What does the Recruitment Process Entail?

Uncover the key elements of the recruitment process and transform it into a streamlined journey toward finding the right talent for your organization.

Growing concerns over financial security are reshaping employee expectations around pay, prompting companies to reconsider their compensation structures.

SHRM’s 2025 State of the Workplace report shows that 42% of U.S. workers rank total rewards as their top priority, and nearly half worry their pay is losing value amid ongoing inflation.

Traditional fixed salaries alone may no longer be enough to meet these expectations.

Variable pay, which ties rewards directly to performance or business results, offers a solution.

It allows employers to recognize effort and impact without overextending tight budgets while providing employees with the opportunity to increase their earning potential.

But what is variable pay in practice? More importantly, what should employers consider before introducing it, and how can they determine if it aligns with their culture and goals?

Answering these questions provides the foundation for building a pay structure that motivates performance and ensures long-term sustainability.

Compensation comes in many forms, each reflecting the value companies place on different contributions. So, what is variable pay, and how does it fit into this landscape?

By definition, variable pay is a contingent payment in which earnings fluctuate rather than remain fixed, based on performance metrics or other specific criteria. Workers receive this compensation in addition to their base salaries, creating a total rewards package that balances stability with performance-driven earnings potential.

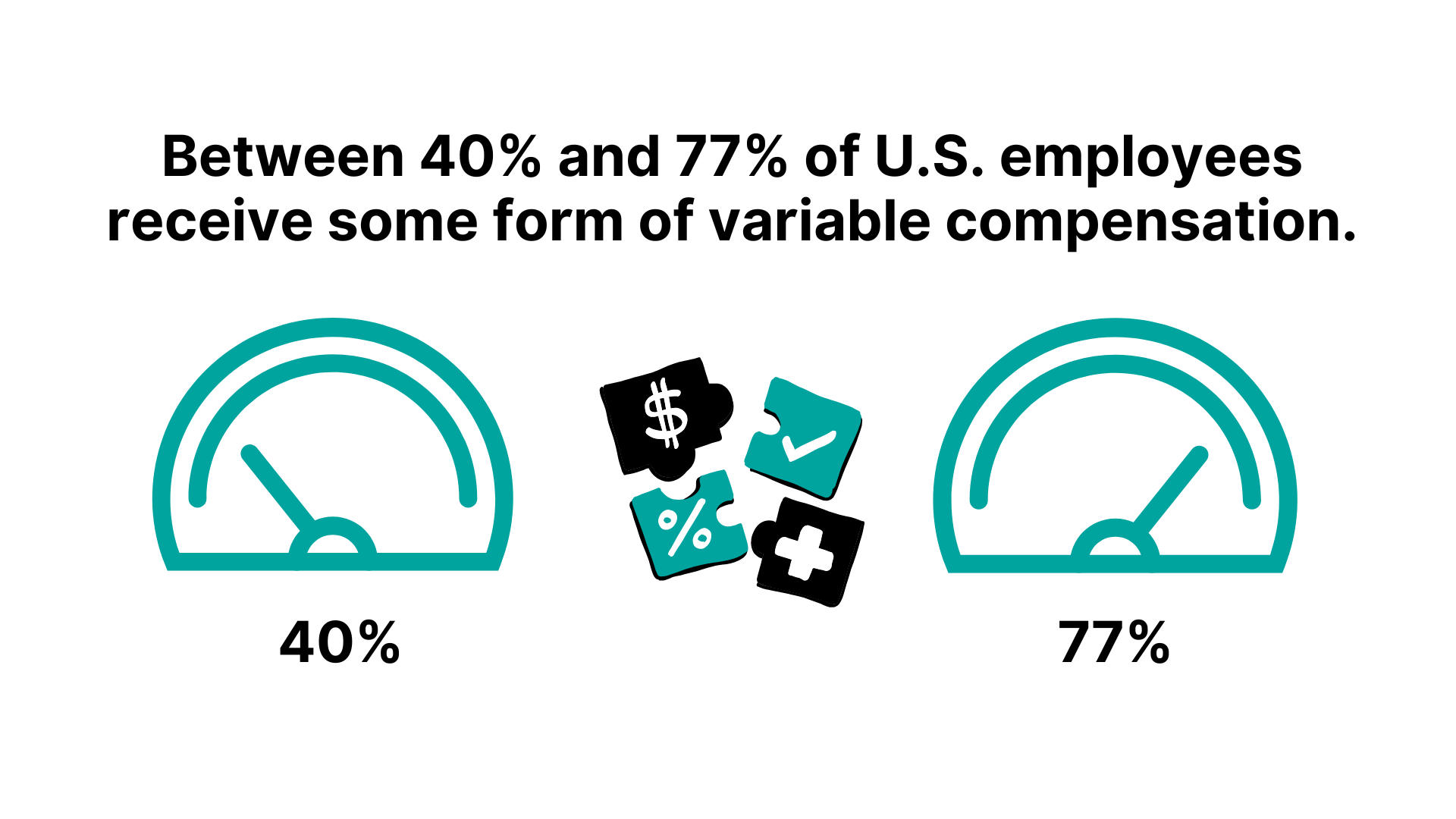

According to Variable Pay and Risk Sharing Between Firms and Workers, approximately 40% of salaried, full-time U.S. employees receive some form of variable compensation, while other sources estimate the figure to be closer to 77%.

The findings also suggest that the salary variable accounts for approximately 15% of total earnings for employees who receive it, indicating a clear economic benefit. Due to this impact, many employers now use it not only to reward top performers but also to enhance retention and align pay with organizational objectives.

Variable pay functions as a performance-driven component of total compensation. Rather than being guaranteed, it’s tied to outcomes the company defines as valuable, such as individual and team performance or business results (e.g., profitability or revenue growth).

