37 Work, Stress & COVID-19 Statistics

Explore 30+ statistics on work, stress, and the impact of COVID-19, providing valuable insights into the challenges employees face in today’s dynamic work environment.

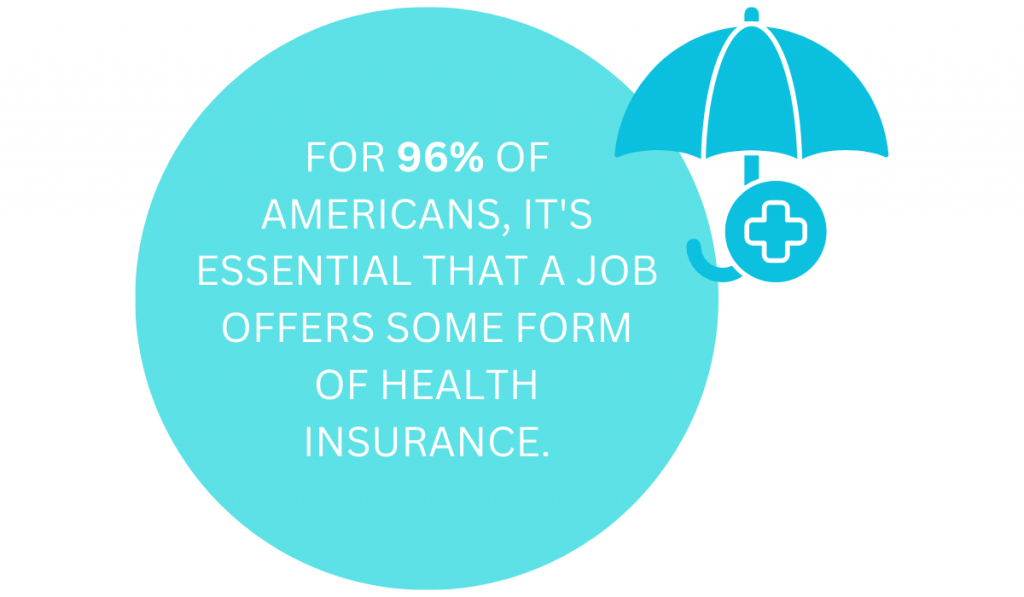

According to a survey by the Protecting Americans Coverage Together (PACT) campaign, health insurance is the most important benefit for employees And for 96% of Americans, it’s essential that a job offers some form of health insurance.

The insights from the study are generally positive towards employer-sponsored healthcare plans and cite them as an incentive for better retention.

As expectations and interest in health and wellness grow, especially post-pandemic, it’s becoming increasingly important to understand the different health insurance offerings, their advantages and drawbacks, and how they can benefit insureds and policyholders.

In this Shortlister article, we’ll explore the difference between group insurance and blanket health policies to help you choose the right insurance plan for your organization.

Group health insurance is an employer-sponsored health insurance policy that provides medical benefits for company employees or members of an organization. Its coverage can extend to family members and eligible dependents and usually includes benefits like doctor visits and access to urgent care facilities and hospitals. However, depending on the employer, the policy can cover prescription drugs, dental, and other health and wellness perks.

Although similar, group insurance should not be confused with a Group Health Plan (GHP) – a broader term for health insurance beyond a company or an organization. Instead, employer group health insurance is a subset of GHP.

A blanket health insurance policy is a less comprehensive health plan that offers medical coverage to a broader group of people, not just employees, for a specific period or purpose. It’s often used for events, to cover a group of individuals engaged in a particular activity, or for larger groups of people like trade associations and chambers of commerce.

An example of a blanket health policy is when organizations ensure medical assistance for all participants of an event or a conference or when nonprofits ensure healthcare coverage for all their beneficiaries, clients, or participants as part of their service.

The difference between group insurance and blanket health policies lies mainly in the extent of the health services they cover, the insureds, and their intent. While group insurance usually covers comprehensive benefits tailored for full-time employees, blanket health policies provide more limited services to a broader group of people connected by a particular purpose, like an event.

