What is Imputed Income?

Explore the concept of imputed income, its tax implications, and the importance of accurate reporting to understand how employers handle imputed income on pay stubs and tax forms.

The government shutdown of 2025 has now become one of the three longest funding lapses in modern U.S. history.

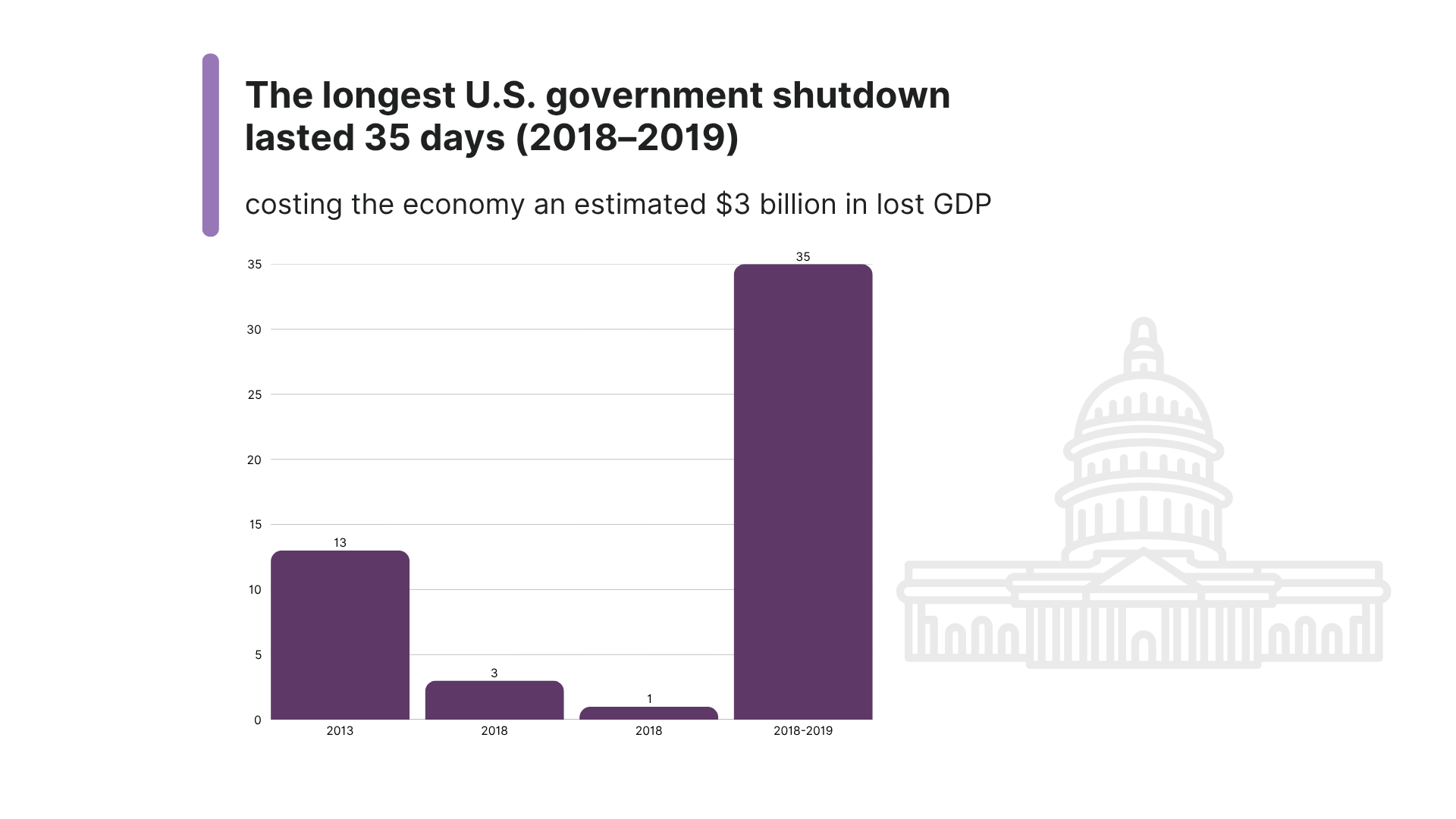

Historical patterns reveal that shutdowns can extend for significant periods. In fact, three of the last four federal shutdowns lasted more than a week, with the longest continuing for 35 days in 2018–2019. That record-setting shutdown cost the U.S. economy an estimated $3 billion in lost GDP.

For employers and HR leaders, an extended government shutdown introduces prolonged uncertainty and operational challenges that call for strategic foresight and preparedness.

The current government shutdown began at 12:01 A.M. on October 1, 2025, after Congress missed the fiscal year deadline without passing either a budget or a continuing resolution.

Under federal law, no government spending can occur without a budget approved by Congress. When lawmakers fail to pass appropriations or a temporary stopgap measure, federal agencies must suspend all “non-essential” operations until new funding is authorized.

So far, the Senate has failed to advance a funding bill thirteen times, leaving federal operations in limbo. Thousands of federal employees have received layoff notices as the administration carries out reduction-in-force (RIF) actions.