Its application usually depends on transparent metrics, timelines, and payout formulas. Employers typically link these objectives to measurable KPIs and use compensation management systems or specialized payroll software to track results and calculate variable payout accurately.

The compensation timing, amount, and type differ across companies and can take many forms, including commissions, bonuses, profit-sharing, or other project-based incentives. What’s mutual for all is that they rely on a clear connection between performance (individual, team, or company) and payout. Without it, employees may perceive incentives as arbitrary and lose motivation.

Fixed pay represents an employee’s guaranteed base salary regardless of performance outcomes. This component remains constant throughout employment, providing financial predictability and security. Employees receive it in regular installments, typically on a bi-weekly or monthly basis, forming the foundation of their total compensation package.

Variable payment, in contrast, fluctuates based on performance and is designed to reward results. Usually, it supplements a fixed salary, creating higher earning potential for ambitious, goal-oriented workers.

These two differ on multiple levels, from the payment methods to their compensation philosophy.

| Fixed Pay | Variable Pay | |

|---|---|---|

| Payment Method and Predictability | Regular and predictable income that offers financial stability | Fluctuates with performance, creating earning potential but less certainty |

| Compensation Philosophy | Focused on stability, fairness, and role-based pay | Driven by performance and outcomes, linking rewards to results |

| Employee Motivation | Encourages loyalty and consistency but may not drive peak performance | Boosts motivation and engagement through performance-based rewards |

| Talent Attraction and Retention | Appeals to employees who value stability and security | Attracts goal-oriented talent seeking higher earning potential |

| Budget Impact | Fixed costs, which are easier to forecast | Variable and scales with business performance |

| Cultural Impact | Fosters equality and predictability across the workforce | Promotes a performance-oriented culture focused on results |

Many modern compensation structures combine both elements, and their ratio typically depends on role type or industry.

Fixed pay ensures financial stability and equity, while variable pay introduces motivation and accountability. Together, they create a system that rewards effort, sustains engagement, and keeps costs aligned with performance.

