30+ Benefits of Corporate Wellness Programs

Discover over 30 advantages of implementing corporate wellness programs in your workplace.

Seven years ago, industry consultants predicted major shifts in workplace wellness. While these predictions were correct, the transformation exceeded even their most confident expectations. Now, with five years of actual behavioral data, Shortlister can close the loop on those predictions and reveal where the market is truly headed.

This context is especially relevant in 2026. Today, leaders are navigating tighter budgets, higher employee expectations, and increasing regulatory volatility. Employers face the fastest benefits cost increases in more than a decade, while employees demand deeper support for their mental, financial, and family health.

Given these pressures, organizations must separate genuine market signals from trends and be more intentional about how they invest in their people.

Our Workplace Wellness Trends Report for 2026 delivers something no survey can: actual buying behavior representing millions of employee lives over a five year span.

In 2018 and 2019, we surveyed leading benefits consultants about where they believed the industry was headed. Their predictions, based on years of experience and thousands of client interactions, represented the conventional wisdom of the time.

Seven years later, the data proves they were right, and not just directionally correct. The transformation exceeded even the most optimistic projections, with growth rates in the following categories far surpassing what consultants anticipated.

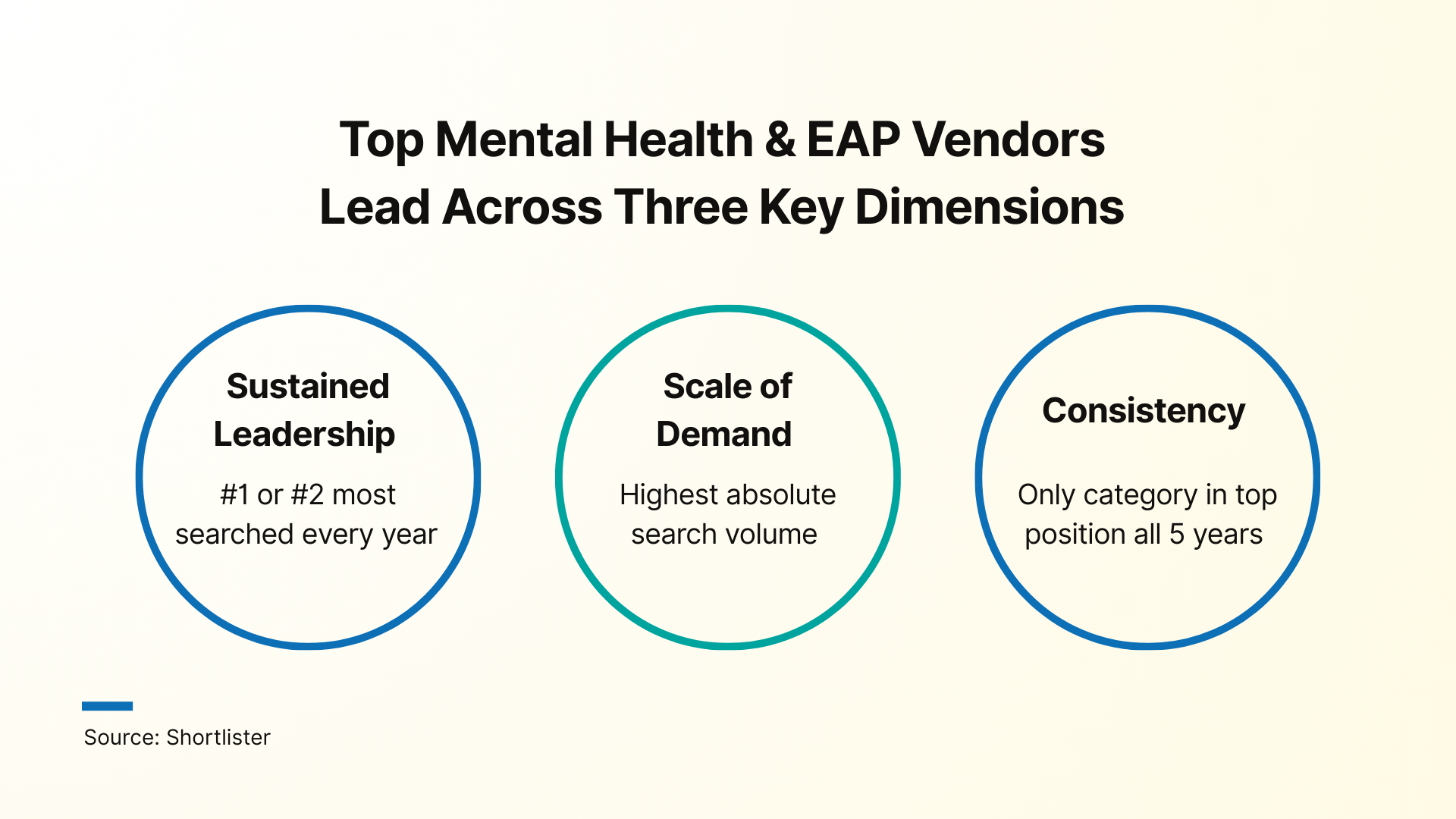

When consultants ranked mental and emotional wellbeing as the #2 growth category in 2018, they correctly predicted what would become a definitive transformation in workplace benefits.

Between 2020 and 2025, search activity for mental health and behavioral solutions increased 21% off an already high base. Mental health and EAP vendors dominate on three dimensions:

Early signals show that momentum has not slowed in 2026. Despite it being a well-established category, employers are actively reassessing vendors, upgrading delivery models, and layering in new capabilities.

In fact, employers are increasingly tying mental health to core health, disability, and talent strategies, treating it as infrastructure rather than a perk.

Five years ago, “wellness” typically referred to step challenges, biometric screenings, and one-size-fits-all programs. Today, wellness has evolved into an integrated, whole-person health ecosystem that encapsulates physical, mental, social, and financial well-being.

In 2018, 84% of consultants reported that clients were moving towards holistic wellbeing. That intent has now turned into a measurable reality. Holistic categories show 107% average growth, confirming that wellness strategies have expanded well beyond “health only” programs.

Traditional wellness models are still prevalent, but they are being reimagined. Corporate challenges are evolving into team-building and culture initiatives. Health coaching is transitioning from human-only to AI-augmented models. Traditional wellness platforms are repositioning as engagement hubs that orchestrate multiple point solutions.

As a result, the winning wellness strategies in 2026 will be built around personalization, flexibility, and outcomes rather than participation.

