What is Pharmacy Benefit Management (PBM)?

If two different people with the same prescription medicine get two different bills for the same medicine, it makes you wonder – how is the price of the prescription medicine determined?

Receiving a cancer diagnosis is a moment that can turn a person’s world upside down, evoking fear and devastation. Uncertainty looms as patients grapple with questions about the efficacy of treatments and the extent of the challenges that lie ahead.

The side effects of cancer treatment are infamous for their harshness, with a dauntingly long list that includes nausea, hair loss, potential fertility loss, and relentless fatigue.

However, another heavy burden is often underestimated and equally threatening – the financial toll exacted by this battle, known as “financial toxicity.”

Imagine if, on top of enduring the terrible side effects, there is a big possibility that this diagnosis could also bankrupt you.

Unfortunately, this is a reality for many, as financial toxicity paints a picture of mounting out-of-pocket costs, job loss, and escalating insurance deductibles or copayments in healthcare.

This article explores the financial toxicity that accompanies a breast cancer diagnosis and examines how employers can ensure that all workers have access to the care they need without facing financial ruin.

Financial toxicity is a growing problem that lacks widespread recognition and discussion.

One contributing factor to this lack of awareness is the relatively recent introduction of the term “financial toxicity” into the medical vocabulary, which only occurred in 2011.

So, what is financial toxicity?

Simply put, financial toxicity is a term used to describe the harmful financial consequences of a medical treatment. Think of it as the unintended, yet very real, financial strain that cancer patients experience while undergoing treatment.

Clearly, financial toxicity caused by this disease can significantly impact behavioral and mental health, leading to stress, anxiety, depression, and bankruptcy. It can also force patients to make difficult choices, such as skipping appointments, delaying treatment, or taking on unmanageable debt.

Surprisingly, many patients (49%) underestimate the cost of cancer, and the frightening consequences of financial toxicity, such as its link to lower survival rates, often go unrecognized.

Awareness of this burden is becoming increasingly important as cancer care costs continue to rise, and many patients struggle to afford the treatment they need. One initiative aiming to raise awareness of financial toxicity and breast cancer is the Emotional Well-being and Economic Burden Research Network (EMOT-ECON), which is a collaborative effort to advance research and generate new knowledge about this pressing topic.

When discussing financial toxicity, it’s essential to understand that it represents a complex and multi-layered challenge for cancer patients. That’s because it involves both the objective or actual burden on their finances and the subjective or psychological distress they feel due to the costs associated with their treatment.

The objective financial burden includes the direct and indirect costs of care not reimbursed by health insurance:

On the other hand, subjective financial distress refers to the emotional and psychological impact of financial toxicity. This can include anxiety and stress about the ability to afford care and the impact on one’s savings and future financial goals.

While it’s true that financial wellness is a concern for all cancer patients, those battling breast cancer are even more vulnerable.

Breast cancer is the second most prevalent cancer among women in the United States, constituting approximately 30% (or one in three) of all new female cancer cases annually.

With an average lifetime risk of around 13%, meaning a one in eight chance of development in a woman’s lifetime, the statistics underline this disease’s considerable impact on society.

Given this high prevalence, a question arises: to what extent do breast cancer patients struggle with financial toxicity while battling this illness?