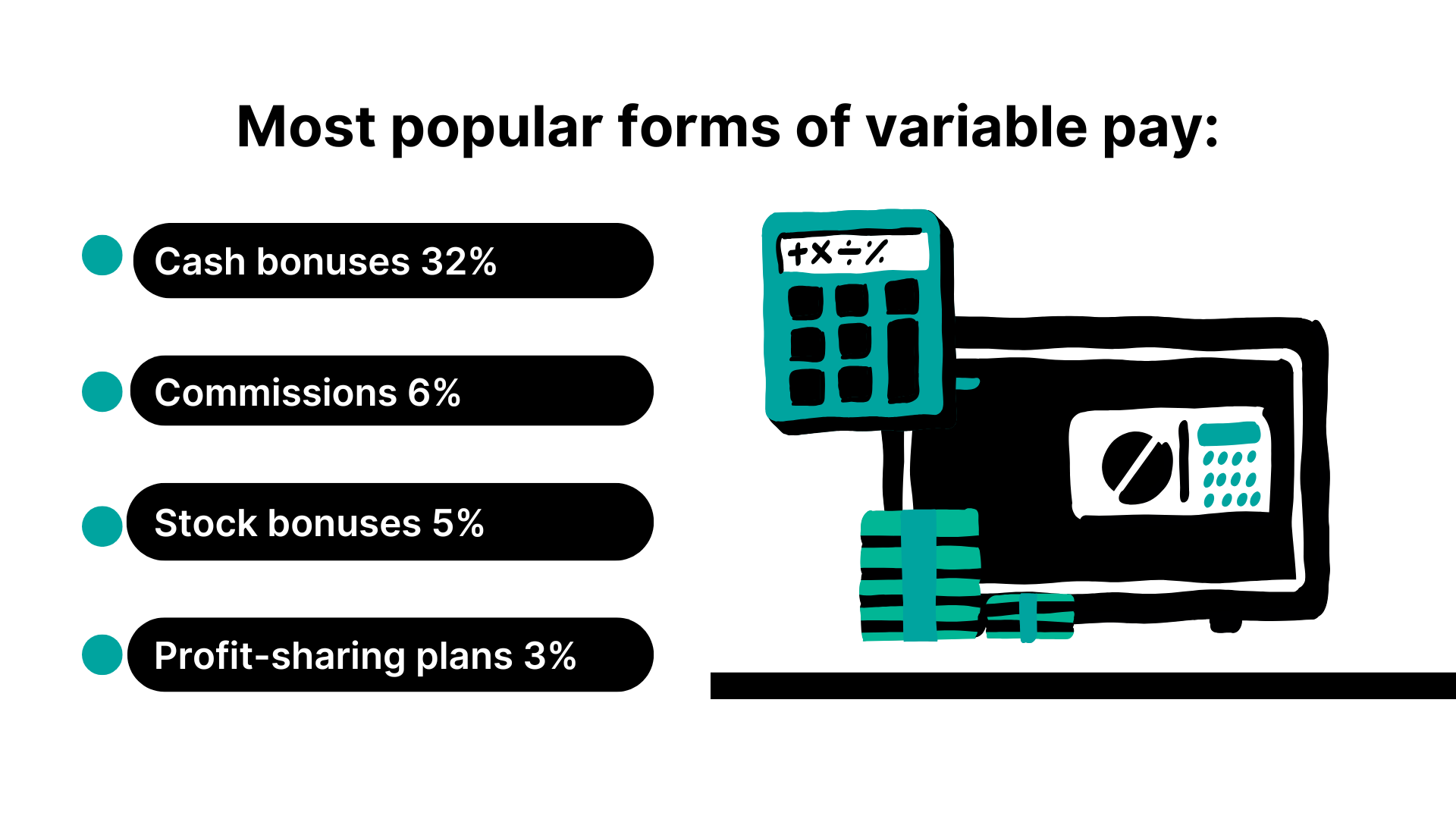

Understanding what variable pay is also requires examining the different types of compensation and what each represents. While there are many ways to structure performance-based rewards, the most common forms include:

The research on variable compensation we referenced earlier shows that cash bonuses are the most common, received by nearly one-third of employees (32%), followed by commissions (6%), stock bonuses (5%), and profit-sharing plans (3%).

While the types listed above illustrate how variable pay works in practice, it is also helpful to categorize rewards by their scope — either individual, team, or organizational. Understanding this distinction helps clarify how each form influences behavior and aligns with broader business objectives.

On an individual level, a variable compensation plan commonly includes bonuses (e.g., performance-based bonuses) and sales commissions. It usually targets employees whose decisions and output directly impact measurable outcomes.