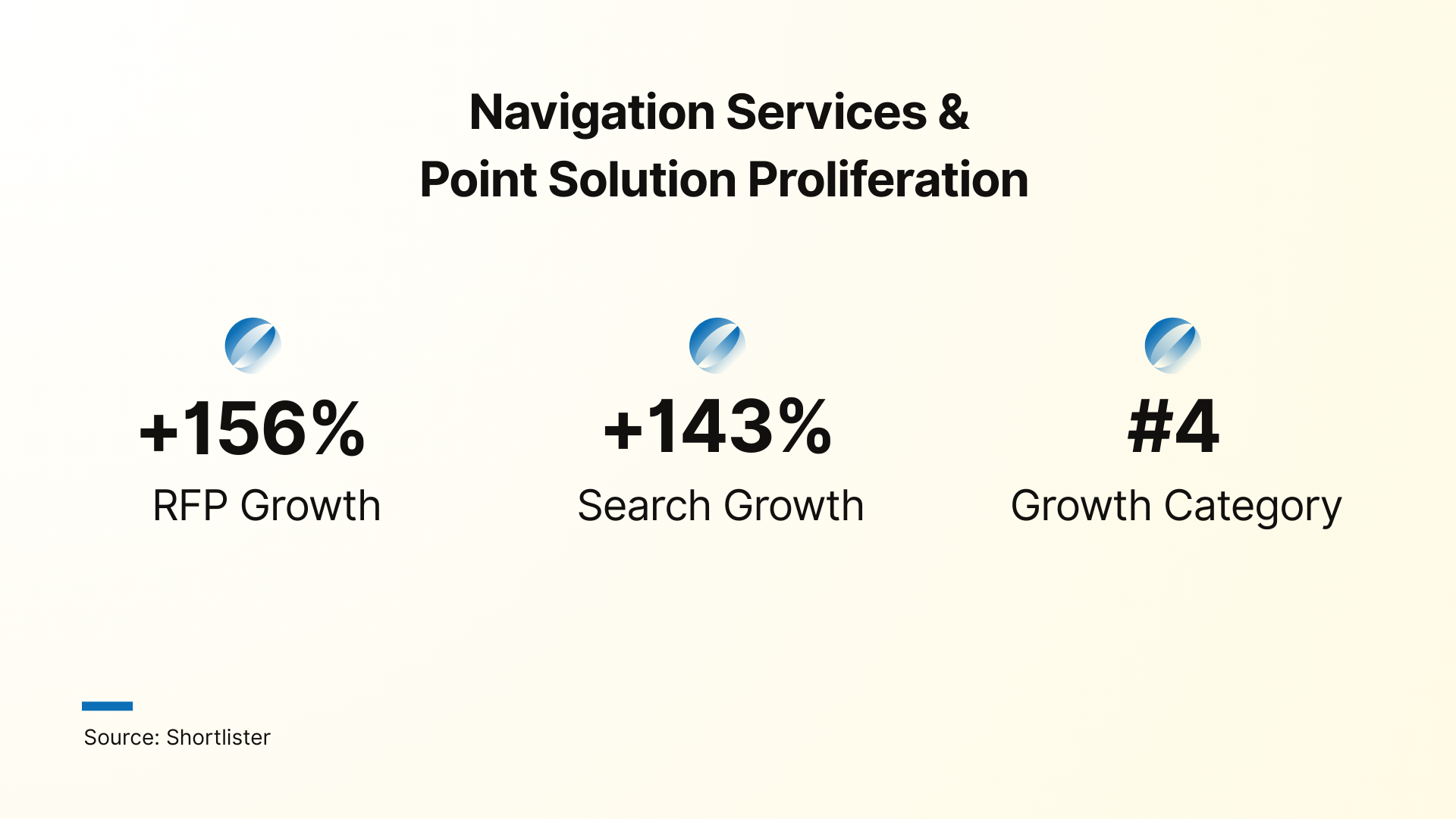

In 2018, 79% of brokers reported clients adding point solutions to address specific needs. The data validates that this trend has not only continued but accelerated.

Shortlister’s platform now tracks over 290 active product categories, with new solutions emerging regularly. In fact, many categories that did not exist just a few years ago now generate substantial RFP activity.

However, this point solution proliferation has created exactly the demand that 2018 consultants predicted: a growing need for navigation help.

Shortlister data shows that navigation services and concierge services rank among the four fastest-growing categories on the platform.

Complexity fatigue is driving demand for “benefits concierge” services that help employees find the right resources at the right time. As employers add more specialized point solutions, the need to simplify the employee experience is becoming more urgent than ever.

While many 2018-2019 predictions proved accurate, several important trends evolved in ways the market did not anticipate.

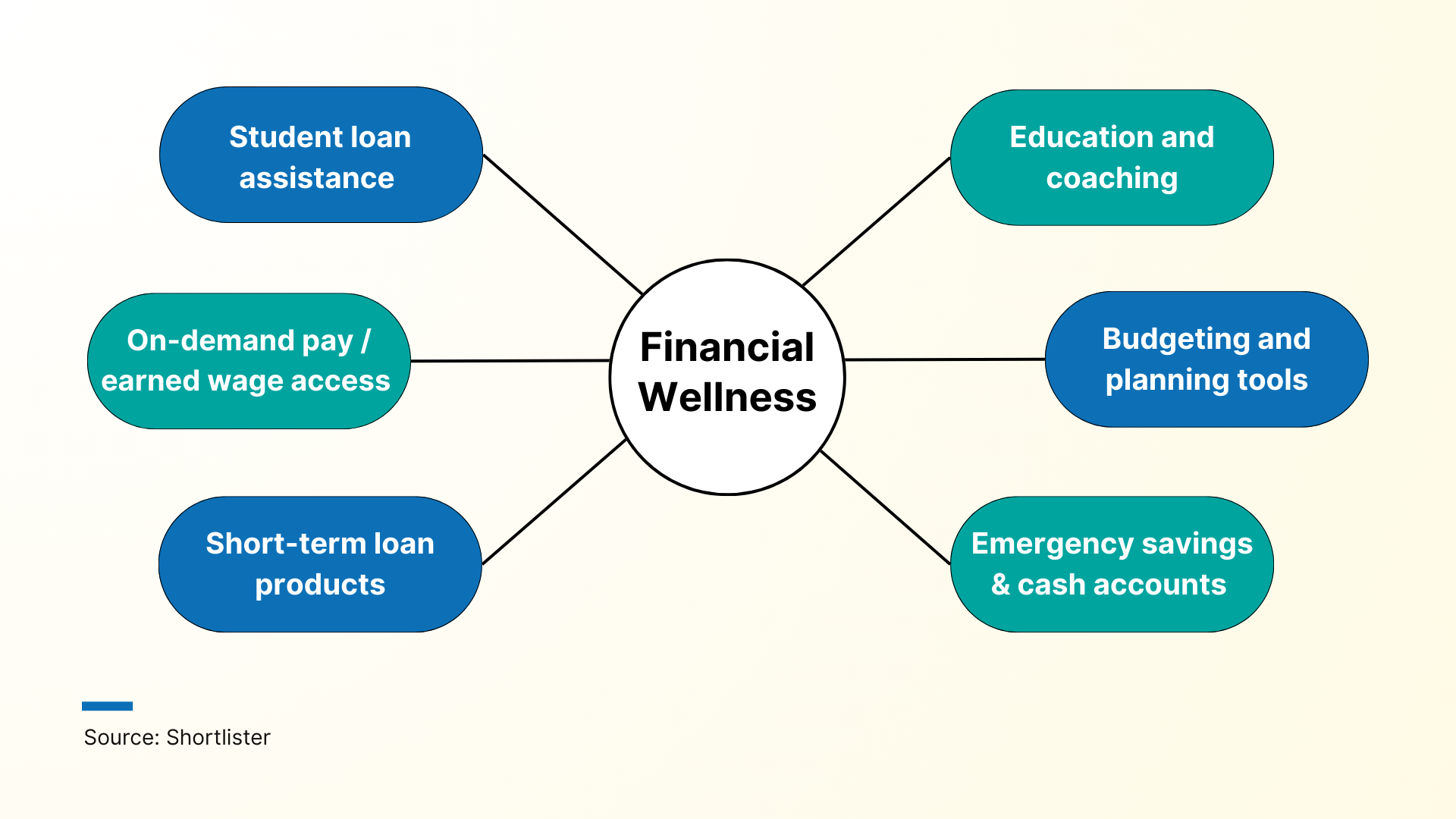

Financial wellness presents the most nuanced story in our analysis. The 2018 survey revealed it as the #1 growth category with 73% of brokers expecting increased demand.

