Can I Cash Out my 401(k) while still Employed?

You can cash out 401(k) early while still working. But how will it affect tax retributions and your overall pension fund?

The turbulent events of the past few years reshaped the investment ecosystem, introducing new and somewhat anticipated investment management trends.

From geopolitical turmoil and the rise of inflation worldwide to the expansion of generative AI (GenAI) and record bull markets, there have been as many challenges as there were opportunities.

As employers seek investment solutions for their business and employee benefits packages, this Shortlister article provides direction in an already complex investment landscape by exploring the most significant asset management trends shaping 2025.

Investment management involves overseeing the financial assets of individuals, organizations, or institutions to achieve specific financial goals.

In the workplace, it plays a crucial role in both corporate and personal finance.

On one side, it helps organizations make better investment decisions and influences how they allocate their capital, ultimately impacting their ability to grow, expand, and remain competitive.

On the other, investment management services, as part of a comprehensive benefits package, help workers make informed financial decisions about their future. These benefits may include access to retirement savings plans, investment advice, and educational resources on financial literacy.

Thus, while wealth and asset management trends are significant for investment managers, they also impact how employers maximize returns and structure their financial benefits packages and how employees manage their finances and generate wealth.

With that in mind, from emerging technology to digital investments to an impending shift in growth and tax strategies, here’s what to expect for the rest of 2025.

Expectations among investors, employees, regulators, and society are growing.

Research shows this is especially true for mutual funds, creating challenges and opportunities for investment managers.

While investors seek innovation, transparency, and personalization, regulators are vigilant, emphasizing compliance, transparency, and cybersecurity.

The workforce, on the other hand, is challenging the way companies retain and attract talent.

Expectations shifted to work flexibility and purpose-driven jobs, especially during the pandemic. Moreover, diversity, equity, and inclusion (DEI) came into focus, and tech-enabled experience became paramount for companies to remain competitive.

Beyond this, stakeholders also demand trust and social responsibility.

According to research by PwC, 91% of executives agree that their ability to earn and maintain trust with stakeholders improves the bottom line. Moreover, 50% of workers want companies to take a stance on social issues only if they’re related to the core business, with business leaders agreeing that this will increase stakeholder trust.

These predictions and trends underscore the dynamic nature of asset management, where meeting evolving expectations from stakeholders while navigating regulatory requirements and workforce dynamics is essential for success.

The unprecedented technological growth in the past couple of years makes this the most anticipated and, perhaps, most predictable investment management trend for 2025.

According to PwC, nine in ten institutional investors believe that using big data, AI, and blockchain, among other disruptive technologies, will lead to better outcomes and investment returns.

On top of that, GenAI stands out as one of the latest innovations revolutionizing operations in many industries, including asset management.

Right now, this AI product can generate different data, text, images, audio, and video, aiming to optimizeoperational efficiency, facilitate data-driven decision-making, augment data analysis, and more.

In fact, a survey by McKinsey reveals that 79% of respondents across different regions, industries, and seniority levels have some exposure to gen AI, while 22% regularly use it in their work.

Considering its expansion, employers should seek investment management partners that embrace digital transformation and leverage advanced technologies to deliver personalized solutions and meet evolving client needs effectively.

As a direct consequence of emerging technologies, strategic digital investments have surfaced as another significant asset management industry trend.

McKinsey’s survey on GenAI reveals that high-performing companies—those where AI contributed at least 20% to their earnings—fully embrace this technology, using it across multiple business functions like product development, risk management, and HR tasks.

At the same time, these companies prioritize GenAI to create new revenue rather than cutting costs. They are twice as likely to focus on developing new businesses or enhancing existing ones with new AI-based features.

That isn’t to say that cost savings aren’t driving digital investments, especially for smaller businesses and startups jumping on the AI train.

BlackRock iShares report predicts a 70% increase in AI investment driven by lower costs in 2024. Less than a third, or 29%, will use AI for new revenue streams, and 5% intend to use it for transformation.

These strategic digital investments, when done right, are instrumental in enhancing operational efficiency.