Another, more structured example is an employee incentive program that combines these elements into a well-defined plan with clear metrics, providing transparency on how performance translates into bonuses and rewards.

When rewards are tied to team outcomes, employees naturally collaborate and share responsibilities more effectively. For example, group performance bonuses, a project completion incentive, or a department goal achievement reward can shift focus from individual tasks to shared goals, creating stronger coordination and a sense of joint ownership.

Programs like gainsharing and goalsharing also illustrate how variable pay can be structured at the group level.

Both approaches tie payouts to performance rather than being fixed, shaping behaviors that support teamwork and drive broader organizational results.

On a corporate level, variable payments can link employee earnings to the company’s overall performance, regardless of their role.

Profit-sharing plans are the most common type, but other examples also include company-wide bonuses, stock options for employees, gainsharing, and equity grants.

These programs create alignment between individual contributions and company performance, offering a flexible approach to compensation. During high-performing periods, employees share in the company’s success through additional rewards, but while in slower periods, compensation costs are adjusted in proportion to the results.

Some variable compensation plans don’t fit neatly into performance categories but respond to specific circumstances or needs.

Understanding the different types helps companies design compensation plans that strategically motivate desired behaviors and meet operational priorities.

Variable compensation is typically awarded to employees whose contributions have a direct impact on business results, such as sales staff, managers, executives, and those in roles with high-stakes or high-demand responsibilities.

It’s also especially common in industries where results can be measured and tied to performance, such as in finance, technology, or retail.

Roles with clear performance metrics are the primary recipients of variable pay.

Sales representatives remain the most obvious example. In fact, Salesforce data indicates that they often work with a commission portion ranging between 5-30% of the sales value, depending on the industry.

According to the 2024 RC Capital Senior Management Compensation survey, variable pay is also growing across roles such as Chief Revenue Officers, CEOs, and VPs of Business Development, who receive a significant portion of their total compensation through bonuses, commissions, and equity incentives.

On average, target bonuses and commissions provide 33% more compensation than base salaries. The CRO position shows the highest variable component at 54% above base, followed by CEOs at 48% and VP Business Development at 39%.

These cases illustrate the pattern, though variable pay is applied wherever performance can be measured effectively.

A breakdown of bonus percentages by industry shows apparent differences across sectors based on role and market demand.

For example, high-stakes industries like finance and banking offer the highest bonuses, which may range between 20-50% because individual performance has a substantial impact on profitability.

Technology and software follow, with 10-20%, balancing the high demand for talent with other perks such as development programs or wellness benefits.

Healthcare offers moderate bonuses of 5-15% as the industry incorporates quality-based metrics into its compensation models, rather than relying solely on financial results.

While the data shows retail and hospitality on the lower end at 1-5%, it’s necessary to recognize that these industries rely heavily on other forms of variable compensation that can substantially increase total earnings. For example, a retail sales associate’s 3% bonus might be supplemented by a much higher commission percentage on sales.

Bonuses represent just one component of variable compensation, but they reveal that industries are increasingly tying pay to measurable outcomes. This shift reflects a fundamental change in how companies motivate employees, shifting from purely time-based pay toward results-driven compensation structures.

The widespread use of variable compensation reflects the clear advantages it offers for both organizations and employees, including:

Introducing incentives can fundamentally change how companies drive performance. When employees see a direct connection between their results and their pay, they become more invested in achieving those outcomes. As a result, engagement and productivity often increase under this model.

Another benefit is their flexibility, countering the rigid cost structures of fixed salaries.

It can be especially valuable during periods of economic fluctuation. Employers can reward employees more generously during profitable periods while reducing compensation pressure when revenue declines or market conditions tighten.

This adaptability is also a powerful tool for attracting talent in competitive roles and industries.

Beyond financial mechanics, variable payouts can contribute to a stronger company culture, as they signal that merit matters more than tenure or politics. In response, higher achievers can feel more valued when their contributions receive tangible recognition, which in turn increases their earning potential. Meanwhile, underperformers are encouraged to raise their performance to meet expectations.

Ultimately, this creates healthier team dynamics and clearer performance standards.