The prediction was directionally correct: financial wellness RFP volume grew 145% over the period. Yet, that growth came through fragmentation rather than the fully integrated platforms many brokers expected.

In hindsight, that fragmentation reflects an underlying reality: financial health is multi-dimensional, shaped by life stage, income volatility, debt burdens, and family responsibilities. Therefore, support needs to adapt to employees as they progress through these phases.

In practice, this has produced a set of distinct subcategories rather than one dominant, integrated category.

Some features have also been integrated into existing platforms, with many modern EAP programs now including financial counseling and education, and HRIS systems increasingly offering financial planning tools natively.

Taken together, these dynamics explain why financial wellness shows strong growth on paper but falls short of the “explosive,” standalone category brokers originally envisioned.

In 2018, diabetes management looked like one of the safest bets in employer health benefits. Point solutions for diabetes were quickly climbing the priority list: 42% of employers ranked them as their number two solution in 2018, and by 2019, 36% had moved them into the top spot.

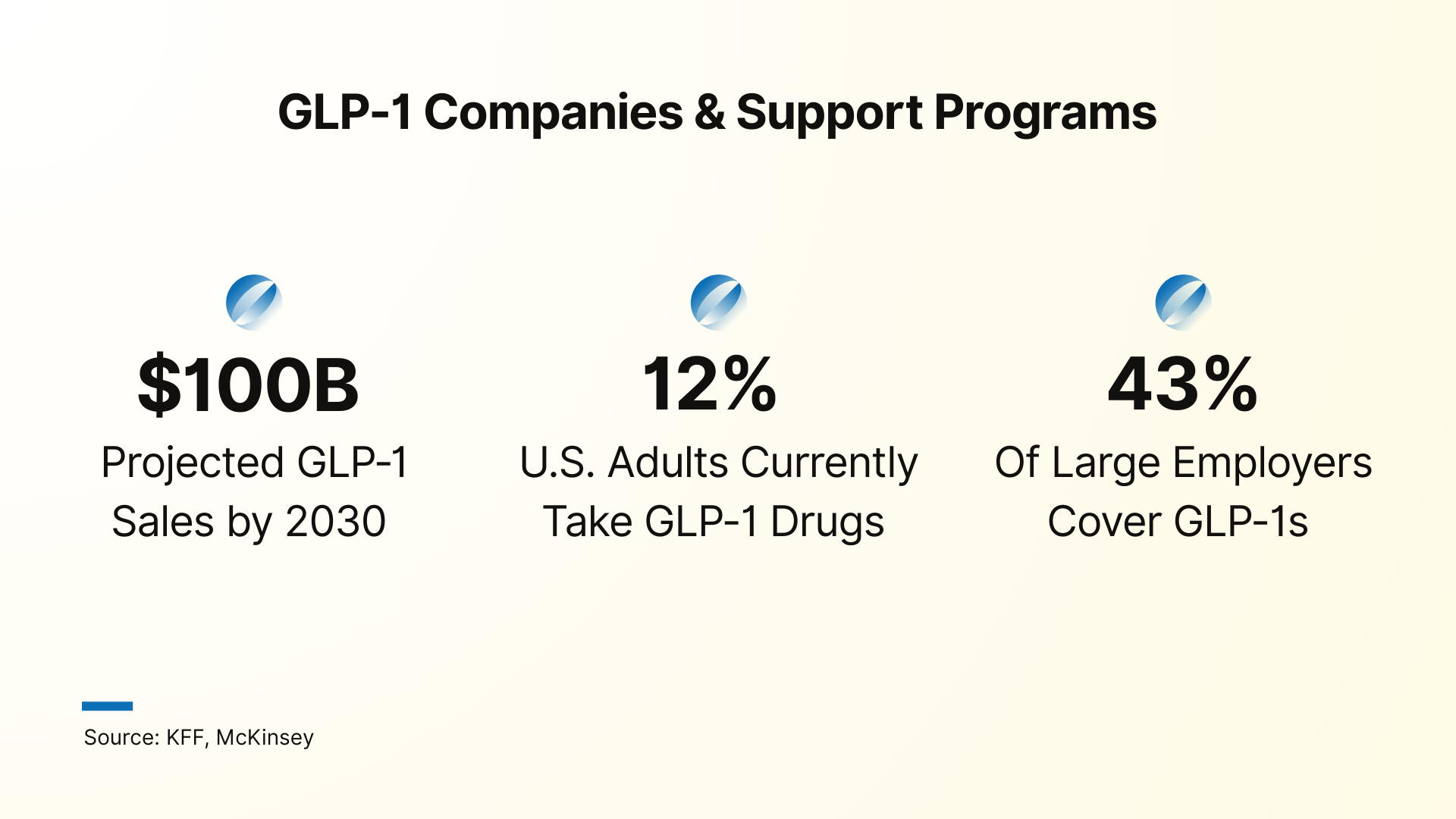

By 2025, the interest has remained, but the market is barely recognizable. Originally prescribed for diabetes, GLP-1 drugs like Ozempic, Wegovy, Mounjaro, and Zepbound unlocked rapid weight-loss results and triggered a massive surge in demand.

As a result, weight management and diabetes began to blur into a single, drug-driven category.

Our data shows that in 2024 and 2025, diabetes-specific RFP activity has slowed. Increasingly, budget and attention are being redirected towards weight management programs and GLP-1 coverage decisions. Many buyers are in a holding pattern, or “research mode,” where search interest remains very high but conversion into actual projects remains lower than typical.

In 2018, 63% of brokers expected rising complexity to be tamed by consolidating everything into a streamlined benefits administration platform. Seven years later, the need to simplify is even greater, but the actual solution taking hold looks different.

Rather than consolidating around a single hub model, the market evolved through several structural shifts:

These changes are reflected in our data – employers and brokers are still actively researching hub-style solutions, particularly around renewal cycles, but they are not replacing core platforms as often.

Essentially, employers are prioritizing platforms that manage the full employee lifecycle and using those systems as the de facto hub, with point solutions and navigation services plugged in around them.

Moving from prediction validation to investment patterns, our RFP data reveals where employers directed resources over the past five years. These patterns show not only what employers claim is important, but where they are willing to allocate budget and administrative resources. Beyond the primary growth categories already discussed, the data also surfaced several benefit areas with unexpected momentum.

