Best Practices for Managing the Employee Exit Process

If endings shape the whole memory, why treat the exit process like admin work instead of strategy?

Founder, eLearning Industry Inc

Co-Founder & Managing Partner, J&Y Law

Principal of SCUBE Marketing

Owner, SEO Optimizers

Few areas of HR are as fragmented as wage and hour compliance.

Federal, state, and local laws intersect in ways that are difficult to track without a system in place. At the same time, rules vary not only by jurisdiction but also by employee classification, work arrangement, and pay structure.

An HR compliance checklist provides structure to these complex, interconnected elements, allowing companies to anticipate exposure and maintain consistency as the workforce evolves.

Drawing on recent research, legislative updates, and expert insights, this Shortlister article examines the key components of an HR checklist that help businesses effectively manage wage and hour compliance risks.

Within any company, the human resources department operates inside a defined legal and regulatory framework.

Therefore, compliance in HR refers to the systems and controls that ensure all employment-related policies and practices align with applicable laws and internal standards.

However, whether in human resources or across other departments, regulatory alignment has long been one of the most significant challenges companies face.

In fact, PwC’s Global Compliance Survey 2025 reveals that 77% of employers have been negatively impacted by compliance complexities across various areas.

Navigating this evolving landscape of federal, state, and local laws requires a proactive and structured approach.

Complex rules require a structured approach to remain manageable.

An HR compliance checklist is a formal review tool that provides this structure, allowing companies to assess whether their policies, procedures, and records meet current legal and regulatory requirements.

By organizing compliance obligations into defined review areas, the list allows systematic evaluation and documentation. Used regularly, it also identifies gaps and violations, providing a clear audit trail.

In practice, an HR checklist serves as both a control mechanism and a reference point for ongoing compliance management.

Wage and hour laws exist to ensure employees are compensated fairly for their work. They protect workers’ rights, but also promote fairness, transparency, and accountability in the workplace.

Consequently, any form of non-compliance carries significant financial and legal consequences.

For example, in fiscal year 2024, the Department of Labor’s Wage and Hour Division recovered more than $273 million in back wages and damages for nearly 152,000 workers nationwide.

Depending on the seriousness of the violation, companies can also face civil penalties, class-action lawsuits, or, in rare cases, criminal prosecution.

Even a single misclassification or record-keeping mistake can quickly become a costly penalty.

Therefore, employers and HR teams must place greater emphasis on wage and hour processes in their HR compliance checklists.

Otherwise, they risk their company’s financial stability and overall reputation.

Compliance is grounded in accurately understanding and interpreting the law.

In the United States, the foundation for wage and hour laws at the federal level is the Fair Labor Standards Act (FLSA).

It establishes the baseline requirements for minimum wage, hours worked, overtime pay, record-keeping, and child labor standards. They apply nationwide, and the U.S. Department of Labor’s Division of Hours and Wages (WHD) is responsible for enforcing them.

Another important consideration is the Equal Pay Act of 1963, a labor law that amends the FLSA. It requires employers to pay employees equally for equal work, regardless of sex.

Meanwhile, the Family and Medical Leave Act (FMLA) governs job-protected unpaid leave and interacts with wage and hour compliance through eligibility thresholds, tracking hours worked, and return-to-work practices.

State and local governments often impose extra requirements that are stricter than federal law, such as higher minimum wages, expanded overtime rules, or additional pay transparency obligations.

When these federal, local, and state regulations conflict, Article 6 of the U.S. Constitution stipulates that federal laws prevail over state laws.

However, there are exceptions when state laws provide greater rights and protections. For example, according to the FLSA, when an employee is subject to both state and federal minimum wage laws, they are entitled to the higher of the two minimum wages.

Many laws and regulations don’t universally apply to all businesses.

Coverage depends on a combination of federal standards, state and local regulations, employee classification, industry-specific rules, and the business’s structure and revenue.

For example, the FLSA covers most employers with annual gross sales of at least $500,000 or those engaged in interstate commerce.

FMLA, on the other hand, applies to all public agencies, as well as public and private elementary and secondary schools, and companies with 50 or more employees.

State laws vary significantly by location and may impose stricter rules than federal laws.

Therefore, seeking legal counsel and using reliable HR compliance services ensures that laws are interpreted correctly and applied consistently.