However, their contrasts don’t end here.

From who the policyholder is to the insurance structure, there’s a lot more to unpack before deciding between the two.

Since it’s essential to understand them thoroughly, we’ll go over their specific characteristics, the roles of policyholders, eligibility criteria, cost differences, and more.

Let’s start by taking a more in-depth look at what group health insurance is.

Usually employer-sponsored, this health plan covers full-time employees or members of an organization but can expand to the recipient’s immediate family, such as spouses and children and other eligible dependents. These are the insureds.

In group health insurance, the employer or the organization takes on the role of a policyholder.

They decide on the cost and coverage options of the plan, including anything from benefits and healthcare providers’ networks to additional features such as wellness programs or preventive care services. Policyholders also negotiate rates with insurance providers and decide on their contribution, as premiums are usually split.

How much employers cover and the number of insureds per policy affects the total employee cost. For example, an extension of coverage, in terms of adding more insureds, typically comes at an additional cost, which is deducted from the employee’s paycheck.

The good thing, however, is that the premiums for this type of plan are typically lower since the insurance provider’s risk is spread across many people. Since they are collected from employees’ paychecks pre-tax, they can serve as an incentive for employees, further saving them money and lowering their taxable income.

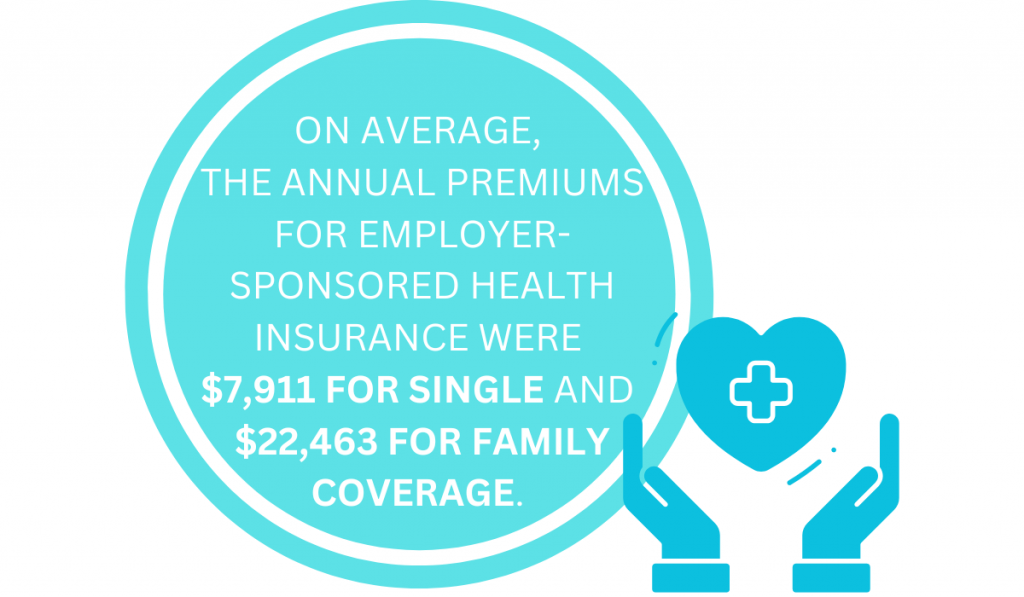

Although it depends on the insurance company and the employer, the Kaiser Family Foundation 2022 Employer Health Benefits Survey shows that, on average, the annual premiums for employer-sponsored health insurance were $7,911 for single and $22,463 for family coverage.

Employers covered approximately 83% of the total cost for single coverage and 72% for family plans. For smaller firms, the numbers were lower.

In the past, some employees would receive higher premiums due to pre-existing medical conditions or wouldn’t get coverage altogether. However, under the Affordable Care Act (ACA), which ensures equal healthcare opportunities, they now enjoy the same rights as others.