However, a federal judge in San Francisco temporarily blocked the Trump administration’s latest round of layoffs at over 30 federal agencies, pausing further cuts for now.

Shutdowns are not confined to Washington. It’s easy to assume that only federal agencies are impacted, but the consequences often extend well beyond government walls.

SHRM data reveals that while up to 860,000 federal employees face daily furloughs, cascading effects can be felt across businesses and communities nationwide. Contractors, suppliers, universities, hospitals, and local governments feel the strain, and households lose income.

Even a brief shutdown of one to three days could disrupt daily operations for 25% of organizations and put 23% of their annual financial goals at risk.

Research shows 89% of workers believe their communities would be affected by the shutdown, threatening the livelihoods and stability of millions and leaving families to cope with growing uncertainty and shrinking support systems.

The impact across industries isn’t evenly distributed.

Travel and tourism face outsized losses. The U.S. Travel Association estimates about $1 billion in weekly losses as people cancel trips to national parks, historic sites, and Washington, DC. Venues such as the Smithsonian museums and the National Zoo are closed to visitors.

Small businesses are also facing mounting pressure as federal funding and loan programs remain frozen.

Per the U.S. Chamber of Commerce, the SBA typically backs roughly $860 million in loans each week for about 1,600 firms, but new lending is paused during the shutdown. Flood insurance issuances and renewals are also on hold, slowing home closings and real estate deals.

Aviation is strained by staffing gaps. The FAA reports air traffic controller shortages from Boston and Philadelphia to Atlanta and Houston, triggering delays that have spread to airports including Nashville, Dallas, and Newark.

These macroeconomic ripple effects eventually land in HR’s hands, reshaping compliance timelines, changing payroll services routines, and workforce confidence.

An extended shutdown can affect employers in both obvious and unexpected ways.

Over the last four weeks, federal agencies critical to HR operations have drastically reduced their functions.

The EEOC has suspended new investigations and mediations, while the NLRB has paused case handling and elections, continuing only emergency actions.

The Department of Labor has suspended operations across most key divisions, pausing the processing of Labor Condition Applications (LCAs), prevailing wage determinations (PWDs), and PERM labor certification filings.

Workplace safety inspections, except for emergencies, have essentially stopped.

What does this mean for your pending compliance issues? Consider these immediate impacts:

In addition, federal courts lost funding for full operations on October 20, with judges continuing to serve with pay while 33,000 court staffers either perform limited tasks unpaid or face furlough.

As the funding freeze enters a critical fourth week, delays in civil litigation will compound other business disruptions.

The shutdown creates immediate cash flow concerns for businesses, particularly federal contractors. Unlike furloughed federal employees who receive guaranteed backpay, contractor employees have no such assurance.

Moreover, the Affordable Care Act marketplace opens for enrollment on November 1, but with the current shutdown and the ongoing political battle over ACA subsidy extensions, employers face much uncertainty about their benefits strategies.

Similarly, while electronic tax filings continue, the IRS cannot process paper documents or respond to taxpayer inquiries after its initial five-day operating period using special funding.

Employers awaiting guidance on complex tax matters face indefinite delays.

The E-Verify system had been unavailable since the start of the 2025 federal government shutdown on October 1.

On October 9, the U.S. Citizenship and Immigration Services (USCIS) confirmed that E-Verify became operational again as of October 8, allowing employers to resume verifying new hires’ work eligibility, resolve pending cases, and manage compliance duties.

Beyond E-Verify, the government freeze has caused ripple effects across immigration processes. USCIS announced it may excuse late filings for certain visa petitions, such as H-1B, H-2A, H-2B, and CW-1, if delays were directly caused by the shutdown or the inability to secure necessary labor condition approvals.

Employers facing missed deadlines are advised to document how the closure disrupted their submissions and be prepared to justify the delay once operations stabilize.

The current shutdown reveals how deeply federal operations intertwine with private sector success. From the smallest contractor to the largest corporation, no business remains untouched by such disruptions.

Ultimately, employers can stay operational, but friction grows by the day. The question isn’t whether your organization will be affected, but how well you can navigate and position yourself for the inevitable post-shutdown challenges ahead.

As the government shutdown of 2025 continues to unfold, staying informed, maintaining flexibility, and supporting your workforce remain your best strategies for weathering this government disruption.

Senior Content Writer at Shortlister

Browse our curated list of vendors to find the best solution for your needs.

Subscribe to our newsletter for the latest trends, expert tips, and workplace insights!

Explore the concept of imputed income, its tax implications, and the importance of accurate reporting to understand how employers handle imputed income on pay stubs and tax forms.

How is cloud-based payroll, a fully automated way of payroll processing that leverages the power of cloud computing, revolutionizing the industry? Analyze the best cloud-based payroll software vendors and learn how to choose the right one and implement it in the workplace.

Weighing the pros and cons of a disregarded entity can help make a more informed decision in selecting the type of business entity that would be the best choice for new business entrepreneurs.

Get a clear understanding of your earnings by exploring the concept of gross wages.

Used by most of the top employee benefits consultants in the US, Shortlister is where you can find, research and select HR and benefits vendors for your clients.

Shortlister helps you reach your ideal prospects. Claim your free account to control your message and receive employer, consultant and health plan leads.