Employee Incentive Deep Dive: Nectar Review

As one of the leading employee incentive providers, Nectar HR stands out with its simple yet effective recognition and rewards mechanism and features built around elevating company culture.

Since their introduction to the workplace, voluntary benefits have always played a supporting role.

They were considered “perks”, allowing employees to choose what best aligned with their lifestyle, enhancing their overall well-being and financial security.

However, given the turbulent events of recent years, between the pandemic and the rising costs of healthcare and living, these benefits have surged in popularity.

Their role elevated from a “perk” to a “benefit.”

Now, voluntary benefits are shifting from nice-to-have incentives to a significant contributor to employee satisfaction, retention, and talent acquisition.

To understand the rising trend and its implications in the workplace, this Shortlister article answers the question of what voluntary benefits are and discusses their history, types, advantages, and limitations.

Voluntary benefits are non-wage compensations that employees can enroll in or decline, hence the name. They supplement the standard benefits package that usually includes health insurance and retirement plans.

Also called perks, fringe benefits, or voluntary group insurance, these products and services support workers’ well-being by addressing different needs.

Typically, available at a much lower rate than what individuals would pay, voluntary employee benefits cover expenses that other types of insurance might not. Sometimes, costs can also be split between employers and their employees.

This financial advantage and the flexibility to choose what best suits the individual have contributed to increased demand for these benefits, especially in recent years.

The history of employee benefits started as early as the 17th century, when the colony of Plymouth, present-day Massachusetts, introduced the first pension law that provided pensions to people disabled in the colony’s defense.

However, voluntary benefits as we know today came much later.

In the mid-20th century, as employee priorities changed, companies started expanding their offerings beyond traditional compensation packages. Initially, these perks mainly consisted of supplemental insurance policies, such as life and disability insurance, offered to employees at group rates.

Now, employees can choose anything from comprehensive wellness programs to pet insurance.

According to a Goldman Sachs 2023 Benefit & Compensation Trends report, voluntary benefits plans steadily grew in the past decade, reflecting increased employee expectations for these compensations.

The COVID-19 pandemic, fierce talent competition, and escalating inflation also contributed to a massive expansion in several benefits between 2020 and 2023:

Seeing that the array of options continues to grow, let’s go over the most common types of voluntary benefits on the market right now.

Voluntary benefits cover a broad range of offerings that meet different employee needs. As a flexible perk, they aim to support employees in various aspects of their lives. Thus, examples span across many categories, some of the most common being insurance, wellness, and financial planning.

|

Category |

Type of Voluntary Benefit |

Coverage |

|

Insurance |

Supplemental Health Insurance |

Additional coverage beyond basic health insurance plans, including critical illness insurance, telehealth access, disability insurance, etc. |

|

|

Dental Insurance |

Coverage for dental procedures like tooth removal, dentures, and treatments, including sealants, crowns, etc. |

|

|

Vision Insurance |

Coverage for vision-related expenses such as laser eye surgery, glasses, contact lenses, and eye exams |

|

|

|

Financial protection for beneficiaries in case of the employee's death |

|

|

|

Coverage for accidental death or injury for employees who travel on business |

|

Wellness & Lifestyle Benefits |

|

Access to fitness facilities or programs |

|

|

|

Counseling and support services for mental well-being |

|

|

|

Resources and support to help workers quit smoking |

|

Financial Planning Services |

Retirement Savings Plans |

Different investment options to save for retirement |

|

|

|

Guidance on managing personal finances |

|

|

|

Assistance with paying off student loans |

|

|

|

Investment advice for individuals, and assistance with asset aggregation, portfolio management, etc. |

|

Personal & Miscellaneous |

Flexible Work Schedules |

Ability to adjust work hours to accommodate personal needs |

|

|

Telecommuting Options |

Providing an option to work remotely |

|

|

|

Support for childcare expenses, such as subsidies or daycare services |

|

|

|

Coverage for veterinary expenses related to pet care |

|

|

|

Assistance with legal matters such as estate planning or family law |

|

|

|

Monitoring and support services in case of identity theft |

Employers can offer multiple different alternatives under a voluntary benefits plan.