Once policyholders settle contractual arrangements, eligible workers can review the coverage options available within the employer group health insurance during the annual open enrollment period. Those who do not want to participate can choose another option, like an individual health plan.

Their employer or organization oversees the following administrative tasks for those who enroll.

Collecting premiums from their paychecks and facilitating the payment to the insurance provider goes to HR and accounting. They also handle the administrative tasks related to enrollment, terminations, and changes to coverage due to life events (e.g., marriage, childbirth, job change).

Between the lower premiums and more comprehensive coverage, group health insurance has many benefits and seems an excellent alternative for employers. However, as with every other type of insurance, there are also some disadvantages to consider.

|

Advantages of Group Health Insurance |

Disadvantages of Group Health Insurance |

|

Comprehensive health coverage |

Limited customization and flexibility |

|

Lower premium costs due to risk pooling |

Complete dependence on employment |

|

Shared contributions |

Limited portability due to job changes |

|

Simplified enrollment and administration |

Annual premium increases |

|

Family coverage option and guaranteed coverage for pre-existing conditions |

Employers can make changes to the plan, which can impact employees' coverage and out-of-pocket costs |

Although group health insurance covers employees and organization members, eligibility criteria exist for policyholders and the insureds.

For example, group policies usually require 70% participation.

However, for small businesses (between one and 50 employees) to become qualified, they must:

That means the owner and at least one qualified worker must enroll in the group plan for the company to qualify. Sole proprietors are not eligible for group health insurance.

As for insureds, eligible participants are full-time employees, which the IRS defines as people who work at least 30 hours per week. The policy can extend to qualified dependents or the spouse and children. Under the ADA, the coverage for dependent children has expanded until they reach the age of 26.

Workers on maternity, sick, or paid vacation leave are still eligible. The only exceptions, unless stated otherwise in the contract, are:

Any other constraints or special criteria, like coverage expansion to part-time employees or unmarried partners, depend on the policyholder.

Now that we have a clear idea of what this plan represents, let’s go over what blanket health insurance is and how these two compare.

Blanket health insurance also falls under the umbrella of group health plans. However, its purpose is not to provide comprehensive medical benefits to employees but coverage that is usually accident-only, with a specific purpose and for a larger group of people.

For example, the policyholder can be an organization that takes blanket health insurance for a conference. The insureds are all the conference participants, including employees, attendees, and any other individuals registered to participate in the event.

This type of coverage provides a safety net for unforeseen medical expenses that might arise during the conference, such as accidents or illnesses that require medical attention.

Depending on the purpose, policyholders can also be schools and other educational institutions, sports teams and clubs, event organizers, professional associations, religious groups, nonprofits, community organizations, and more.

They work with insurance providers to select the appropriate coverage options, determine the scope, and negotiate the policy terms. Their role also expands to premium payments, which usually only the policyholder pays, enrollment, claims processing, and administration.

When implemented correctly, blanket health insurance can significantly benefit the policyholders.

However, since it has a more specific use, especially for employers, it can also have some drawbacks for those seeking a group health plan. The key is to use it accurately and strike a balance between the goal of the policyholder and their expectations.

|

Advantages of Blanket Health Insurance |

Disadvantages of Blanket Health Insurance |

|

Wider eligibility criteria, expanding to more than employees |

Lack of customization and personalization |

|

Flexible medical coverage for specific health hazards or incidents based on the event |

Although flexible, the coverage is usually less comprehensive |

|

Simplified enrollment, administration, and management |

Complex claims processing procedures |

|

More affordable than individual insurance, with predictable costs |

|

The eligibility criteria for blanket health policies are more flexible and cast a wide reach, comprising a diverse category of policyholders and insureds.

That means a policyholder can be anyone from an employer to a volunteer organization to a sports club. This entity decides who falls under the policy’s coverage. However, they must clearly define the insureds, for example, all attendees of an event, members of an organization, and, in some cases, immediate family members.

In terms of the coverage, this plan extends to include specific hazards or incidents that insureds might encounter. Whether it’s a sports injury at a sporting event or a medical emergency at a conference, the policy is designed to provide coverage for particular events and scenarios.

