What is a Payroll Tax Holiday?

Explore the perks and potential concerns of payroll tax holiday and their significance for workers and companies.

Over the last 12 months, the Consumer Price Index increased by 9.1%, the most significant increase on record since 1981. With record-high inflation rates, many states aim to revise their minimum wage standards to lessen the blow of high gas and food prices.

The minimum wage hasn’t kept up with the rising cost of living, leading many minimum wage workers to be impoverished – disproportionately harming women and people of color.

What is the federal minimum wage, and what are the implications of changing it?

This article aims to find answers surrounding this pressing issue.

The federal minimum wage is a labor law set by the Fair Labor Standards Act (FLSA) by which employers can determine the lowest hourly wage they can pay their employees.

Today, the federal minimum wage is $7.25 unless a worker’s occupation falls under a category specifically exempt from FLSA.

Hourly Minimum Wage | Weekly Minimum Wage | Yearly Minimum Wage |

$7.25 / hour | $290.00 / 40-hr week | $15,080.00 / year |

The government periodically adjusts the federal minimum wage level with changes in inflation or the cost of living, but Congress has left the minimum wage unchanged since 2009.

Although it has been over 13 years since the federal minimum wage increased, nearly half of the country’s minimum wage increased after January 1, 2022. A failure of action on the national level has resulted in states and localities raising the wage floors above the federal minimum wage.

Currently, Washington D.C., has the highest minimum state wage at $14.49 per hour. Over the next few years, several other states plan to follow suit.

Even though the federal minimum hourly wage hasn’t increased since 2009, the “Raise of Wage Act of 2023” is about to change this. As of July 25, 2023, the federal minimum wage will rise gradually to reach a minimum wage of $17 an hour by 2028.

This bill introduced in the US Senate and the US House of Representatives should gradually raise and eliminate the subminimum wages for tipped workers, youth workers, and employees with disabilities, resulting in equal wages for all workers covered by the Fair Labor Standards Act (FSLA).

Economic Policy Institute’s Analysis put those estimates into numbers. The analysis predicts that the federal minimum wage raises in 2023 will affect 27,858,000 employees throughout the United States or 19% of the country’s workforce.

Moreover, the impact of the “Raise of the Wage Act of 2023” will translate as an annual raise of $3,100 for the average worker in year-round job positions.

The federal minimum wage is applied nationwide and overrides state laws that provide a lower wage. This means employers may not pay employees under $7.25 per hour unless the worker’s occupation is specifically exempt from the minimum wage.

In 2020, 73 million workers in the United States aged 16 and above were paid hourly rates, representing 55% of all wage and salaried employees. Among them, 247,000 employees earned exactly the prevailing federal hourly minimum wage of $7.25 per hour.

Even more surprising is that about 865,000 workers had wages below the federal minimum. Altogether, 1.1 million American workers earned wages at or below the federal minimum.

As of February 3, 2022, President Joe Biden increased the minimum wage for federal civilian workers and contractors to $15 per hour.

Generally, employers must abide by the FLSA if they have at least $500,000 or more annual gross volume of sales or business done. It also applies to employees of smaller firms that do “interstate commerce” – if they do business between states. Under this definition falls, making phone calls to another state, sending mail out of state, or handling goods that come and go between other states.

In other words, this means the FLSA covers nearly all employers.

While employers are not obligated by law to offer pay above the minimum wage, they must consider the implications of doing so. Paying a competitive salary improves workers’ productivity and reduces turnover and absenteeism.

It also boosts the overall economy by stimulating consumer spending.

Covered, non-exempt employees have a right under federal law to receive overtime pay of at least 1.5 times an employee’s regular pay rate after 40 hours.

Specific exceptions to the 40 hours-per-week standards apply under special circumstances to firefighters and police officers employed by public agencies and workers of hospitals and nursing homes. The FLSA doesn’t require overtime pay for work on holidays, weekends, or regular days of rest unless overtime is worked on those days.

Since some states also have enacted overtime laws, in a case where an employee is subject to state and Federal overtime laws, the employee is entitled to the higher rate of overtime standard.