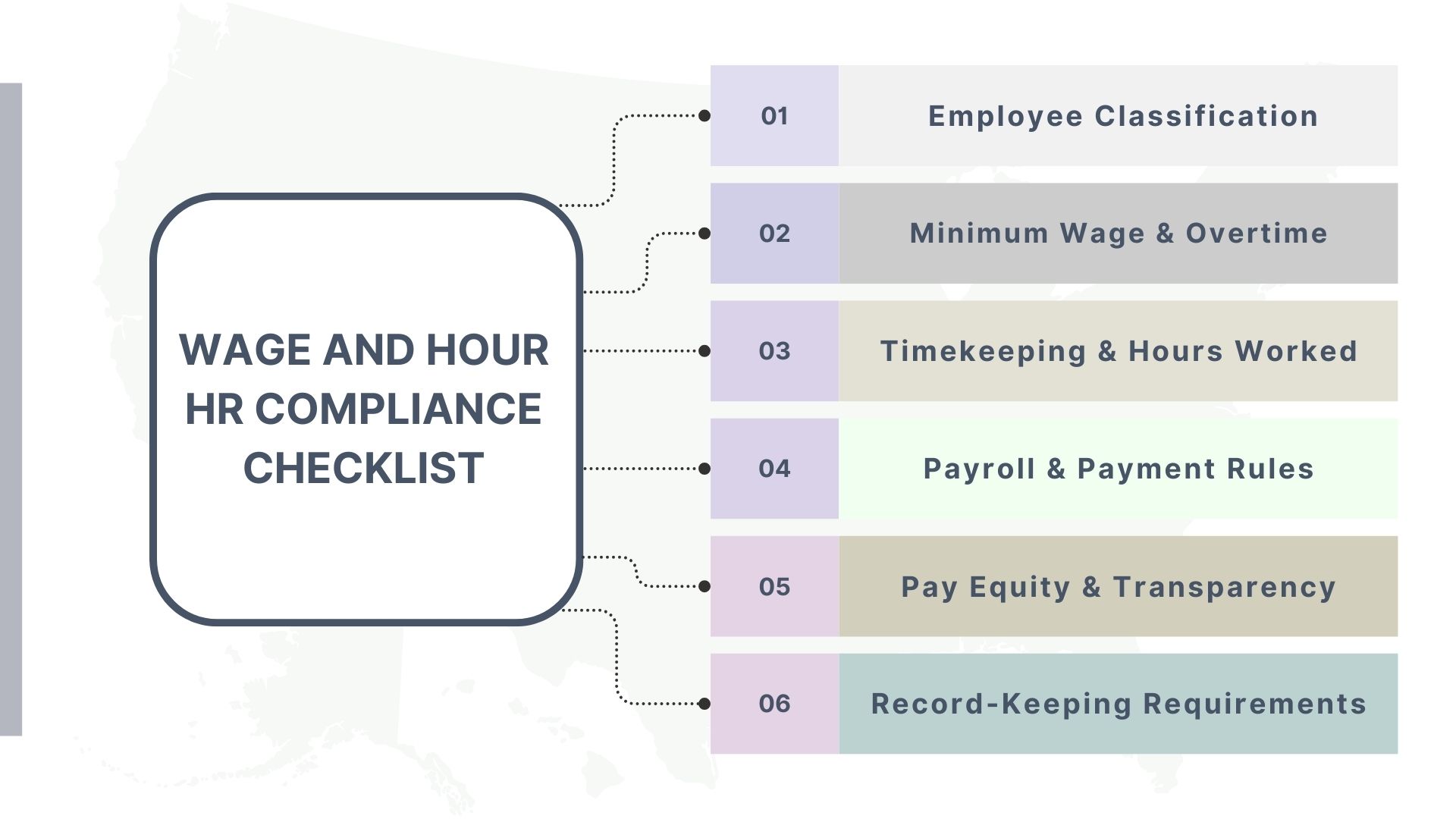

At its core, a wage and hour HR checklist brings together federal, state, and local requirements into a single, practical guide. It covers the key areas HR must review to stay compliant, including:

Below, we explore each of these components in detail, outlining the specific legal considerations, requirements, and purpose.

Wage and hour HR compliance starts with proper employee classification.