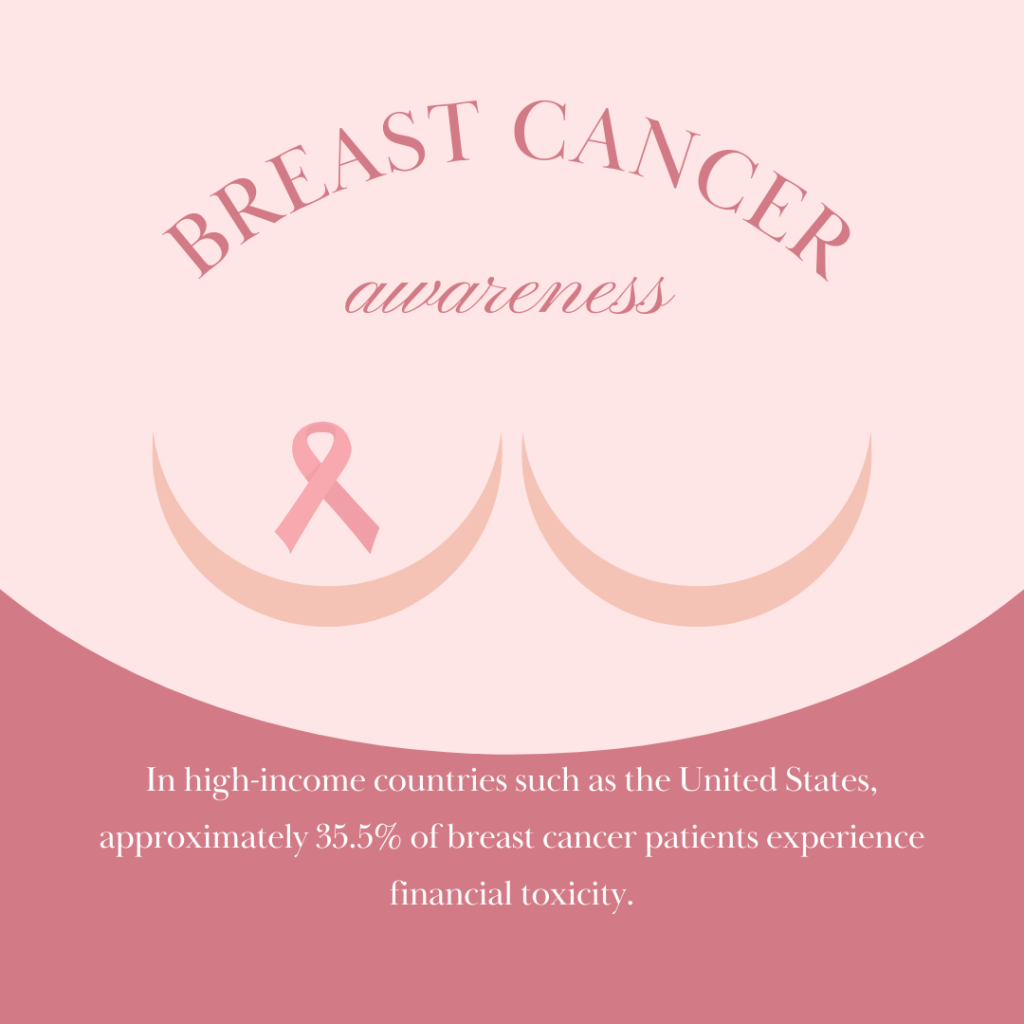

In high-income countries such as the United States, approximately 35.5% of breast cancer patients experience financial toxicity, highlighting the economic burden of this disease.

However, this burden amplifies dramatically in low to middle-income countries, with a staggering 78.8% of breast cancer patients facing financial toxicity.

To put this into perspective, the financial toxicity rates in these countries exceed those for various health conditions combined, which typically range from 6% to 12%.

Furthermore, a 2020 study of women with breast cancer revealed that most women had to dip into their finances to cover out-of-pocket expenses. Additionally, one in four had to borrow from family or friends, leave some medical bills unpaid, accumulate credit card debt, or defer other bill payments.

This raises another crucial question: what factors contribute to this financial toxicity among breast cancer patients?

Women diagnosed with breast cancer face a disproportionately high risk of encountering financial toxicity because of a mix of factors that amplify the economic burden.

Some of these factors include the exorbitant cost of breast cancer treatment, the long duration of treatment regimens, and the alarming prevalence of job loss among breast cancer survivors.

Shockingly, breast cancer has the highest treatment cost among all cancer types, accounting for 14% of all cancer treatment costs.

An in-depth assessment of direct medical costs to treat breast cancer in the United States has revealed that these expenses can escalate to a staggering $100,000 per patient over their lifetime.

What’s more, recent studies have shown that for younger and midlife women grappling with metastatic breast cancer, the cumulative financial burden can soar to over $200,000.

Even more concerning is that cases have been reported where the total cost of breast cancer care surged to an astounding $334,000, as seen in a Forbes report from 2022.

Contributing to these costs is the fact that women may have to exhaust funds for fertility preservation and egg freezing, as the side effects of chemotherapy and radiation may cause temporary or permanent infertility and menopause.

Moreover, breast reconstruction may require multiple surgeries, and some therapies for metastatic disease can cost over $18,000 per month.

It’s also worth noting that breast cancer treatment typically encompasses a year of intensive therapy and sometimes extends to five to ten years involving maintenance therapy. For those dealing with stage IV metastatic breast cancer, treatment is continuous and ongoing.