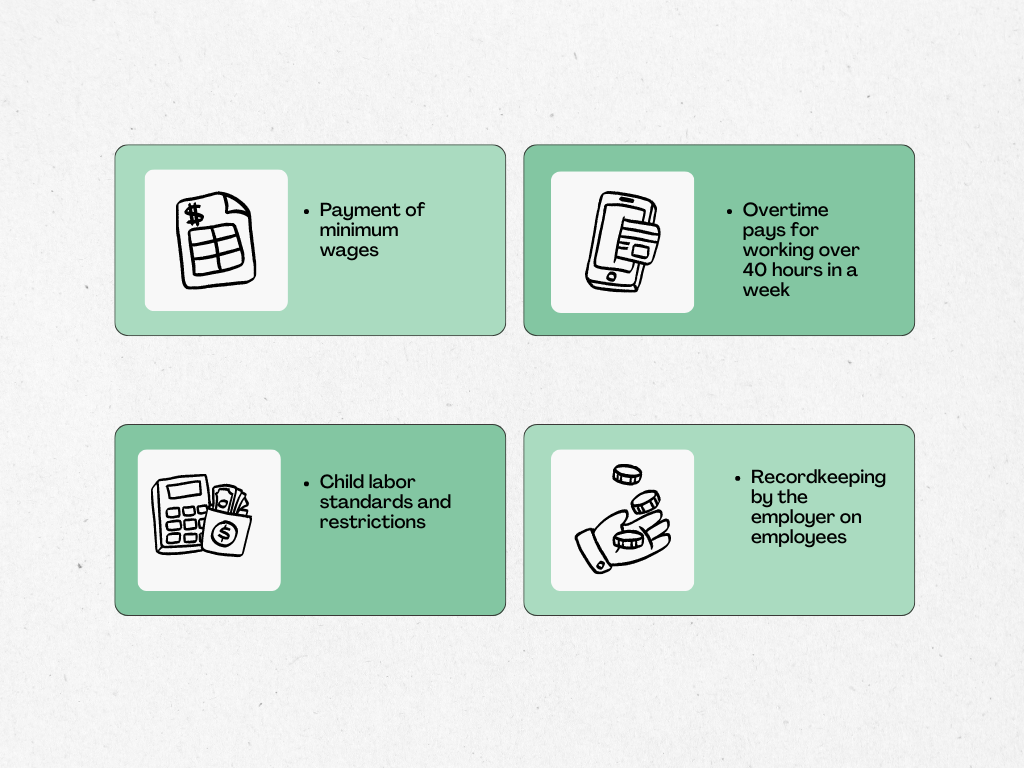

The Fair Labor Standards Act (FLSA) is a U.S. law that protects workers against unfair pay practices. The FLSA was signed and passed into law in 1938 by President Franklin D. Roosevelt and has seen numerous changes since then. While this law sets out various labor regulations, the four main elements covered by the FLSA are:

FLSA is one of the most important laws for employers to understand, as it sets out many regulations for dealing with employees.

Minimum wage laws were first introduced in the 1890s in New Zealand and Australia. The movement for a minimum wage initially attempted to raise the income of sweatshop laborers – predominantly women and young workers. Today, most modern developed and many underdeveloped economies enforce a national minimum wage.

In the United States, the first minimum wage law appeared in Massachusetts in 1912, establishing a minimum hourly rate for women and children under 18 years of age.

The federal government set a minimum wage of $0.25 under the Fair Labor Standards Act (FLSA) in 1938. This wage is worth $5.32 today when adjusted for inflation.

The federal minimum wage was last increased in July 2009. The Fair Minimum Wage Act of 2007 ordered the minimum wage to be increased from $5.15 to $7.25 in three increments.

Each individual state in the United States can impose its own minimum wage as long as the stipulated hourly wage is not lower than the federal minimum wage. In addition, many cities and localities may pass “living wage” laws, which may set an even higher minimum wage. An employer subject to the federal minimum wage vs. state requirement must pay the higher of the two.

For example, an employer would have to pay employees a minimum wage of $16.99 per hour, the city minimum and the highest wage standard, if a business is located in San Francisco, California.

The city wage is higher than the California minimum wage, which falls between $14-$15, depending on the size of the business, and the federal minimum wage of $7.25 per hour.

As of 2022, 30 out of the 50 states have a state minimum wage that exceeds the federal rate. The average minimum wage by state varies since states set a minimum wage that reflects the region’s cost of living. As a result of the rising cost of living, 23 states have announced they will raise their minimum wage in 2023.