While variable pay can drive performance, it also presents several challenges that employers must carefully manage, including:

First, there’s the risk of perceived inequity. Employees may view payouts as inconsistent or subjective if goals, metrics, or evaluation processes are unclear, which can undermine trust and engagement.

Complexity in administration is another factor. Variable compensation plans require ongoing tracking, calculation, and adjustments, which adds a substantial workload to already-stretched HR teams.

In fact, data shows that 96.6% of HR leaders already report spending more than a quarter of their time on administrative tasks. Adding variable pay management can strain resources further without proper systems in place.

Finally, legal and compliance considerations require careful attention. Variable payment structures must comply with wage and hour laws, anti-discrimination regulations, and tax requirements. Different jurisdictions have varying rules regarding the structure of performance-based compensation. Missteps in these areas can lead to costly penalties and legal disputes.

Careful planning and ongoing monitoring are crucial to maximizing the benefits of variable pay while mitigating associated risks.

Designing a variable pay plan starts with understanding which behaviors and results drive business success, then structuring all metrics to reinforce those outcomes.

Therefore, success relies on three key steps: setting clear targets, linking performance to meaningful rewards, and communicating the plan so employees understand how it works.

First, set a clear objective (e.g., improved performance, increased retention, or higher sales) and determine which outcomes or behaviors to reward, ensuring they are measurable and aligned with business goals.

Based on the goal, choose the preferred type of variable pay. For example, a company aiming to boost overall team productivity might implement a profit-sharing plan, whereas one focused on individual sales growth could offer commission-based bonuses.

Research suggests that profit sharing and group performance pay tend to produce stronger long-term productivity gains than individual variable pay, with estimated gains of 22%, 19%, and 11% respectively.

However, results largely depend on factors such as firm size, innovativeness, and employee representation, emphasizing the importance of tailoring pay structures to the organizational context.

Once objectives are clear, establish measurable performance metrics that define expectations. These should be based on industry benchmarks or past performance and linked to the desired business outcomes.

Next, decide on the payout structure, including:

Including employees in the design process at this stage is critical. It ensures the program is relevant, encourages practical input, and builds ownership as workers see how metrics translate into compensation.

Finally, share the plan clearly with employees and provide them with the necessary tools and guidance to track progress.

Communication must be clear, consistent, and ongoing. This step begins with a shared understanding of the variable pay definition and its meaning within the context of your organization.

Effective implementation also involves ongoing monitoring and transparency.

Technology plays a central role in this step, integrating the program with HR, payroll, and performance management platforms, which ensures accuracy and streamlines tracking. Managers can observe progress and adjust the program as needed, creating transparency and reinforcing the connection between effort and compensation.

After exploring what variable pay is, how it works, and what its benefits are, the real question emerges: Should you include it in your compensation strategy?

Variable pay isn’t universally beneficial and works best when aligned with the business model, culture, and operational realities. Therefore, the answer depends entirely on your company’s specific circumstances.

Before implementing any form of salary variable, ask yourself the following:

Answering these questions honestly will help you determine if variable pay is a good fit for your business.

When performance can be measured clearly and employees trust the system, variable pay can motivate staff and reinforce business goals. If those conditions are missing, it’s wiser to wait until you’ve established the necessary infrastructure rather than risk implementing a system that could demotivate rather than inspire.

Content Writer at Shortlister

Browse our curated list of vendors to find the best solution for your needs.

Subscribe to our newsletter for the latest trends, expert tips, and workplace insights!

Uncover the key elements of the recruitment process and transform it into a streamlined journey toward finding the right talent for your organization.

Explore why it is vital to have disciplinary action in place to deal with each inappropriate behavior professionally and legally.

Explore the ins and outs of running payroll and the different methods and payroll services businesses use to compensate their employees.

What’s the smarter path to growth? An Employer of Record that eliminates the need for legal entities or a PEO that optimizes your existing infrastructure?

Used by most of the top employee benefits consultants in the US, Shortlister is where you can find, research and select HR and benefits vendors for your clients.

Shortlister helps you reach your ideal prospects. Claim your free account to control your message and receive employer, consultant and health plan leads.