HRIS: Benefits & Challenges

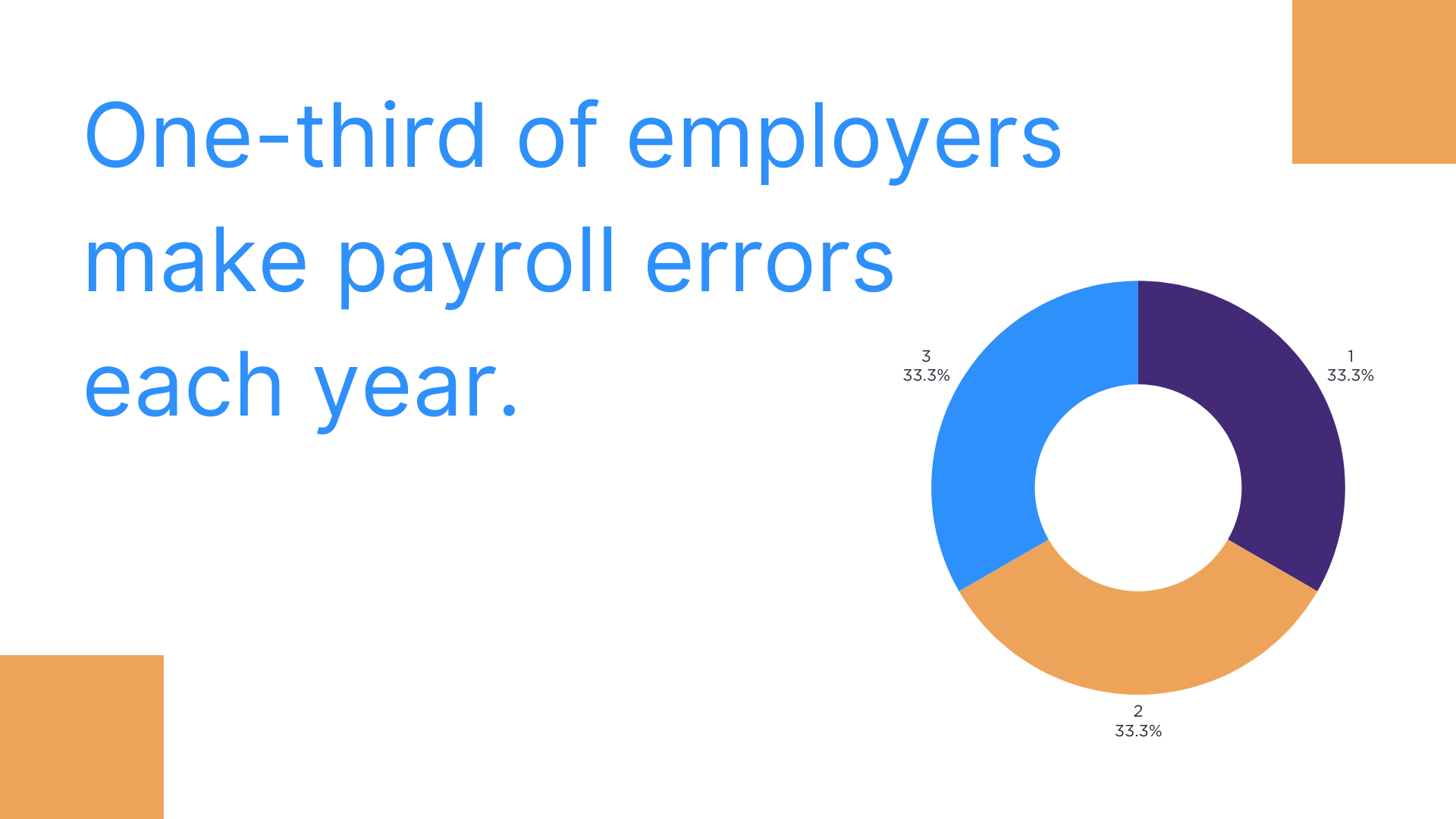

From streamlining administrative and bureaucratic tasks to boosting motivation and productivity – the benefits of HRIS within an organization are extensive, making the investment worth it for both HR departments and companies.