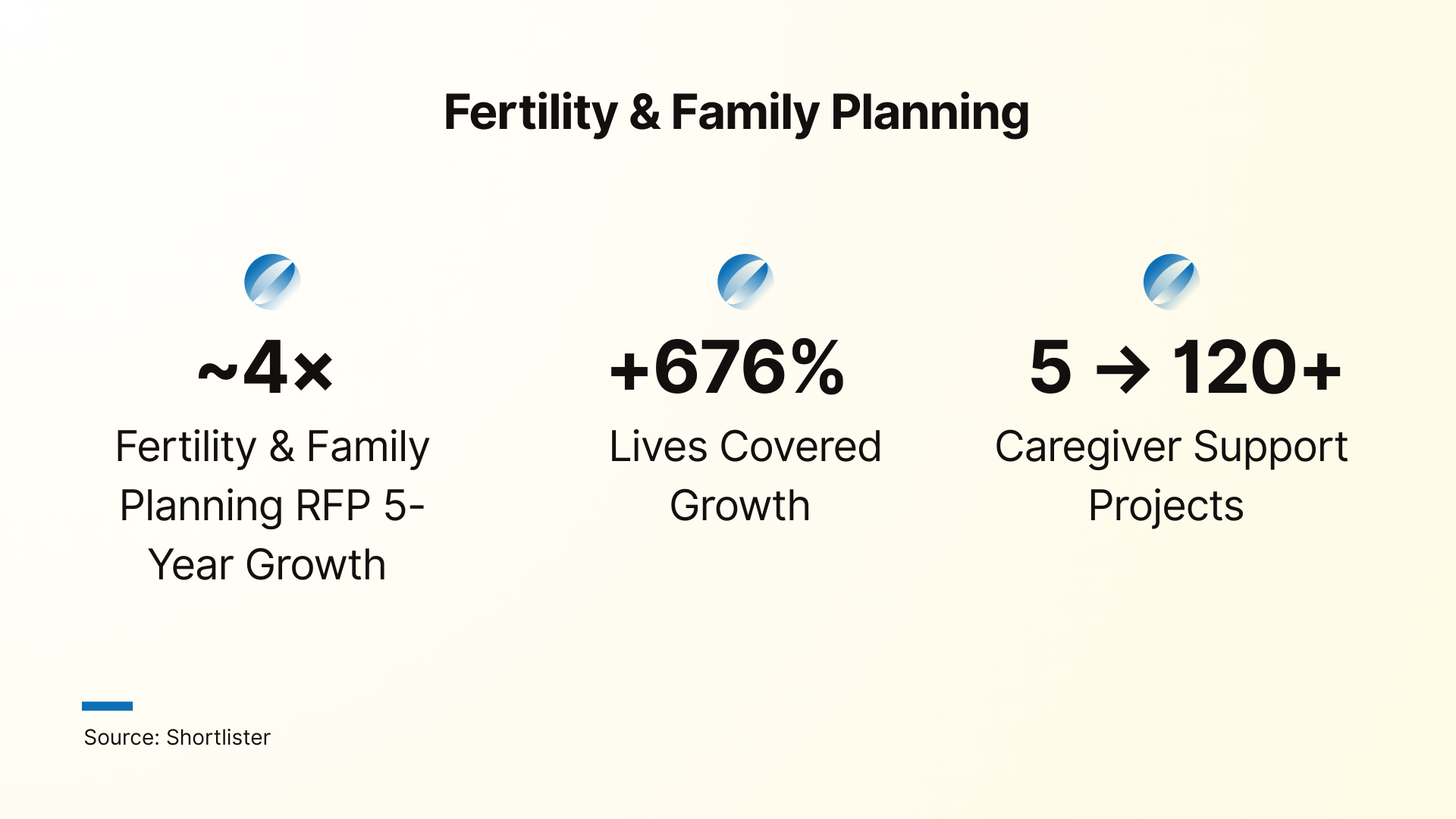

In 2018–2019, “family benefits” inside most companies meant one thing: maternity leave. Fertility support, parenting resources, childcare, or eldercare were not framed as employer responsibilities, and caregiving challenges went largely unrecognized in benefits planning.

From 2020 onward, this changed. COVID-19 highlighted the realities of caregiving, a younger workforce pushed for broader support, and employers began investing in the whole family journey rather than just parental leave.

Fertility and family planning programs have evolved from a non-existent presence to one of the fastest-growing benefit categories. Project volume grew roughly four to five times between 2020 and 2025, and this growth translated into a significantly larger share of covered lives.

Employer investment now spans the full family formation journey. Infertility and egg freezing benefits, for example, have evolved from a niche offering to a competitive necessity, with employer adoption increasing year by year.

Caregiving support has followed a parallel trajectory and has grown from fewer than 5 projects in 2020 to more than 120 in 2025. As the “sandwich generation” juggles childcare and eldercare responsibilities, companies are responding with more comprehensive programs.

Over the past few years, employers have shifted from broad, generic programs to targeting where cost and risk truly sit.

As musculoskeletal conditions remain a top driver of medical spend, MSK programs show steady, mature demand with consistent employer evaluation, ranking as the third most searched category on the platform.

While the MSK category began with elevated demand tied to COVID-related home office concerns, employer investments have remained consistent even as those conditions normalized. In addition, the market has seen a steady influx of new entrants and expansions, including virtual physical therapy platforms and at-home experiences.

Virtually absent in 2020, cancer support programs now generate meaningful RFP volume and cover hundreds of thousands of employees. Search volume has tripled in two years as employers recognize the convergence of:

For benefits leaders, these factors create a strong business case for structured cancer navigation and support, and the trajectory suggests cancer programs are on track to become as standard as EAP within the next five years.

