Employee Benefits Report: Benefits Administration

How can employers meet diverse employee needs while simplifying benefits oversight, administration, and vendor management?

COO at AAA State of Play

Founder and CEO / Health & Fitness Entrepreneur at Hypervibe (Vibration Plates)

Chief Operating Officer at InboxAlly

President & CEO of Zaxis Inc.

Director of Demand Generation & Content at Thrive Internet Marketing Agency

CEO & Founder of Fig Loans

As executive teams focus on growth, a silent tension is pulling at their people strategy: nearly half of companies struggle to reconcile equitable pay with compensation spending.

According to Payscale’s Compensation Best Practices Report, 44% of survey participants feel that compensation is their most significant challenge in 2025, continuing a trend seen over the last two years.

Yet, only a third have a “mature” compensation model (advancing or optimizing), and almost four in ten still lack a formal strategy.

Effective enterprise compensation management closes the gap between potential, company goals, and the current reality, especially in large corporations.

But what does that look like in practice?

Our complete guide will walk you through the steps of developing a pay and rewards infrastructure that balances equity, cost-efficiency, and competitiveness.

Enterprise compensation management involves planning, designing, and administering a large company’s pay and reward system.

This process represents the cornerstone of HR strategy and can involve anything from creating pay grades to budgeting complex benefits systems.

It complements the operational aspects, such as tax compliance, multi-state payroll processing, or benefits administration, with a strategic approach to managing the entire compensation structure.

Its relevance is intensifying in the current business landscape.

A closer look at labor costs shows that they account for up to 70% of overall business expenditures, making compensation management a critical area for controlling costs and driving business outcomes.

In a market shaped by inflation pressures, shifting employee expectations, and a push for pay transparency, how companies approach pay and rewards strategies can directly impact profitability, retention, and competitiveness.

