses by giving employees more frequent pay than monthly schedules and without the extra administrative work that comes with weekly payroll. Still, the right choice depends on your cash flow, industry standards, and what works best for your employees.

Bi-weekly pay doesn’t change how much tax or deductions an employee owes for the year. Taxes like Social Security and Medicare are calculated on each paycheck and add up over time. The main difference is how much gets withheld each time: bi-weekly paychecks have smaller deductions but more pay periods.

Yes, but it requires careful planning for tax implications, benefit adjustments, and employee communication. For simplicity, many companies prefer making frequency changes at the beginning of a new fiscal or calendar year.

There is no federal law that mandates specific payroll frequencies for most employees, but state laws vary significantly. Some states require weekly or bi-weekly pay for certain industries or employee types. It’s best to check your state’s labor requirements before implementing changes.

As the name suggests, automated payroll systems handle bi-weekly calculations, tax withholdings, and direct deposits automatically. Most modern platforms today also adjust for holidays, leap years, and the varying number of pay periods per month without manual intervention.

When payday falls on a holiday, most companies process payroll the business day before. Some payroll providers offer early processing to ensure employees receive direct deposits on schedule despite banking holidays.

Bi-weekly payroll affects how employee benefits are calculated and deducted. For flat-dollar benefits like health insurance, the amount is usually spread across 24 of the 26 paychecks, meaning two pay periods each year don’t have that deduction. Percentage-based deductions, like 401(k) contributions, are taken from every paycheck.

Senior Content Writer at Shortlister

Browse our curated list of vendors to find the best solution for your needs.

Subscribe to our newsletter for the latest trends, expert tips, and workplace insights!

From behind-the-scenes support to the forefront of strategic HR innovation, payroll systems are evolving into indispensable tools for transforming the employee experience and driving organizational success.

Learn how pre-tax deductions can be a great work perk to get many company benefits and insurance while saving money.

Learn more about the free payroll tools small business owners can use to save hours and grow their business.

While Paycom has set a high standard in payroll services, our guide to its top competitors and alternatives reveals other innovative solutions that can transform your HR and payroll operations.

Used by most of the top employee benefits consultants in the US, Shortlister is where you can find, research and select HR and benefits vendors for your clients.

Shortlister helps you reach your ideal prospects. Claim your free account to control your message and receive employer, consultant and health plan leads.