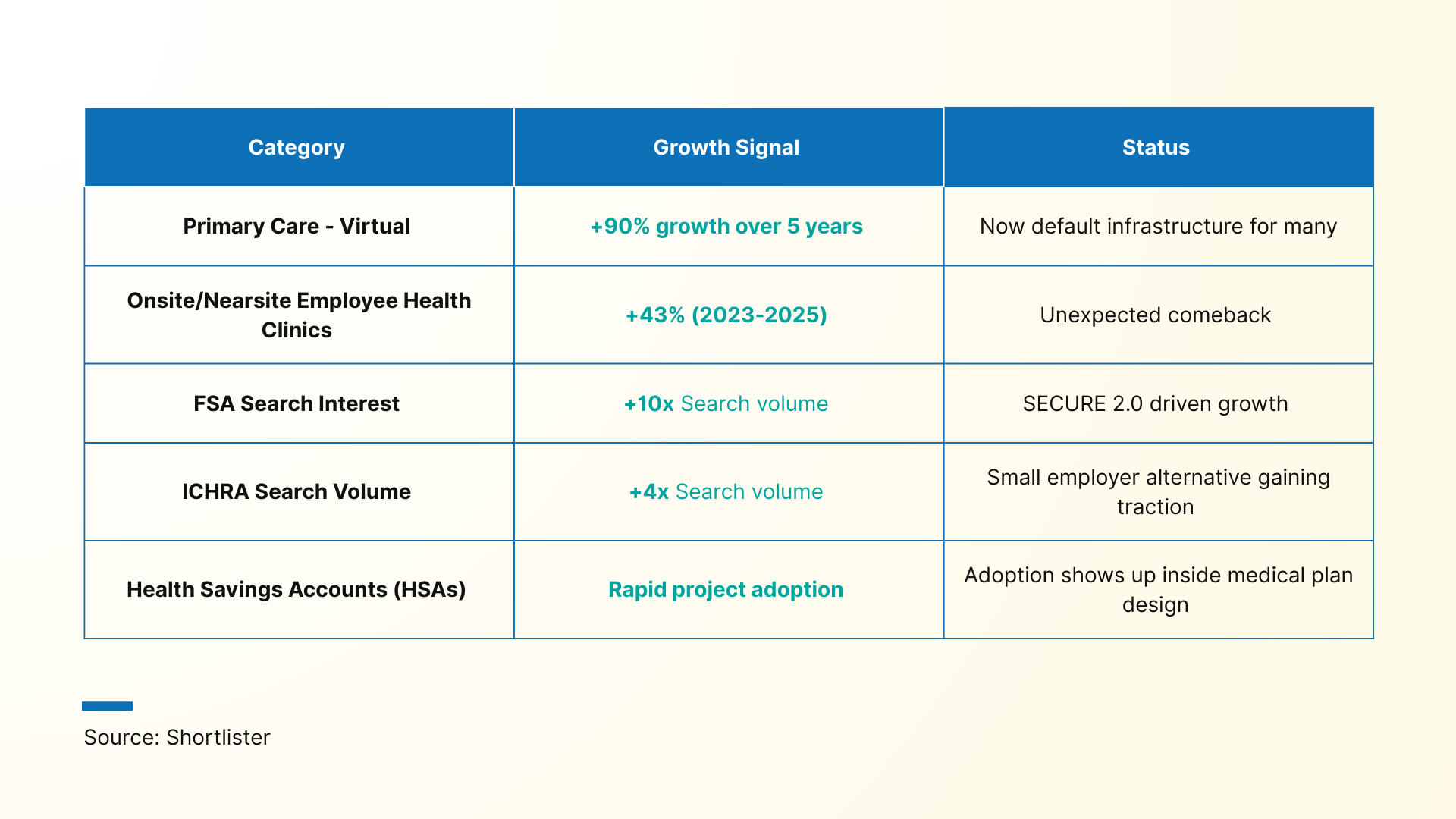

In five years, employer healthcare moved from crisis-driven telehealth adoption to an integrated digital care model now built into most plans.

Demand for telehealth and virtual primary care has remained consistently high throughout this period, with RFP demand increasing 90% over five years.

Adoption of these alternative healthcare models now diverges by employer size, with smaller organizations favoring virtual-first models and larger employers investing in hybrid care ecosystems that combine virtual access with physical sites of care.

This hybrid care infrastructure also explains the unexpected clinic comeback. Projects for onsite and nearsite employee health clinics grew 43% between 2023 and 2025.

Beyond changes in care delivery models, we are also seeing a broad evolution in how health benefits are financed, with account-based designs such as HSAs, FSAs, and ICHRAs gaining popularity.

In 2026, more employers will treat innovation in health technology and benefit design as a primary lever for value within their organizations’ offerings.

Perhaps no technology has generated more discussion in benefits circles than artificial intelligence. AI now supports benefit functions ranging from open-enrollment assistance and personalized plan recommendations to claims analysis and digital wellness.

As these applications expand and move from pilot to expectation, technology has become a primary differentiator among vendors – and a growing focus of employer investment.

Our data shows that mentions of AI in vendor proposals increased by 340% between 2024 and 2025, and employers routinely expect vendors to demonstrate AI-driven targeting and recommendations as part of finalist evaluations.

The most interesting signal in our data is not about growth or decline, but about creation. Multiple benefit categories that barely existed, or were entirely absent in 2020, have now become frequent and enticing components of modern benefits packages.

State-mandated paid leave laws are proliferating at an unprecedented pace, creating both compliance challenges and opportunities for technological solutions. What was once a straightforward HR function has become a regulatory maze requiring specialized tools and expertise.

Employers operating across multiple states must navigate different eligibility rules, benefit amounts, duration limits, and employer contribution requirements. Absence management platforms have emerged to handle this complexity.