The long, natural trajectory of breast cancer treatment exposes patients to the risk of experiencing financial toxicity throughout their journey with the disease.

Breast cancer can have a significant financial impact on women, especially those who are younger, have lower incomes, or are from minority groups.

According to an overwhelming majority of studies, risk factors for financial toxicity in cancer patients include:

The staggering financial burdens have led to an alarming trend where women facing a breast cancer diagnosis are increasingly forced to make agonizing choices that can impact their health and wellness.

The long list of expenses involving diagnostic tests, surgical procedures, genetic testing, radiation therapy, systemic treatments, and even participation in clinical trials can weigh heavily on their decision-making process.

Many opt to delay crucial steps in their healthcare journey, such as screening mammography and treatment initiation, because of the financial distress accompanying their diagnosis.

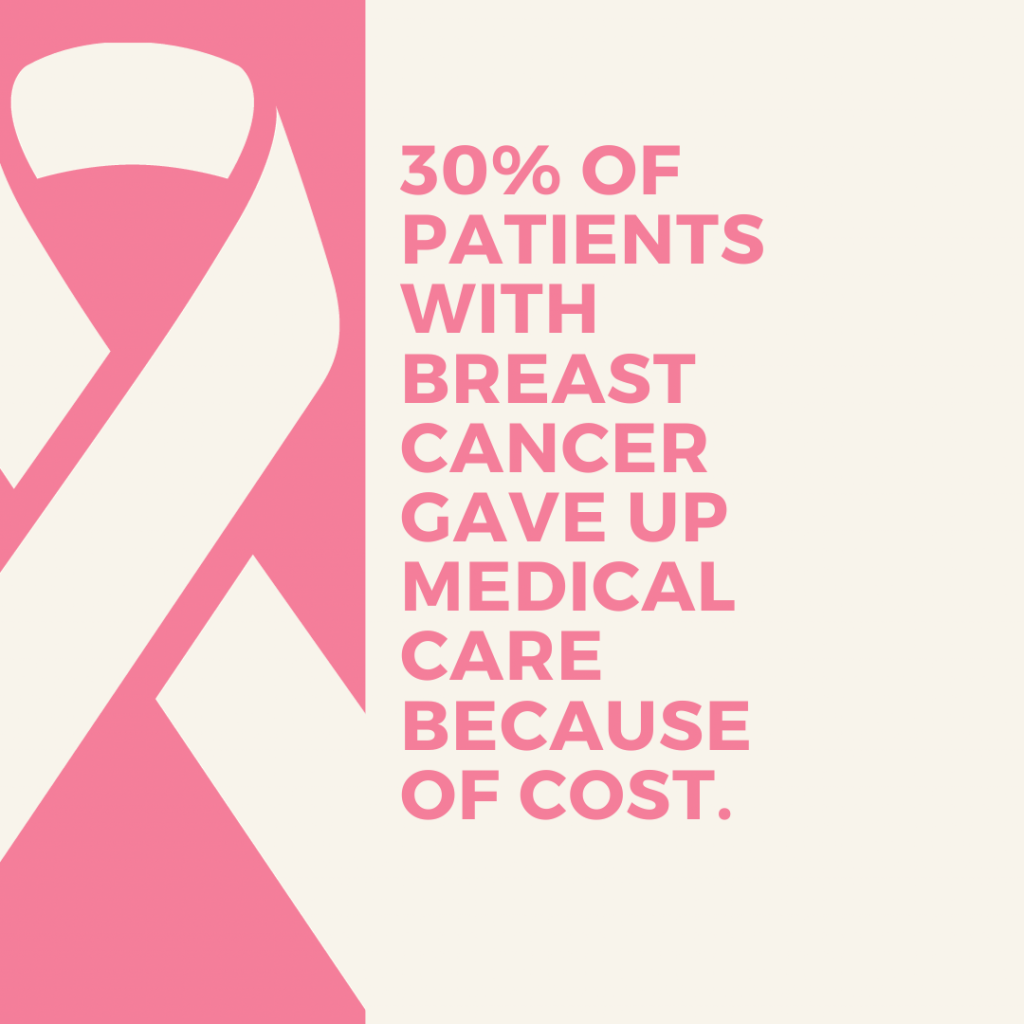

A recent study found that over 30% of patients with breast cancer gave up medical care because of cost, including missing appointments (14.7%), delaying or forgoing treatment (11.9%), and taking less medication than prescribed (6.2%).

