Employee Benefits Report: Payroll

From behind-the-scenes support to the forefront of strategic HR innovation, payroll systems are evolving into indispensable tools for transforming the employee experience and driving organizational success.

It’s not uncommon for payroll mistakes to happen. When they do, the company reimburses the money it owes to its workers for their performance as retro pay.

Whether it’s a simple accounting mistake, an unpaid bonus, or a more pressing matter, there are ways for employees to get their money from the employer.

Therefore, it’s essential for both parties, including accounting and HR professionals, to fully understand this form of worker compensation, when and how it happens, the differentiation from back pay, and its effect on taxes.

Retroactive pay is a form of employee compensation.

When workers, usually by mistake, receive less money on their paycheck than they initially earned, the employer must repay them in a given period.

The unintentional money cut can happen for many reasons, including an accounting error or when an employee gets a raise in the middle of a pay cycle or contract negotiation. Regardless of the cause, when the company counteracts these mistakes, that’s what retro pay is.

This form of payroll reimbursement is usually the responsibility of HR managers and the accounting team. Once it happens, they should comply with wage and labor laws and handle it as quickly as possible.

A company’s retroactive payment is basically a paycheck adjustment.

Usually, the employee talks to a team leader or goes straight to HR to report the issue. Then, a human resource specialist communicates the problem with the accounting team, letting them know they need to make the retro pay adjustments for the next payment period.

It means they will reimburse the difference between the money they paid in the last pay period and the amount they owed and should’ve disbursed in the first place.

To calculate retro pay, we need to consider several aspects, including the type of salary, the duration of the payroll misstep, and the possibility of employee overtime.

Firstly, it’s essential to know the compensation type, or whether the employee’s pay is hourly or salaried. Sometimes the core of the issue happens when the worker switches from an hourly wage to a fixed salary.

The next thing to consider is the option for overtime work since this is one of the most common reasons for a payroll mistake. If employees are eligible for overtime pay by their contract yet didn’t receive it, the employer must make the retro pay adjustments.

Finally, to calculate gross retro pay, one must determine how many pay periods were affected and correct them as soon as possible.

In most cases, this error happens when the worker gets a raise or a promotion, but the paycheck remains the same. The payroll program has to process the increase, determine when the change happened and reimburse the money to the employee to track the potential mistake and see how many pay periods were affected.

After determining the error and all potential causes and factors, one can either manually calculate the total compensation shortfall or use a retro pay calculator. Then, companies withhold taxes and usually add the money to the paycheck under miscellaneous income.

Calculating retroactive payment considers the employee compensation type, whether the worker is exempt from overtime, and the duration of the payroll miscalculation.

Once HR or accounting establishes the error, the best way to process it is to use payroll software, preferably with a retro pay calculator, to avoid a manual calculation mistake.

Paying workers what they’re owed is every employer’s obligation. Once it sets up the pay cycle, the company must stay compliant and pay attention to labor laws.

However, it’s not uncommon for employees to get a smaller pay stub than expected. Once they notice the mistake, they should immediately notify a team leader, manager, or HR.

Generally speaking, retro pay is mandatory.

Usually, the employer covers the error as fast as the next paycheck. But if the workers don’t get monetary compensation and it counts as a breach of contract, the employer could face legal consequences.

The short answer is yes. Under certain circumstances, court rulings can require retro pay, including:

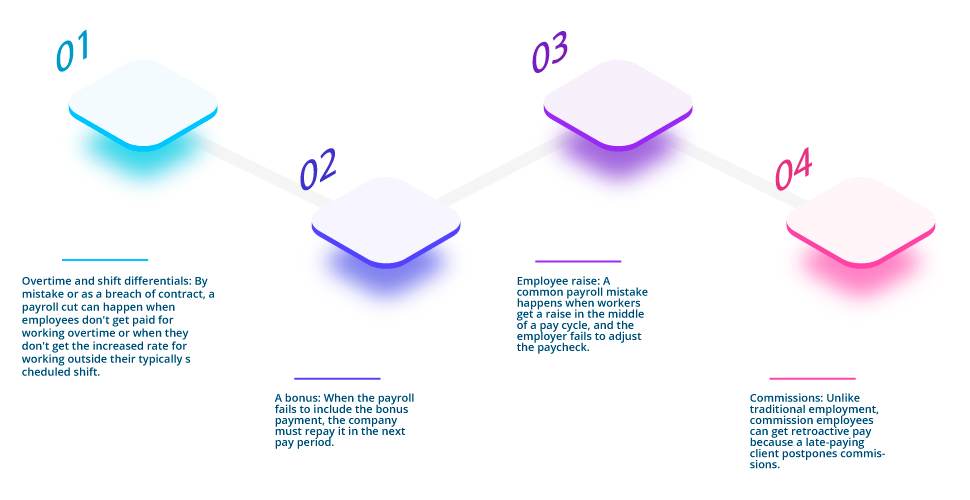

Compensation shortfalls are usually the result of an accounting mistake in the employee payroll.

When the issue happens, it’s often because of a change in salary in the middle of a pay cycle, but it can also occur due to:

Sometimes, companies can pay unemployment insurance retroactively. Employees who apply for a benefits check might receive it several weeks later since processing it takes time. They are eligible for unemployment retro pay or back pay when this happens.

These delays can also happen due to an applicant’s mistake, for example, incorrect or lack of information and other administrative issues.

The bottom line is that a breach in the eligibility date mandates employees to receive their unemployment insurance as retroactive payments regardless of the reason.

Although retro and back pay are both a type of company reimbursement, they differ in many aspects, including their nature, shortfall amount, and the reason they happened.

Namely, retroactive payment usually happens due to a miscalculation. On the other hand, back pay occurs when the employer doesn’t pay the worker for their performance or when the employee could but was prevented from performing.

Another distinction is that back pay is often higher since workers don’t receive the total settlement amount, while retro pay affects just a portion of their earnings.

Consequently, retroactive payments are more difficult to calculate since they need to include the particular payroll mistake that the employer made.

Retroactive payments are not exempt from taxes. The employer is responsible for complying with local laws and regulations and withholding taxes before reimbursing the employees.

That includes federal, state, and local income taxes and Social Security and Medicare taxes.

As supplemental pay, companies must be careful with tax calculations. To ease up the process, they can outsource expert payroll companies or implement an HRIS software that can help HR staff file taxes.

Payroll errors can happen. However, once they do, issuing retro pay as quickly as possible and ensuring their employees’ well-being is the responsibility of every employer.

Browse our curated list of vendors to find the best solution for your needs.

Subscribe to our newsletter for the latest trends, expert tips, and workplace insights!

From behind-the-scenes support to the forefront of strategic HR innovation, payroll systems are evolving into indispensable tools for transforming the employee experience and driving organizational success.

Learn how pre-tax deductions can be a great work perk to get many company benefits and insurance while saving money.

Learn more about the free payroll tools small business owners can use to save hours and grow their business.

Explore the advantages and disadvantages of payroll outsourcing to evaluate if it is the right solution for your business.

Used by most of the top employee benefits consultants in the US, Shortlister is where you can find, research and select HR and benefits vendors for your clients.

Shortlister helps you reach your ideal prospects. Claim your free account to control your message and receive employer, consultant and health plan leads.