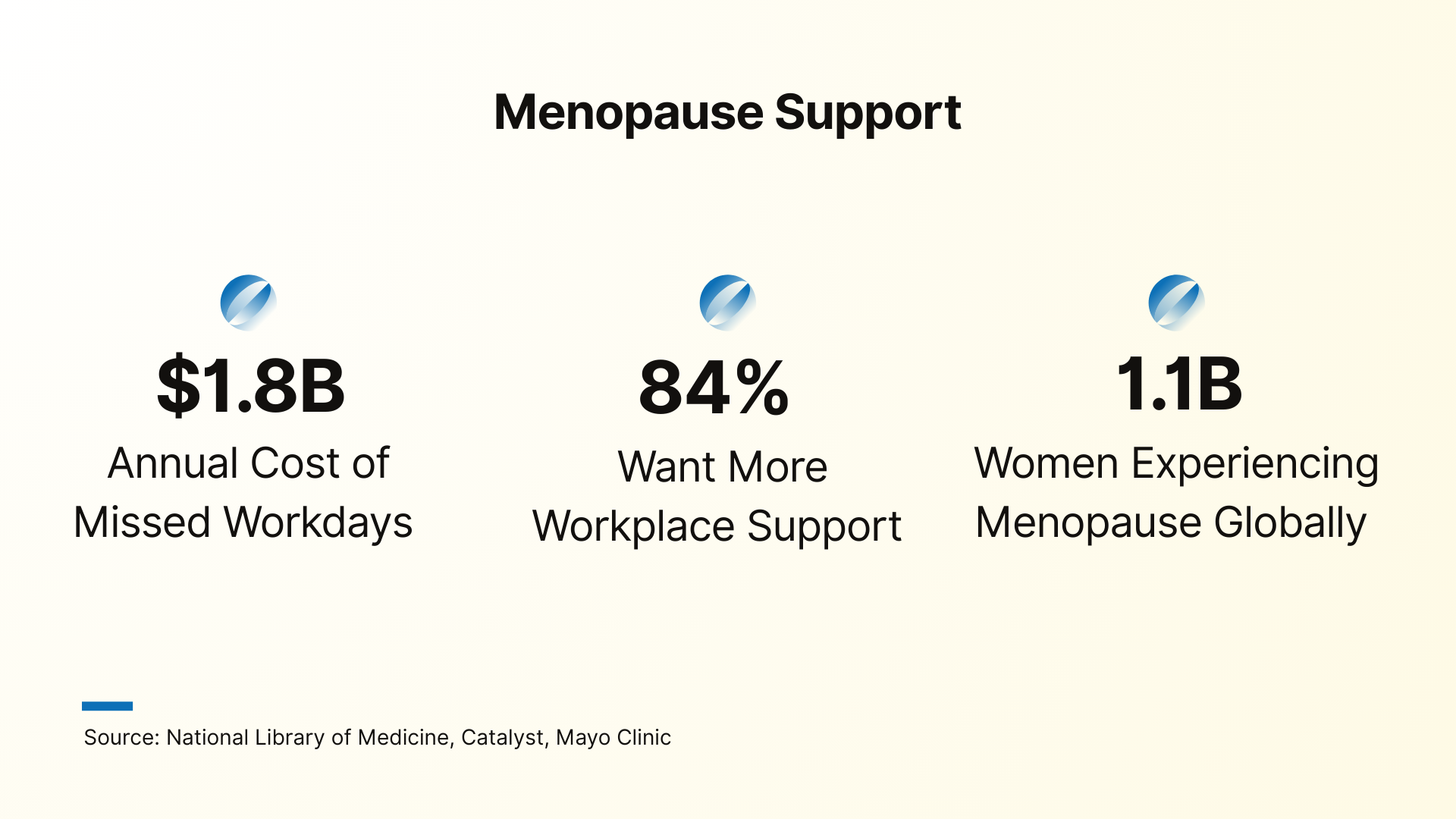

Menopause support looks today the way mental health did a decade ago – stigmatized and largely absent from core benefits design. However, many employers are starting to treat it as a focus area, with specialized vendors, measurable outcomes, and clear expectations for navigation, coaching, and clinical support.

Menopause and perimenopause often affect women at the height of their careers – a time when they hold institutional knowledge and influence organizational outcomes. Without support, organizations risk losing this talent at precisely the wrong moment.

While GLP-1 programs are still a relatively new category to generate meaningful trends, they already represent the single largest disruption to plan design and employer healthcare spending in decades.

For employers, the question is no longer whether to cover these drugs, but how to pair them with behavioral coaching, nutrition support, and clear clinical guardrails so use is safe, sustainable, and financially defensible.

Over the next year, GLP-1 programs are likely to bifurcate into two models: pharmaceutical-centric solutions focused on access, prior authorization, and adherence, and behavioral-centric solutions that combine medication and lifestyle change, nutrition, and deprescribing protocols.

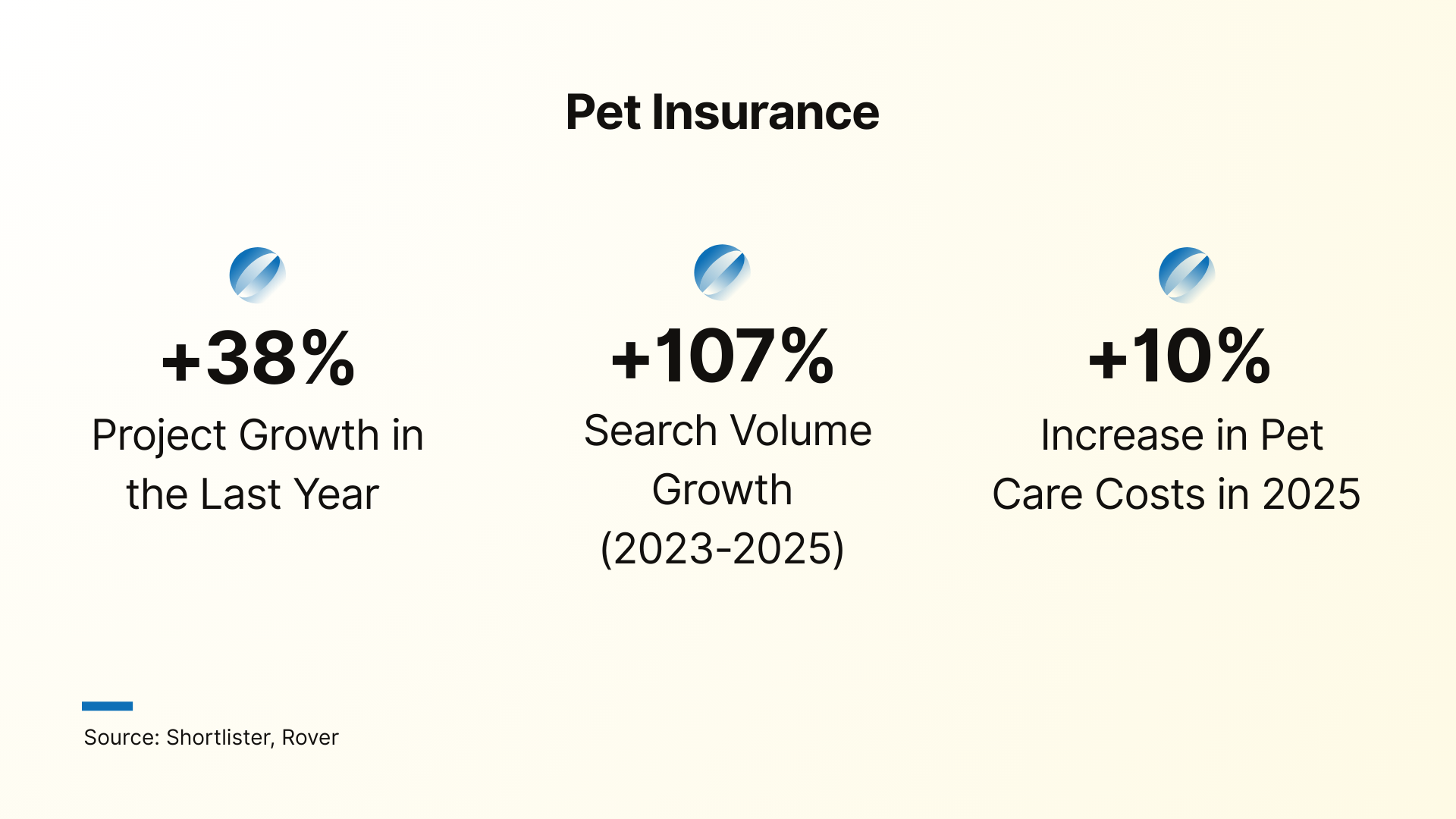

When employees consider whether to join or stay with a company, they’re increasingly asking about benefits for their entire family, iwhich includes their pets. What seemed like a quirky perk just a few years ago has become an attractive retention tool.

In a market where 66% of U.S. households have at least one pet and an estimated 33% of millennials are pet owners, pet benefits are no longer a niche preference.