It’s a customizable package with flexible benefits that workers can choose from based on their needs and priorities. Usually, the employee pays them partially or entirely through payroll deductions.

However, they are generally affordable.

A rough cost estimate by Forbes Advisor reveals they can cost as little as a couple of dollars per employee per month. For example, vision insurance may cost between $5 to $20, life and dental insurance starts at $20, legal insurance services can be anywhere between $8 to $18, etc.

The average premiums for pet insurance, particularly an accident-only policy, was $18.17 per month for dogs and $11.13 for cats.

These voluntary benefits plans are not only cost-effective, but they promote autonomy and ownership over one’s benefits package by empowering workers to choose the benefits that best suit their circumstances.

Besides, the advantages expand to employers as well.

While employees enjoy the advantage of receiving extra benefits and paying less, these non-wage compensations are a sound business investment for companies.

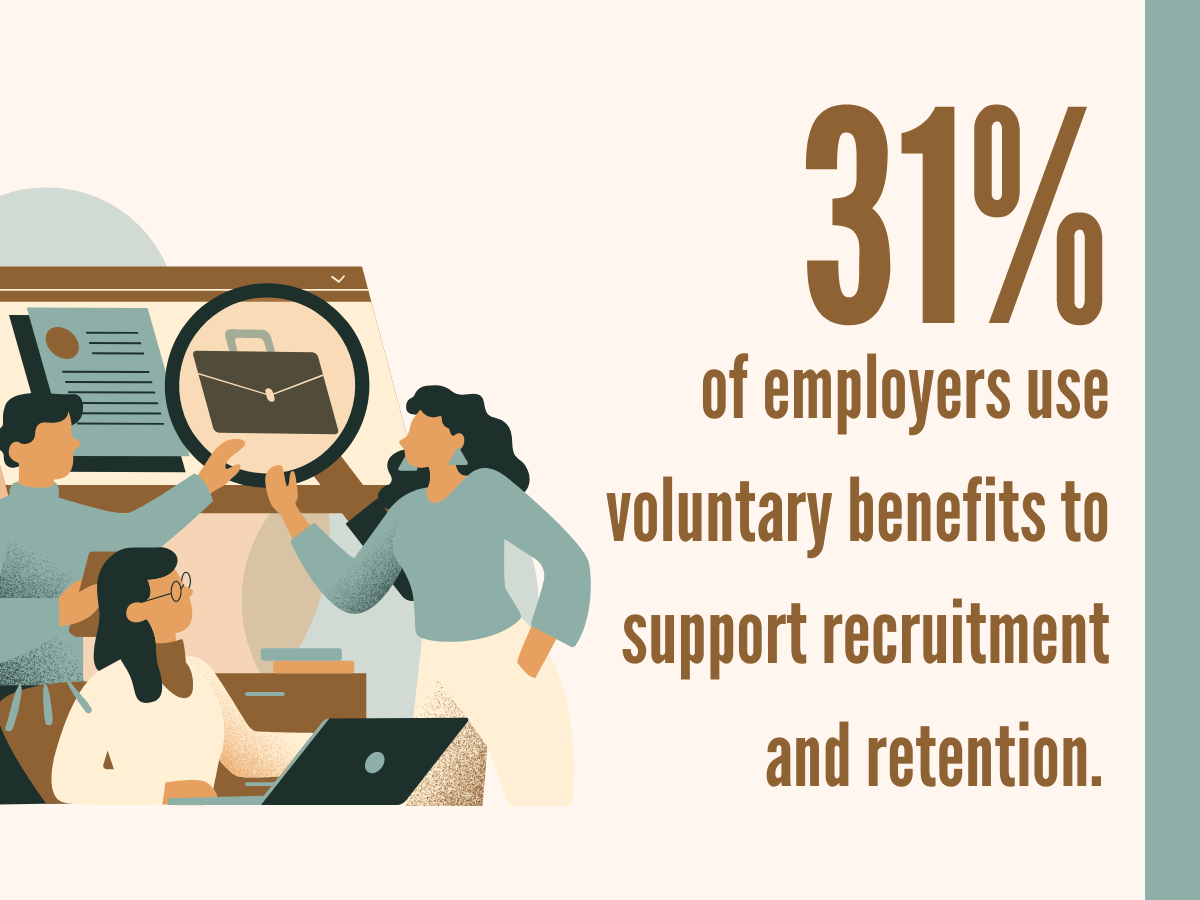

Gallagher’s 2023 Voluntary Benefits Benchmarking report reveals that, in 2023, 31% of employers were using them to support recruitment and retention.