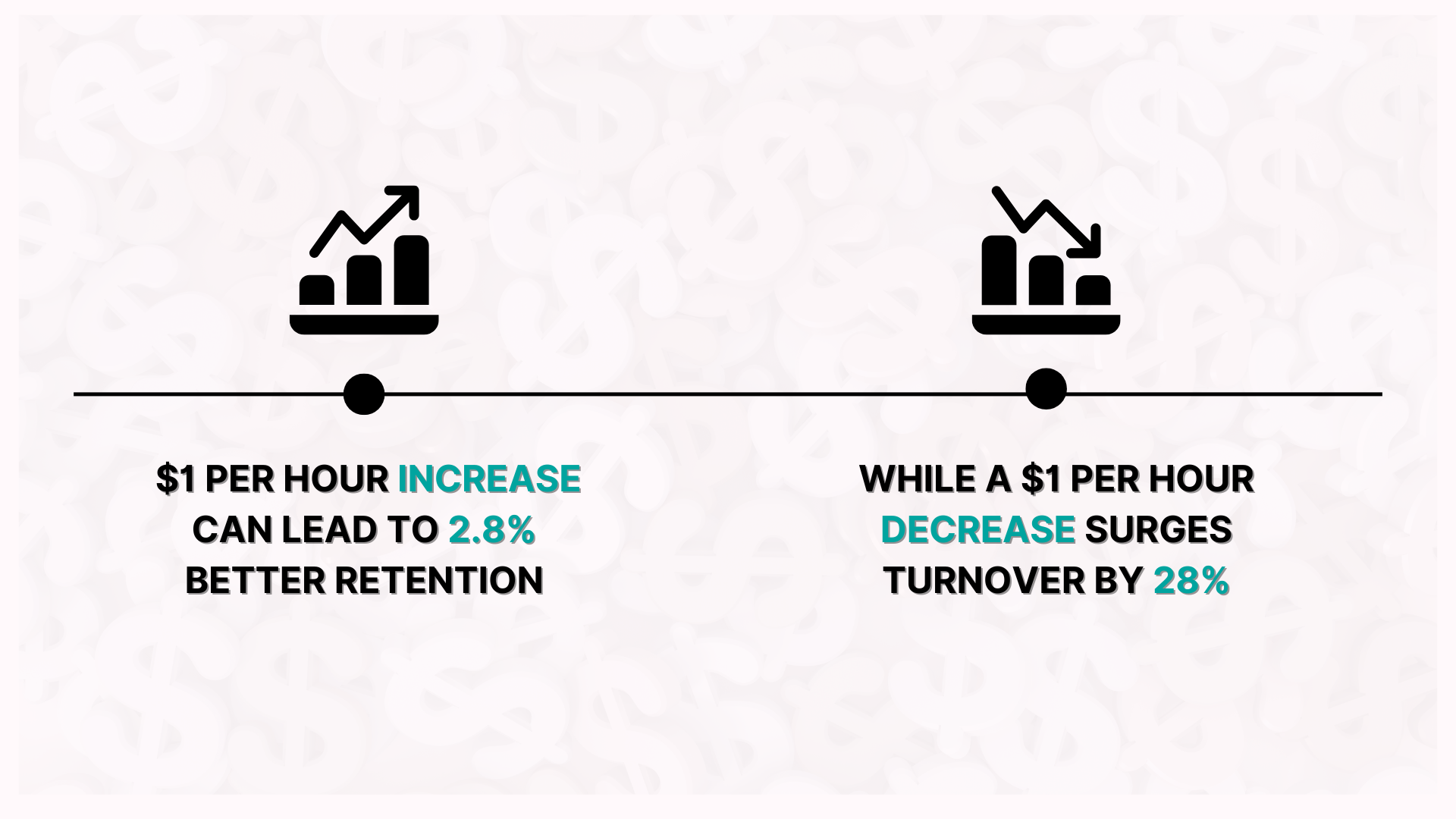

The business case for higher wages and better benefits is so apparent that even a minor adjustment can make a significant difference.

A Harvard study, The Payoffs of Higher Pay, revealed that a $1 per hour increase can lead to 2.8% better retention, while a $1 per hour decrease surges turnover by 28%.

Concurrently, wellness statistics show that for every dollar spent on well-being benefits, companies save $5.82 in lower employee absenteeism costs.

Understanding the strategic and financial ripple effects behind these subtle changes in compensation is the foundation of its successful management.

What can go wrong, what can go right, and what’s the best path forward all depend on having the proper structure, data, and strategy in place.

The best enterprise compensation management models drive ROI through productivity, retention, and a competitive advantage in attracting talent.

“Compensation management has been our biggest growth driver,” says Zac Peeler, President and CEO of Zaxis Inc.

“We went from struggling with talent retention to having people actively refer quality candidates.

The ROI is clear: our revenue per employee increased significantly while our hiring costs dropped because employees became our best recruiters,” concludes Peeler.

Enterprise compensation management relies on multiple interconnected elements, each serving specific strategic purposes while contributing to an integrated rewards framework.

Understanding the core components (or what ideally goes into a compensation package) and how they work together is the first step in supporting effective oversight.

As salary firmly holds its place as the most important job factor for American workers, its design inevitably forms the foundation of effective compensation management.

Modern structures typically employ job evaluation methodologies that consider multiple factors, including the scope of responsibility, required skills and experience, decision-making authority, and impact on business outcomes.

At the same time, the pay grade administration oversees the income levels as part of the salary structure.

These are specific “tiers” that group jobs based on similar roles (horizontal equity) and responsibilities (vertical equity). Managing them involves defining these levels, setting salary ranges for each pay grade, and overseeing adjustments like promotions, salary increases, or changes due to market shifts.

In large companies, these two components work hand-in-hand to maintain a fair, competitive, and transparent compensation system.

To stay competitive, salary structures and pay grades should be regularly benchmarked against market data and designed with enough flexibility to adapt to changing business needs.

While important, salary is not the only factor driving the employee experience.

Employee rewards statistics show that 82% of workers consider recognition essential for job satisfaction.

However, it needs to be genuine to make an impact, as 64% choose meaningful recognition over frequent praise while 47% prefer a personalized incentive.

When the incentives satisfy employees’ individual needs, they are seven times more likely to be engaged at work.

Performance-based incentives represent the most direct connection between employee contributions and rewards. They have the potential to model behavior, maintain fairness in the workplace, and support business goals.

Therefore, well-designed incentive programs become another core component of effective enterprise compensation management.

Employees increasingly evaluate compensation through a holistic lens.

For companies, this means recognizing that base salary represents only one component of the complete value proposition.

Total rewards management integrates all forms of compensation, including direct compensation (base salary and incentives), benefits (e.g., health insurance, retirement plans, PTO), work-life initiatives (flexible schedules, remote work options, or wellness programs), and career development opportunities.

The challenge lies in balancing the total rewards cost against the needs and preferences of a multigenerational workforce, which leading companies usually achieve through flexible benefits plans.

One final aspect to consider is the long-term impact as a defining criterion that separates reactive pay strategies from effective enterprise compensation management.