New minimum wage rates for 2023 have been announced in the following states:

For employers with workers in different states, it’s important to accurately calculate gross wages and taxes to avoid any fines. Payroll software can help streamline payment of employees who work in multiple states, whether remotely, in-office, or a combination of both.

Employees who are paid on an hourly basis are often considered non-exempt.

Non-exempt employees are, for the most part, guaranteed to earn at least the federal minimum wage. Workers generally classified as non-exempt include, but are not limited to, the following:

Many American workers are unaware that the Department of Labor has specified dozens of exemptions to the Federal minimum wage law. Who can get paid less than the federal minimum wage, and why?

New data from the U.S. Bureau of Labor Statistics highlights the characteristics of federal minimum wage workers in 2021.

Most of the federal minimum wage earners are predominantly Black and Latina women. Many women struggle to make ends meet due to the increasing prices of necessities like food and gas, partly because of the gender wage gap.

In 2021, women were paid just 73 cents for every dollar a man earns, and women of color experienced even more significant disparities. The overrepresentation of women among those earning at or below the federal minimum wage has contributed to persistent gender and racial pay gaps.

Tipped workers and workers with mental or physical disabilities also earn subminimum wages, which remains fully legal on a federal level. Low-income workers are often most likely to be employed in the service industry – as dishwashers, fast food cooks, cashiers, and child care providers – representing nearly 74% of jobs that pay at or below the federal minimum wage.

Failure to increase the minimum wage in line with the cost of living has caused many workers to earn poverty-level wages and struggle to meet basic needs. Women and people of color, including Hispanic employees, often have limited access to worker protections and basic benefits – such as healthcare or paid sick days – and disproportionately experience a lack of access to quality healthcare, food and housing insecurity, and lower economic opportunities.

According to the Economic Policy Institute, net worker productivity has increased 61% since 1979, but hourly pay has barely grown since then. This means worker productivity has increased 3.5 times as much as employee pay.

Soaring inflation rates have forced lawmakers to reassess the federal and state minimum wages. As a result, nearly two-dozen states, counties, and local jurisdictions have increased minimum wages for workers in 2022. In addition, the minimum wage is indexed for inflation in 18 states and D.C., meaning it is automatically adjusted each year for price increases.

However, is minimum wage, state or federal, meant to be a living wage?

A living wage is the minimum income necessary for a worker to maintain a normal living standard and meet their basic needs. In 2021, the U.S. poverty threshold for a four-person household was an income of $26,500, which is equal to $13.25 per hour, above the current federal minimum wage.

A sharp decline in purchasing power means low-wage employees must work longer hours to achieve the basic standard of living. Therefore, many believe the current federal minimum wage fails to meet a living standard.

Moreover, the Economic Public Institute published a fact sheet analyzing the impact of raising the minimum wage to $15 by 2024 and found that it would lift pay for nearly 40 million workers.

However, increasing the minimum wage means higher payroll taxes for employers too. A higher minimum wage may have many effects that shouldn’t be overlooked, such as accounting for other wages, imputed income, or fringe benefits.

Raising the federal minimum wage sparks a debate, enlisting its advantages and disadvantages. On the one hand, some suggest that increasing the federal minimum wage will boost the overall economy. On the other hand, others argue that this act will have negative implications, especially in small businesses, with higher labor costs resulting in reduced hiring and slower economic growth.

What are some of the arguments supporting raising the minimum wage?

What are some of the arguments against raising the federal minimum wage?

Undeniably, the livelihoods of many workers can forever be changed depending on the answer to what is the federal minimum wage. Whether or not the minimum wage needs to be increased is yet to be decided. One thing is certain – business owners must stay up-to-date with the latest labor law changes.

Browse our curated list of vendors to find the best solution for your needs.

Subscribe to our newsletter for the latest trends, expert tips, and workplace insights!

Explore the perks and potential concerns of payroll tax holiday and their significance for workers and companies.

Streamline your payroll processes and ensure accuracy with free payroll software solutions.

From behind-the-scenes support to the forefront of strategic HR innovation, payroll systems are evolving into indispensable tools for transforming the employee experience and driving organizational success.

Payday might feel like just another date on the calendar, but it’s the difference between stability and stress for millions of employees.

Used by most of the top employee benefits consultants in the US, Shortlister is where you can find, research and select HR and benefits vendors for your clients.

Shortlister helps you reach your ideal prospects. Claim your free account to control your message and receive employer, consultant and health plan leads.