The data also highlights the shifting focus to maintaining or reducing costs while growing revenue, which is doable since these plans enable companies to expand their benefits offerings without significantly increasing costs.

In other words, they are doing more with less.

HR professionals also agree on their importance, according to a survey by Corestream. In fact, the majority believe that offering employee voluntary benefits will:

The survey also shows that the importance of these perks, especially in talent retention, is on the rise.

Up to 76% of the workforce agrees that they would impact their company’s ability to retain them, up from 68% in 2020.

Luckily, employers are listening, as 82% of companies offered at least three types of voluntary benefits, an increase compared to 70% in 2020.

So, it’s safe to say that they offer a major strategic advantage in such a competitive talent market.

However, as crucial as these advantages are, it’s also worth noting that voluntary employee benefits come with some limitations.

Despite their benefits, like with traditional, voluntary benefits have their downsides.

One major limitation is their eligibility criteria.

For example, specific benefits include different criteria, such as minimum employee requirements or age limits. Some plans also come with potential exclusions, such as pre-existing health conditions.

Moreover, independent contractors, as well as part-time and remote workers, might also be excluded.

Beyond this, from an administrative standpoint, voluntary employee benefits can be somewhat challenging for HR since they must manage multiple options and individual selections. At the same time, workers may find themselves struggling to navigate the range of offers, often due to a lack of information.

In fact, the Corestream survey points out a communication gap between companies and their workforce.

Only 22% of employers communicated benefits regularly throughout the year, leading to only 54% of employees feeling adequately informed about available benefits.

Moreover, 36% of HR professionals believe their employees don’t fully understand voluntary and core benefits.

Finally, as a direct result of this disconnect, low engagement surfaces as a potential challenge.

To tackle it, employers must invest time and resources in effective communication to ensure employees understand what they can get and participate. Otherwise, low participation rates can diminish the perceived value of benefits.

According to the Goldman Sachs report, answering what voluntary benefits are offered by companies, the following options top the list:

Companies provide these benefits for both their and their employees’ advantage. They alleviate work-related and external stressors for workers and increase job satisfaction by signaling employer care for employees’ holistic well-being, ensuring a more reliable and engaged workforce.

Amidst this, their integration into overall benefits programs emerges as a strategic imperative for employers.

The rise of voluntary benefits mirrors the evolution of the workplace and the emerging benefits trends. As of the latest, they have become integral to modern benefits programs.

However, their integration should be approached cautiously since every plan can differ based on complexity, coverage, and purpose.

With that, companies should consider the following:

In conclusion, as employers recognize the importance of voluntary benefits, their integration becomes an opportunity to remain competitive while tending to their employees’ needs.

Content Writer at Shortlister

Browse our curated list of vendors to find the best solution for your needs.

Subscribe to our newsletter for the latest trends, expert tips, and workplace insights!

As one of the leading employee incentive providers, Nectar HR stands out with its simple yet effective recognition and rewards mechanism and features built around elevating company culture.

Explore the critical connection between HR risk management strategies and their impact on recruitment effectiveness. Learn how mitigating risks can lead to more successful hiring outcomes.

Thought leadership is all about assisting people to understand themselves better, find their purpose, and achieve success in the long term. So, how to make way for thought leadership that works wonders?

Can employers afford to cover GLP-1 medications without letting costs spiral out of control?

Used by most of the top employee benefits consultants in the US, Shortlister is where you can find, research and select HR and benefits vendors for your clients.

Shortlister helps you reach your ideal prospects. Claim your free account to control your message and receive employer, consultant and health plan leads.