Long-term incentive plans embody this principle by tying recognition to sustained business performance. They reward workers for achieving predetermined business goals and encourage commitment to the company’s goals over time.

Equity compensation, such as restricted stock units (RSU) and performance shares, is a common non-cash form of LTIPs. These incentives give employees partial ownership of the company, motivating them, especially executives and top talent, to align their interests with shareholder value.

According to a McKinsey report, inadequate compensation is a leading reason workers across all age groups leave their jobs.

When turnover costs reach one-half to two times the employee’s annual salary, a good pay strategy can become the deciding factor in attracting and retaining talent.

Compensation planning is designing a pay program that aligns base salaries, benefits, and rewards with business priorities and employee needs.

This step balances the core components (salary, benefits, incentives) against organizational goals, market competitiveness, employee performance, and budgetary considerations.

When optimized, it creates a competitive position in the job market, allowing companies to improve their retention.

Market benchmarking provides the external perspective necessary for competitive compensation positioning. It includes a complete analysis of total rewards packages, performance standards, and market trends.

The process usually begins by identifying comparable companies, typically direct talent competitors, similar-sized employers in the same industry, and organizations in the same geographic markets.

Benchmarking data comes from salary surveys, consulting databases, and published or custom studies, and its frequency can vary from quarterly reviews for high-demand roles to annual or occasional updates.

Competitive positioning is what sets your offer apart in the job market. It involves strategically deciding where to position compensation relative to market benchmarks.

Will you position your pay at the 75th or 90th percentile to attract top talent?

Will you align your salary structure with the market median (50th percentile) while focusing more on other value propositions?

If you’re cost-focused, you may also consider a below-the-market position while excelling in job security or work-life balance.

This decision largely influences talent acquisition, retention efforts, and employer brand perception. However, it’s important to maintain flexible positioning strategies that adapt easily to volatile market conditions.

Compensation should reflect employee contribution.

Merit-based pay structures translate performance differences into compensation differences, creating incentives for high performers while maintaining base salary competitiveness.

These work best based on fair, transparent, and data-driven performance reviews.

However, they must capture how individual performance supports broader team outcomes across the value chain.

“Companies that tie incentive pay to meaningful value chain milestones create stronger, more collaborative teams,” illustrates Jeffrey Zhou, CEO and Founder of Fig Loans.

“When bonuses are linked to outcomes like on-time delivery, product usability, or customer retention, departments begin to work in true partnership rather than in silos.”

According to Zhou, revenue tells part of the story, so companies should recognize the full effort it takes to deliver value, including operations, product, and customer success.

“Incentives that reflect the full journey from design through delivery build habits of alignment and shared responsibility.

This kind of structure rewards consistency, clarity, and team-wide accountability. It shows the business values long-term trust as much as short-term wins.”

Strategic compensation planning works within the constraints of financial reality.

Therefore, allocating budgets across departments, roles, and incentive programs should be realistic and involve close collaboration between HR, finance, and executive leadership.

Budgeting must also consider economic shifts, inflation, and other market disruptions.

In this case, “scenario planning” can help companies prepare for plausible outcomes and market conditions. This approach typically includes best-case, worst-case, and most likely scenarios with corresponding allocation strategies.

Financial forecasting allows for quick decision-making when budget parameters change.

After allocating the budget, the leadership challenge shifts from how much to spend to how well it’s spent.

Strategic compensation planning ensures those funds are purposefully deployed, targeting critical roles, high-impact teams, and performance outcomes.

One way to do this is by conducting audits of current compensation to identify inefficiencies and misalignments with business goals.

Next, define clear compensation and benefits strategies that align with market benchmarks, employee needs, and company values.

Implementing cost-effective, flexible benefits can optimize spending, while employing technology can improve accuracy and maintain legal and regulatory compliance.

Finally, continuous monitoring and adjustment ensure compensation programs remain competitive, fair, and financially sustainable as business needs evolve.

With the planning and design phases established, it’s time to move into administering compensation, where strategic and disciplined execution ensures the pay programs deliver real impact.

Data shared by Forbes reveals four main strategies for achieving the best results:

Successful compensation programs start with understanding what truly motivates your workforce. Use one-on-one conversations or anonymous surveys to align compensation with their needs beyond pay, including career aspirations, expanding skill sets, life goals, and values.

Your compensation strategy should reflect fairness, transparency, and market competitiveness. Conduct regular salary audits to benchmark pay against industry and regional standards.

