1. Risk: Time Constraints

Background checks can be lengthy, especially if we consider all FCRA requirements, which could cause hiring teams to lose the candidate.

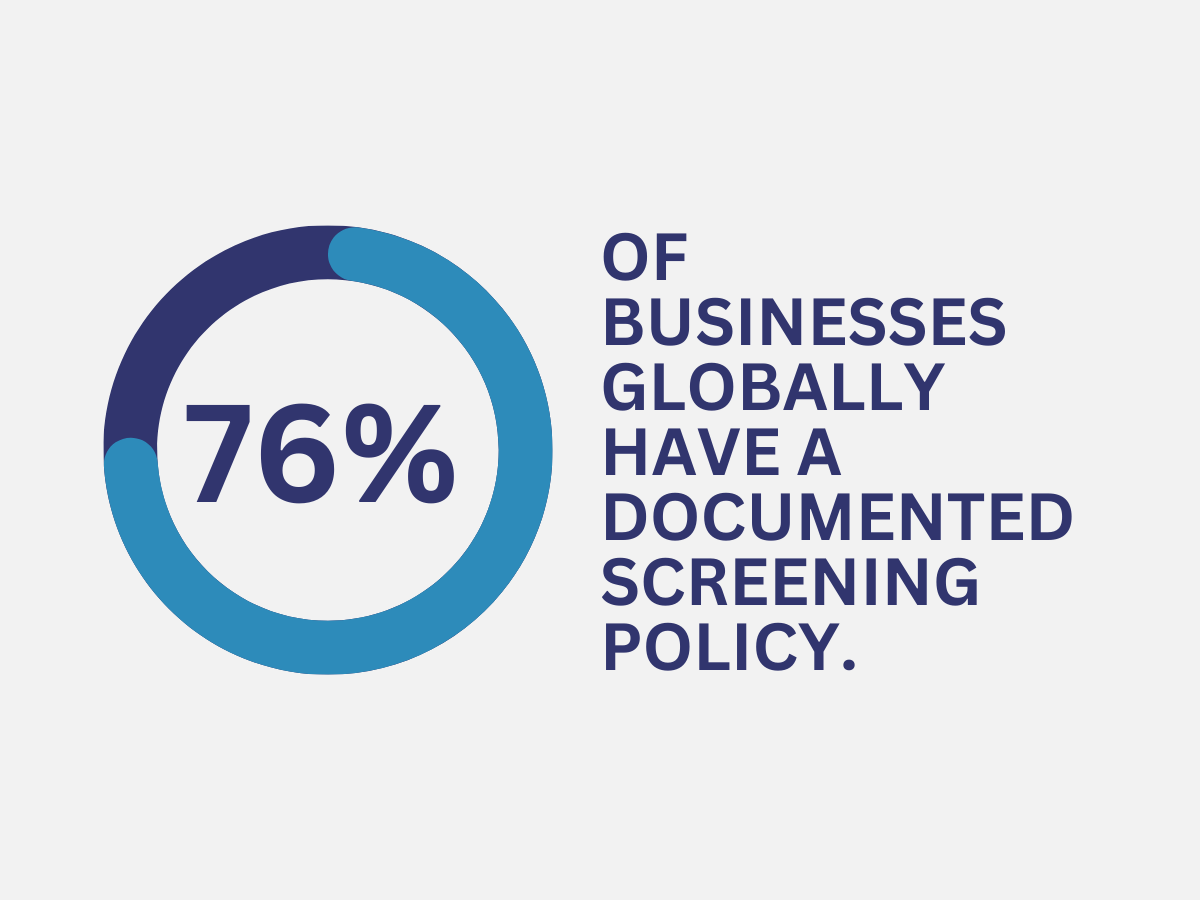

In fact, Statista reveals how long prospective employees in the U.S. are willing to wait before moving to another opportunity.

Namely, 41% responded that they’ll wait between one week and less than ten days. Another 22% were willing to wait between ten days and less than two weeks, and only 20% agreed to wait over two weeks.

How to Avoid: Streamlined Process & Better Communication

According to Indeed, pre-employment background checks take two to five business days. Although this period is shorter than when employees are willing to wait, it can be prolonged for different reasons.

So, how can employers avoid this?

For starters, employers should use efficient and reliable background check services to reduce processing time and prevent losing candidates due to lengthy background checks. Moreover, they must set clear expectations about the timeline and regularly inform candidates.