Considering the expansion of technology, they are also likely to continue beyond 2025.

Amid evolving client preferences, heightened expectations, and shifting market dynamics, investment management firms are increasingly adopting new growth strategies.

Traditionally, investors relied on beta returns attributed to market movements.

Now, asset and wealth management (AWM) firms must diversify their approach.

The latest EY CEO Outlook Pulse survey reveals that 98% of CEOs intend to pursue a strategic transaction in the next 12 months, a significant increase from 89% last January.

Among these, 58% specifically consider mergers and acquisitions (M&A).

Additionally, a separate report for Europe by CMS suggests that the UK and Ireland are poised to witness the highest growth in M&A activity this year.

These M&As and strategic partnerships allow firms to expand into new asset classes, tap into emerging distribution channels, and enter new geographical markets, all while driving sustainable growth.

Moreover, as the wealth transition unfolds and private markets become more important, the shift in growth strategies becomes even more relevant.

A pending “great transfer” of wealth, projected to amount to over $84 trillion, is poised to reshape the AWM industry.

According to a report by Cerulli, of those, heirs will get $72.6 trillion, and $11.9 trillion will go to charities.

As younger investors inherit assets, their investment objectives could create new opportunities different from those of the generations before them.

Early indicators suggest a shift in investment, hinting at the emergence of new investment management industry trends.

For example, a Bank of America Private Bank report reveals that 75% of Millennials and Gen Z investors won’t rely on traditional stocks and bonds.

These investors, aged 21 to 42, hold a quarter of their portfolio in stocks, compared to older investors with 55%.

In fact, the younger generations are convinced that relying solely on that won’t yield above-average returns.

Instead, they are open to alternative investments, including crypto, private equity, private debt, and direct investment in companies.

Moreover, younger investors also perceive the potential for wealth growth in their personal brand or business. At the same time, those aged 43 and above prefer traditional asset classes, mainly domestic and international stocks.

Real estate remains popular across all age groups.

As they inherit wealth, new investors are more likely to advocate for diverse investment options, bringing private markets into the spotlight.

Consequently, employers should look for investment management partners capable of adapting their strategies to cater to the evolving preferences of the next generation.

Private markets emerge as another investment management trend, presenting opportunities for asset management firms to diversify their offerings.