Performance-linked compensation can incentivize high achievers. However, to preserve motivation and clarity, it’s essential to maintain a transparent appraisal process and separate discussions about bonuses from performance feedback.

Forbes also highlights that comprehensive benefits packages are key differentiators in employee retention. Health insurance, retirement plans, and paid time off remain vital, but flexible work schedules and wellness programs are increasingly important.

Therefore, regularly review and adapt your benefits to remain competitive.

In addition to these strategies, Lacey Jarvis, the COO of AAA State of Play, acknowledges that, “a well-built compensation strategy should feel steady, transparent, and human.”

“If someone can’t predict how their effort translates into reward, they won’t bring their best to the table. Especially in high-performance teams, clarity beats cleverness every time.

Executives who treat comp design as part finance, part storytelling tend to build stronger, stickier cultures—and better business outcomes.

Because when compensation feels fair, people stay focused on growing the company, not second-guessing their worth,” concludes Jarvis.

The way companies handle employee pay and rewards has become increasingly tech-enabled.

Enterprise compensation management software evolved to support more strategic, data-driven decisions across large, complex organizations. It complements existing HRIS, performance management, and payroll services to create a seamless HR tech ecosystem.

That said, selecting the right solution requires careful evaluation of current and future needs.

Functional requirements typically include core administration capabilities like salary tracking, incentive management, and data centralization.

However, enterprise organizations also need advanced features like workflow management, reporting and analytics, and strong integration capabilities with other business systems.

Scalability is another primary consideration.

The selected provider must handle large employee populations, complex organizational structures, and multiple business units or geographic locations. It should also accommodate growth and changing business requirements without requiring a complete system replacement.

Overall, investing in a robust solution frees HR to focus on strategic activities rather than administrative tasks.

While compensation is often viewed through the lens of motivation, its legal and ethical dimensions are just as significant, especially for large enterprises that span multiple countries and jurisdictions.

Employers must maintain detailed records of all compensation plans and payouts. Accurate documentation supports tax compliance, annual disclosures, and audit readiness.

Labor laws, tax regulations, and wage standards are constantly evolving. Therefore, ongoing legal guidance is essential to ensure compensation practices remain compliant across all jurisdictions, including local, domestic, and international.

Compensation decisions must also comply with anti-discrimination laws, ensuring equal pay for equal work regardless of gender, race, disability, or background.

Routine internal audits help verify compliance, identify discrepancies, and address legal or ethical risks before they escalate.

Large companies face unique challenges in compensation management, requiring sophisticated strategies that balance consistency with flexibility, efficiency with customization, and global integration with local responsiveness.

These advanced strategies often become competitive advantages for organizations that implement them effectively.

Global compensation management presents one of the most complex challenges for multinational organizations. The tension between consistency and localization affects every aspect of their payment strategy, from job evaluation methods to incentive plan design to benefits offerings.

On the one hand, global consistency offers significant benefits, such as simplified administration, clearer career progression paths, and stronger organizational identity.

On the other hand, localization is necessary for staying competitive and culturally relevant.

Labor markets vary significantly between countries, with different supply and demand dynamics, regulatory requirements, and cultural expectations. What motivates employees in one culture may be less effective or even counterproductive in another.

Murray Seaton, founder and CEO of Hypervibe, reflects on his experience, explaining that “compensation is a behavioral signal that tells your team what you truly value.”

“When we launched in multiple global markets, I quickly saw how one-size-fits-all models fall apart.

In Australia, flexibility outweighed bonuses. In Eastern Europe, immediate cash rewards drove results. In the U.S., equity helped retain engineers who’d otherwise jump in a year,” concludes Seaton.

The “global framework, local implementation” model is one potential compensation approach to balance this. This strategy applies shared principles globally while adjusting details like pay grades and salary ranges to fit local conditions.

Another challenge is the incentive program design, which requires a separate strategy.

A large company with thousands of employees can’t rely on a uniform model, especially when roles, goals, and performance drivers vary widely across functions and regions.

Individual incentives are effective for roles where personal output is easily measurable, like sales or customer service. However, they can create unhealthy competition and a much heavier administrative burden.

Team-based incentives promote collaboration and are better suited for projects requiring cross-functional effort. These programs align everyone toward shared outcomes, but risk diluting motivation if high performers feel their effort isn’t fully recognized.

Since both have pros and cons, choosing the right model depends on business objectives, team dynamics, and cultural context.