2. Risk: Consent and Complex Procedures

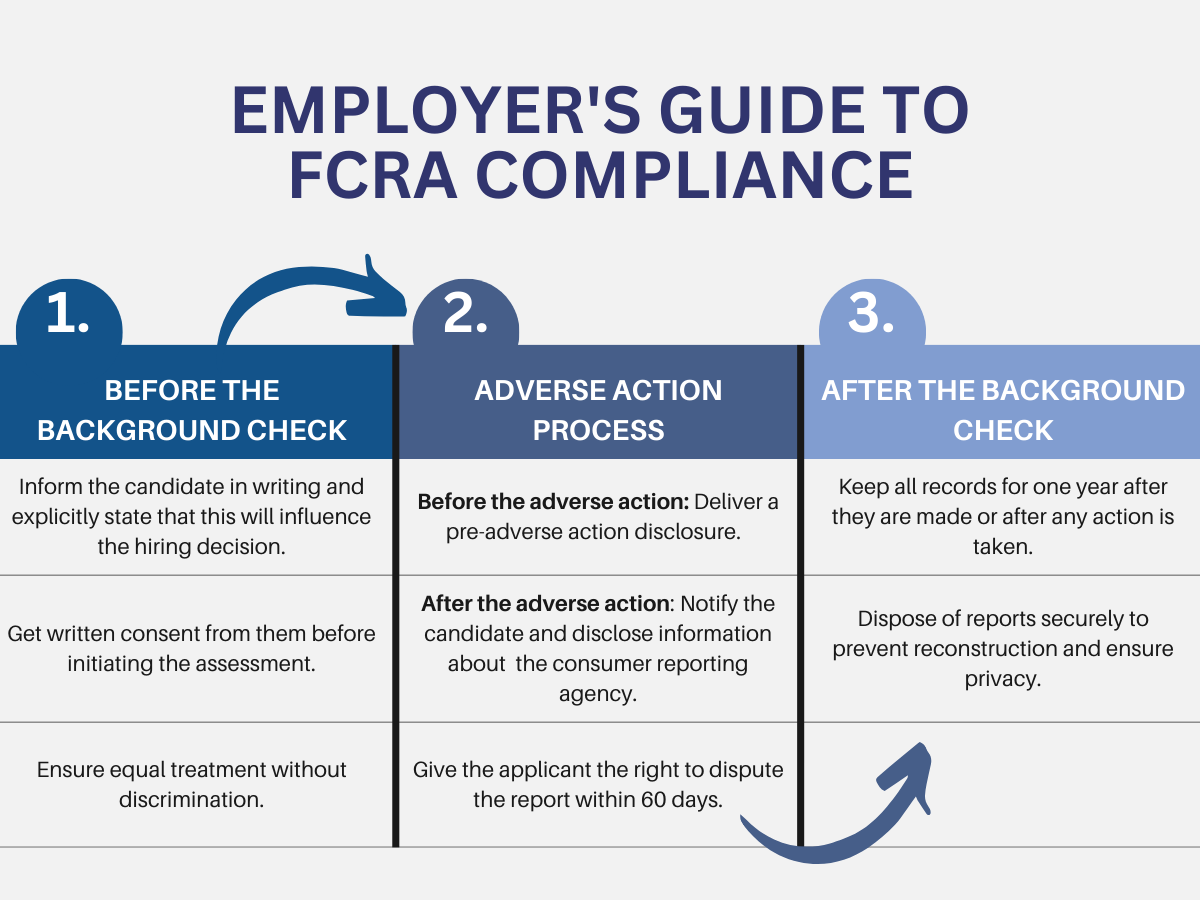

A significant risk area involves properly handling data, obtaining consent, and adhering to established procedures and adverse actions.

Failure on each of these fronts can lead to legal violations and penalties.

How to Avoid: Understanding FCRA Compliance and The Risks

Companies must provide clear disclosures to candidates and obtain explicit written consent before proceeding. These forms should be separate from other documents and clearly presented.

Moreover, as part of the procedures imposed by the Act, employers should provide applicants or employees with pre-adverse action notices, copies of background check reports, and a summary of their rights to dispute findings before final decisions are made.

3. Risk: Inaccuracies or Incomplete Reports

Another common pitfall is handling the data from start to finish. Also, relying on inaccurate or incomplete background check reports can pose a compliance risk.

How to Avoid: Partnering with Reputable CRAs

Regularly reviewing and verifying information provided by consumer reporting agencies helps ensure the accuracy and fairness of the screening process. Another way to ensure this is by partnering with reputable CRAs, preferably accredited by the Professional Background Screening Association(PBSA).

Moreover, the FTC and EEOC guidelines on recordkeeping must be followed to ensure privacy and compliance.