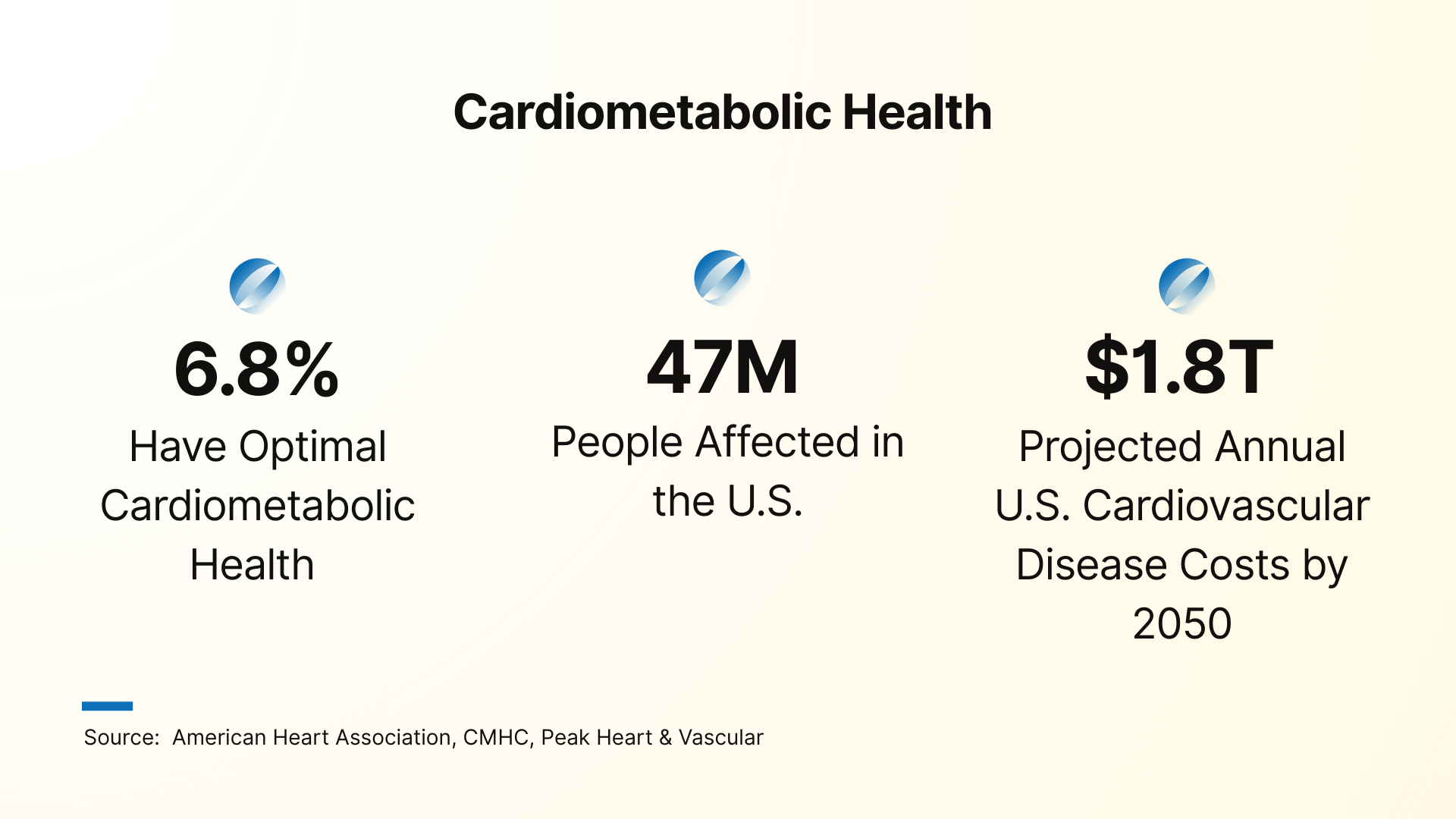

Cardiometabolic health is a relatively new category in the employer benefits space. However, it is one that addresses the most significant and costly health challenges simultaneously.

Cardiometabolic programs recognize that heart disease, stroke, diabetes, hypertension, and obesity are not isolated conditions, but interconnected outcomes of metabolic dysfunction. By addressing these conditions through a single, integrated care model, cardiometabolic programs are positioned for significant growth in the coming years.

How employers buy benefits has changed as dramatically as what they buy.

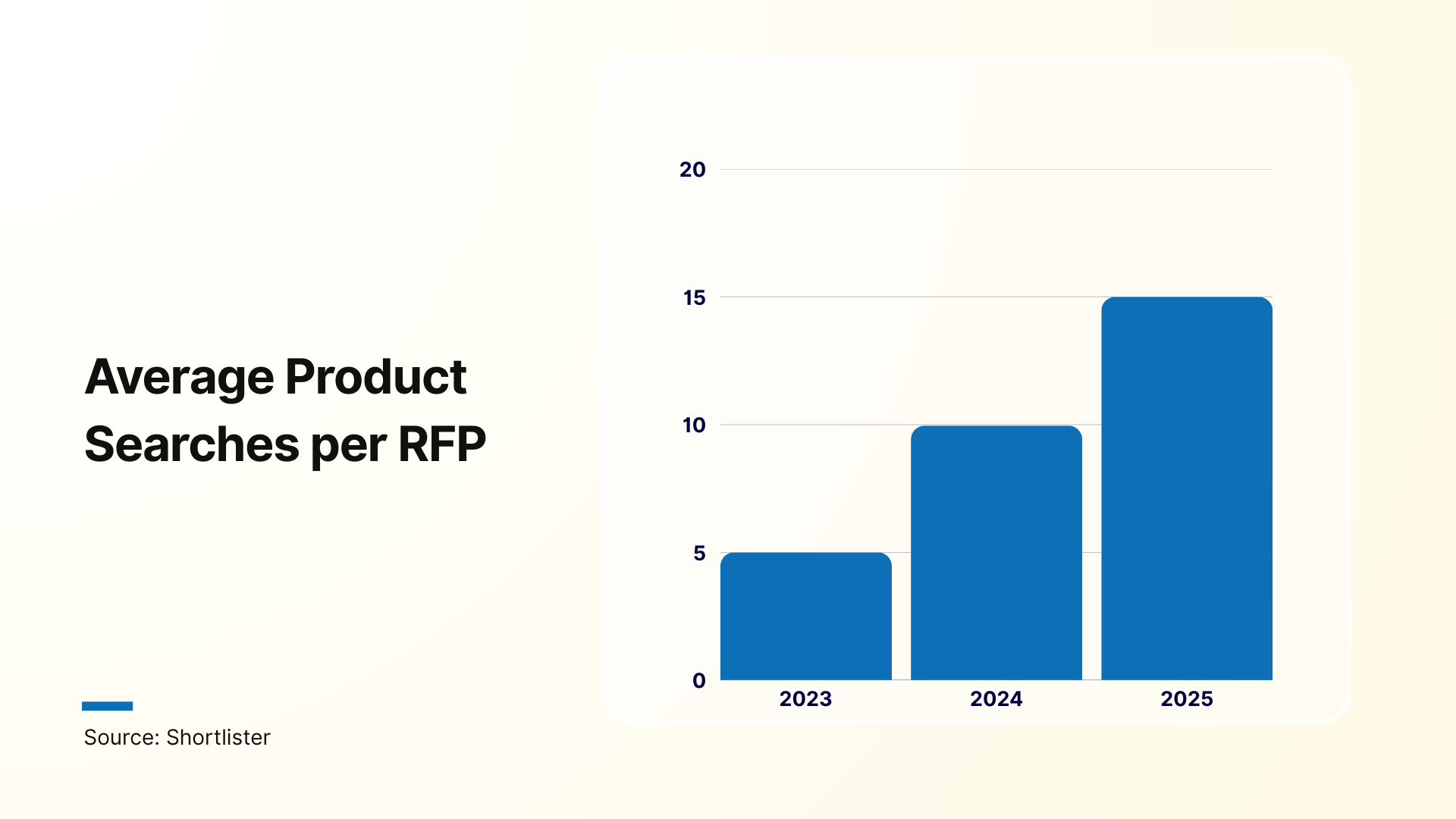

One of the more consequential, yet often overlooked trends in workplace wellness is the rising sophistication of brokers and consultants. As benefit decisions carry greater strategic weight, consultants are responding with more rigorous evaluation and due diligence.