Christopher Pappas, Founder of eLearning Industry Inc., addresses this through the lens of managing diverse teams, contractors, and remote workers, which, as he says, is often misunderstood due to the complexity of these processes.

“Many companies fail to update their compliance practices to reflect modern work structures. This leads to operational inefficiencies and an increased risk of non-compliance,” explains Pappas.

It’s therefore understandable that misclassification is one of the most common and costly violations found in DOL investigations.

Research indicates that approximately 10-30% of employers misclassify employees as independent contractors.

Beyond the financial impact, which amounts to billions of dollars in lost tax revenue, this deprives workers of their core rights and protections, including minimum wage and overtime pay.

Thus, proper employee classification, especially among such a diverse workforce, forms the foundation of wage and hour compliance.

In a human resources compliance checklist, this means correctly categorizing workers, such as exempt versus non-exempt employees or full-time workers versus independent contractors.

Doing so ensures proper compensation, benefits, and adherence to legal requirements.

Under the FLSA, employees fall into one of two categories: exempt or non-exempt.

Exempt employees are typically salaried and perform executive, administrative, or professional roles requiring independent decision-making authority. Those who fall under the FLSA exemption criteria are excluded from minimum wage and overtime pay protections.

Non-exempt employees are generally entitled to overtime pay when they work over 40 hours per week. They usually perform non-managerial or more routine tasks.

As part of the HR checklist, companies must accurately classify their workers. They can do that based on three tests (for exemption), including salary basis, salary level, and duties test.

The classification of workers as independent contractors rather than employees remains a significant enforcement focus, and can be determined by the economic reality test.

Making this distinction relies on accurately determining whether a worker is economically dependent on the business or is in business for themselves. This includes the degree of control the business exercises, the worker’s opportunity for profit or loss, and the permanence of the working relationship.

The federal minimum wage remains $7.25 per hour.

However, state and local governments have established higher rates that exceed state requirements.

In 2026, nearly 20 states and over 40 cities or counties have increased their wage floors, including:

When multiple rates apply, employers must pay the highest applicable rate.

Therefore, an essential part of an HR legal compliance checklist is to track minimum wage changes across all jurisdictions where employees work, as many states adjust rates annually in response to inflation indices.

The FLSA defines a tipped employee as one who is “engaged in an occupation in which they customarily and regularly receive more than $30 a month in tips”.

These workers are subject to specific wage and hour requirements that allow employers to apply a tip credit toward the minimum wage, provided the employee earns sufficient tips to meet or exceed the required wage.

The federal tipped wage is $2.13 per hour, with a maximum tip credit of $5.12.

If tips plus the cash wage do not equal the full minimum wage, the employer must make up the difference.

At the state level, these rules can vary significantly, with some states, such as Washington, prohibiting tip credits entirely.

Another critical aspect of compliance in HR is accurately calculating overtime.

Under current FLSA enforcement, employees earning less than $684 per week are entitled to overtime pay, regardless of their job title or position. Highly compensated employees need to earn at least $107,432 annually to be exempt.

These non-exempt workers receive pay at 1.5 times the regular rate for any hours worked beyond 40 in a workweek.

Moreover, any premium pay that’s guaranteed by policy and not purely discretionary must be included when calculating an employee’s regular rate for overtime purposes. This includes hazard pay, shift differentials, and emergency pay.

The employer cannot exclude these payments even if they’re labeled as special premiums. They also can’t average hours across multiple weeks and must pay overtime wages on the regular payday for the period when the work was performed.

Several states impose overtime requirements that exceed federal standards.

For example, California has stricter overtime rules, which require non-exempt workers to receive overtime pay for hours worked beyond eight in a workday or 40 in a workweek.

The pay rate is 1.5 times regular pay for hours between 8 and 12 per day, and double pay for hours exceeding 12 per day. Employees also get overtime rates for the seventh consecutive day worked in a week.

Other state variations include lower weekly overtime thresholds for particular industries and additional requirements for specific worker categories.

Accurate timekeeping sets the foundation for payroll compliance, correct invoicing, efficient project management, and workforce productivity.

It’s also a legal requirement to maintain records of “hours worked”, which is all time an employee must be on duty, on the employer’s premises, or at a prescribed workplace.

Although the FLSA doesn’t mandate a specific timekeeping method, research indicates that companies are increasingly relying on technology, with 55% using HR tech for compliance and security purposes.