This focused approach ensures that participants can engage in the event with peace of mind, knowing they have health insurance protecting them from the risks associated with the occasion.

Overall, while a blanket health plan has more flexible requirements, the extent of this depends on the insurance company and the entity’s needs.

As organizations continue to prioritize the well-being of their employees, understanding the distinctions of the different health plans becomes paramount.

Now that we’ve covered both types of health insurance policies, let’s compare some of their most essential features side-by-side.

The coverage difference between group insurance and blanket health policies lies in their purpose.

While the first can include anything from doctor visits and hospital stays to prescription drugs and dental care, the latter is often an accident-only healthcare policy.

In terms of cost, both can be affordable in their way.

For example, premiums for group health plans are usually lower between cost sharing with employers and spreading risk across a larger pool of insureds. They can be even more cost-effective when bundled with additional coverage options like dental insurance.

As for blanket health insurance, the purpose-specific predictability of the policy can make it affordable. However, the total cost depends on how much of the coverage is and how much you add to the policy.

Group plans are typically less customizable than individual healthcare plans.

But between these two, blanket health policies have more limited customization, and the entire choice of coverage depends on the policyholder.

On the other hand, although group health insurance can limit personalization and the choice mainly falls on the employer, employees can still contribute their opinions for a better choice and option, making it a more flexible option of the two.

Finally, one last aspect in this comparison is the administration and management of these two insurance policies.

With group insurance policies, employers, with the help of HR, take a central role in plan setup, enrollment, and premium management.

On the other hand, blanket health policies offer a simplified administration model, focusing on event-specific coverage and customization.

These administrative differences can determine the insurance approach needed for your organization’s capacity.

In 2024, health insurance premium costs under the ACA are expected to increase by 6%.

To relieve the financial strain of what is already an expensive healthcare system, policyholders should make a well-informed decision before selecting a plan or changing their insurance policy by:

While both can be affordable, the perks of employer group health insurance make it a suitable choice for smaller companies looking for year-round comprehensive medical coverage since the policy spreads the risk across all their employees.

Blanket health insurance is most suited for businesses hosting short-term events or needing temporary and less comprehensive coverage. It’s designed for participants with relatively homogeneous health profiles and health risks. However, additional coverage options may be available depending on the specific policy to meet distinct event-related risks.

In addition to traditional health insurance options, many employers offer Health Savings Accounts (HSAs) and Health Reimbursement Arrangements (HRAs) as supplementary benefits that cater to different healthcare needs and financial situations. These tax-advantaged accounts, like Health Care Flexible Spending Accounts (FSAs) and Dependent Care Flexible Spending Accounts (FSAs), allow individuals to save money for medical expenses.

They enhance the overall insurance package by offering employees more flexibility and control over their healthcare expenses.

Ultimately, after weighing the difference between group insurance and blanket health policies, the final verdict would be choosing one that best fits your organization’s type and budget while also keeping in mind the needs of the employees. That way, policyholders can strike a balance between providing comprehensive healthcare coverage and managing the financial implications of rising premium costs.

Content Writer at Shortlister

Browse our curated list of vendors to find the best solution for your needs.

Subscribe to our newsletter for the latest trends, expert tips, and workplace insights!

Explore 30+ statistics on work, stress, and the impact of COVID-19, providing valuable insights into the challenges employees face in today’s dynamic work environment.

Explore women’s options for covering the cost of egg freezing with insurance, including financial assistance programs that may help cover expenses.

Explore the connection between stress and heart disease. Dive into the role of stress management and cardiovascular health programs in preventing coronary conditions.

With less than 7% of Americans in optimal cardiometabolic health, the urgency for workplace interventions has never been clearer.

Used by most of the top employee benefits consultants in the US, Shortlister is where you can find, research and select HR and benefits vendors for your clients.

Shortlister helps you reach your ideal prospects. Claim your free account to control your message and receive employer, consultant and health plan leads.