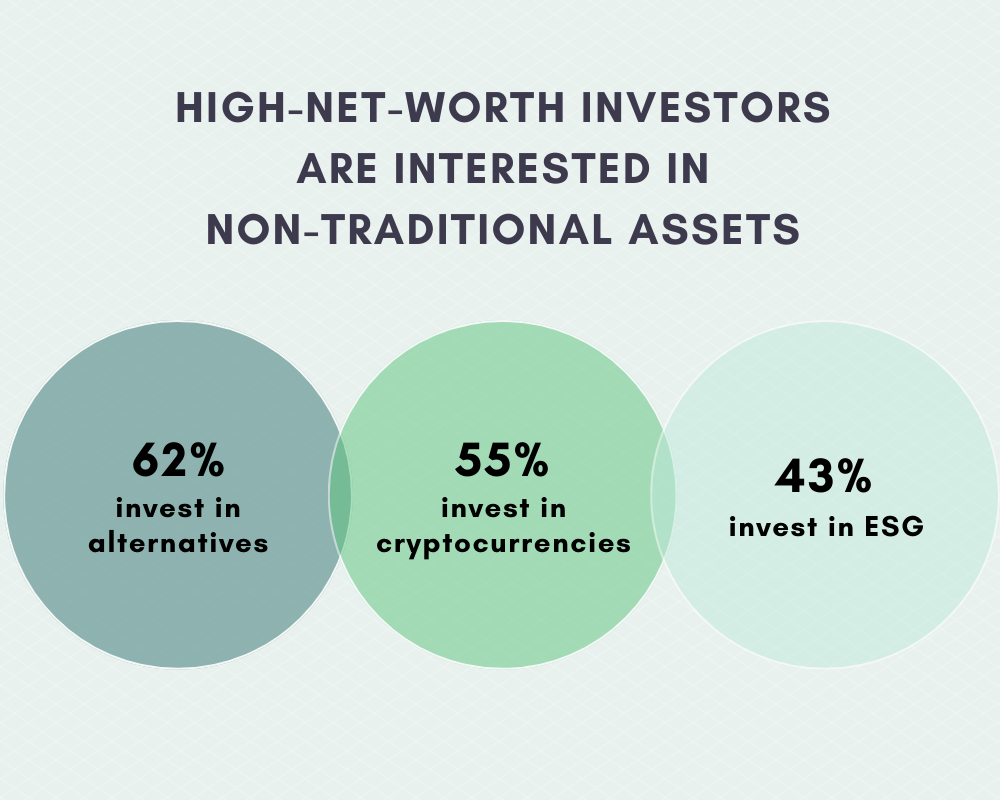

For one, research shows that high-net-worth (HNW) investors are interested in non-traditional assets or:

Driven by the demand for growth from shareholders and owners, asset management firms increasingly focus on offering alternative market products to HNW investors.

Simultaneously, technological advancements and evolving regulations make private market products more accessible to a broader investor base.

This change has prompted interest in retail investorsseeking access to private market products historically limited by high investment minimums and illiquid structures.

Overall, following the rise in interest, employers should consider investment management partners that offer access to private market products and leverage technology to enhance accessibility and liquidity for employees.

As the last on the list, tax strategies closely correlate to the other investment management industry trends we explored.

Each trend presents unique challenges for tax planning and regulation, requiring a strategic approach that won’t be too costly.

For example, interest in private market transactions might involve complex tax structures and compliance requirements. At the same time, non-traditional assets need a different approach than traditional ones. One example is cryptocurrencies, which still face inconsistent tax treatment due to a lack of a comprehensive regulatory framework.

Moreover, mergers, acquisitions, and strategic partnerships may trigger tax implications such as capital gains, tax liabilities, transfer pricing issues, and concerns related to tax treaties.

Thus, tax optimization strategies play a pivotal role for AWM firms.

Outsourcing tax reporting functions or using tax-advantaged accounts such as IRAs or 401(k)s can mitigate some compliance risks, but not all of them.

Hence, it’s essential to integrate tax concerns into strategic decision-making so that businesses can optimize value creation and minimize regulatory complexities.

While it’s difficult to predict the exact evolution of the AWM industry due to its complex and ever-evolving nature, these asset management industry trends are a response to what’s already in motion.

So, as we navigate the complex terrain of 2025, embracing proactive measures helps us adapt to these evolving challenges and opportunities.

For asset and wealth managers, that means shifting their strategies, expanding offerings, embracing digital transformations, and strengthening stakeholder trust.

On the other hand, employers seeking investment management providers must understand and align with these investment management trends to deliver value and drive long-term financial wellness for their business and employees.

Disclosure: The information provided in this post is for general informational purposes only and should not be considered as legal, tax, accounting, or investment advice. For advice on specific issues, please consult with a qualified professional.

Content Writer at Shortlister

Browse our curated list of vendors to find the best solution for your needs.

Subscribe to our newsletter for the latest trends, expert tips, and workplace insights!

You can cash out 401(k) early while still working. But how will it affect tax retributions and your overall pension fund?

It’s almost impossible to predict when a stock market crash will happen and how long it will last. Thus, how can you find peace of mind long before and after your retirement?

Understanding the pros and cons of using 401(k) as a first-time home buyer is crucial. Should using the 401(k) as a first-time home

buyer be considered as a last resort?

What is the cost of employee financial stress? For employers, economic hardships usually mean reduced efficiency, increased absenteeism, and turnover rates. But for employees, the situation can be even more challenging.

Used by most of the top employee benefits consultants in the US, Shortlister is where you can find, research and select HR and benefits vendors for your clients.

Shortlister helps you reach your ideal prospects. Claim your free account to control your message and receive employer, consultant and health plan leads.