For timekeeping, time and attendance software replaces manual timesheets, providing records that directly integrate into payroll systems. Automated solutions are more accurate, which helps with compliance, and they support consistent pay practices across the company.

However, according to Yosi Yahoudai, Co-Founder and Managing Partner at J&Y Law, the right technology helps only when paired with good policy. He explains, “Tools that track edits and flag problems are key, but they only work if managers and employees know how to use them and what to look for.”

Tom Bukevicius, Principal of SCUBE Marketing, notes that tools are most helpful when they identify anomalies early.

For him, the most effective approach to timekeeping is “consistency, a single system, clear rounding rules, and regular audits of exceptions.”

“Compliance improves when HR focuses less on rules and more on how work actually happens day to day,” concludes Bukevicius.

Payroll necessitates an in-depth analysis of state laws, as they introduce varying requirements for pay frequency, payment methods, and permissible deductions.

For example, California mandates (with some exceptions) that employers must pay wages at least twice a month on the days designated in advance as regular paydays.

In New York, manual workers receive their wages weekly, while other employees are paid at least semi-monthly.

Some states, such as Delaware, Idaho, or Kansas, mandate monthly payments.

The timing of the last paycheck also varies by location and whether the termination is voluntary or involuntary. Some states require immediate payment upon termination, while others allow payment on the next regular payday.

Therefore, payment rules, especially those related to multi-state payroll processing, become another pillar on the HR compliance checklist.

Using reliable payroll software and maintaining thorough documentation and audit trails ensures the company can substantiate its pay practices if questioned.

While pay equity and transparency may not fall directly under traditional wage and hour regulations, they still play a significant role in overall compensation compliance.

Pay equity, or “equal pay for equal work,” is mandated by federal law under the Equal Pay Act of 1963. It protects employees from pay discrimination based on their sex, with limited exceptions. Many states have even gone a step further and expanded these protections.

Pay transparency, on the other hand, is not a requirement under federal law.

However, as of 2025, at least 15 U.S. states and localities have enacted laws that require or encourage employers to disclose their salary ranges.

Companies operating in multiple states must track varying thresholds, disclosure timing, and reporting obligations.

Otherwise, non-compliance can result in civil penalties and expose employers to litigation.

“Be transparent, that’s your best bet as a business or HR leader,” advises Yosi Yahoudai, clarifying that “People should understand how their pay is set, and they should feel comfortable enough to ask questions that are sometimes uncomfortable.”

Brandon Leibowitz, Owner of SEO Optimizers, adds that ensuring fair and transparent pay practices also requires open communication, which, according to him, includes “publishing pay ranges, defining roles clearly, and training managers on wage laws.”

Finally, employers should maintain specific data for non-exempt employees, making record-keeping another key component in the HR compliance list.

Although the FLSA doesn’t require a particular form, records must be accurate and include:

Under federal law, employers are required to maintain payroll records, collective bargaining agreements, and sales and purchase records for a minimum of three years.

Timecards and piece work tickets, wage rate tables, work and time schedules, and records of additions to or deductions from wages should be retained for at least two years.

State laws may impose more extended retention periods or additional requirements.

Companies can use HRIS as a single system of record for employees and compliance data. By centralizing this information, they establish a clear audit trail, which helps them meet compliance requirements while minimizing the risk of errors or disputes.

An HR compliance checklist is more effective when treated as an ongoing practice rather than a static reference. Because wage and hour requirements impact everyday decisions about pay, classification, and timekeeping, compliance must evolve in tandem with operational changes.

Tom Bukevicius agrees with this, remarking that “HR compliance checklists work when they are tied to events, not calendars.

For example, changes in role scope, overtime patterns, or work location should automatically trigger a review of wages and hours. Static annual checklists tend to miss these moments.”