The data reveals a 74% increase in research intensity over just two years, with brokers now conducting an average of 14.3 vendor searches per RFP compared to 8.2 in 2023.

These numbers reflect the heightened scrutiny from employers and a market where meaningful differentiation is increasingly more difficult to assess immediately.

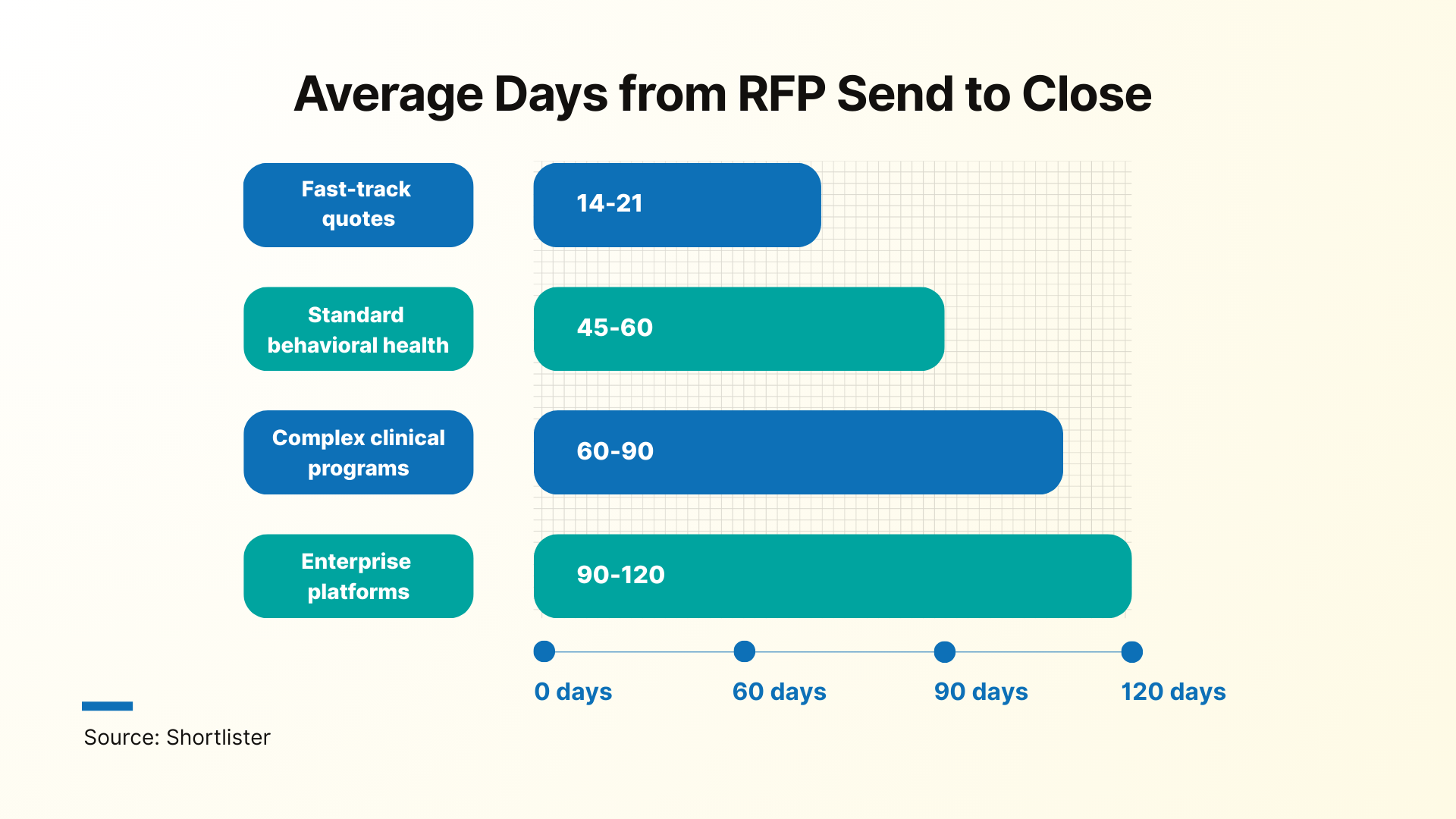

As a result, the timeline from research to decision has stretched accordingly, with implications for both vendors and employers. Long sales cycles are now the norm, particularly in enterprise and clinical categories, where projects can require multiple months of evaluation.

These extended timelines reflect not indecision but thoroughness – employers recognize that benefits choices have multi-year implications and deserve proportional diligence.

During our analysis, several themes consistently surfaced: rapid AI innovation, greater support, and a clear shift towards more flexible and personalized approaches to employee care.

At the same time, 2026 is shaping up to be one of the most challenging years for affordability and cost management in recent memory.

In this environment, vendors will need to show unmistakable value. This means quantifiable impact on outcomes and costs, credible AI capabilities that go beyond superficial claims and offerings that genuinely reflect the realities of a diverse, multigenerational workforce.

Employers, in turn, will need to prioritize partners that can help them navigate not just the benefits of today, but the much more complex wellness landscape that is already taking shape.

Ultimately, the employers who will thrive are those who treat benefits not as a cost center to be managed, but as a strategic investment in workforce health, retention, and productivity.

This report draws on multiple data sources to examine shifts in employee benefits with a focus on actual market behavior.

Primary data includes five years of employer activity on the Shortlister platform (2020–2025), representing millions of employee lives annually. We analyzed actual buying patterns, including searches, RFPs, and vendor selections.

Historical context is provided through Shortlister’s 2018–2019 Wellness Industry Survey of more than 100 benefits consultants from leading firms. Findings were cross-referenced with external research from major industry organizations and consulting firms.

To distinguish genuine market demand from platform adoption effects, growth figures were normalized against baseline platform activity. Throughout the report, trends are presented using percentage-based measures rather than absolute RFP volumes, allowing for clearer comparisons over time.

The scale of the dataset, its grounding in purchasing behavior, and external validation support the reliability of the patterns identified.

Senior Content Writer at Shortlister

Browse our curated list of vendors to find the best solution for your needs.

Subscribe to our newsletter for the latest trends, expert tips, and workplace insights!

Discover over 30 advantages of implementing corporate wellness programs in your workplace.

Unlock the secret to a longer, healthier, and happier life: It’s not just about steps and veggies, it’s about the power of meaningful social connections.

Uncover the importance of a well-planned and thoughtfully allocated wellness program budget that meets your organization’s needs.

Beyond step counters and group exercise, corporate fitness challenges inspire movement in the company’s bottom line, but only when done right.

Used by most of the top employee benefits consultants in the US, Shortlister is where you can find, research and select HR and benefits vendors for your clients.

Shortlister helps you reach your ideal prospects. Claim your free account to control your message and receive employer, consultant and health plan leads.