Another solution is a layered approach that combines individual, team, and organizational incentives, such as performance bonuses, team achievement awards, or company-wide profit sharing.

Executive compensation usually faces intense scrutiny from shareholders, regulators, and the public, demanding careful design and clear justification for all program elements.

A single misstep in executive compensation can either drive top leadership talent away or damage the company’s credibility.

Take, for example, the backlash over Starbucks CEO Brian Niccol’s 1,000-mile commute by corporate jet, which goes against the company’s sustainability efforts. Or, Goldman Sachs’ January 2025 grant of $80 million in restricted stock units to its CEO and COO amid growing shareholder dissatisfaction.

“A disconnect between leadership pay and company performance can quickly erode trust,” confirms Paul Eidner, Chief Operating Officer at InboxAlly.

Therefore, executive pay plans must be carefully balanced, market-competitive, performance-driven, and aligned with governance standards due to their visibility and impact.

Based on his experience managing executive compensation, Eidner advises linking pay to tangible outcomes to preserve fairness and inspire accountability.

“A thoughtful compensation strategy isn’t just about numbers on a spreadsheet; it’s about showing employees that effort and achievement are truly valued”, says Eidner.

Board oversight of compensation programs has intensified significantly in recent years, driven by increased shareholder activism, regulatory requirements, and public response to executive pay practices.

These committees guarantee that payment policies align with corporate strategy, shareholder interests, and evolving regulatory expectations.

Their oversight typically involves:

Strong governance from the board helps prevent reputational risk, supports investor confidence, and ensures compensation programs serve long-term business goals.

Compensation plays a pivotal role in both due diligence and post-merger integration. Poorly aligned pay practices can lead to culture clashes, talent loss, and disrupted deal outcomes.

Deloitte highlights that a thoughtfully designed compensation strategy throughout the M&A life cycle helps mitigate retention risks and supports a smoother integration. According to their analysis, key considerations include:

Broad talent focus or keeping top contributors beyond executives to preserve organizational knowledge and support long-term growth.

If you only see compensation as a cost, you’re overlooking its impact.

“Compensation directly impacts business growth through talent acquisition speed, retention rates, and performance motivation,” says Brandon George, Director of Demand Generation and Content at Thrive Internet Marketing Agency.

He then explains that measuring it requires tracking revenue per employee, time-to-productivity for new hires, and voluntary turnover rates rather than just payroll costs.

“We measure compensation ROI by analyzing how quickly new hires reach full productivity, whether top performers stay longer than industry averages, and if compensation investment correlates with client satisfaction scores and revenue growth.

Effective compensation management becomes a competitive advantage when it attracts talent that drives measurable business outcomes rather than simply maintaining market competitiveness,” concludes George.

For Zac Peeler, effectiveness can also be measured through culture metrics, not just financial ones.

“We track internal promotion rates, employee referral success, and how quickly new hires reach full productivity. Since implementing our comprehensive benefits package (100% paid medical, disability, life insurance, plus the bonus structure), our time-to-productivity for new hires dropped from 6 months to 3 months.”

The bottom line is that compensation programs transform talent costs into talent investments that deliver measurable returns across every aspect of a business.

As workforces evolve, laws change, and business priorities shift, the best enterprise compensation management models remain adaptive, data-driven, and human-centered.

Companies at different stages of development will have different priorities and resource needs, but all can benefit from sustained commitment and continuous improvement through:

Additionally, they can tap into resources such as compensation consultants, legal guidance, and certification programs (Certified Compensation Professional, CCP).

Finally, professional networks (e.g., WorldatWork and SHRM) and thought leadership resources (Shortlister) can help leaders anticipate future challenges and opportunities in enterprise compensation management.

Content Writer at Shortlister

Browse our curated list of vendors to find the best solution for your needs.

Subscribe to our newsletter for the latest trends, expert tips, and workplace insights!

How can employers meet diverse employee needs while simplifying benefits oversight, administration, and vendor management?

A great onboarding process can make a significant difference in retention. Explore 120+ onboarding statistics that show how valuable this process can be for a company.

While competitive salaries help, retaining top talent involves much more than financial incentives. These insightful employee retention statistics reveal how employers can turn high turnover into even higher loyalty.

Find a suitable platform to connect and engage with your global audience at no cost.

Used by most of the top employee benefits consultants in the US, Shortlister is where you can find, research and select HR and benefits vendors for your clients.

Shortlister helps you reach your ideal prospects. Claim your free account to control your message and receive employer, consultant and health plan leads.