These principles are reflected in our complete wage and hour HR legal compliance checklist below, which consolidates key risk areas with clear actions and review timing.

| Category | Action Item | Frequency |

|---|---|---|

| Classification | Review exemption status against duties and salary requirements | At hire and promotion |

| Audit independent contractor relationships using the economic reality test | Annually | |

| Wages | Update minimum wage rates by location (check state and local laws) | January 1 and July 1 |

| Verify exempt salaries meet $684/week federal or higher state thresholds | January 1 | |

| Confirm tipped employees receive full minimum wage (cash wage plus tips) | Each pay period | |

| Include non-discretionary bonuses in overtime regular rate calculation | Each pay period | |

| Timekeeping | Capture pre- and post-shift work and remote hours in time records | Each pay period |

| Document meal breaks taken | Daily | |

| Records | Retain payroll records 3 years; timecards and wage tables 2 years | Ongoing |

| Maintain I-9s, pay stubs, and classification analyses for inspection | Ongoing | |

| Pay Equity | Post salary ranges in job listings | Each posting |

| Submit pay data reports by deadline | Annually | |

| Audits | Run an internal wage and hour compliance audit | Quarterly |

| Review state law updates for all employee work locations | Monthly |

While this HR checklist provides general guidance, companies should consult qualified legal counsel for advice on specific situations and jurisdictional requirements.

“One of the biggest operational misunderstandings about HR compliance is treating it as a policy exercise rather than a process discipline,” says Tom Bukevicius.

“On paper, many companies are compliant.

In practice, risk shows up in handoffs when time data moves from systems to payroll, or when managers make one-off pay decisions that never get reviewed.”

Bukevicius’s observation highlights the reality that compliance is not just about having a policy on paper.

Mistakes appear in everyday operational gaps, including:

Overall, as Christopher Pappas points out, addressing HR compliance challenges requires a shift in mindset.

“Compliance should not just focus on avoiding legal penalties but on integrating practical processes into daily operations. It is important to build compliance into the company’s culture and workflow. By doing so, companies can ensure smooth operations and avoid potential setbacks,” concludes Pappas.

HR compliance is often seen as a technical requirement, but at its core, it reveals how a company values its people and operations.

When employers treat each checkbox, from fair pay to transparent practices, as non-negotiable, compliance becomes a practical test of operational maturity.

As Yosi Yahoudai notes, “Compliance works best when it’s part of everyday processes, not just a project that comes and goes.“

Checklists, he adds, are most useful when tied to clear training and follow-through.

“They help reduce risk only if people know how and why to use them.”

When supported by technology, regular audits, consistent oversight, and leadership training, HR compliance checklists can foster a culture where errors are identified and corrected before they escalate, thereby establishing trust and fairness as defining characteristics of the workplace.

As employment laws and regulations continue to evolve, their proper implementation becomes even more challenging. To further simplify the complexities of HR compliance, we are addressing the most frequently asked questions and concerns of employers.

An HR compliance checklist helps companies systematically track and manage their legal and regulatory obligations. It provides a structured way for human resources teams to review their polices and ensure they align with applicable federal, state, and local laws.

Companies should check their HR policies at least annually, as well as whenever there are changes to employment laws or regulations.

They should also conduct reviews after significant business changes, such as expanding into new jurisdictions, updating pay practices, reclassifying roles, or shifting to remote or hybrid work arrangements.

Human resources teams use an HR compliance list to identify gaps in their policies and stay ahead of regulatory changes. These documents ensure that they don’t overlook compliance responsibilities, helping companies proactively avoid the risks of costly violations, audits, and penalties.

Wage and hour requirements are crucial in an HR compliance checklist. They typically cover minimum wage and overtime requirements, employee classification, timekeeping and hours worked, payroll accuracy, pay equity and transparency considerations, record-keeping requirements, state and local wage laws, and procedures for audits and corrections.

Content Writer at Shortlister

Browse our curated list of vendors to find the best solution for your needs.

Subscribe to our newsletter for the latest trends, expert tips, and workplace insights!

If endings shape the whole memory, why treat the exit process like admin work instead of strategy?

An HR investigation can easily turn into a stressful and uncomfortable experience, but your rights are your best defense. This Shortlister article helps you understand and use them.

Thought leadership is all about assisting people to understand themselves better, find their purpose, and achieve success in the long term. So, how to make way for thought leadership that works wonders?

“You only get one chance to make a first impression.” As the old saying is still true today, learn how to create a new employee orientation program to set up your new employees for success.

Used by most of the top employee benefits consultants in the US, Shortlister is where you can find, research and select HR and benefits vendors for your clients.

Shortlister helps you reach your ideal prospects. Claim your free account to control your message and receive employer, consultant and health plan leads.