However, the consequences of these decisions can be devastating.

When women are forced to delay or forgo crucial steps in their breast cancer care due to financial distress, they are more likely to experience worse outcomes, including a higher mortality risk.

Cancer often impedes a patient’s ability to work, support themselves and their families, maintain healthcare insurance, and afford treatment.

Breast cancer, in particular, significantly impacts work capabilities and career decisions. Several studies have shown that women with breast cancer are more likely to leave the workforce and may experience difficulty returning to work after treatment.

For example, a recent survey found that:

Employers can play a pivotal role in helping breast cancer patients return to work successfully. Women with accommodating employers are more than twice as likely to retain their jobs than those without.

However, low-income women are less likely to have accommodating employers, making it more challenging to retain their employment status. Improving consistency in providing accommodations, regardless of job pay scales, could help narrow the employment disparities faced by women diagnosed with breast cancer.

In addition, breast cancer survivors who felt discriminated against by their employers were less likely to return to work. This suggests that employers must be aware of the potential for discrimination and take steps to prevent it.

There are a number of things that can be done to help women with breast cancer maintain their careers and create a more supportive workplace. These include:

Employers can be crucial in providing support, resources, and assistance to their employees facing chronic illnesses like breast cancer.

On top of providing flexible work arrangements and raising awareness about cancer, here are some critical programs and benefits to consider:

Many employers offer EAPs, which are confidential support services that can provide counseling, financial advice, and resources to employees dealing with personal challenges, including medical conditions like breast cancer. Encouraging employees to utilize EAPs can alleviate some of the emotional and financial stress they may experience.

Employers can implement chronic condition programs tailored to the specific needs of employees with breast cancer. These programs may offer educational resources, support groups, and access to healthcare navigators who can help individuals understand their insurance coverage and available benefits.

Employers can partner with healthcare providers to offer health management services that focus on managing the financial aspects of breast cancer treatment. These services can help patients understand medical bills, insurance claims, and available financial assistance programs.

For breast cancer patients dealing with chronic pain, employers can provide information on pain management resources and strategies. This can include access to pain management specialists, physical therapy, and alternative therapies like acupuncture or mindfulness meditation.

Employers can offer financial counseling services to employees facing substantial medical expenses. These financial counselors can work with individuals to create budgets, navigate cost-saving options, and provide guidance on managing debt related to their treatment.

Financial toxicity is a complex issue deeply intertwined with the American healthcare system and individual circumstances, making it challenging to completely eliminate.

However, there are practical steps that can be taken to mitigate its impact and potentially prevent it in some cases:

Despite the grim outlook, relief is on the horizon with the Inflation Reduction Act of 2022—a comprehensive federal legislative initiative to tackle inflation, decrease prescription drug costs, and advance clean energy production in the United States.

The implementation of new prescription drug regulations is planned over a seven-year period, beginning in 2024. The precise effect on the financial burden for individuals battling cancer remains uncertain.

In the end, addressing the issue of financial toxicity in breast cancer is not just a matter of healthcare, but also a matter of compassion and social responsibility, as we strive to ensure that the weight of financial ruin compounds no one’s battle against breast cancer.

Disclosure: The information provided in this post is for general informational purposes only and should not be considered as legal or medical advice. For advice on specific issues, please consult with a qualified professional.

Senior Content Writer at Shortlister

Browse our curated list of vendors to find the best solution for your needs.

Subscribe to our newsletter for the latest trends, expert tips, and workplace insights!

If two different people with the same prescription medicine get two different bills for the same medicine, it makes you wonder – how is the price of the prescription medicine determined?

What compels someone to travel halfway around the world for a hip replacement or cancer therapy?

Gain insight into the current state of adoptions in the United States with 50+ crucial statistics and trends, providing valuable information on the evolving adoption landscape.

Are you doing enough to support employees with chronic conditions, or are rising healthcare costs and absenteeism quietly impacting your bottom line?

Used by most of the top employee benefits consultants in the US, Shortlister is where you can find, research and select HR and benefits vendors for your clients.

Shortlister helps you reach your ideal prospects. Claim your free account to control your message and receive employer, consultant and health plan leads.