Infographic: Buy Now Pay Later Statistics

Discover the growing trend of consumers utilizing BNPL services to pay for purchases.

State disability insurance (SDI) tax is something that all employees in states with disability insurance programs must pay. The money from the SDI tax is transferred directly to the fund from which the state’s disability insurance is funded.

If an employee cannot work due to a physical or mental disability, the SDI tax fund will assist them. Moreover, the tax also contributes to paid family leave benefits. These benefits kick in when an employee leaves work to care of a sick family member or bond with their new child.

An SDI tax also covers the recently unemployed. If a person loses their job, this fund can assist in covering the cost of unemployment. However, the person needs to be actively looking for work to qualify for SDI payments.

Also, if a person is sick from COVID-19, they may be eligible for SDI benefits. Or, if they are caring for someone ill due to COVID-19, they may be eligible for paid family leave.

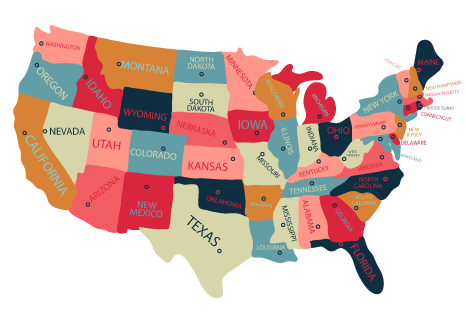

Many states levy an SDI tax, but not all of them refer to it as such. Some states refer to the tax as temporary disability insurance (TDI). California is the only state with a tax specifically called SDI.

There are six states currently that have an SDI or TDI tax:

The rate that an employee can see deducted on their pay stub is determined by their state and the region’s current tax rates. Typically, the tax rate ranges from 0.25% to 1.5%.

An employee’s wages can only be taxed up to a certain amount. After an employee has earned the maximum rate in a year, the rest of their earned wages are exempt from taxation.

For example, employees who pay between $1,000 and $2,000 do not have to pay any more SDI tax for the year.

Here are the current tax rates for SDI in the states and regions employees are obligated to pay them:

The employee contribution rate for temporary disability in New Jersey is 0.47% of the taxable wage base, which is $138,200.

This equates to a maximum annual contribution of $649.54. See: New Jersey Tax Rate Information, Contributions and Due Date.

New York employers have two choices when it comes to state disability insurance (SDI) coverage. They can either fully cover the cost or opt to withhold a percentage of their employees’ wages. The permissible amount to be withheld is 0.5% of the paycheck, no more than $0.60 per week.

The current interest rate is 0.60%. The employer and the employee bear an equal share of the tax burden.

The disability insurance tax is levied on the first $9,000 in salaries paid to an employee by an employer during the calendar year.

Any additional compensation paid to the employee by the same employer after that year is exempt from tax.

As of January 1, 2021, the current withholding rate is 1.3% of the first $74,000 earned.

Employee’s age 14 and 15 are exempt from TDI tax.

Moreover, employees may be eligible for a TDI tax refund if they worked for more than one Rhode Island employer in a calendar year and their total wages are more than $71,000.

SDI taxes are paid on income up to certain amounts, dependent on state.

In most cases, employers don’t pay SDI tax, but employees do.

In the business world, not everyone is easily classified as an employer or an employee. Self-employed people are technically both employers and employees. Therefore, they are not required to pay the tax. However, if they want disability coverage, they can enroll in various state insurance programs.

In addition, even if a person hires employees on behalf of another, they are still considered an employee for tax purposes.

Here are the employees that can’t benefit from SDI tax:

There are three SDI tax plans:

This plan includes paid family leave.

Some companies provide voluntary plans, which include coverage almost as good as the state plan and at least one feature that the state plan does not.

However, the private plan can’t be more costly than the state plan, and it must be approved by a majority of the employees.

Although some of the rules are not the same if a person is self-employed or owns a business, they can purchase elective coverage.

For example, elective coverage is only available for 39 weeks, and premiums are calculated as a percentage of their previous year’s profit.

SDI and TDI taxes vary by state, and rates can change every year. Each state has its own rates and policies in place, so always consult state government resources for the most up-to-date information.

Browse our curated list of vendors to find the best solution for your needs.

Subscribe to our newsletter for the latest trends, expert tips, and workplace insights!

Discover the growing trend of consumers utilizing BNPL services to pay for purchases.

Could stock options be the decision that transforms your career into a life-changing investment opportunity?

Discover how integrating life insurance into your financial planning can provide you and your loved ones protection and long-term security.

With the growing popularity of legal insurance plans, particularly as employee benefits, legal protection through group legal plans is rapidly becoming the norm due to its numerous advantages.

Used by most of the top employee benefits consultants in the US, Shortlister is where you can find, research and select HR and benefits vendors for your clients.

Shortlister helps you reach your ideal prospects. Claim your free account to control your message and receive employer, consultant and health plan leads.